Market Musings

Rates, FX and Commodities Strategy

21 October 2015 | New York

Look Who’s Buying

Most of the traditional and price insensitive buyers of Treasuries

(the Fed, foreign official reserves, and commercial banks)

appear to have stepped away in 2015.

Instead, the emerging buyers of Treasuries have become

mutual funds and we believe, private foreign investors. These

investors are more price sensitive, not just outright, but relative

to alternative investments. This should continue to support

strong correlation between long end rates and risky assets, as

well as global rates.

Shifting tides in demand

Recent market attention has been focused predominantly on large

selling of Treasury securities by foreign central banks. This has

occurred with the Fed no longer adding to its portfolio and many

immediate commercial bank LCR needs being fulfilled, which has

served to keep bank demand in check. Conspicuously absent from

the recent discussion have nevertheless been the key sources of

demand that have allowed Treasury yields to remain low despite

notable selling pressure. After all, with China selling $200bn in

Treasuries since the start of the year (according to TIC data), the

decline in Treasury yields during this period suggests that other

buyers have been able to more than offset the selling pressure.

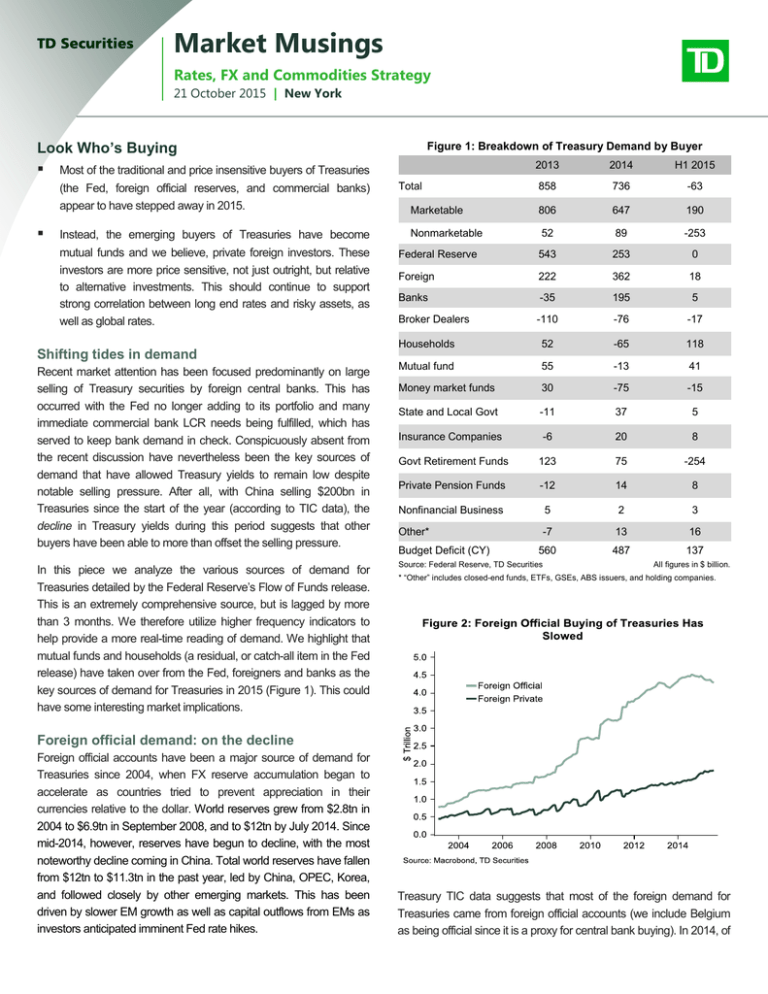

In this piece we analyze the various sources of demand for

Treasuries detailed by the Federal Reserve’s Flow of Funds release.

This is an extremely comprehensive source, but is lagged by more

than 3 months. We therefore utilize higher frequency indicators to

help provide a more real-time reading of demand. We highlight that

mutual funds and households (a residual, or catch-all item in the Fed

release) have taken over from the Fed, foreigners and banks as the

key sources of demand for Treasuries in 2015 (Figure 1). This could

have some interesting market implications.

Figure 1: Breakdown of Treasury Demand by Buyer

2013

2014

H1 2015

858

736

-63

Marketable

806

647

190

Nonmarketable

52

89

-253

Federal Reserve

543

253

0

Foreign

222

362

18

Banks

-35

195

5

Broker Dealers

-110

-76

-17

Households

52

-65

118

Mutual fund

55

-13

41

Money market funds

30

-75

-15

State and Local Govt

-11

37

5

Insurance Companies

-6

20

8

Govt Retirement Funds

123

75

-254

Private Pension Funds

-12

14

8

Nonfinancial Business

5

2

3

Other*

-7

13

16

560

487

Total

Budget Deficit (CY)

Source: Federal Reserve, TD Securities

137

All figures in $ billion.

* “Other” includes closed-end funds, ETFs, GSEs, ABS issuers, and holding companies.

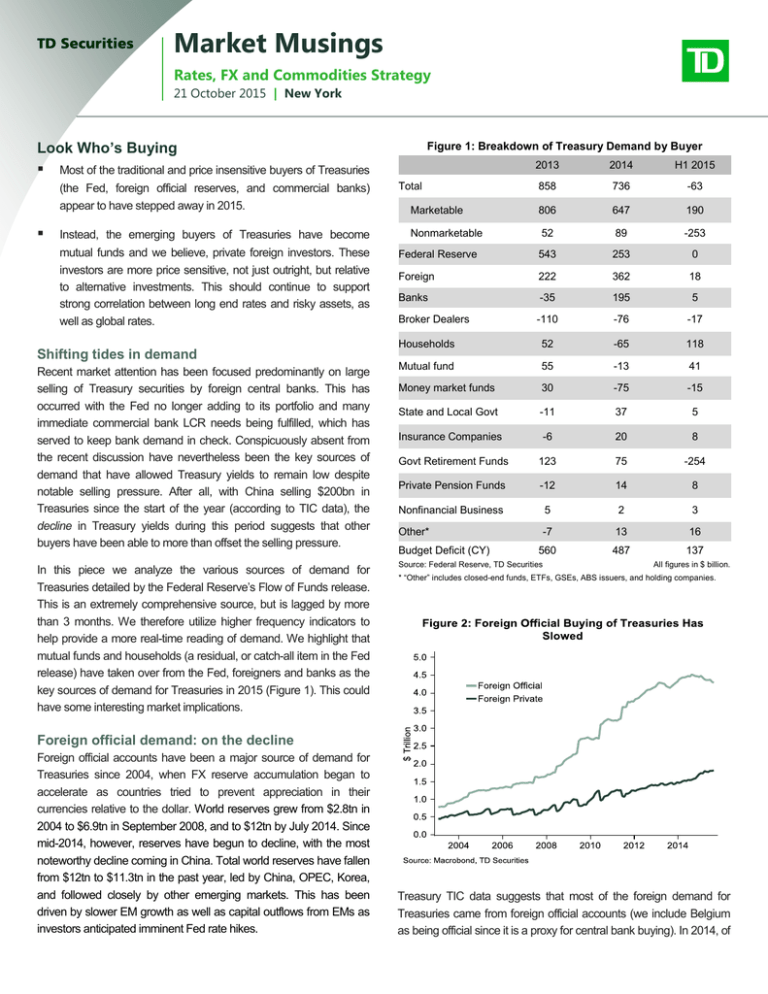

Foreign official demand: on the decline

Foreign official accounts have been a major source of demand for

Treasuries since 2004, when FX reserve accumulation began to

accelerate as countries tried to prevent appreciation in their

currencies relative to the dollar. World reserves grew from $2.8tn in

2004 to $6.9tn in September 2008, and to $12tn by July 2014. Since

mid-2014, however, reserves have begun to decline, with the most

noteworthy decline coming in China. Total world reserves have fallen

from $12tn to $11.3tn in the past year, led by China, OPEC, Korea,

and followed closely by other emerging markets. This has been

driven by slower EM growth as well as capital outflows from EMs as

investors anticipated imminent Fed rate hikes.

Treasury TIC data suggests that most of the foreign demand for

Treasuries came from foreign official accounts (we include Belgium

as being official since it is a proxy for central bank buying). In 2014, of

Market Musings

21 October 2015 | TD Securities | New York

the $362bn in total foreign demand for Treasuries, we estimate that

$137bn emanated from foreign official accounts (Figure 2).

Figure 1 shows that total foreign demand accounted for $362bn in

Treasuries in 2014 but slowed to a meager $18bn in H1 2015. We

argue that the picture likely looks much worse in H2 given further run

-off in FX reserves after the devaluation of the RMB in August.

Treasury TIC data suggests that foreigners sold a total of $88bn in

July and August, and we believe that holdings continued to decline in

September as well, with Chinese reserves falling another $43bn

during the month. Figure 3 highlights that even though Treasuries

comprise about 40% of China’s reserves, much of the recent decline

in reserves has been met by a disproportionate amount of Treasury

selling.

Federal Reserve: no more QE, but reinvestments

Following the end of QE3, the Fed is no longer buying Treasury

securities (and MBS). Thus it is natural for this buyer base to decline

in importance. This is particularly important for the long end for the

curve, since Treasury buying removed a large chunk of long duration

paper during Operation Twist and QE3. We expect the Fed to

continue reinvesting maturing Treasuries throughout 2016, which

would keep demand from this category unchanged at zero. However

once reinvestment ends, maturing Fed issues will add additional

supply to the market since Treasury will need to issue extra paper.

This is particularly an issue in 2017 and 2018, when we estimate a

respective $194bn and $373bn of paper rolls off the Fed balance

sheet.

Banks: LCR no longer a binding constraint

Commercial banks have historically not been large buyers of

Treasuries, but they emerged as one of the strongest buyers in 2014

due to Liquidity Coverage Ratio (LCR) needs. We believe that the

run-up in bank Treasury holdings was predominantly driven by LCR

needs (rather than a market view about Treasury yields or MBS

spreads), since banks’ advances from the FHLB system increased

considerably during the same period when banks purchased $210bn

in Treasuries between late-2013 and early-2015.

There has been little buying of Treasuries by banks in 2015,

suggesting that many have reached full LCR compliance and may

currently be focused on optimization, replacing some of their

Treasuries with higher-yielding Level 1 assets. The Fed’s H8 release

provides a more high frequency indicator of bank demand,

suggesting that banks have actually sold $9bn in Treasuries this

year. MBS holdings, in contrast, have risen $124bn since the start of

2015 (Figure 4). We do not expect Treasury demand to repeat 2014

levels going forward as banks continue to focus on optimizing their

LCR strategies.

2

Market Musings

21 October 2015 | TD Securities | New York

Figure 7: Net Marketable Issuance Has Declined

Considerably

Year Treasuries TIPS FRNs Total

Net

Bills

Maturing

Net

Issuance

2011

2004

131

0

2135

-252

791

1344

2012

2004

149

0

2153

108

1184

969

2013

1985

155

0

2140

-37

1297

843

2014

1896

155

164

2215

-181

1447

768

2015

1803

155

164

2122

-107

1425

697

Source: Treasury, TD Securities

Broker dealers: SLR forcing reduction

While broker dealer holdings of Treasuries have continued to decline

steadily in recent years due to the rising cost of dealer balance sheet

due to SLR, recent central bank selling of Treasuries has ended up

on dealer balance sheets (Figure 5). Weekly Fed data shows that

dealer holdings of nominal coupon securities reached a high of

$60bn during the recent selloff—the highest level since late-2013.

While the Flow of Funds data shows that broker dealer balance

sheets declined by $17bn in H1 2015, we expect recent selling to

help push the figure higher in August and September, offsetting the

lower H1 data. This higher demand should nevertheless prove

temporary as dealers should look to offload this paper over time.

Mutual funds and households (residual)

Mutual funds have emerged as one of the strongest sources of

Treasury demand so far in H1, buying $82bn on an annualized

basis. We believe that this is a function of hedging demand against

risky assets as well as a shift away from other lower-yielding bond

markets globally. By the end of January 2015 (when the ECB

announced QE), 10yr Treasuries yielded 1.64%, compared with

similar maturity Bunds at just 0.30%, JGBs at 0.28% and Gilts at

1.33%. We expect this source of demand to have strengthened in

H2 2015 given the risk-off move that occurred in August and

September, and expectations of more easing by the ECB and BoJ.

The “household” sector is a little more difficult to explain. It is a

residual or catch-all in the Flow of Funds report, which measures

“pure households” but also includes any demand that was not

captured by the other categories. Note that “pure households” tend

to buy US savings securities rather than marketable debt.

Interestingly, total US savings certificates have shrunk by $2.8bn this

year, after declining by $3.3bn and $3.2bn in 2013 and 2014,

respectively.

* All figures in $ billion.

Thus we believe that the Flow of Funds household sector is

capturing some other buyer base (rather than pure households)

demanding more Treasuries. Growth in this category has often been

associated with hedge funds, since there is no other category that

can capture this investor base. However we find it difficult to explain

such large demand for Treasuries since hedge funds often need to

employ a great deal of leverage—a difficult undertaking in a balance

sheet-constrained world. Instead we believe this category may be

reflecting private foreign demand as well as some mutual fund

demand that was not entirely being captured by mutual fund flow.

The supply story: debt ceiling

nonmarketable debt and bills

effect

on

While shifts in demand for Treasuries have been more dramatic in

2015, there have been important changes in supply as well—both

structural and one-off.

Structural: Due to a stronger economy as well as the budget

accord in 2011, the deficit has been declining in recent years. In

fact, improving economic growth momentum since the crisis

has allowed revenues to rise to 18% of GDP from a low of 14%

in 2009. The decline in outlays has been equally dramatic, with

outlays falling to 20% of GDP today from 25% in 2009. Outlays

have nevertheless seen some stabilization at these lower levels

over the past two years, while stronger than expected economic

growth has allowed revenues to continue expanding steadily

(Figure 6). Improving budget dynamics have allowed Treasury

to considerably cut back net issuance. We estimate that net

coupon issuance (including floaters and TIPS) declined by

$71bn in 2015 compared with 2014 (Figure 7).

One-off: With the debt ceiling rapidly approaching, Treasury

began to cut bill issuance in August and started to cut

3

Market Musings

21 October 2015 | TD Securities | New York

nonmarketable debt issuance in May. Since the start of

extraordinary measures, nonmarketable debt has declined by

$210bn and bills outstanding have declined by another $210bn,

with $42bn more expected in the run-up to the X-date. This is

consistent with the drop in holdings by government retirement

funds (nonmarketable debt) and money market mutual funds

(Figure 1). We do not expect this decline to persist; assuming

that the debt ceiling is raised by the November 3 X-date, bills

and nonmarketable debt issuance should rise rapidly.

Market implications

Even though supply and demand technically do balance each other

out, the more important question is one of the price clearing level.

The biggest market impact of the supply-demand technical is on

term premium (the component of rates that is independent of Fed

expectations). According to the Kim-Wright model, the 10yr term

premium has been largely range bound all year despite this rotation

of key Treasury buyers. This indicates that the stepping away of the

traditional buyers has not impacted term premium so far. The decline

in 10yr yields has been more a function of Fed expectations, but the

stability of term premiums is still impressive.

We believe that there are two main market implications of this

shifting demand technical:

Greater volatility: Price insensitive buyers (such as foreign

officials, banks, and the Fed) have been replaced by price

sensitive buyers. This suggests that demand for Treasuries

could become somewhat more volatile as the market searches

for the marginal buyer. This can argue for more realized volatility

—a factor already vividly reflected in this year’s volatile price

action.

Greater cross asset correlations: However the “price” in this

context of price sensitive buyers does not refer solely to

Treasury prices, but also to the prices of alternative investments.

If equities fall, mutual fund safe haven demand for Treasuries

should increase. Similarly, low global bond yields can create

demand for higher yielding Treasuries. Thus we argue that the

correlation between 10yr Treasury yields and risky assets as

well as global developed market rates should remain strong.

Priya Misra, Gennadiy Goldberg, Cheng Chen

4

Market Musings

21 October 2015 | TD Securities | New York

GLOBAL STRATEGY TEAM

Global Strategy

Richard Kelly

Head of Global Strategy

44 20 7786 8448

Global Rates Strategy

Priya Misra

Head of Global Rates Strategy

1 212 827 7156

Gennadiy Goldberg

US Rates Strategist

1 212 827 7180

Cheng Chen

US Rates Strategist

1 212 827 7183

Andrew Kelvin

Canada Rates Strategist

1 416 983 7184

Prashant Newnaha

Asia/Pac Rates Strategist

Renuka Fernandez

Quantitative Strategist

65 6500 8047

44 20 7786 8408

Global Macro Strategy

David Tulk

Head of Global Macro Strategy

1 416 983 0445

Millan Mulraine

Deputy Chief US Macro Strategist

1 212 827 7186

Annette Beacher

Chief Asia-Pacific Macro Strategist

65 6500 8047

Jacqui Douglas

Chief European Macro Strategist

44 20 7786 8439

James Rossiter

Senior Global Strategist

44 20 7786 8422

Ned Rumpeltin

Head of European FX Strategy

44 20 7786 8420

Mazen Issa

Senior FX Strategist

FX Strategy

1 212 827 7182

Emerging Markets Strategy

Global Strategy

United States

Canada

Europe

United Kingdom

Australia

New Zealand

Emerging Markets

Foreign Exchange

Commodities

Cristian Maggio

Head of Emerging Markets Strategy

44 20 7786 8436

Paul Fage

Senior Emerging Markets Strategist

44 20 7786 8424

Commodities Strategy

Bart Melek

Head of Commodity Strategy

1 416 983 9288

Mike Dragosits

Senior Commodity Strategist

1 416 983 8075

Research Home Page: https://www.tdsresearch.com/currency-rates

Bloomberg Page: TDGR<GO>

5

Market Musings

21 October 2015 | TD Securities | New York

Global Disclaimer

This material is for general informational purposes only and is not investment advice nor does it constitute an offer, recommendation or solicitation to buy or sell a particular financial

instrument. It does not have regard to the specific investment objectives, financial situation, risk profile or the particular needs of any specific person who may receive this material. No

representation is made that the information contained herein is accurate in all material respects, complete or up to date, nor that it has been independently verified by TD Securities. Recipients

of this analysis or report are to contact the representative in their local jurisdiction with regards to any matters or questions arising from, or in connection with, the analysis or report.

Historic information regarding performance is not indicative of future results and investors should understand that statements regarding future prospects may not be realized. All investments

entail risk, including potential loss of principal invested. Performance analysis is based on certain assumptions, the results of which may vary significantly depending on the modelling inputs

assumed. This material, including all opinions, estimates and other information, constitute TD Securities’ judgment as of the date hereof and is subject to change without notice. The price,

value of and income from any of the securities mentioned in this material can fall as well as rise. Any market valuations contained herein are indicative values as of the time and date indicated.

Such market valuations are believed to be reliable, but TD Securities does not warrant their completeness or accuracy. Different prices and/or valuations may be available elsewhere and TD

Securities suggests that valuations from other sources be obtained for comparison purposes. Any price or valuation constitutes TD Securities’ judgment and is subject to change without notice.

Actual quotations could differ subject to market conditions and other factors.

TD Securities disclaims any and all liability relating to the information herein, including without limitation any express or implied representations or warranties for, statements contained in, and

omissions from, the information. TD Securities is not liable for any errors or omissions in such information or for any loss or damage suffered, directly or indirectly, from the use of this

information. TD Securities may have effected or may effect transactions for its own account in the securities described herein. No proposed customer or counterparty relationship is intended or

implied between TD Securities and a recipient of this document.

TD Securities makes no representation as to any tax, accounting, legal or regulatory issues. Investors should seek their own legal, financial and tax advice regarding the appropriateness of

investing in any securities or pursuing any strategies discussed herein. Investors should also carefully consider any risks involved. Any transaction entered into is in reliance only upon the

investor’s judgment as to financial, suitability and risk criteria. TD Securities does not hold itself out to be an advisor in these circumstances, nor do any of its representatives have the authority

to do so.

The information contained herein is not intended for distribution to, or use by, any person in any jurisdiction where such distribution or use would be contrary to applicable law or regulation or

which would subject TD Securities to additional licensing or registration requirements. It may not be copied, reproduced, posted, transmitted or redistributed in any without the prior written

consent of TD Securities.

If you would like to unsubscribe from our email distribution lists at any time, please contact your TD Securities Sales Contact or email us at privacyEAP@tdsecurities.com. You can access our

Privacy Policy here (http://www.tdsecurities.com/tds/content/AU_Privacy_EandAP_en_CA).

Australia: If you receive this document and you are domiciled in Australia, please note that TD Securities is not a registered bank in Australia, is not a holder of an Australian Financial

Services License (AFSL), and is exempt from the requirement to hold an Australian Financial Services License under the Corporations Act 2001 in respect of the financial services provided by

the Singapore branch of The Toronto-Dominion Bank (“TD Bank”) as part of its operations in Singapore and the UK. TD Bank is regulated by the Monetary Authority of Singapore under the

laws of Singapore and the Financial Conduct Authority under UK laws, which differ from Australian laws. TD Securities Limited is providing financial services to wholesale clients in Australia in

reliance on Class Order CO 03/1099.

Canada: Canadian clients wishing to effect transactions in any security discussed herein should do so through a qualified salesperson of TD Securities or TD Securities Inc. TD Securities Inc.

is a member of the Canadian Investor Protection Fund.

Hong Kong: This document, which is intended to be issued in Hong Kong only to Professional Investors within the meaning of the Securities and Futures Ordinance (the "SFO") and the

Securities and Futures (Professional Investor) Rules made under the SFO, has been distributed through TD Bank, Hong Kong Branch, which is regulated by the Hong Kong Monetary

Authority.

India, South Korea and Other Locations in Asia: TD Bank has representative offices in Mumbai and Singapore which should be contacted for any general enquiry related to TD Securities.

In locations in Asia where TD Securities does not hold a license to conduct business in financial services, it is not TD Securities’ intention to, and the information contained in this document

should not be construed as conducting any regulated financial activity, including dealing in, or the provision of advice in relation to, any regulated instrument or product.

Japan: For Japanese residents, please note that TD Securities is not licensed in Japan and this is being provided to you under a relevant exemption to the Financial Instruments and

Exchange Law.

People's Republic of China: Insofar as the document is received by any persons in the People's Republic of China (which, for such purposes, does not include Hong Kong, Macau or

Taiwan), it is intended only to be issued to persons who have the relevant qualifications to engage in the investment activity mentioned in this document. The recipient is responsible for

obtaining all relevant government regulatory approvals and licenses themselves, and represents and warrants to TD Securities that the recipient's investments in those securities do not violate

any PRC law or regulation, including, but not limited to, any relevant foreign exchange regulations or overseas investment regulations. TD Bank has a representative office in Shanghai, which

should be contacted for any general enquiry related to TD Securities. However, neither TD Securities nor the Shanghai representative office of TD Bank is permitted to conduct substantial

business within the borders of the People's Republic of China.

Singapore: This document is intended to be issued in Singapore only to Institutional Investors or Accredited Investors as defined under the Securities and Futures Act. Recipients of the

analysis or report are to contact the financial adviser in Singapore in respect of any matters arising from, or in connection with, the analysis or report. Recommendations are intended for

general circulation and do not take into account the specific investment objectives, financial situation or particular needs of any particular person. Advice should be sought from a financial

adviser regarding the suitability of the investment product, taking into account the specific investment objectives, financial situation or particular needs of any person in receipt of the

recommendation, before the person makes a commitment to purchase the investment product. TD Bank, Singapore Branch, is regulated by the Monetary Authority of Singapore.

United Kingdom and Europe: This document is prepared, issued or approved for issuance in the UK and Europe by TD Securities Limited in respect of investment business as agent and

introducer for TD Bank. The Toronto-Dominion Bank is authorised by the Prudential Regulation Authority and subject to regulation by the Financial Conduct Authority and limited regulation by

the Prudential Regulation Authority. TD Securities Limited is authorised and regulated by the Financial Conduct Authority. Insofar as the document is issued in or to the United Kingdom or

Europe, it is intended only to be issued to persons who (i) are persons falling within Article 19(5) ("Investment professional") of the Financial Services and Markets Act 2000 (Financial

Promotion) Order 2005 (as amended, the "Financial Promotion Order"), (ii) are persons falling within Article 49(2)(a) to (d) ("High net worth companies, unincorporated associations, etc.") of

the Financial Promotion Order, or (iii) are persons to whom an invitation or inducement to engage in investment activity (within the meaning of section 21 of the Financial Services and Markets

Act 2000) in connection with the issue or sale of any securities may otherwise lawfully be communicated or caused to be communicated. European clients wishing to effect transactions in any

security discussed herein should do so through a qualified salesperson of TD Securities Limited. Insofar as the information in this report is issued in the U.K. and Europe, it has been issued

with the prior approval of TD Securities Limited.

United States: U.S. clients wishing to effect transactions in any security discussed herein must do so through a registered representative of TD Securities (USA) LLC.

TD Securities is a trademark of TD Bank and represents TD Securities Inc., TD Securities (USA) LLC and TD Securities Limited and certain investment and corporate banking activities of TD

Bank and its subsidiaries.

© Copyright 2015 The Toronto-Dominion Bank. All rights reserved.

Global Disclaimer: http://goo.gl/Jsf4vd

6