Discussion Paper - ESMA

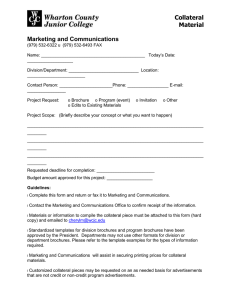

advertisement