Study to identify electronic assemblies, sub

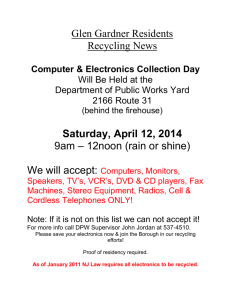

advertisement