Distributed Renewable Energy Finance and Policy Toolkit

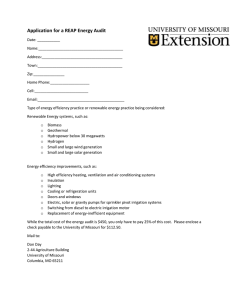

advertisement