Overview of Financial Aid Financial aid consists of four basic types

advertisement

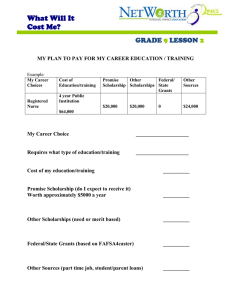

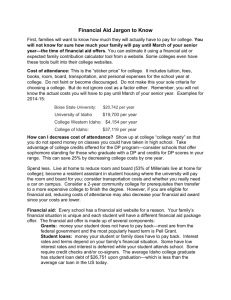

Overview of Financial Aid Financial aid consists of four basic types: grants, employment programs, loans, and scholarships. The first three types are need-based financial aid; scholarships may or may not be need-based. To be eligible for federal student aid, a student must: be a U.S. citizen or an eligible non-citizen be enrolled, or accepted for enrollment, in a degree or certificate program at a college, occupational or career school approved by the U.S. Department of Education have a high school diploma or GED have a valid social security number register with the U.S. Selective Service if required to do so Since financial aid is based on the concept of need, it is important that you understand the definition of “need.” Need is the difference between the total cost of attendance at the school of your choice and your family contribution plus any aid you will receive from private sources. Need is determined by analysis of the data on your FAFSA (Free Application for Federal Student Aid). [THE FAFSA IS A FEDERAL FINANCIAL FORM THAT IS USED TO DETERMINE YOUR ELIGIBILITY FOR FINANCIAL AID AND IS ABSOLUTELY NECESSARY SHOULD YOU BE SEEKING SCHOLARSHIP/FINANCIAL AID FROM ANY COLLEGE OR UNIVERSITY. THE FAFSA IS AVAILABLE IN DECEMBER OF THE SENIOR YEAR BUT MUST NOT BE MAILED UNTIL AFTER JANUARY 1.] The total cost of attendance at a school will vary from college to college and can even vary within the same school depending on numerous factors such as your status within the school, the number of courses you take, your state of residency, and your choice of residence on campus. Once a student is admitted to a college, career or vocational school, the financial aid officer at the given school is the primary source of information regarding the financial aid package which can consist of grants, loans, work/study, and scholarships. Students are encouraged to contact the financial aid officer for assistance. Unless there is a drastic change in your family finances, the family contribution and student expected contribution will not change.