RMS Policy Document

advertisement

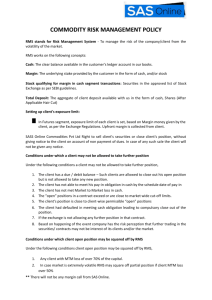

“RMS Policy Document” Trustline Commodities Pvt. Ltd INDEX 1. Definitions . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1) 2. Department Structure . . . . . . . . . . . . . . . . . . . . . . . . 2) 3. Glance of Client `/ Margin Reports . . . . . . . . . . . . . 3) 4. Limits Policy . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 4) 5. Square-off Policy . . . . . . . . . . . . . . . . . . . . . . . . . . . . 5) 6. Important Points to Remember . . . . . . . . . . . . . . . . 6) For Internal Distribution only Page 1 “RMS Policy Document” Trustline Commodities Pvt. Ltd DEFINITIONS 1.1 MEMBER: Member means Trading Member and/or Clearing Member the case may be, of the Exchange. 1.2 BRANCH : Branch means the branch office of a member to facilitate all kind of broking/ financial services of the member to the clients their specific region. 1.3 BRANCH MANAGER: Branch manager means the person responsible for the day to day management, operations and administration of the Branch. 1.4 CLIENT/CONSTITUENT: A Constituent or a client means a person, on whose instructions and, on whose account, Branch/Member enters into any contract for the purchase or sale of any commodity or Futures contract or derivative or does any act in relation thereto or on whose account. 1.5 CLIENT’S OPEN POSITION : Clients open position means the sum of long and short positions of the client in any or all of the Commodity Derivatives Contracts at any given point of time. 1.6 COMMODITY RMS DESK(CRD): RMS stands for Risk Management System RMS department monitors/manage the risk of the company/client from the volatility of the market. 1.7 FUTURES CONTRACT: Means a legally binding agreement to buy or sell an underlying commodity in the future. 1.8 TRADING SYSTEM: Trading System refers to Automated Trading Software System facilitated by Trustline Commodities Pvt. Ltd to execute the orders of the clients by branches or clients i.e. ( OMNYSIS) 1.9 MARGIN/SPAN: Margin/Span means the amount to be deposited by the Clients/market participants in their margin account with member before they place any order to buy or sell a futures contracts. This must be maintained throughout the time their position is open and is returnable at delivery, exercise, expiry or closing out. For Internal Distribution only Page 2 “RMS Policy Document” Trustline Commodities Pvt. Ltd 1.10 NOTIFICATION, NOTICE OR COMMUNICATION: It refers to any such intimation that can be served on landline/ mobile/ email address/ Trading System of the client in any one or more of the following ways: By Telephonically through Land line/ Mobile By sending a message through the Trading System By electronic mail or fax By SMS through a mobile device Any communication sent by the CRD to any client/branch shall be deemed to have been properly delivered or served, even if such communication is returned as unclaimed/ refused/ undelivered, if the same is sent to mobile no. / e-mail address in records or last known address of the client/branch. 1.11 OUTSTANDING POSITION: Means the position which has neither been closed out nor been settled. 1.12 RULES AND BYE LAWS: The terms Rules and Bye Laws shall mean the Rules and Bye Laws framed by any of Commodity Exchange from time to time and approved by the Forward Market Commission or any authority under Forward Contracts (Regulation) Act, 1952. For Internal Distribution only Page 3 “RMS Policy Document” Trustline Commodities Pvt. Ltd Department Structure Mr. Raj Garg Head RMS Mr. Shiv Parashar Manager Mr.Shashi Kant Asst. Manager - RMS Mr. Vijay Kumar Sr. Executive - RMS Mr. Deepak Thakur Executive – Back office Mr. Anil Kr Patel Sr. Manager Mr. Amit Kumar Sr. Executive - RMS Mr. Vijay Rawat Executive – Back office Mr. Pradeep Kr Yadav Sr. Executive - RMS “RMS Policy Document” Trustline Commodities Pvt. Ltd Key Responsibilities: Mr. Raj Kumar Garg Mr. Anil Patel For Internal Distribution only Any critical queries and disputes which were not resolved by concerned persons at previous levels. Communications regarding request for holding of positions (which are subject to CRD square off) or special leverage under exceptional circumstances.) Unresolved Queries & issues. Co-ordination with branches for Understanding of reports. For creation/deletion of Dealing Terminals. Trading Platform (OMNESYS) Application issues (For Connectivity related issues contact IT Department) Commodities Delivery related issues and queries. Exchange related issues and queries. Page 5 “RMS Policy Document” Trustline Commodities Pvt. Ltd Mr. Shiv Parashar Mr. Shashi Kant Mr. Amit Kumar Mr. Vijay Kumar Mr. Deepak Thakur Mr. Vijay Rawat Mr. Pradeep Kumar For Internal Distribution only Communications and clarifications regarding confirmation of Client positions and Mark to Market losses. Communications Regarding HNI/Approved Clients. Clients Cheque Updation & related Queries and Confirmations. Intimating & Square-off the positions in tender period contracts. Queries regarding illiquid far month contracts / Banned Contracts All the queries regarding Limit Updation, Trade Confirmation, Order Confirmation, Confirmation of Clients Position & MTM Losses etc, Client Mapping & Password related queries. Trading in emergency conditions (Like VSAT or Internet connectivity is broken)* Trading & Back-office reports updation on FTP. Clients Square off Confirmations to branches via mail/phone. Page 6 “RMS Policy Document” Trustline Commodities Pvt. Ltd REPORTS: Following MIS Reports are sent to all the branches to get updated position of clients to access the financial, open exposures, margins and short margin positions of the clients. Client MIS Report is sent on the daily basis to all the branches not later than one hour before the market opens on Trustinfo as well as on branch FTP. The report is elaborated below:- Client MIS Account Code Account Name abc01 aaaa bbbb cccc xyz02 xxx yyy zzz pqr03 ppp qqq rrr SpanReq 0 0 0 A. B. C. D. E. F. G. H. I. J. K. L. M. OverallDrCr -0.84 0 -0.29 mis.Ref Code xxxxx xxxxx xxxxx PreviousdayBal -0.84 0 -0.29 RMCode xxxxxxx xxxxxxx xxxxxxx FinalDrCr -0.84 0 -0.29 Today'sImpact 0 0 0 Adjustments 0 0 0 Margin% 0 0 0 BenStocks 0 0 0 LimitAvailable 0.84 0 0.29 Account Code: Account Name: Mis Ref Code : RM Code: Final Dr.Cr.: Unique Client Code of the Client Name of the Client Branch Code where the client is mapped Relationship Manager Code to which client is mapped Ledger Balance of Client, where Debit Balance is shown as Positive figure while Credit Balance is shown in Negative figure. Adjustments: if any. Ben Stocks: Value of Total Stock Pledged in Commodities as margin. Span Req: Total Span Margin which is Levied on Commodity Positions both Exchanges (MCX & NCDEX) Overall Dr.Cr.: Overall Ledger Balance which is sum of Ledger Balance & Span Margin. Previous Day Bal: Ledger Balance of previous trading day Today’s Impact: Difference of Previous day’s ledger & today’s Ledger Margin%: Percentage of Span Margin levied against Ledger Balance. Limit Available: Clear Ledger for Limit For Internal Distribution only Page 7 “RMS Policy Document” Trustline Commodities Pvt. Ltd Commodity Short Margin Report is E-mailed on the daily basis to the respective Branch Managers to keep them updated as well as intimation to collect the short margins from the clients by 10:30 AM to 11:00 AM. The report is elaborated below:- Commodities Short Margin Report Account Code Account Name Branch Code Final DrCr Span Req. Overall Dr.Cr Margin% Limit Available abc01 aaaa bbbb cccc B336 (4756) 1243 7 7681 262% 4756 xxx zzz yyy xyz02 B103 (28047) 1079 09 79862 385% 28047 ppp rrr qqq pqr03 BR84 (7478) 1414 4 6666 189% 7478 Pending Chqs 50,000 - STATUS SHORT MARGIN SHORT MARGIN SHORT MARGIN It is the prime responsibility of the respective Branch to collect the margins early in the morning and provide the information to CRD in time to avoid any kind of position reducing kind of situation even without any failure of client’s end. In case of no intimation from Branch, positions shall be reduced on the random basis by CRD to the extent of funds available in the client’s account. Short Margin SMS Intimation: SMS are sent to respective Branch Managers & Clients on their Mobile numbers by 9:15 PM (First Alert) & by 10:30 PM(Second Alert). Proper reply* is needed from Branch end, in case of no satisfactory reply from branch than positions might be reduced on the random basis by CRD before market closing to the extent of margin available in the client’s account after considering prevailing Mark to Market Loss/Profit. For Internal Distribution only Page 8 “RMS Policy Document” Trustline Commodities Pvt. Ltd MARGIN COLLECTION FROM THE CLIENTS Branch must collect upfront margins from its clients in respect of the business done by branches for such clients. Branches shall accept orders to buy / sell derivatives contracts on behalf of the clients only on the receipt of margin, unless the client already has an equivalent credit with Trustline. Branch/Trustline can even collect higher margins from client, as and when it deems fit. Branch is responsible to demand/collect MTM/Short Margins from its client, the amounts arising in respect of daily settlement for the trades/business done by the branch on behalf of their clients. Branch may even demand higher amounts, as the Branch/Trustline deems fit. Mode of Margin Collection: Margins can be collected in the following modes: A) Online funds transfer into the Bank account (Bank A/cs detail given below) of Trustline Commodities by client directly. B) Same Bank Cheque deposit: Credit for the same is received in one day. C) Other Banks’ clearing Cheque: Credit for the same is received in 3-5 working days. D) Shares: Margins can be collected in the form of shares as per the exchanges’ prescribe list and limits decided by exchanges. Benefit for the same is given after haircut for the maintenance of open position. However, Any MTM loss arises from the open position, must be paid in cash. Haircut varies on the category of stock it belongs to. Span and Exposure margins are applicable on all the open positions as the Exchange’s/ FMC rules, regulations & guidelines. Details of Bank A/cs of Trustline Commodities Pvt. Ltd. Sr. No Bank Name Exchange Account No. 01) 02) 03) 04) 05) 06) 07) 08) AXIS Bank HDFC Bank ICICI Bank IDBI BANK KOTAK MAHINDRA BANK PUNJAB NATIONAL BANK STATE BANK OF INDIA BANK OF BARODA NCDX NCDX MCX MCX MCX MCX MCX MCX 126010200029759 00030340028091 000705018173 0109102000029661 1911262457 2726002100053860 31252043128 25620200001178 For Internal Distribution only Page 9 “RMS Policy Document” Trustline Commodities Pvt. Ltd LIMITS & EXPOSURE: Span and exposure margin is applied on all the open positions in the commodities as per respective Exchange guidelines. Limits are updated in the trading software as per the ledger balance available in the account of client. In case client carries forward exposure more than the available ledger balance after deducting MTM, then he will have to pay-in the short margin by next trading day morning before 10:30 A.M. Clients shall be solely responsible to deposit the short margin. If client fails to mark up the short margin by above given time, than the positions shall be squared off / reduced to the extent of margin available in the respective client’s ledger. Limits shall be provided to the clients on the behalf of cheques only when they are appearing in the Bank Statement under clearing unless below mentioned conditions have happened earlier. If any Cheque of the respective client had ever bounced/returned, earlier. Branch had earlier provided the Cheque collection details but the same cheque was not deposited / presented in the bank. Square Off Cases: TCPL RIGHT TO SELL CLIENTS’ SECURITIES OR CLOSE CLIENTS’ POSITIONS, WITHOUT GIVING NOTICE TO THE CLIENT, ON ACCOUNT OF NON-PAYMENT OF CLIENT’S DUES: 1. TCPL reserves the rights to square off position of the client with its own discretion as far as instrument, quantity, price is concerned & no obligation of communicating the same to the client, for non-payment of margins or other amount, including the pay-in obligations; outstanding debts etc. and adjust the proceeds of such liquidation/close-out, if any, against the client’s liabilities /obligations. TCPL reserves the right to decide the order price keeping in view of the size of the order and the depth of market. 2. If the client does not square off his intraday position (MIS product) before the specified time 11:00 PM in summer / 11:30 PM in winters or the client does not convert open position to NRML, TCPL shall attempt to square off / close out the open positions on the same day before closure off the market. On the days of market volatility or when there are system issues, TCPL shall have the right to change /modify the timings of square off by either pre-opening or postponing the same. Further, whenever any price of commodity future contract breaches the internally prescribed percentage change, TCPL may at its discretion square off the existing open position in the margin (MIS product) segments (s) without giving any prior notice to customer. However, TCPL does not guarantee square off of the open position. 3. The client shall ensure timely availability of funds / securities in designated form and manner at designated time and in designated bank at designated place, for meeting his /her /Its pay in obligation of funds. If the clients fail to maintain or provide the required margin /fund or to meet funds /margin pay in obligation for orders /trades /deals of the client within the prescribed time and form, TCPL shall have the right without any further notice or communication to the client to take any one or more of the following steps: “RMS Policy Document” Trustline Commodities Pvt. Ltd A. To withhold any payout of funds /securities. B. To withhold /Disable the trading /dealing facility to the client. C. To liquidate on or more open positions of the client by selling the same in such manner and at such rate which the TCPL may deem fit in its absolute discretion. D. To take any other steps which in the given circumstances, the TCPL may deem fit. 4. Clients solely are responsible for profit /loss from open position. However in case of intraday commodity derivative position, TCPL shall attempt to square off / close the open positions on the same day or in case of any difficulty’s /issues, on the next trading day. TCPL does not guarantee square off such open positions. Clients are solely responsible for profit/loss arising out of such positions. 5. The client accepts to comply with TCPL’s requirement of payment of Margin /settlement obligation of the client immediately failing which TCPL may sell, dispose the open position and cancel pending orders or square off all or some of the outstanding position of the client as it deems fit at its sole discretion without further reference to the client and any resultant or associated losses that may occur due to such square off / sale shall be borne by the client. TCPL shall be fully indemnified and held harmless by the client in this behalf at all times. 6. The client has to maintain applicable margin all the time i.e., till positions are open. TCPL reserves the right to change /Modify the margin requirement at any point of time and if the client fails to meet the margin requirement, TCPL has the discretion to square off the open positions to the extent that the existing margin after deducting MTM losses meet the initial margin requirement of TCPL for the remaining open positions. TCPL may decide at its sole discretion to exercise or not to exercise the rights to square off the positions, which are failing to meet the margin requirements. Further, the client has been provided with tool / web page on the trading software through which he can ascertain his open positions, amount of margin blocked, margin required, MTM loss, margin percentage etc. The MTM losses and margin requirement displayed on these / web pages will be considered as demand for the additional margin top up calls / margin availability before square off the open positions. Clients are responsible / bound to monitor and review their open positions and margin requirements all the times and furnish additional margin to TCPL before the positions squared off by TCPL. 7. Where there is breach in underlying commodity specified market wide position limit (MWPL) as specified by exchange, Client will not permitted to take fresh positions in that commodity future but he can square off his existing open positions. In case of any of the positions limits (Client level, Trading member level, market level) are breached, TCPL may initiate square off. *Proper reply No Telephonic confirmations shall be entertained regarding collection of requisite/short funds from client to hold the positions unless that is e-mail along with details of Cheque as well as attachment of Scan Copy of Cheque along Details in the Excel format as given below: “RMS Policy Document” Trustline Commodities Pvt. Ltd For Internal Distribution only Page 10 “RMS Policy Document” Trustline Commodities Pvt. Ltd Sr No. 1. 2. 3. Client Code Client Name Amount Cheque No. Bank Name Deposited Bank Remarks Only Transfer Cheques will be entertained. Reporting of the same is required by 10:00 AM in the morning. Even in case of Transfer Cheque, if the same is not reflecting in the bank before 02:00 PM, position will be squared off after 02:00 PM. Specify that you will square off the position before 11:00 AM in case the same is not done, we will square off the balance position. For Internal Distribution only Page 11 “RMS Policy Document” Trustline Commodities Pvt. Ltd Important Points to Remember Branches should send the replies to the square up cases latest by 10:15 AM in the morning. Above said replies should be mailed from the Branch Head/Manager’s E-Mail Id only. Only Transfer Cheque would be acceptable for square off cases, a copy of the same should be mailed to the Funds department and CRD at com_deposits@trustline.in Position will be squared off immediately, if Cheque bounces. In case the reply says that the client’s position will be reduced, the same should be done before 10:30 AM failing which the CRD will reduce the position. Limits are set from the HO as per the policy; one should not call CRD for any limits. A penalty of Rs. 500/- will be imposed on Relationship Manager and Branch head per Cheque, in case of wrong reporting of Cheque and for those cases where client is under square off and his Cheque got bounced. All E-mails regarding the CRD send at rms.commodities@trustline.in instead of individual mail Ids. CRD team is not entertaining any mail of individual E-mail ID. No Calls will be entertained to hold the positions unless there is a mail with details of acceptable negotiable instrument stipulated earlier on with proper details like Scan Copy, Excel Details, No details of cheques will be considered after 4:30 PM (Agri) & 11:00 (11:30) PM on other Commodities All the Reports of Clients i.e.(Contract Notes, Ledgers, Bills, Transaction Details, Net Positions etc) are updated on respective branches FTP on daily basis. For Internal Distribution only Page 12 “RMS Policy Document” Trustline Commodities Pvt. Ltd Disclaimer Note and terms for Use (document for internal use only). This Document contains confidential information and is intended for use and understanding operational activities related to Risk management Department at Trustline Commodities Private Limited and is meant and addressed to Branch managers and authorized persons from branch and business associate. If you are not the intended recipient you are notified that disclosing, copying, distributing or taking any action in reliance on the contents of this information is strictly prohibited. Any form of transmission cannot be guaranteed to be secured or error-free as information could be intercepted, corrupted, lost, destroyed, arrive late or incomplete, or contain viruses. Trustline Commodities Private Limited therefore does not accept liability for any errors or omissions in the contents of this message, which arise as a result of such transmission. If verification is required please request a hard-copy version. Employees of Trustline Commodities Private Limited are expressly required not to make defamatory statements and not to infringe or authorize any infringement of copyright or any other legal right by email communications. Any such communication is contrary to company policy and outside the scope of the employment of the individual concerned. The company will not accept any liability in respect of such communication, and the employee will be personally liable for any damages or other liability arising. Further please note the above mentioned policies are subject for internal use of Trustline Commodities Private Limited and no concern is meant for communicating the same to clients of TRUSTLINE Commodities Private Limited. Also it is hereby expressed that the margin requirement and sufficient liquidity and margin availability has to be maintained and is only the sole responsibility of client to maintain it in accordance with all rules, regulations and bye laws stated by exchanges and FMC. However The RMS Department is facilitating leveraged trading must not be misunderstood as company responsibility to carry any form of short margin or Debit Instances on behalf of client, it is the sole responsibility of client to maintain sufficient margin in their accounts referring SPAN and other requirements as and when posted by exchange. It is also expressed that in case any client is reported with blank debits will only remain as client responsibility to provide funds to cater deficit in their account. Trustline Commodities Pvt. Ltd. Trustline Tower B-3, Sector – 3 Noida, - 201301 Uttar Pradesh, India 0120-4663333 0120-4663388 For Internal Distribution only Page 13