GE India - GE Newsroom

advertisement

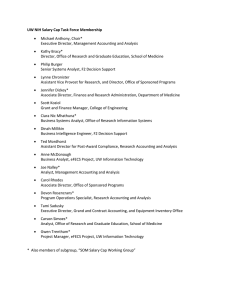

Nalanda University – 5 B.C. Taj Mahal – 17th Century Lotus Temple- 20th Century Corporate Park-21st Century TP Chopra President & CEO GE Commercial Finance - India GE India “go BIG ” Growth & Margin Analyst Meeting 07-26-06/1 India … taking off ($ in billions) GE revenue ~40% Population 1.1B GDP 796.5B ’06 GDP growth 8.5% $1.0 ’05 ~$1.4 ‘06E Priorities 9 $122B invested in energy products 1 Win key power proposals 9 Demographics driving needs – Energy, transportation – Healthcare, water – Financial services 2 Build infrastructure capability / financing At inflection point … strong fundamentals 3 Win water programs 4 Build enterprise accounts 5 Establish real estate position GE uniquely positioned Growth & Margin Analyst Meeting 07-26-06/2 Young populace fuelling the boom 75% population < 44 yrs % growth in income groups* 73 Urban Indian middle class >300MM 40 30 Rural 14 ‘07 ‘01 *Higher & Upper middle 6th largest 5th largest 500 170 ‘06 5th largest 20 11 ‘10 ‘06 15th largest 15 90 9.5 ‘10 ‘06 36 ‘10 ‘05 ‘10 Per capita income doubled in last 10 yrs Growth & Margin Analyst Meeting 07-26-06/3 Source: NCAER, Goldman Sachs, Figures in MMs … and the change is irreversible Consumer Boom Sustained Reforms • Liberalization across sectors • Legal & tax reforms • State governments participation • Growing primary demand • Lower interest rates • Growth in young spenders India‘s Growth • Stable Capital Markets • Overseas acquisitions • Increasing Forex reserves & FDI stock • High capacity expansions • Strong investor confidence* Financial Stability • Strong Corporate performance Robust Industry Growth & Margin Analyst Meeting 07-26-06/4 * AT Kearney Business Confidence Index 2004 GE Businesses in India Consumer Finance Heathcare Infrastructure Industrial Commercial Finance $1.4B Revenue CNBC 12,500 + Employees 25,000 + GE affiliates GE‘s presence in India over 100 yrs Growth & Margin Analyst Meeting 07-26-06/5 GE - well aligned to growth sectors Sector Power Defense Healthcare Investments GE Business $256B Infrastructure Commercial Finance $54B Infrastructure Industrial Commercial Finance $45B Healthcare Infrastructure Commercial Finance Industrial Growth & Margin Analyst Meeting 07-26-06/6 GE - well aligned to growth sectors Sector Investments GE Business Rail, Road & Ports $40B Infrastructure Industrial Commercial Finance Civil Aviation $34B Infrastructure Commercial Finance Financing $20B Consumer Finance Commercial Finance Growth & Margin Analyst Meeting 07-26-06/7 Significant upside to Indian aviation Economic growth + Expansion of low-cost carriers = Affordable travel for millions of new travelers 52 million passengers forecasted for India by 2008 Four-fold increase from 2002 Demand for aircraft in India expected to triple current fleet to near 700 by 2020 Growth & Margin Analyst Meeting 07-26-06/8 Domestic growth - expanding the network Domestic Passengers (millions) 2.5x 90 36 7 '95 12 '00 '05 '10F Pan India air footprint Growth & Margin Analyst Meeting 07-26-06/9 Huge potential for capturing rail travel share Mumbai to Delhi by Express Rail Trip time Fare (first class) Mumbai to Delhi by Air ~18 hours Trip time ~2 hours US$75.00 Fare (LCC) US$48.00 Low cost carriers to catalyze air travel Growth & Margin Analyst Meeting 07-26-06/10 Source: GECAS Research GECAS & GE Aviation in India … ‘06 & beyond GE expertise across • Strong backlog: $3.5B Established airlines • 10 yr Services opportunities Æ $1.3B Start-up/low-cost airlines • GECAS: ~$2B in financing commitments through ’08 … 29 aircraft with 8 airlines Airport opportunities Positioned to be the aviation leader in the market Growth & Margin Analyst Meeting 07-26-06/11 GE Money in India 9 5M+ customer base 9 3M+ cards Issued ‘04 ‘03 9 10M+ applications processed ‘02 9 $2B+ Assets ‘01 ‘99 ‘98 ‘96 ‘95 Two Wheeler Finance Durable Finance Auto Finance ‘94 Captive Auto Finance SBI Credit Cards Personal Loans Cash Access GE Money Home Loans Home Equity Insurance SME Lending Program • • • • • • • Personal loans Auto finance Consumer durable loans Credit cards Two Wheeler loans Loans against property Home loans Built business over 12+ years Growth & Margin Analyst Meeting 07-26-06/12 GE Money - Tailoring products for local needs Big Market Winning Capability Branches (150+) Retail & Auto $430B+ Expand SBI Cards partnership Launch Wizard product Mortgage $30B+ Opportunity by 2010 Opportunity for rapid growth Growth & Margin Analyst Meeting 07-26-06/13 GE Commercial Finance … Taking advantage of the opportunity Capex $35B (Auto, steel, engineering & construction) Infrastructure $25B Real Estate $24B (Residential, IT, commercial) Private Equity / M&A $22B Power $20B Commercial Vehicles $10B ~$100B in investments growing at 10 – 15% Growth & Margin Analyst Meeting 07-26-06/14 Opportunities for FY ‘07 GE Commercial Finance … Key Businesses & Verticals in India Real Estate Corporate Financial Healthcare Financial Services Services Capital Solutions y 35,000+ customer y 250+ Employees Energy Financial Services Aviation Services y Pan India footprint Equipment Finance Corporate Finance Acquisition Finance Project Finance Leasing Structured Lending Expertise across multiple industry verticals Growth & Margin Analyst Meeting 07-26-06/15 India vision 8 X 8 X 10 ($ in Billions) Priorities Revenue $8.0 9 Win key power proposals 6X $1.4 9 Build infrastructure capability / financing ‘05A ‘10F 9 Win water programs Assets $8.0 9 Build enterprise accounts 4X 9 Establish real estate position $2.0 ‘05A ‘10F GE uniquely positioned to win Growth & Margin Analyst Meeting 07-26-06/16 20060109-3 JRI BOD 04-25-06/16