Financial Aid 101

advertisement

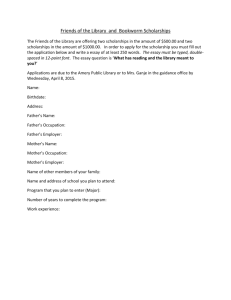

Financial Aid Jargon to Know First, families will want to know how much they will actually have to pay for college. You will not know for sure how much your family will pay until March of your senior year—the time of financial aid offers. You can estimate it using a financial aid or expected family contribution calculator tool from a website. Some colleges even have these tools built into their college websites. Cost of attendance: This is the “sticker price” for college. It includes tuition, fees, books, room, board, transportation, and personal expenses for the school year at college. Do not faint or become discouraged. Do not make this your sole criteria for choosing a college. But do not ignore cost as a factor either. Remember, you will not know the actual costs you will have to pay until March of your senior year. Examples for 2014-15: Boise State University: $20,742 per year University of Idaho $19,700 per year College Western Idaho: $4,154 per year College of Idaho: $37,119 per year How can I decrease cost of attendance? Show up at college “college ready” so that you do not spend money on classes you could have taken in high school. Take advantage of college credits offered for the DP program—consider schools that offer sophomore standing for those who graduate with a DP and credits for DP scores in your range. This can save 25% by decreasing college costs by one year. Spend less. Live at home to reduce room and board (53% of Millenials live at home for college); become a resident assistant in student housing where the university will pay the room and board for you; consider transportation costs and whether you really need a car on campus. Consider a 2-year community college for prerequisites then transfer to a more expensive college to finish the degree. However, if you are eligible for financial aid, reducing costs of attendance may also decrease your financial aid award since your costs are lower. Financial aid: Every school has a financial aid website for a reason. Your family’s financial situation is unique and each student will have a different financial aid package offer. The financial aid offer is made up of several components: Grants: money your student does not have to pay back—most are from the federal government and the most popularly heard term is Pell Grant. Student loans: money your student or family does have to pay back. Interest rates and terms depend on your family’s financial situation. Some have low interest rates and interest is deferred while your student attends school. Some require credit checks and/or co-signers. The average Idaho college graduate has student loan debt of $26,751 upon graduation—which is less than the average car loan in the US today. Work study: Organized programs which allow your student to work for pay (usually on campus in a job that is flexible and works around school schedules). It is part of the financial aid package but your student still has to apply for the work study position and work in that position to receive this money. Scholarships: can be either need-based or merit-based. Need-based scholarships can also consider merit (grades, SAT/ACT scores, leadership, activities, etc.). The “need” for need-based scholarships is calculated using the FAFSA—more below. Scholarships can come from donors to schools, or from outside organizations. Applications frequently require letters of recommendation from teachers and counselor and for the student to write an essay. Need to learn more about financial aid and/or scholarships? The Boise National College Fair will have workshops covering these topics (scholarships is offered at 10, 10:45, 12:30; 1:15 and 7 pm; others are not yet posted so check their website for topics and times). Most campus open house days also offers workshops on these topics. Expected family contribution (EFC): This is what the government expects your family to pay toward college and, quite frankly, may not be the same as what your family is expecting to pay. This amount is calculated using a formula taking into account cost of attendance, your family’s assets and liabilities, for undergraduates it usually considers the parents’ income and the student’s income, the number of family members, the number of family members in college, etc. How do they find out all of this information? The Free Application for Federal Student Aid (FAFSA): This is an online application that the family submits between January 1st and February 1st of the student’s senior year (and then every year while the student is in college if you want to continue receiving aid). It is somewhat akin to filling out tax forms with the IRS in complexity. You and your student will need to set up an online account and you will need a PIN to access that account (and you will need to keep that PIN for subsequent years). You can fill it out after February 1st but February 1st is the priority deadline where the most financial aid will be available. So do not delay! You will either need your tax forms for the year filled out or you will need an estimate of your taxes (and then you’ll go back and verify the information once your taxes are filed). Need help? I highly recommend finding out whether colleges have a “FAFSA Day” where the allow students and families to come in for assistance in completing the FAFSA. If you are a middle- or high-income family, you may also want to attend a workshop to learn what information is or is not included in income, assets and liabilities. Residency: Last, if you are considering an out of state public institution, consider residency. Some states offer “resident” rates to alumni, veteran’s and military member dependents, or tuition reductions to resident rates as a form of scholarship. Some states do not offer non-resident scholarships or make it difficult to change residency to receive in-state rates after starting school. The Western Undergraduate Exchange (WUE) is a consortium of states and schools that have agreed to reduce tuition for some students of western states to 150% of resident rate. Ask about residency at financial aid and scholarship workshops during campus visits.