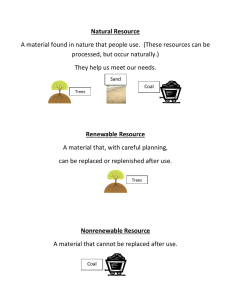

Natural Gas Prices and Coal Displacement

advertisement