Couverture pour visualisation.indd

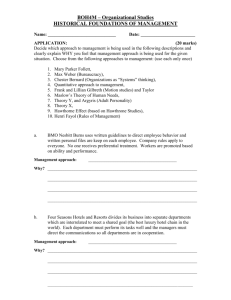

advertisement