PWL Model Portfolios as of June 30, 2016

advertisement

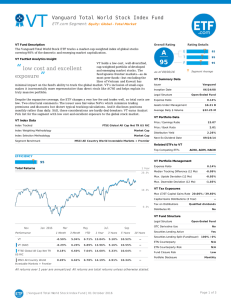

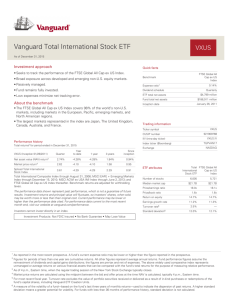

PWL Model Portfolios Security Name as of June 30, 2016 Conservative Cautious Balanced Assertive Aggressive Ticker DFA Five-Year Global Fixed Income Fund Class F DFA231 35.0% 30.0% 25.0% 20.0% 15.0% Vanguard Canadian Short-Term Bond Index ETF VSB 35.0% 30.0% 25.0% 20.0% 15.0% DFA Global Real Estate Securities Fund Class F DFA391 2.0% 2.7% 3.3% 4.0% 4.7% VRE 1.0% 1.3% 1.7% 2.0% 2.3% DFA Canadian Vector Equity Fund Class F DFA600 6.0% 8.0% 10.0% 12.0% 14.0% Vanguard FTSE Canada All Cap Index ETF VCN 3.0% 4.0% 5.0% 6.0% 7.0% DFA223 6.0% 8.0% 10.0% 12.0% 14.0% VUN 3 3.0% 0% 4 4.0% 0% 5 5.0% 0% 6 6.0% 0% 7 7.0% 0% DFA227 6.0% 8.0% 10.0% 12.0% 14.0% iShares Core MSCI EAFE IMI Index ETF XEF 2.4% 3.2% 4.0% 4.8% 5.6% iShares Core MSCI Emerging Markets IMI Index ETF XEC 0.6% 0.8% 1.0% 1.2% 1.4% 100.0% 100.0% 100.0% 100.0% 100.0% 0.28% 0.30% 0.31% 0.33% 0.35% YTD Return 1.88% 1.77% 1.67% 1.56% 1.45% 1-Year Return 2.14% 1.94% 1.74% 1.55% 1.36% 3-Year Annualized Return 5.43% 6.26% 7.06% 7.87% 8.68% 5-Year Annualized Return 4.83% 5.45% 6.05% 6.64% 7.21% 10-Year Annualized Return 4.76% 5.00% 5.20% 5.37% 5.50% 20-Year Annualized Return 6.01% 6.36% 6.68% 6.98% 7.25% Lowest 1-Year Return (03/2008-02/2009) -7.57% -11.72% -15.90% -20.12% -24.38% 20-Year Annualized Standard Deviation 3.65% 4.70% 5.82% 6.98% 8.18% Vanguard FTSE Canadian Capped REIT Index ETF DFA US Vector Equity Fund Class F Vanguard U U.S. S Total Market Index ETF DFA International Vector Equity Fund Class F Weighted Average Management Expense Ratio Model Performance as of June 30, 2016 Sources: Morningstar Direct, MSCI. S&P Dow Jones, Russell, and FTSE TMX Indices courtesy of Dimensional Returns 2.0 This table is published by PWL Capital Inc. for your information only. Information on which this table is based is available on request. Particular investments or trading g j p p g strategies should be evaluated relative to each individual’s objectives in consultation with the Investment Advisor. Opinions of PWL Capital constitute its jjudgment as of the date on this document, and are subject to change without notice. They are provided in good faith but without responsibility for any errors or omissions contained herein. This table is furnished on the basis and understanding that neither PWL Capital Inc. nor its employees, agents or information suppliers is to be under any responsibility of liability whatsoever in respect thereof.