Food Assets, Trenton, NJ - Center for Urban Environmental

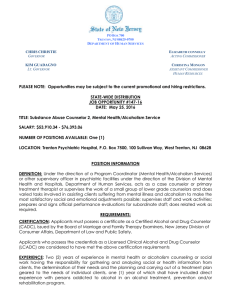

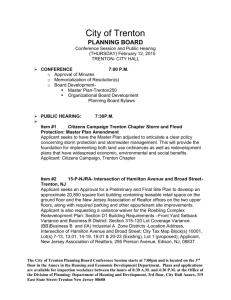

advertisement