Evidence from Microsecond Timestamps

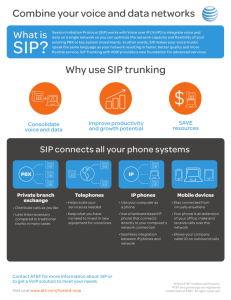

advertisement