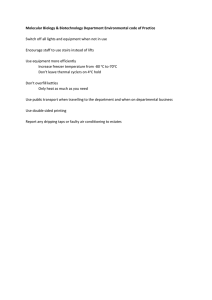

Application Form for Additional Dedicated TAPs/IDs (for Primary

advertisement

Form 5 (yyyy/mm/dd) Date: (Trading Participant→OSE) To Osaka Exchange, Inc. Application Form for Additional Dedicated TAPs/IDs (for Primary Market Makers) <Application Procedure Flow> 1. Submission of Application Form (Draft version) ・Please submit Application Form (draft) with the contents except for the TAP information filled in . ・Please also submit the draft of (a) Application Form for Maket Maker (*1) and (b) Usage Application for TAPs/IDs (*2) 2. Receiving of TAP information ・OSE sends back Application Form with the TAP information included after OSE reviews the contents along with (a) and (b) described above. 3. Submission of Application Form (Final version) ・After receiving the TAP information, please submit the signed Application Form as well as the singed version of (a) and (b) described above. 4. Product Operation Application ・Please submit the production operation application including additional Dedicated TAPs/IDs to JPX Service Desk. XYZ Securities Company Name of Trading Participant Signed by the Person in Charge (Phone) XXX-XXXX-XXXX (E-mail) abc@xyz Name of Client ●●●● △△△△△ Sub-Participant Code (*1) Please submit Application Form for Maket Maker when the applicant is not designated as a market maker for the eligible contracts correponding to additional Dedicated TAPs. (*2) Meaning the Usage Application for TAPs/IDs to be submitted to JPX Service Desk. Please describe the number of Dedicated TAPs/IDs including the additional usage in the Usage Application for TAPs/IDs. We hereby apply for additional Dedicated TAPs/IDs as a primary market maker with respect to the following eligible contracts for conducting market making on OSE. Additional Dedicated TAP Eligible Contracts for Market Making #1 Nikkei 225 mini #2 DJIA Futures #3 FTSE China 50 Index Futures #4 JPX-Nikkei Index 400 Options #5 JPX-Nikkei Index 400 Options #6 JPX-Nikkei Index 400 Options #7 Nikkei 225 Options (Regular Options) #8 Nikkei 225 Options (Regular Options) #9 Nikkei 225 Options (Regular Options) #10 Nikkei 225 Options (Regular Options) #11 Nikkei 225 Options (Regular Options) #12 Nikkei 225 Options (Regular Options) #13 #14 #15 TAP Information (Described by OSE) The number of additional Dedicated TAPs/IDs that may be applied is up to 1 TAP/ 10 IDs per eligible futures contract and 3 TAPs/ 30 IDs per eligible options contract. In cases where the applicant wishes to use several Dedicated TAPs per options contracts, please include the same eligible contracts by the Please submit the draft version with TAP information blank. After OSE reviews the Application Form for Market Maker and Usage Application for TAPs/IDs, OSE will fill in the TAP information. In case of applying for Nikkei 225 Options Dedicated TAPs, please write down the corresponding "Additional Dedicated TAP" number and indicate that these are Nikkei 225 Options Dedicated TAPs in "Remarks" box. Remarks: please fill in if necessary. #10 - #12: Nikkei 225 Options Dedicated TAPs <Note> ・ Please submit this application form per primary market maker (PMM). ・ The number of additional Dedicated TAPs/IDs that may be applied is up to 1 TAP/ 10 IDs per eligible futures contract and 3 TAPs/ 30 IDs per eligible options contract. However, as for only Nikkei 225 Options (Regular Options), the additional of 10 TAPs/ 100 IDs may be applied under the following condition. Condition: Dedicated TAPs which exceed 3 TAPs shall be “Nikkei 225 Options Dedicated TAPs”, which register IDs placing orders only to Nikkei 225 Options (J-GATE Partition 1). ・ In case of applying for Nikkei 225 Options Dedicated TAPs, please write down the corresponding "Additional Dedicated TAP" number (#1 - #15) and that these are Nikkei 225 Options Dedicated TAPs in "Remarks" box above. ・ The number of additional Dedicated TAPs that may be applied is up to 10 TAPs in total. However, the upper limit will be 15 TAPs in total under the following condition. Condition: Dedicated TAPs which exceed 10 TAPs shall be “Nikkei 225 Options Dedicated TAPs”. ・ If the applicant is not desingated as a primary market maker, the applicant must submit the Application Form for Market Maker (Form 1) along with this application form. ・ This application form is to ask for permission to use additional Dedicated TAPs/IDs for primary market makers against the upper limit. Please note that it is necessary to apply seperately for Dedicated TAPs/IDs to JPX Service Desk in order to receive allocation and issueance of Dedicated TAPs/IDs. ・ OSE allows the use of additional Dedicated TAPs/IDs by corresponding to eligible contract for market making per Dedicated TAP. Therefore, in cases where OSE deems that the market maker does not sufficiently fulfill its role as a market maker, OSE will suspend the additional use of Dedicated TAPs/IDs. In such cases, the primary market maker will not be allowed to suspend Dedicated TAPs/IDs other than the ones applied for the eligible contracts for market making. ・ Please submit the original of this form after completion. Furthermore, OSE will confirm the contents of draft versions submitted via email. Please submit the draft versions with TAP information blank. OSE designates TAP information. <Contact Information> Osaka Exchange,Inc. / Market Operations Department / Trading Participant team 1-8-16, Kitahama, Chuo-ku, Osaka 541-0041, Japan Tel: +81-6-4706-0935 / E-mail:torisan_ose@jpx.co.jp (Treatment of personal information) OSE requests personal information in order to maintain communication, etc. pertaining to Market Making. Please access the following URL for our Privacy Policy and inquiries about personal information. (http://www.jpx.co.jp/en/handling-of-personal-information/index.html)