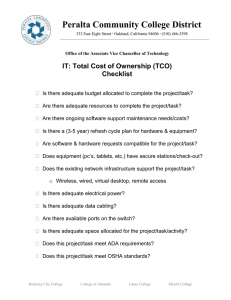

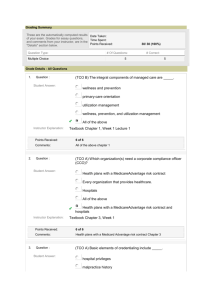

Total Cost of Ownership - Lund University Publications

advertisement