Responsible lending conduct

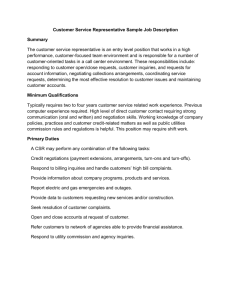

advertisement