Release date 09-30-2016

Page 1 of 5

Morningstar Analyst Rating

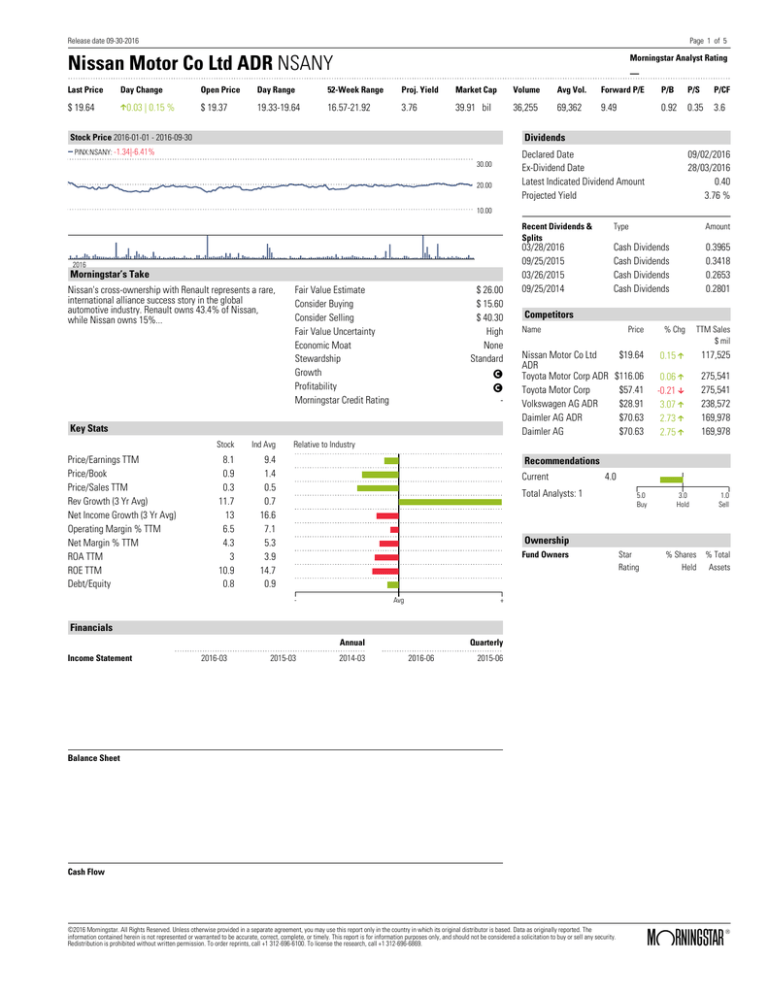

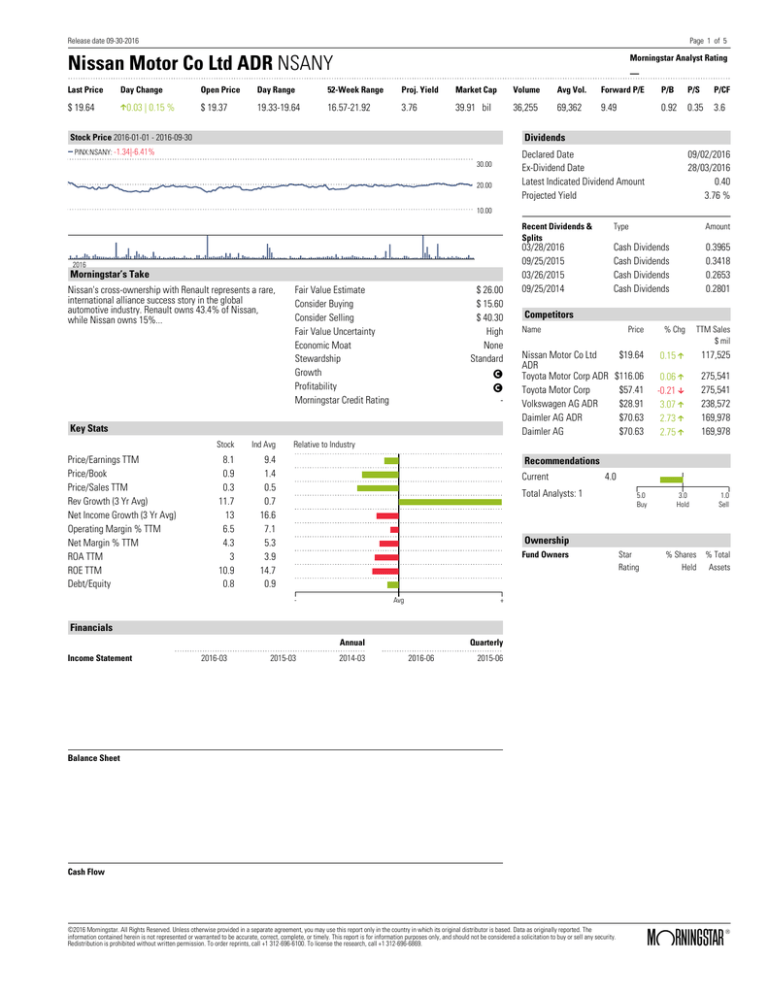

Nissan Motor Co Ltd ADR NSANY

.

Last Price

Day Change

Open Price

Day Range

52-Week Range

Proj. Yield

Market Cap

Volume

Avg Vol.

Forward P/E

P/B

P/S

P/CF

$ 19.64

]0.03 | 0.15 %

$ 19.37

19.33-19.64

16.57-21.92

3.76

39.91 bil

36,255

69,362

9.49

0.92

0.35

3.6

Dividends

Stock Price 2016-01-01 - 2016-09-30

PINX:NSANY: -1.34|-6.41%

Declared Date

Ex-Dividend Date

Latest Indicated Dividend Amount

Projected Yield

30.00

20.00

09/02/2016

28/03/2016

0.40

3.76 %

10.00

2016

Morningstar’s Take

Nissan's cross-ownership with Renault represents a rare,

international alliance success story in the global

automotive industry. Renault owns 43.4% of Nissan,

while Nissan owns 15%...

Fair Value Estimate

Consider Buying

Consider Selling

Fair Value Uncertainty

Economic Moat

Stewardship

Growth

Profitability

Morningstar Credit Rating

$ 26.00

$ 15.60

$ 40.30

High

None

Standard

C

C

-

Key Stats

Price/Earnings TTM

Price/Book

Price/Sales TTM

Rev Growth (3 Yr Avg)

Net Income Growth (3 Yr Avg)

Operating Margin % TTM

Net Margin % TTM

ROA TTM

ROE TTM

Debt/Equity

Stock

Ind Avg

8.1

0.9

0.3

11.7

13

6.5

4.3

3

10.9

0.8

9.4

1.4

0.5

0.7

16.6

7.1

5.3

3.9

14.7

0.9

Recent Dividends &

Splits

Type

Amount

03/28/2016

09/25/2015

03/26/2015

09/25/2014

Cash Dividends

Cash Dividends

Cash Dividends

Cash Dividends

0.3965

0.3418

0.2653

0.2801

Competitors

Name

Price

% Chg

TTM Sales

$ mil

Nissan Motor Co Ltd

$19.64

ADR

Toyota Motor Corp ADR $116.06

Toyota Motor Corp

$57.41

Volkswagen AG ADR

$28.91

Daimler AG ADR

$70.63

Daimler AG

$70.63

0.15 ]

117,525

0.06 ]

-0.21 [

3.07 ]

2.73 ]

2.75 ]

275,541

275,541

238,572

169,978

169,978

Relative to Industry

Recommendations

Current

4.0

Total Analysts: 1

5.0

Buy

3.0

Hold

1.0

Sell

Ownership

Fund Owners

-

Avg

Star

Rating

% Shares

Held

% Total

Assets

+

Financials

Annual

Income Statement

2016-03

2015-03

2014-03

Quarterly

2016-06

2015-06

Balance Sheet

Cash Flow

©2016 Morningstar. All Rights Reserved. Unless otherwise provided in a separate agreement, you may use this report only in the country in which its original distributor is based. Data as originally reported. The

information contained herein is not represented or warranted to be accurate, correct, complete, or timely. This report is for information purposes only, and should not be considered a solicitation to buy or sell any security.

Redistribution is prohibited without written permission. To order reprints, call +1 312-696-6100. To license the research, call +1 312-696-6869.

®

ß

Release date 09-30-2016

Page 2 of 5

Morningstar Analyst Rating

Nissan Motor Co Ltd ADR NSANY

.

Last Price

Day Change

Open Price

Day Range

52-Week Range

Proj. Yield

Market Cap

Volume

Avg Vol.

Forward P/E

P/B

P/S

P/CF

$ 19.64

]0.03 | 0.15 %

$ 19.37

19.33-19.64

16.57-21.92

3.76

39.91 bil

36,255

69,362

9.49

0.92

0.35

3.6

Financials

Annual

Quarterly

In millions except "EPS". Currency in JPY.

©2016 Morningstar. All Rights Reserved. Unless otherwise provided in a separate agreement, you may use this report only in the country in which its original distributor is based. Data as originally reported. The

information contained herein is not represented or warranted to be accurate, correct, complete, or timely. This report is for information purposes only, and should not be considered a solicitation to buy or sell any security.

Redistribution is prohibited without written permission. To order reprints, call +1 312-696-6100. To license the research, call +1 312-696-6869.

®

ß

Release date 09-30-2016

Page 3 of 5

Nissan Motor Co Ltd ADR NSANY

Quote

Stock Type

Industry Classification

NAICS

SIC

ISIC

Fair Value Estimate

Morningstar Rating TM

19.64

$ 26.00

QQQQ

Company Profile

()

Manufacture of Motor Vehicles (2910)

Operation Details

Fiscal Year Ends

CIK

Year Established

Employees (31/03/2009)

Full Time

Part Time

Auditor (31/03/2009)

Legal Advisor ()

Key Executives

Last Close 30/09/2016

2017-03-31

800937

152,421

Nissan Motor Co Ltd is engaged in the manufacturing,

sale and related business of automotive products,

industrial machinery and marine equipment.

30-day Avg Volume

Market Cap

Net Income

Sales

Sector

Industry

Stock Style

Direct Investment

Dividend Reinvestment

0.1Mil

39.9Bil

5.0Bil

117.5Bil

Consumer Cyclical

Auto Manufacturers

1 Large Value

No

No

Ernst & Young ShinNihon LLC

©2016 Morningstar. All Rights Reserved. Unless otherwise provided in a separate agreement, you may use this report only in the country in which its original distributor is based. Data as originally reported. The

information contained herein is not represented or warranted to be accurate, correct, complete, or timely. This report is for information purposes only, and should not be considered a solicitation to buy or sell any security.

Redistribution is prohibited without written permission. To order reprints, call +1 312-696-6100. To license the research, call +1 312-696-6869.

®

ß

Release date 09-30-2016

Page 4 of 5

Nissan Motor Co Ltd ADR NSANY

Quote

Stock Type

Last Close 30/09/2016

Fair Value Estimate

Morningstar Rating TM

19.64

$ 26.00

QQQQ

Industry Peers

Morningstar

Rating

Market

Cap $Mil

Net

Income $Mil

P/S

P/B

P/E

Dividend

Yield%

5 Yr Rev

CAGR%

Med Oper.

Margin%

Interest

Coverage

D/E

Nissan Motor Co Ltd (JPY)

Toyota Motor Corp (USD,JPY)

Toyota Motor Corp (USD,JPY)

Daimler AG (USD,EUR)

Daimler AG (USD,EUR)

QQQQ

QQQ

39,852

193,587

192,034

73,548

73,538

507,421

2,218,765

2,218,765

7,974

7,974

0.3

0.7

0.6

0.4

0.4

0.9

1.2

1.2

1.3

1.3

8.1

8.3

8.2

8.2

8.2

3.8

3.1

3.0

5.4

5.4

6.8

8.4

8.4

8.9

8.9

5.1

9.5

9.5

7.9

7.9

30.5

85.3

85.3

42.2

42.2

0.8

0.6

0.6

1.1

1.1

Volkswagen AG (USD,EUR)

Volkswagen AG (USD,EUR)

Volkswagen AG (USD,EUR)

Volkswagen AG (USD,EUR)

Bayerische Motoren Werke AG (USD,EUR)

QQQQ

70,306

70,040

64,065

63,975

53,831

-3,454

-3,454

-3,454

-3,454

6,686

0.3

0.3

0.3

0.3

0.5

0.7

0.7

0.6

0.6

1.1

7.2

0.1

0.1

0.2

0.2

4.4

8.8

6.0

6.0

6.0

6.0

10.8

0.2

0.2

0.2

0.2

22.8

0.7

0.7

0.7

0.7

1.2

53,708

52,554

51,959

49,169

48,603

6,686

333,193

333,193

12,444

6,686

0.5

0.4

0.4

0.3

0.5

1.1

0.8

0.8

1.1

1.0

7.2

15.9

15.7

4.1

6.5

4.4

2.9

2.8

4.8

5.0

8.8

10.3

10.3

2.4

8.8

10.8

5.3

5.3

3.2

10.8

22.8

36.0

36.0

18.4

22.8

1.2

0.5

0.5

1.2

1.2

47,559

40,035

32,239

30,235

30,169

8,482

507,421

6,417,303

3,493

431,336

0.3

0.3

0.3

0.5

0.9

1.5

0.9

0.6

1.1

2.3

5.6

8.2

5.5

7.7

7.1

5.0

4.2

2.9

3.7

3.0

6.8

6.5

10.5

15.4

5.4

5.1

9.5

10.1

14.1

14.3

30.5

33.6

86.2

248.7

3.1

0.8

0.7

0.0

0.0

29,842

29,389

26,703

24,502

23,488

-1,125

431,336

95,883

6,417,303

2,945

5.9

0.9

0.7

0.2

0.4

11.8

2.2

2.3

0.4

0.7

6.9

18.4

4.2

6.7

3.4

0.0

3.9

3.3

103.2

15.4

17.0

6.5

3.1

-17.7

14.1

3.3

9.5

2.7

-6.4

248.7

3.6

33.6

9.5

1.0

0.0

0.7

0.7

0.1

Renault SA (USD,EUR)

BYD Co Ltd (USD,CNY)

BYD Co Ltd (USD,CNY)

Porsche Automobil Holding SE (USD,EUR)

Suzuki Motor Corp (USD,JPY)

23,097

16,613

16,552

15,159

15,150

2,945

4,616

4,616

-944

122,916

0.4

1.2

1.2

6.6

24.9

24.8

3.4

3.1

10.7

10.7

2.7

4.8

4.8

0.1

0.2

0.2

0.5

0.7

3.2

3.2

0.5

1.7

Porsche Automobil Holding SE (USD,EUR)

Toyota Industries Corp (USD,JPY)

Suzuki Motor Corp (USD,JPY)

Toyota Industries Corp (USD,JPY)

Jardine Cycle & Carriage Ltd (USD)

15,147

14,708

14,590

14,507

12,845

-944

177,898

122,916

177,898

656

0.7

0.5

0.7

0.8

12,459

12,196

12,125

12,118

11,729

323

32,112

656

1,540

1,540

11,490

10,425

9,688

9,477

9,248

Great Wall Motor Co Ltd (USD,CNY)

Mazda Motor Corp (USD,JPY)

Great Wall Motor Co Ltd (USD,CNY)

Guangzhou Automobile Group Co Ltd (USD,CNY)

Mazda Motor Corp (USD,JPY)

Dongfeng Motor Group Co Ltd (USD,CNY)

Bayerische Motoren Werke AG (USD,EUR)

Honda Motor Co Ltd (USD,JPY)

Honda Motor Co Ltd (USD,JPY)

General Motors Co (USD)

Bayerische Motoren Werke AG (USD,EUR)

QQQQ

QQQQ

QQ

QQQQ

Ford Motor Co (USD)

Nissan Motor Co Ltd (USD,JPY)

Hyundai Motor Co (USD,KRW)

Audi AG (USD,EUR)

Fuji Heavy Industries Ltd (USD,JPY)

QQQQ

Tesla Motors Inc (USD)

Fuji Heavy Industries Ltd (USD,JPY)

Tata Motors Ltd (USD,INR)

Hyundai Motor Co (USD,KRW)

Renault SA (USD,EUR)

QQQQ

Ferrari NV (USD,EUR)

Mahindra & Mahindra Ltd (USD,INR)

Jardine Cycle & Carriage Ltd (USD)

Peugeot SA (USD,EUR)

Peugeot SA (USD,EUR)

Sime Darby Bhd (USD,MYR)

Fiat Chrysler Automobiles NV (USD,EUR)

Isuzu Motors Ltd (USD,JPY)

Dongfeng Motor Group Co Ltd (USD,CNY)

Isuzu Motors Ltd (USD,JPY)

QQQ

QQQ

QQQQQ

13.1

2.2

0.5

4.0

6.0

9.5

3.6

3.6

-18.8

39.5

0.5

0.8

1.6

0.8

2.3

8.3

12.6

8.2

19.5

2.3

2.2

1.0

2.5

2.1

8.5

4.0

8.5

0.0

5.4

6.0

5.4

10.4

-18.8

16.9

39.5

16.9

27.3

0.4

0.5

0.4

0.4

2.9

1.1

0.8

0.2

0.2

104.6

2.8

2.2

0.9

0.9

34.4

26.4

18.4

8.5

8.2

1.0

0.9

2.2

16.2

0.0

-0.5

-0.5

15.6

6.8

10.4

0.2

0.2

2.3

27.3

3.6

3.6

23.4

0.9

0.4

0.4

0.4

2,157

719

102,704

11,424

102,704

1.1

0.1

0.5

0.5

0.5

1.5

0.6

1.3

0.7

1.3

21.9

14.5

9.9

5.5

9.4

3.2

2.6

2.8

2.4

6.1

25.2

6.4

0.7

6.4

9.6

0.8

9.0

5.8

9.0

15.8

1.1

95.0

55.3

95.0

0.4

1.5

0.2

0.1

0.2

9,127

9,086

9,081

9,073

9,062

8,267

118,896

8,267

6,443

118,896

0.8

0.3

0.8

1.6

0.3

1.5

1.0

1.5

1.4

1.0

7.4

7.7

7.4

9.6

7.7

4.9

1.9

6.9

2.2

1.8

27.0

7.9

27.0

27.5

7.9

14.8

6.7

14.8

-2.2

6.7

168.7

14.0

168.7

6.2

14.0

0.0

0.4

0.0

0.3

0.4

8,650

11,424

0.5

0.6

5.1

3.0

0.7

5.8

55.3

0.1

©2016 Morningstar. All Rights Reserved. Unless otherwise provided in a separate agreement, you may use this report only in the country in which its original distributor is based. Data as originally reported. The

information contained herein is not represented or warranted to be accurate, correct, complete, or timely. This report is for information purposes only, and should not be considered a solicitation to buy or sell any security.

Redistribution is prohibited without written permission. To order reprints, call +1 312-696-6100. To license the research, call +1 312-696-6869.

0.5

®

ß

Release date 09-30-2016

Page 5 of 5

Nissan Motor Co Ltd ADR NSANY

Quote

Stock Type

Last Close 30/09/2016

Fair Value Estimate

Morningstar Rating TM

19.64

$ 26.00

QQQQ

Industry Peers

Geely Automobile Holdings Ltd (USD,CNY)

Geely Automobile Holdings Ltd (USD,CNY)

Yamaha Motor Co Ltd (USD,JPY)

Hino Motors Ltd (USD,JPY)

8,252

8,054

7,019

6,267

2,763

2,763

40,321

57,162

1.6

1.6

0.5

0.4

2.6

2.5

1.5

1.5

19.9

19.5

17.6

11.1

0.5

0.5

2.4

3.0

8.4

8.4

4.5

7.0

10.8

10.8

4.2

5.9

671.7

671.7

18.5

15.6

0.1

0.1

0.3

0.1

Hino Motors Ltd (USD,JPY)

Brilliance China Automotive Holdings Ltd (USD,CNY)

Brilliance China Automotive Holdings Ltd (USD,CNY)

Mitsubishi Motors Corp (USD,JPY)

Ford Otomotiv Sanayi AS (USD,TRY)

6,225

5,701

5,591

4,632

3,878

57,162

3,386

3,386

72,575

899

0.4

7.2

7.1

0.2

0.6

1.5

1.7

1.7

0.7

3.6

11.0

11.3

11.0

6.4

12.9

3.1

1.2

1.3

2.7

5.0

7.0

-11.5

-11.5

4.4

17.0

5.9

-2.9

-2.9

6.0

6.2

15.6

23.6

23.6

69.6

18.0

0.1

New Flyer Industries Inc (USD)

Elio Motors Inc (USD)

Blue Bird Corp (USD)

Supreme Industries Inc (USD)

Kandi Technologies Group Inc (USD)

1,844

525

326

324

261

88

-26

12

18

5

0.9

3.3

20.3

2.0

9.4

4.3

0.9

0.4

1.1

1.2

3.3

1.0

49.1

17.5

45.8

0.7

4.7

36.2

3.5

5.5

3.1

7.2

-1.1

1.9

216.7

10.4

75

48

28

5

1

15

-1

-4

-1

-9

0.3

8.4

-16,088.0

-74.5

-47.0

-132.7

14.0

-68.9

-38.9

-5.6

-2.7

0

0

0

0.2

51.5

-205.6

-2.8

4.5

-51.6

-68.8

4.2

-1.0

-8.0

18.5

-5.2

17.0

-109.7

-991.4

6.2

18.0

-1,018.9

-9.9

19.9

-146.0

-0.3

22.6

27.5

-17,943.4

9.7

-2.2

-10.4

3.2

6.2

2.2

0.3

7.0

6.8

2.5

9.2

9.5

1.8

14.9

7.7

990.5

33.6

0.3

1.0

0.3

0.0

0.7

46.7

2.3

282.4

236.0

88.1

0.1

0.9

0.0

14.8

5.9

6.8

11.6

13.4

7.5

9.7

9.2

9.7

6.5

6.5

6.8

8.4

6.8

9.5

9.5

14.9

6,018.9

14.9

33.6

33.6

1.0

0.0

1.0

0.7

0.7

6.5

6.5

9.5

9.5

33.6

33.6

0.7

0.7

11.1

-378.4

119.1

0.9

SORL Auto Parts Inc (USD)

GreenPower Motor Company Inc (USD,CAD)

Grande West Transportation Group Inc (USD,CAD)

Greenkraft Inc (USD)

Saleen Automotive Inc (USD)

Balqon Corp (USD)

Green Automotive Co Corp

MotivNation Inc (USD)

Carroll Shelby International Inc (USD)

Yamaha Motor Co Ltd (USD,JPY)

3.8

0.7

0.1

0.6

33.3

57.4

4.8

1.9

-3

-4

40,321

Highline Technical Innovations Inc (USD)

Electric Car Co Inc (USD)

Ford Otomotiv Sanayi AS (USD,TRY)

Sea Star Group Inc

eFleets Corp (USD)

-11

-3

899

-4

0.3

T3 Motion Inc (USD)

Xtreme Motorsports International Inc

Vision Industries Corp (USD)

Otokar Otobus Karoseri Sanayi AS (USD,TRY)

Guangzhou Automobile Group Co Ltd (USD,CNY)

-10

0.1

-1

95

6,443

Ghabbour Auto (USD,EGP)

Tofas Turk Otomobil Fabrikasi AS (USD,TRY)

BAIC Motor Corp Ltd (USD,CNY)

Maruti Suzuki India Ltd (USD,INR)

Hyundai Motor Co (USD,KRW)

188

911

3,559

46,988

6,417,303

Kia Motors Corp (USD,KRW)

Mahindra & Mahindra Ltd (USD,INR)

Hero MotoCorp Ltd (USD,INR)

Eicher Motors Ltd (USD,INR)

Chongqing Changan Automobile Co Ltd (USD,CNY)

2,611,392

32,112

23,647

14,323

10,358

0.5

0.7

6.0

2.7

Tofas Turk Otomobil Fabrikasi AS (USD,TRY)

Jiangling Motors Corp Ltd (USD,CNY)

Tofas Turk Otomobil Fabrikasi AS (USD,TRY)

Hyundai Motor Co (USD,KRW)

Hyundai Motor Co (USD,KRW)

911

1,845

911

6,417,303

6,417,303

0.9

3.8

11.5

6.4

Hyundai Motor Co (USD,KRW)

Hyundai Motor Co (USD,KRW)

6,417,303

6,417,303

Industry Average

—

25,658

567,908

23.7

9.7

9.4

6.5

0.5

1.4

9.0

2.9

7.0

16.2

11.8

©2016 Morningstar. All Rights Reserved. Unless otherwise provided in a separate agreement, you may use this report only in the country in which its original distributor is based. Data as originally reported. The

information contained herein is not represented or warranted to be accurate, correct, complete, or timely. This report is for information purposes only, and should not be considered a solicitation to buy or sell any security.

Redistribution is prohibited without written permission. To order reprints, call +1 312-696-6100. To license the research, call +1 312-696-6869.

0.0

0.4

0.1

0.3

0.0

0.3

0.4

®

ß