Initial Margin - BNP Paribas Securities Services

advertisement

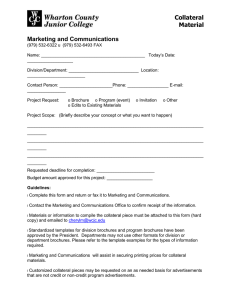

Risk Management Consultants Initial Margin: A commentary on issues for centrally cleared and non-cleared business October 2013 Sponsored by: Table of Contents Introduction ........................................................................................................ 3 Background and regulatory drivers .................................................................. 3 Calculation and optimisation of IM requirement ............................................ 5 Non-cleared ................................................................................................. 6 Cleared ........................................................................................................ 7 In which system does IM validation and optimisation take place? ................ 8 Controlling and optimising collateral ............................................................... 8 Calculation and validation of IM .................................................................. 8 Optimisation of collateral ............................................................................. 9 Instructing movements ............................................................................... 10 Reconciliation, disputes and controls .......................................................... 11 Maintain IM in a legal and operationally secure environment .................... 12 Bringing it all together .................................................................................... 13 Strategic .................................................................................................... 13 Organisational ............................................................................................ 13 Systems ...................................................................................................... 14 Methodology and policy ............................................................................ 14 About InteDelta ................................................................................................ 15 About BNP Paribas Securities Services.............................................................. 16 About Lombard Risk ......................................................................................... 17 About TMX Technologies, Razor Risk ............................................................. 18 Risk Management Consultants Introduction The financial crisis revealed major weaknesses in the global financial system, particularly in the interdependence between large financial institutions. A number of regulatory initiatives are in the process of being put in place to reduce the overall counterparty risk in the system. Most significant is the move to central clearing of OTC derivatives. A key risk mitigating feature of central clearing is the requirement to post Initial Margin (IM) to Central Clearing Counterparties (CCPs). Rules have also been produced requiring IM to be posted bilaterally between counterparties for transactions that are not subject to central clearing. This paper examines the management of IM for both cleared and non-cleared OTC derivatives. The diagram below summarises the high level processes an institution needs to follow in the management of IM. High level processes an institution needs to follow in the management of IM > Calculate/optimise IM requirement > Optimise and control collateral to be delivered > Maintain IM in a legally and operationally secure environment The regulatory drivers will first be discussed followed by each of the above processes. Finally, the features of a Target Operating Model (TOM) that an institution should adopt to bring together the organisational model, systems architecture and processes to manage IM are described. Background and regulatory drivers G20 initiated the move towards central clearing An understanding of IM requirements must first start with the regulatory initiatives driving the change. After the 2008 crisis the G20 initiated the move towards central clearing. In Europe this became enshrined in the European Market Infrastructure Regulations (EMIR) whilst the US adopted the Dodd Frank Act. Equivalent regulations are also being imposed around the world e.g. in Hong Kong, Singapore and Australia. This paper will focus mainly on the European situation. EMIR is a wide ranging regulation and this paper will only refer to the aspects that impact IM. Also of relevance are the recommendations by the Working Group on Margin Requirements (WGMR)1 that cover transactions which will not be subject to central clearing. IM has long been a feature of the financial markets. It was originally best known in the context of exchange traded derivatives and cash equity where exchange members must make an upfront payment of IM to the exchange and also settle daily Variation Margin (VM). In the OTC world the concept of IM has historically been less well developed although is economically similar to the Independent Amount (IA) under a Credit Support Annex (CSA) (using ISDA collateral terminology). In financing transactions such as securities lending and repo the Margin Ratio (MR) is also economically similar to IM. 1 2013 © InteDelta Limited Consists of the Basel committee on Banking Supervision (BCBS), the International Organization of Securities Commissions (IOSCO), the Committee on Payment and Settlement Systems (CPSS) and the Committee on the Global Financial System (CGFS) 3 Risk Management Consultants For OTC derivatives it was market practice to call IM/IA only when a bank was dealing with a less creditworthy and non-prudentially regulated institution such as a hedge fund. Most collateralised OTC business has historically been conducted without an IA. Supposedly many of the losses incurred during the financial crisis, such as the collapse of AIG, could have been mitigated if all transactions had been collateralised and had been subject to an IM with specific segregation arrangements. Recent regulatory changes mean that the majority of OTC derivatives will need to be transacted with an IM. EMIR (and Dodd Frank) stipulate that a large proportion of OTC derivatives will need to be cleared through a CCP. Depending on the product and the classification of the derivative it is estimated that 50-80% of OTC derivatives will be eventually centrally cleared. CCPs will require the payment of an IM. If a market participant is not a member of a CCP they will nevertheless need to clear through a clearing broker (which is in turn a member of a CCP) and will need to post IM to their broker. For institutions in scope of the clearing obligation, the EMIR deadlines for central clearing have been subject to a number of revisions, but the current guidelines require mandatory clearing somewhere between mid 2014 and mid 2015, with the exception of pension funds which have an exemption until 2016, with possible extension. Transactions that are dealt outside a collateral arrangement or not centrally cleared are subject to higher regulatory capital charges for counterparty risk and Credit Valuation Adjustment (CVA) under Basel III (except trades done with sovereign and corporate institutions which receive special treatment). This is generally in turn passed on to their counterparties in the pricing of transactions. Despite the move to central clearing a sizeable proportion of OTC derivatives will remain outside of this regime. For non-cleared transactions, BCBS/IOSCO have issued recommendations stating that non-centrally cleared transactions should be subject to IM requirements. The requirement to post IM will be bilateral – both counterparties to a trade must post to one another on a gross basis with specific segregation mechanisms to avoid IMs netting between each other. This contrasts with the historic practice of banks requiring an IA which was unilateral (i.e. only the counterparty posts to the bank) and was only required for less creditworthy counterparties. Requirements to post IM have a number of exceptions and exemptions 4 The requirements to post IM have a number of exceptions and exemptions: • Physically settled FX forwards and swaps are excluded, as well as the physically settling portion (i.e. final exchange of notional) of cross-currency swaps • Counterparties which – in 2019 – will have less than EUR 8 billion notional of outstanding derivatives are excluded from having to post IM. The threshold should be calculated on a “consolidated group basis” – i.e. including the institution’s subsidiaries and not just the legal entity that entered into the transaction • Requirement to exchange IM may be subject to a EUR 50 million threshold (again calculated on a consolidated group basis) and is based on all non-centrally cleared derivatives between the two groups (i.e. determined on a counterparty pair basis) • The rules apply to “covered entities” (as per BCBS/IOSCO’s terminology) i.e. financial firms and “systemically important non-financial firms”. Central banks, sovereigns, multilateral development banks, the Bank for International Settlements and non-systemic non- financial firms are excluded (the responsibility to define exactly “financial firms” and “systemically important non-financial firms” will fall onto each national regulator) • Rules will be prescriptive in terms of IM computation and will need to be approved by regulators • Limits will be imposed in terms of collateral eligibility, and re-use of IM collateral under specific constraints 2013 © InteDelta Limited Risk Management Consultants For those entities that are not subject to the EUR 8 billion permanent exclusion BCBS/IOSCO envisages phasing in the requirement to exchange IM between 2015 and 2018. For covered entities with gross derivative notional exceeding EUR 3 trillion IM is mandatory from 1st December 2015. The BCBS/IOSCO recommendations will be followed by national implementation. It is expected that a high proportion of sell-side firms will fall under the IM requirements while many buy-side firms will be covered by the exemptions. One large asset service provider has calculated that, based on the current recommendations, only 10% of its buy-side clients will fall under the requirements to post IM. Industry concern has recently emerged surrounding leverage ratios. The June 2013 revisions to the Basel III framework imply that leverage exposure will be calculated for both the transaction between the client and the clearing member and the transaction between the clearing member and the CCP. Leverage ratios are calculated using the relatively unsophisticated Basel I Current Exposure Method which provides only limited benefit for netting. The industry is concerned that this treatment may adversely affect leverage ratios. A second issue involves an inconsistency in the treatment of cash and non-cash collateral. Where a recipient receives cash collateral this must be included on the recipient’s balance sheet in the calculation of the leverage ratio. Collateral received as securities is off-balance sheet and therefore excluded from the leverage ratios. Banks that are struggling to meet their leverage ratios may therefore be incentivised to accept non-cash collateral. A further general concern in the market is that the imposition of IM on transactions where previously none was required may affect the profitability of uncleared OTC business. This has led some participants to suggest that market liquidity could be adversely affected as institutions scale back their businesses. Calculation and optimisation of IM requirement Systems will come under increasing pressure As the day-to-day activities and processes evolve to adopt these new requirements and resources are increasingly drawn to providing additional support to clients unsure of the new paradigm, systems and IT infrastructures will come under increasing pressure. Based on old rules and legacy procedures, systems currently deployed will either have to undergo significant enhancement or more likely be replaced. Replacement may be necessary as legacy systems typically have design limitations for providing the level and type of calculation as well as perform greater number of transactions to provide results faster and at or near real-time as can be achieved. The technical environment will need to provide both pre and post-trade IM calculations for both cleared and non-cleared transactions. The pre-trade calculation will provide “what-if” analysis and focus on whether the transaction is optimal in terms of collateral usage (e.g. whether trade conducted with most optimal venue/counterparty). The post-trade IM calculation will be used to verify the IM requirements calculated by CCPs (for cleared transactions). The scope for disputes is greatly increased and an automated system is essential to be able to resolve disputes on a timely basis. By providing a firm-wide view of collateral and margin deposits across the various venues and depositories as well as the segregation of house and client trading the firm will be better placed to make the optimum decision for its own trading positions and providing fully evidenced analysis for its clearing clients. Near real-time capabilities will provide significantly enhanced controls and decision making and improve the efficiency and timeliness of processes within multiple types of institutions such as trading firms, brokers, general clearers and indeed CCPs, depositories and collateral agencies. Firms will need to critically examine their existing systems to determine if they can support the increased complexity and shorter response times required by the new landscape. 2013 © InteDelta Limited 5 Risk Management Consultants Not only are there likely to be requirements to look across the entire firm’s trading to ensure the full collateral and margin landscape comes into view, there will be more complexity as well. In particular, the calculation and optimisation of IM needs to distinguish between non-cleared and cleared transactions. Non-cleared Under the BCBS/IOSCO rules IM may be calculated using internal models or a standardised margin schedule. The latter is somewhat broad brush and highly conservative and we expect that most major institutions will choose to adopt internal models to avoid being at a competitive disadvantage. ISDA have estimated that the total IM for the entire market under the standardised margin schedule would be USD 10.2 trillion versus USD 1.7 trillion using internal models1. The BCBS/IOSCO rules do not prescribe the precise calculation of IM using internal models. IM must be calculated on the basis that “reflects an extreme but plausible estimate of an increase in the value of the instrument that is consistent with a one-tailed 99 per cent confidence interval over a 10-day horizon, based on historical data that incorporates a period of significant financial stress”. Portfolio effects may be incorporated within an asset class but should not be applied across asset classes. This guidance allows for a large variation in modelling approaches. Basic modelling approaches could include historic simulation, Monte Carlo simulation, parametric VaR or a stress testing approach. All of these methods would produce different results as some are not reliable for certain types of OTC derivative (e.g. parametric VaR is not adapted to non-linear derivatives such as options). Other areas which may give rise to differences between firms are the selection of market data (particularly the selection of a period of financial stress, and how that period is weighted with non-stressed periods) and the interpretation of the extent to which portfolio effects may be taken into account. The IM model can be internally developed or a third party model used. The model must be approved by the institution’s supervisor and must be subject to internal governance processes that continually assess and back test. Institutions require a flexible and robust tool for the calculation of IM. They need not only to calculate the IM that they are charging to their counterparties but should also be able to verify the IM that their counterparties are calling them for by replicating the IM models their major trading counterparties are using. Given that IMs will be exchanged on a bilateral basis, and that there might be some divergences in the application of IM models between different counterparties (different pricing models, different market data and scenarios, different calibration of VaR), there is considerable scope for disputes for IM as is the case for VM. To reduce this risk and the proliferation of IM models ISDA is planning to develop a Standard Industry Margin Model (SIMM) which would enable institutions to apply the internal model calculations but based on a single industry agreed model. The model is currently under discussion within ISDA but details have yet to emerge. The validation of IM will typically need to be achieved at two levels within an institution: • Pre-deal within front office/risk management – the trader, asset manager or risk manager may wish to determine the IM requirement before entering into a transaction • Post-trade – the counterparty will need to be called for the correct IM and the institution may wish to verify the IM that is being called for by the counterparty (Collateral calls and validations are discussed in more detail in a later section) 1 6 Under non-stressed conditions and assuming no thresholds 2013 © InteDelta Limited Risk Management Consultants The effective management of IM goes beyond the calculation and verification of IM to the optimisation (or minimisation) of the IM to be posted. This requires pre-deal check functionality which is able rapidly to calculate the IM requirement with the counterparties with whom an institution could trade in order to select the optimal counterparty. Given the need to reprice and compute a VaR on the whole portfolio of derivatives from the same asset class under a same netting set, there will be some technological challenge (unless an institution chooses to ease the process and approximate the IM requirement via a sensitivity-based approach or a simplified methodology). The IM requirements of doing the same trade with different counterparties may vary significantly for two reasons as the composition of counterparty portfolios will not be uniform and the way in which a new deal contributes to one counterparty portfolio may be very different from how it contributes to another. For example, a trade may reduce the market risk of a portfolio with one counterparty and therefore lead to a reduction in the total IM requirement whereas with another counterparty additional IM may be required. The functionality contained within the risk engine should include: • Ability to rebuild/maintain the whole position with each counterparty in one asset class • Market standard IM methodologies and flexible aggregations • “What if” analysis and collateral optimisation algorithms • Ability to ensure adequate market history and data integrity • Effective IM analysis and drill-down for speedy dispute resolution • Effective liquidity, market and credit stress testing of IM and collateral positions • Sensitivity analytics • Back testing Cleared For cleared derivatives IM requirements are driven by the CCPs. Each CCP will have its own methodology for the calculation of IM and in order to verify the CCP’s margin requirements each clearing member will need to replicate the CCP’s margining methodology. A similar situation exists where an institution clears through a clearing broker rather than being a direct member of a CCP. CCPs are free to choose their own margining methodologies. A consensus appeared to be building around a 5-day “worst case loss” model based on 5 years of historic data. Recently, however, some CCPs have broken ranks. Eurex PRISMA, for example, adopts a VaR methodology and SwapClear uses expected shortfall (similar to VaR but makes different assumptions in relation to the results in the tails of the distribution). Even where CCPs adopt the same basic IM methodology there may still be differences in the length of time series taken and the weightings given to data points within the time series. The clearing broker will need to calculate the IM requirement for each of its clients using the CCP’s methodology, and the clients will in turn need to verify the IM requirement requested by the clearing broker. As with non-cleared trades, institutions can implement processes to minimise the IM they post. Institutions may have the option of clearing through different CCPs and/or clearing brokers and need to be able to ascertain, pre-trade, the optimal trading venue. To perform this optimisation institutions need to be able to view and optimise their entire portfolio across all CCPs and clearing brokers. 2013 © InteDelta Limited 7 Risk Management Consultants In which system does IM validation and optimisation take place? An institution may have access to one or more systems for the calculation and optimisation of IM. The institution may have implemented a risk analytics solution specifically for the calculation and optimisation of IM. Alternatively, it may use components of the institution’s existing market or counterparty risk solution. The institution’s Collateral Management System (CMS) may offer IM validation and optimisation. To perform this, the CMS will either have the IM risk models embedded within it or will interface with an external risk analytics solution. For cleared trades the CMS may either use independent models or interface directly with the CCP to calculate the IM requirement. If the institution has outsourced its collateral management to a third party the institution’s collateral agent may provide analytics that enables the institution to calculate and optimise its IM requirement. Controlling and optimising collateral The diagram below shows the various components to optimising and controlling collateral. ct en in g ts >C val alcu ida t i nc co n > R e tes a u dis p li d a tio co n , nt rol >O of pt co n tio isa ral im late l nd n a IM o i f t la n o io u str > In ve m mo Calculation and validation of IM The CMS or collateral agent will need to calculate the IM that the institution requires of its counterparty and validate the IM that the counterparty is calling for. This will be done post-trade although the institution may have other tools available for pre-trade calculation and optimisation (as described previously). The calculation/validation of IM requires: 8 • Trades to be mapped to the correct products and agreements. For asset managers, this includes ensuring trades are mapped to the correct fund/counterparty pair • Application of market data • Application of relevant models for IM calculation 2013 © InteDelta Limited Risk Management Consultants Optimisation of collateral Whatever the size of the collateral liquidity squeeze, cash will be in short supply Predictions of the so-called “collateral liquidity squeeze” vary; sums of up to USD 5 trillion are often quoted. Whatever the figure turns out to be it is certain that cash for collateral will be in short supply and institutions will look to deliver other assets. For non-cleared derivatives the BCBS/IOSCO recommendations list the following as a non-exhaustive list of eligible collateral: • Cash • High quality government and central banks securities • High quality corporate and covered bonds • Equities included in major indices • Gold For cleared derivatives CCPs need to adhere to the BIS guidance issued in “Principles for Market Infrastructure” which specifies that CCPs should accept as collateral only assets with a high credit quality and liquidity and low volatility and market risk. Beyond this CCPs are free to determine their own detailed collateral acceptance policies. The variation in CCP margining methodologies, particularly the differences between products that may offset one another, and differences in eligibility criteria means that there can be considerable scope for minimising IM payable if optimisation is effectively carried out. The scarcity of collateral will mean that institutions can gain a considerable advantage by effectively centralising collateral requirements and optimising the collateral they deliver. Typical optimisation parameters include: • High level strategy – e.g. 100% securities; 80% securities + 20% cash etc • Cheapest to deliver/most expensive to hold • Availability (including whether collateral can be rehypothecated) • Eligibility criteria (most restrictive parties should be served first) • Collateral haircut (varies between CCPs) • Concentration limits/counterparty name • Client preferences in consideration of/based on their investment strategy • Avoid securities with upcoming corporate actions • Additional risk considerations such as correlation risk and wrong-way risk Optimisation under these parameters requires near real-time responses from the CMS. To reduce the number of collateral movements and ensure there is sufficient collateral available for pending trades, institutions may maintain collateral buffers which need to be managed by the CMS. Asset managers need to ensure they have a correct view of the stock available. As many asset managers have outsourced their lending program to their custodian they may not be aware that some securities are no longer in their accounts (and could not be recalled on time). Asset managers also need to ensure that collateral is correctly allocated down to the fund level where they manage multiple funds. 2013 © InteDelta Limited 9 Risk Management Consultants Where non-cash collateral is to be delivered the collateral should be subject to a haircut to bring it to a cash equivalent value for the purposes of collateral calculations. For non-cleared trades, haircuts may be calculated using a standardised schedule or using internal models similar to those used in the calculation of IM. For cleared transactions the BIS rules similarly require CCPs to apply a haircut based on the collateral volatility and liquidity. Concerns surrounding the availability of collateral differ between buy-side and sell-side firms. Sell-side firms are primarily concerned about their ability to fund IM requirements. When it comes to rehypothecation, the BCBS/ IOSCO permits rehypothecation of a buy-side customer’s IM under the condition that it is re-used to fund IM requirements arising from hedging client’s transactions. Here again, the challenge will lie in the accurate tracking of re-use to make sure that IM is not unduly re-used for other purposes. Buy-side firms are most impacted when they have insufficient eligible collateral and are restricted from using collateral transformation techniques. For example the European Securities and Markets Authority (ESMA) guidance issued in February 2013 restricts the use of repo and stock lending for transactions where securities and cash can be recalled at notice. Other rules surrounding collateral requirements (e.g. rules on issuer diversification) have also been strengthened. Collateral transformation techniques which use securities financing and derivatives transactions to transform assets into eligible collateral are becoming an increasingly common way for institutions to access eligible collateral. For collateral taken as securities the calculation of IM requirement, its optimisation and the calculation of haircuts requires the credit riskiness of the securities to be taken into account and should reflect changing credit ratings. Instructing movements Once the IM has been verified and the optimal collateral to be delivered calculated, the collateral movements may be instructed. When central clearing and IM rules have been fully implemented the level of collateral movement is expected to be significantly higher than today’s volume. A robust collateral management system that fully automates the instruction of collateral movements and provides a workflow is therefore essential. Alternatively, the use of an outsourced collateral agent will relieve the institution of this burden. To reduce the number of collateral movements institutions may chose to maintain a buffer of excess collateral at the CCP, clearing broker or their bilateral counterparty. 10 2013 © InteDelta Limited Risk Management Consultants Reconciliation, disputes and control Number of different IM models may lead to an increase in disputes Once the collateral movements have been instructed the CMS or outsourced collateral agent needs to monitor collateral due versus collateral received. Under Basel III banks need to set aside additional regulatory capital against counterparties with which there is a persistent history of reconciliation problems. Disputes over IM can arise due to disagreements over trade population and mappings, market data, valuation of collateral balances and differences in the mathematics of the IM models. The large number of different IM models for both cleared and non-cleared business could lead to an escalation in the number of disputes. The new “ISDA 2013 EMIR Portfolio Reconciliation, Dispute Resolution and Disclosure Protocol” gives an option to institutions that adhere to it, to place added pressure for firms to escalate disputes for effective resolution via the delivery of a Dispute Notice. Firms may therefore need to invest in enhancing their processes and systems to ensure that disputes are avoided (or investigated efficiently) and reconciliations are kept under control. Functionality that CMS applications will need to support includes: • Workflow to assign disputes to the relevant department for solving issues quickly and specific workflow in case of Dispute Notice with escalation mechanisms • Ability to hold multiple valuations for resolving disputes • Tracking location of assets (e.g. identifying whether assets are held at a custodian or clearing broker) and identification of assets that can be reyhypothecated. This should also include tracking collateral which has been transformed by the clearing broker or another party to improve its eligibility. The emergence of quad-party financing services in which a local agent bank is appointed in addition to the traditional tri-party parties further complicates the tracking of assets • Management of collateral buffers • Near real-time reconciliation ability • Ability to call IM calculations for both non-cleared and cleared business (the latter must include all CCPs with which the institution trades) • Have full visibility for IM, VM and cashflows The CMS needs to be able to offer a reconciliation tool which quickly enables reconciliation differences to be resolved. An outsourced collateral management agent will also do this on behalf of the institution. As well as providing detailed reconciliation control the CMS/collateral agent should provide management information in a dashboard form that shows collateral deficiencies at counterparty and (for cleared trades) clearing broker level. 2013 © InteDelta Limited 11 Risk Management Consultants Maintain IM in a legal and operationally secure environment For non-cleared transactions, IM must be exchanged between counterparties on a gross basis. For example, if counterparties A and B enter into a series of contracts between themselves and A is required to post IM of EUR 10 million to B and B towards A of EUR 8 million, these two amounts must be exchanged. It is not permitted for A to pay a net EUR 2 million to A. The BCBS/IOSCO rules require that: • IM is immediately available to the collecting party in the event of a counterparty default; and • Collected IM should be subject to arrangements that protect the posting party in the event the collecting party enters bankruptcy to the full extent possible under the applicable law Custodians have responded by offering custody services specifically tailored for IM in which IM can be segregated for every client. In addition to the legal aspects of segregation the custodian needs to ensure that it is protected from unauthorised movements (e.g. using SWIFT messaging to ensure that IM can only be moved by agreement of both parties) and provide a regime of reporting to allow clients to monitor their IM positions and movements. For cleared trades, the EMIR regulations require CCPs to offer two types of margin segregation: individual client segregation or omnibus client segregation. Within this the following models are possible: • Net omnibus – the clearing member comingles positions and collateral of its clients. Margins are calculated and transferred on a net basis. Mutual client risk exists in this case between the clients of the clearing member • Gross omnibus – as per net omnibus except that margins are calculated and transferred on a gross basis (equivalent to “LSOC” model in US) • Gross omnibus with excess – as per gross omnibus except that excess margin is held with the CCP (equivalent to “LSOC with excess” model in US) • Individual segregated account – assets of each client are segregated from both the clearing member and the other clients of the clearing member • Full asset segregation – the client deals directly with the CCP rather than through the clearing member The proportion of firms that will be members of CCPs is expected to be higher for the sell-side than the buy- side. Buy side firms are more likely to trade through a clearing broker although a sizeable proportion are still expected to become members of CCPs. A particular concern of pension fund managers in clearing through a broker is that in the event of a broker default the pension fund’s assets would be protected in value terms but it may not receive back its actual assets. This is particularly important to pension fund managers when making long term investment decisions. 12 2013 © InteDelta Limited Risk Management Consultants Bringing it all together It is important that institutions develop a Target Operating Model (TOM) to plan for the challenges presented by IM and the increased demands of collateral management more generally. The diagram below shows the recommended components of the TOM and the questions that should be addressed in each area are described. s ho et po > M nd a do lic l o g y y >O rg & a p em > gic te ra nal tio sa s ni ces ro St A Target Operating Model should be developed to plan for the challenges of Initial Margin y >S st Strategic • Will the institution become a CCP member or clear through a broker? • Will the institution be required to deposit/receive IM for non-cleared transactions or will it be covered by the EUR 8 billion exemption or the transitional arrangements? • Has the institution reviewed the margin services offered by its current and competitor custodians? • Has the institution decided on the margin segregation models it wishes to adopt (whether a member of a CCP or through a clearing broker)? Organisational 2013 © InteDelta Limited • What organisational structure should the institution adopt for the management of IM and collateral management? • To what extent does the institution need to be able to perform pre-trade optimisation of IM to identify the optimal counterparty or CCP with which to execute? • In light of the increased complexity of dealing with IM, and collateral management in general, has the institution considered outsourcing its collateral management to a third party agent? 13 Risk Management Consultants Systems • What systems architecture should be put in place to support IM and collateral management in general? • If the institution decides to keep collateral management in-house is the existing collateral management system fit for purpose? Methodology and policy • For each asset class, will the institution use the standardised grid or internal models to calculate IM? • If the institution will use internal models, does it have suitable models in-house, does it need to develop them or does it wish to look to the vendor market? • What models/systems will the institution use to validate the IM requirements of its counterparties/CCPs? • What collateral optimisation rules and parameters should be put in place? • What models for the calculation of haircuts for non-cash collateral need to be put in place? • What collateral management policies should be developed? Credit Valuation Adjustment Credit Valuation Adjustment (CVA) is a measure of the “market value of counterparty risk” and is effectively the long term credit loss that could be expected on a counterparty’s portfolio of transactions. CVA is calculated by applying a default probability (usually derived from Credit Default Swap data or proxies) and expected recovery to the expected exposure of a counterparty’s positions. CVA increases as a counterparty’s credit quality deteriorates, as measured by the increased cost of buying credit protection. Historically, CVA has been computed in accordance with the accounting standards requiring financial institutions to take counterparty credit risk into account in the fair value of OTC derivatives. In the aftermath of the financial crisis it was found that the CVA losses for many banks exceeded their realised credit losses due to counterparty defaults. Banks were not, however, required to hold regulatory capital against CVA losses and the financial system as a whole was under-capitalised for CVA. In response to this the regulators imposed the CVA capital charge, requiring banks to hold regulatory capital for their CVA. Subjecting transactions to collateralisation under a netting agreement, both on a cleared and non-cleared basis, significantly reduces the CVA regulatory capital charge. There is therefore a large incentive from the perspective of regulatory capital management to collateralise as many transactions as possible. 14 2013 © InteDelta Limited Risk Management Consultants About InteDelta InteDelta helps financial institutions better manage their risk. Through our range of consulting and associated products we provide assistance in areas such as: • Risk management policies and methodologies • Target operating model design • Technology selection and implementation • Market intelligence and benchmarking Our areas of expertise cover the major risk categories faced by financial institutions: credit, market, liquidity and operational risk. We have advised a diverse portfolio of financial institutions located across the world, at different levels of sophistication on counterparty risk methodology and more widely around the systems, processes and policies required to manage counterparty risk. Our global client base includes large US, European and Asian investment banks, asset servicing providers, regional banks, institutional investors and hedge funds. InteDelta applies subject matter expertise through our core consulting approach to deliver change across all aspects of risk management. Further Information If you would like to discuss any of the issues addressed in this White Paper, please contact: Michael Bryant Managing Director Email: michael.bryant@intedelta.com Tel: +44 (0)20 7153 1037 Douglas White Business Development and Marketing Manager Email: douglas.white@intedelta.com Tel: +44 (0)20 7887 2205 www.intedelta.com 2013 © InteDelta Limited 15 About BNP Paribas BNP Paribas, the bank for a changing world. BNP Paribas (www.bnpparibas.com) has a presence in 80 countries with nearly 200,000 employees, including more than 150,000 in Europe. It ranks highly in its three core activities: Retail Banking, Investment Solutions and Corporate & Investment Banking. In Europe, the Group has four domestic markets (Belgium, France, Italy and Luxembourg) and BNP Paribas Personal Finance is the leader in consumer lending. BNP Paribas is rolling out its integrated retail banking model across Mediterranean basin countries, in Turkey, in Eastern Europe and a large network in the western part of the United States. In its Corporate & Investment Banking and Investment Solutions activities, BNP Paribas also enjoys top positions in Europe, a strong presence in the Americas and solid and fast-growing businesses in Asia. BNP Paribas Securities Services, a wholly owned subsidiary of the BNP Paribas Group, is a leading global custodian and securities services provider backed by a strong universal bank. It provides integrated solutions to all participants in the investment cycle including the buy side, sell side, corporates and issuers. The bank has a local presence in 34 countries across five continents, effecting global coverage of more than 100 markets. It partners with clients to help overcome complexity, while offering a one-stop shop for all asset classes, both onshore and offshore, around the world. Key figures as of 30 June 2013: USD 7,679 billion assets under custody, USD 1,381 billion assets under administration, 6,979 administered funds and 7,900 employees. Collateral Access – our integrated collateral offering EMIR, Dodd-Frank and the BCSB-IOSCO framework call for unprecedented collateral requirements, both in terms of volume and quality. At BNP Paribas Securities Services, we are fully aware of the impact of these new requirements on your business model. To accompany you through today’s and tomorrow’s challenges, we have developed the Collateral Access solution. Collateral Access is a fully integrated solution and can be tailored to your needs. It comprises three pillars: Efficient risk mitigation: focused on limiting counterparty risk, trade management and independent valuation Optimisation: focused on margin simulation, asset maximising and asset transformation Protection & velocity: focused on quick and direct access to collateral, the safekeeping and full segregation of assets and open architecture enhancing connectivity with other partners Visit our website to find out more about our range of solutions and how we can accompany you in effectively managing all of your collateral requirements. 16 17