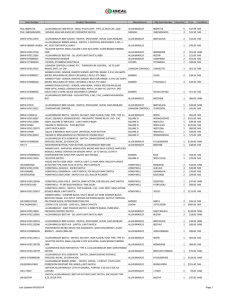

Top Cover $500 Excess

advertisement

Private Health Insurance Standard Information Statement - Combined Policy This Statement provides basic information for the purposes of comparison only. For full explanation of this combined hospital and general treatment policy please contact the health insurer on 13 14 63 or visit http://www.nib.com.au. HEALTH INSURER: NIB Health Funds Ltd. WHO IS COVERED: One adult PRODUCT NAME: Top Cover $500 Excess MONTHLY PREMIUM: # $308.70 (before any rebate or loading) M EDICARE L EVY S URCHARGE : Exempt AVAILABLE FOR: Residents of Tasmania # You may be entitled to an Australian Government rebate on this premium. Your premium may include a Lifetime Health Cover loading and/or an insurer discount depending on your individual circumstances. Check with your insurer for more details. Hospital Component The following applies to the hospital component for the Top Cover $500 Excess policy from NIB Health Funds Ltd.. WHAT'S COVERED IF I HAVE TO GO TO HOSPITAL ? Hospital treatment, including accommodation as a private patient in a private or public hospital Doctors' bills in hospital (see below) (Ambulance is covered by State government) WHAT SERVICES ARE NOT COVERED AT ALL ? (Exclusions) WHAT SERVICES ARE ONLY COVERED TO A LIMITED EXTENT ? (Restrictions, Benefit Limitation Periods) Hospital treatment for which Medicare pays no benefit eg most cosmetic surgery No restrictions or benefit limitation periods HOW LONG ARE THE WAITING 2 months for palliative care, rehabilitation and psychiatric treatment 12 months for treatments relating to other pre-existing ailments 12 months for obstetric treatments 2 months for all other treatments PERIODS FOR NEW AND UPGRADING MEMBERS? WILL I HAVE TO PAY ANYTHING IF I GO TO HOSPITAL ? (Excesses, Co-payments, Medical/Hospital gaps) WHAT OTHER FEATURES DOES THIS POLICY HAVE? EXCESS: You will have to pay an excess of $500 per admission. This is limited to a maximum of $500 per year. EXTRA COST PER DAY (CO-PAYMENTS): No co-payments DOCTORS' AND HOSPITAL BILLS: Almost 9 out of 10 medical services paid for by this health insurer in Tasmania have no out-of-pocket expenses. You may also have to pay other costs depending upon: the doctor(s) chosen the treatment you are having the hospital you go to Before you go to hospital, you should ask your doctor, hospital and health insurer about any out-of-pocket costs that may apply to you. This policy also includes nil excess for child dependants under 21. NIB/J25A/T0500S issued 24 March 2016 www.PrivateHealth.gov.au General Treatment Component The following applies to the general treatment component for the Top Cover $500 Excess policy from NIB Health Funds Ltd.. PREFERRED SERVICE PROVIDER ARRANGEMENTS: This health insurer does not operate a preferred provider scheme in this State. SERVICES COVER DENTAL General dental WAITING PERIOD (MONTHS) BENEFIT LIMITS (PER 12 MONTHS) 2 $600 per policy EXAMPLES OF MAXIMUM BENEFITS Periodic oral examination - 75% of charge Scale & clean - 75% of charge Fluoride treatment - 75% of charge Surgical tooth extraction - 75% of charge (combined limit for major dental, endodontic Full crown veneered - 75% of charge & other services) Filling of one root canal - 75% of charge $1,200 per policy Major dental 12 Endodontic 12 Orthodontic 12 OPTICAL (eg prescribed $500 per policy $2,800 lifetime limit 6 $300 per policy Single vision lenses & frames - 75% of charge Multi-focal lenses & frames - 75% of charge NON PBS PHARMACEUTICALS 2 $500 per policy Per eligible prescription - 75% of charge PHYSIOTHERAPY 2 $550 per policy Initial visit - 75% of charge Subsequent visit - 75% of charge CHIROPRACTIC 2 PODIATRY 2 PSYCHOLOGY 2 ACUPUNCTURE 2 spectacles / contact lenses) NATUROPATHY 2 REMEDIAL MASSAGE 2 HEARING AIDS 36 B LOOD GLUCOSE MONITORS 12 AMBULANCE n/a Braces for upper & lower teeth, including removal plus fitting of retainer - 75% of charge (combined limit for physiotherapy, chiropractic Initial visit - 75% of charge & other services) Subsequent visit - 75% of charge $400 per policy Initial visit - 75% of charge $300 per policy Initial visit - 75% of charge Subsequent visit - 75% of charge (combined limit for podiatry & other services) Subsequent visit - 75% of charge $250 per policy Initial visit - 75% of charge Subsequent visit - 75% of charge (combined limit for acupuncture, naturopathy, Initial visit - 75% of charge remedial massage & other services Subsequent visit - 75% of charge Sub-limits apply) $800 per policy 2 appliance(s) every 5 years Initial visit - 75% of charge Subsequent visit - 75% of charge Per hearing aid - 75% of charge (combined limit for hearing aids, blood glucose monitors & other services - Sub-limits Per monitor - 75% of charge apply) Covered by State government Benefit paid after current PBS patient contribution deducted OTHER FEATURES: Additional Healthier Lifestyle benefit available up to $250 per person per calendar year to use on nib approved weight management, quit smoking and health management programs, first aid courses. Full details are provided on nib.com.au or call our Customer Care on 13 14 63 NIB/J25A/T0500S issued 24 March 2016 www.PrivateHealth.gov.au