Which Promotional Products Work Best?

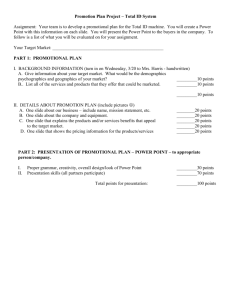

advertisement