Assumptions Throughout the entire term we will make the following

advertisement

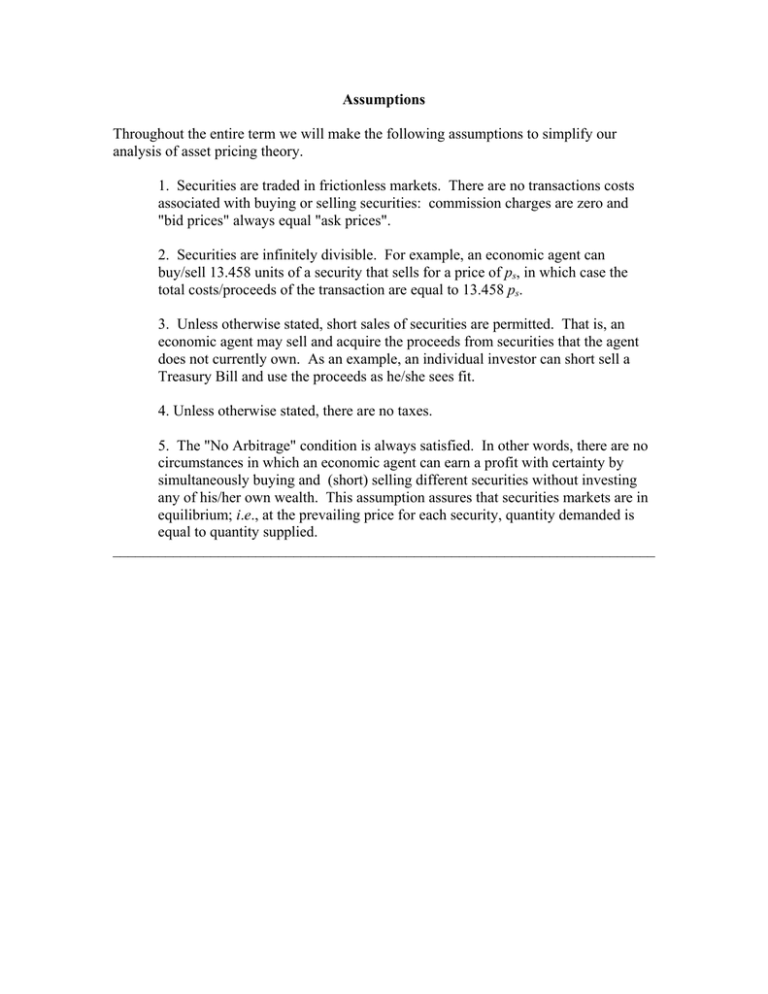

Assumptions Throughout the entire term we will make the following assumptions to simplify our analysis of asset pricing theory. 1. Securities are traded in frictionless markets. There are no transactions costs associated with buying or selling securities: commission charges are zero and "bid prices" always equal "ask prices". 2. Securities are infinitely divisible. For example, an economic agent can buy/sell 13.458 units of a security that sells for a price of ps, in which case the total costs/proceeds of the transaction are equal to 13.458 ps. 3. Unless otherwise stated, short sales of securities are permitted. That is, an economic agent may sell and acquire the proceeds from securities that the agent does not currently own. As an example, an individual investor can short sell a Treasury Bill and use the proceeds as he/she sees fit. 4. Unless otherwise stated, there are no taxes. 5. The "No Arbitrage" condition is always satisfied. In other words, there are no circumstances in which an economic agent can earn a profit with certainty by simultaneously buying and (short) selling different securities without investing any of his/her own wealth. This assumption assures that securities markets are in equilibrium; i.e., at the prevailing price for each security, quantity demanded is equal to quantity supplied. ________________________________________________________________________