Calculations - The Chartered Insurance Institute

advertisement

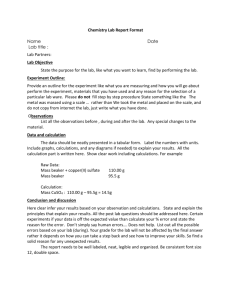

Calculations a basic help guide © The Chartered Insurance Institute 2011 : Calculations : a basic help guide Contents 1. Introduction 3 2. Glossary of common terms 3 3. Golden rules for calculation 4 4. Income Tax A - Grossing up different types of income received (for example: dividends / interest) Example question 4A1: Dividends Example question 4A2: Interest 6 B – Percentages Example question 4B1: Basic percentage calculation Example question 4B2: Higher rate tax calculations on (i) dividends and (ii) interest 8 C - Chargeable gains within onshore insurance bonds Example question 4C1: Basic Rate Tax payer Example question 4C2: Basic Rate Tax payer close to higher rate threshold Example question 4C3: To calculate any tax payable on top slicing Example question 4C4: Higher Rate Tax payer 9 D - Age allowances Example question 4D1: Basic OOA calculation – all allowance lost Example question 4D2: Some allowance lost 12 5. CGT A - Capital gains tax calculations Example question 5A1: CGT at basic rate Example question 5A2: CGT at higher rate 13 6. IHT A - Inheritance tax calculations Example question 6A1: IHT after NRB deduction Example question 6A2: Inherited NRB from deceased spouse 14 7. Other A - Future & present values Example question 7A1: Calculating the future value of an investment Example question 7A2: Calculating an annual rate of return 16 8. Links to some useful free web resources 18 © The Chartered Insurance Institute 2011 2 Calculations : a basic help guide 1. Introduction The ability to perform calculations is a requisite skill of any financial planner. Questions requiring you to work through a calculation correctly appear regularly in examinations, and so you will find many types of calculation exercises in the CII study texts. However, these exercises assume you already have a basic knowledge of how calculations work. If you don’t, or if your memory could do with refreshing, you may struggle to cope. This help guide is intended to cover the basics and, although not covering every calculation that could be tested, it should give you some extra help with the particular calculations that students most often find challenging. 2. Glossary of common terms Glossary of some common terms, formulae and symbols / = 10 = 5 2 This means “divided by”. So 10 / 2 is 10 divided by 2, i.e. 5 This means “Equals”, which means “the same as”. Two sides of an equation can contain different formulae which, once worked out, equal the same number. There are several examples of equations that follow. The line between the two figures means “divided by”. So 10 divided by 2 = (“is the same as”) 5 10 (12 – 4) = 80 The full calculation would be read aloud as: “Twelve minus four (which is 8) times by 10 equals 80” So, deal with the figures in brackets first, then multiply the outcome of this by the number next to the brackets. 20 (14 + 6) = 40 10 Read aloud, this formula is: “Fourteen plus six (which is 20), multiplied by 20 (which is 400) divided by 10 equals 40” You complete all the calculations that sit above the dividing line BEFORE doing the dividing. 7 x (10 - 6) = 14 2 Read aloud, this time it is: “Ten minus six (which is 4) divided by two (which is 2) then multiply by seven equals 14” This is the tax year starting 6th April 2011 and running to midnight on 5th April 2012 You’ll be seeing this phrase a lot in your exams. Some forms of income are paid to people net of tax deducted by the provider (‘tax deducted at source’). HMRC work out someone’s full tax liability using the gross figure, so have to ‘gross up’ the net income by adding back the tax that was stopped at source. 2011/12 tax year Grossing up % ‘Percentage’ means parts per 100. So 10% written another way is 10 ; This is 10 / 100 which is 0.10. 100 © The Chartered Insurance Institute 2011 3 Calculations Equation and formula : a basic help guide An equation is where there is a mathematical expression with an = in the middle; in other words both sides are actually the same. A formula is the content of either of the sides of the equation. For example: Equation is 2 x 3 = Z / 6 The two formulae are: 2 x 3 and Z / 6 3. Golden rules for calculations Before explaining the calculation steps for some of the tricky areas, there are a few golden rules that you should remember every time you are asked to perform a mathematical calculation. 1 Write down the formula you intend to use in full For example, for R03/J01 there is a formula for working out someone’s extended basic rate tax band to cater for gift aid or Personal Pension contributions. The formula is: (Net premium per month x 12) + £35,000 = Extended basic rate tax band (EBRTB) 0.8 2 Insert the relevant figures into the formula Assume the client is paying £50.00 per month: (£50 x 12) + £35,000 = EBRTB 0.8 3 Work out the answer, dealing with each item in the formula in a logical order. Always calculate the items in the brackets first. (£50 x 12 = £600) + £35,000 = EBRTB 0.8 600 ; This is £600 / 0.8 which is £750; so we now have £750 + £35,000 = EBRTB 0.8 £750 + £35,000 = £35,750. This is the client’s new basic rate tax threshold for 2011/12 4 You may need to work out an unknown value in one of the formulae in an equation. If you were trying to find out the value of ‘Z’ below, this could be done by manipulating the equation to get it to reads; Z = Try reversing certain parts of the equation to get the Z on its own, as in the example. For example, a subtraction becomes an addition as it’s reversed. Similarly, multiplication becomes division and a square number becomes a square root. © The Chartered Insurance Institute 2011 4 Calculations : a basic help guide Example from R02/J06. To calculate the yield on a Gilt (your actual return on capital), you need to know the interest rate (‘coupon’) and the current trading (‘clean’) price of the Gilt. The equation is: Coupon x 100 = Yield % Clean price So a coupon of 6% (i.e. £6 per £100) and clean price of £120 would give a yield of: 6 x 100 = 5% 120 If you had to work out the clean price, but know the coupon (6%) and yield (5%), the formula would read: 6 x 100 = 5% Clean price We need to rearrange the equation so that the clean price is on one side of the = and all the numbers that we know are on the other. To get rid of the 100 and the 6 (and so end up with ‘Clean price =’ ): Divide both sides of the equation by 100 6 Clean price = 5a 100 This boils down to 6 = 0.05 Clean price Multiply both sides by ‘Clean price’ gives you: 6 = Clean price x 0.05 Divide both sides by 0.05 gives you: 6 = Clean price. The resulting answer gives you 120 0.05 © The Chartered Insurance Institute 2011 5 Calculations 5 : a basic help guide Calculation questions in J0 papers ask you to ‘Calculate, showing all your workings’. This is LITERALLY what you MUST do to have any chance of getting all the marks available in the question. Show all workings on your answer paper – marks are often missed because the workings haven’t been shown. Even if your final answer is wrong you can usually pick up a lot of the marks available by showing the calculations done along the way to get to your answer. For example: Calculate, showing all your workings, the yield on a gilt with a coupon of 5% and a current clean price of £150 (2) 5 (1) 110 x 100 = 4.55% (1) You can see that one mark was granted for the workings shown and one for the answer. 6 Double check your answer. Does it make sense? Is the decimal point in the right place? 7 If the answer is in multiple-choice format and you have no match in the answers given, check your formula is correct and work through it one more time. 4. Income tax 4A. Grossing up net income received (Topic covered in unit R03 Ch 1, J01 Ch 1) HMRC income tax department always apply the appropriate rates of income tax to gross income. This means that you need to be able to ‘gross up’ any income received net of tax so that the correct rate of tax can be applied. Of course, income that is received where the investor has no personal tax liability should be completely ignored (for example, ISA income or VCT dividends). The main culprits for grossing up in exams are ‘dividends’ and ‘interest’. Dividends are paid to the share holder net of 10% corporation tax. This tax eventually reaches HMRC and is credited against the year’s tax liability for the investor. Interest from deposits or fixed interest based unit trusts or OEICs is paid net of basic rate income tax at 20%. Just like the tax on dividends above, this tax is passed on to HMRC and is credited against the year’s tax liability for the investor. METHOD income received x 100 = gross payment before tax (100 – rate of interest deducted) Example: Client receives £80 interest from a building society, received net of 20%. £80 x 100 = £100 gross interest before tax (100 – 20 = 80) © The Chartered Insurance Institute 2011 6 Calculations : a basic help guide Example question 4A1: Dividends An investor receives a net dividend of £360. What is the gross amount of income subject to tax? Formula to use: Net amount x (100 / 90) (because it is a dividend, therefore net of 10% tax) So the actual calculation is £360 x (100 / 90), but the worked example step by step (using a basic calculator) is shown below. Step 1 Step 2 Always perform the calculations in brackets first, and show your workings, so 100 £360 90 1.111 1.111 £400 Answer: The gross dividend is £400 Useful shortcut: A quick way is just to divide the net amount by 0.9, i.e. £360 divided by 0.9 = £400 Example question 4A2: Interest An investor receives a net interest payment of £400 into his savings account. What is the gross amount of interest? Formula to use: Net amount x (100 / 80) (because it is an interest payment, therefore net of 20% tax) The actual calculation is £400 x (100 / 80) but the worked example step by step (using a basic calculator) is shown below. Step 1 Always perform the calculations in brackets first, and show your workings, so 100 80 1.25 Step 2 £400 1.25 £500 Answer: The gross interest is £500 Useful shortcut: A quick way is just to divide the net amount by 0.8 – i.e. £400 divided by 0.8 = £500 In either example if the investor is a basic rate tax payer there is no further tax to pay, as HMRC has already banked the basic rate tax deducted at source. If the investor is a higher or additional rate tax payer you may be asked to calculate either: The total tax liability due on the income, OR The extra tax owed to HMRC on the income (to add to the amount already banked at source). © The Chartered Insurance Institute 2011 7 Calculations : a basic help guide To work out the total liability on the gross income, you must know the rates of tax that apply. The following table will help. Let’s stick with the gross dividend of £400 and gross interest of £500: GROSS DIVIDEND OF £400 Total liability Extra liability 10% - £10.00 due NIL Non tax payer Savings rate tax payer Basic rate tax payer Higher rate tax payer Additional rate tax payer 10% - £10.00 due NIL 10% - £10.00 due NIL 32.5% - £130 due 22.5% - £90 owed 32.5% - £130 owed 42.5% - £170 due GROSS INTEREST OF £500 Total liability Extra Liability NIL due NIL £100 refund 10% - £50 due NIL £50 refund 20% - £100 due NIL 40% - £200 due 50% - £250 due 20% - £100 owed 30% - £150 owed 4B. Percentages Calculating a percentage of an amount is often an area where mistakes are made. Usually, decimal places are put in the wrong place but there are other pitfalls which are easily avoided. Even if you have a % button on a basic calculator it is worth checking through your answer to ensure it makes sense. Example question 4B1: Basic percentage calculation Find 25% of £500. Formula to use: Amount x (percentage / 100) The actual calculation is 500 x (25 / 100) but the worked example step by step (using a basic calculator without using the % button) is shown below. Step 1 Step 2 Always perform the calculations in brackets first and show your workings, so 25 £500 100 0.25 0.25 £125 Answer: The amount is £125 Useful shortcut: A quick way is just to multiply the amount by 0.25 (or if the percentage were 17% then 0.17. If 50 percent, then 0.50 etc). © The Chartered Insurance Institute 2011 8 Calculations : a basic help guide Example question 4B2(i): Higher rate tax calculations on dividends Using the previous example of the gross income received from dividends of £400, Calculate, showing all your workings, the extra amount of tax that the investor would pay if they were a higher rate tax payer. Formula to use for dividends: Gross amount x 22.5% The actual calculation is £400 x (22.5 / 100) but the worked example step by step (using a basic calculator without using the % button) is shown below. Step 1 Step 2 Always perform the calculations in brackets first, and show your workings, so 22.5 100 £400 0.225 0.225 £90 Answer: The investor would have a further £90 dividend tax to pay Example question 4B2(ii): Higher rate tax calculations on interest Using the previous example of the gross amount received from an interest payment of £500, Calculate, showing all your workings, the extra amount of tax that the investor should pay if they were a higher rate tax payer. Formula to use for interest payments: Gross amount x 20% The actual calculation is 500 x (20 / 100) but the worked example step by step (using a basic calculator without using the % button) is shown below. Step 1 Always perform the calculations in brackets first, and show your workings, so 20 100 0.2 Step 2 £500 0.2 £100 Answer: The investor would have a further £100 savings tax to pay 4C. Chargeable gains within onshore insurance bonds (Topic covered in unit J01 Ch 5) This is a very common type of calculation where many mistakes can be made. Generally speaking, onshore insurance bonds are deemed to have suffered basic rate tax at source. There are then three typical considerations for the investor. 1. Is the investor a basic rate tax payer and when the resulting chargeable gain is added to other taxable income is the total still below the higher rate tax threshold (£35,000)? 2. Is the investor a basic rate tax payer and when the resulting chargeable gain is added to other taxable income is the total now above the higher rate tax threshold (£35,000)? © The Chartered Insurance Institute 2011 9 Calculations : a basic help guide 3. Is the investor already a higher rate tax payer or an additional rate tax payer? If you apply certain principles to these types of calculations they are relatively straightforward. • • • If 1. applies then there is no further tax to pay on the bond gain. If 2. applies then we must do a top slicing calculation. If 3. applies then the investor has a further 20% tax to pay (for a higher rate taxpayer) of the chargeable gain, or 30% if an additional rate taxpayer. (NB. Remember that it is possible that if the gain is partially in higher rate and additional rate tax, then a combination of 20% and 30% will apply to the relevant parts of the gain to work out the total tax due). Let’s go through an example for each consideration. Example question 4C1 – Basic Rate Tax payer An individual makes a chargeable gain on an insurance bond of £5,000. His taxable income is £15,000 per annum. Calculate, showing all your workings, any tax he must pay as a result of encashing his bond. Here, the total income (£15,000 £5,000 £20,000) is clearly below the higher rate tax threshold of £35,000, so there is no tax to pay and no calculation needed. Example question 4C2 – Basic Rate Tax payer close to higher rate threshold An individual makes a chargeable gain on an insurance bond of £5,000 which he held for 5 years. His taxable income is £34,600 per annum. Calculate any tax he must pay as a result of encashing his bond. (Note: Personal allowance has already been offset from income to provide taxable income) The higher rate threshold for 2011/12 is £35,000. Step 1 Step 2 Step 3 Some of the gain falls below the higher rate threshold and some of the gain is above the threshold – to work this out, subtract income from the higher rate threshold, so £35,000 £34,600 £400. This portion of the gain needs no further tax paid on it. Now ‘top slice’ the total gain - divide the gain by the number of full years in force. So, £5,000 5 £1,000 As calculated earlier, £400 of this £1,000 does not need to be taxed. Therefore, the remaining £600 of each top slice must be taxed at 20%. © The Chartered Insurance Institute 2011 10 Calculations : a basic help guide Example question 4C3 – To calculate any tax payable on top slicing The individual in the previous example needs £600 of the amount of the top slice to be taxed at 20%, as it is above the higher rate threshold. Formula to use: Amount of top slice above threshold x number of years in force x 20% The actual calculation is 600 x 5 x (20 / 100) but the worked example step by step (using a basic calculator without using the % button) is shown below. Step 1 Always perform the calculations in brackets first and show your workings, so 20 100 0.2 Step 2 £600 5 0.2 £600 Answer: The income tax liability is £600. Please note: Without top slicing, £4,600 of the gain would have been taxable at 20% i.e. tax of £920. Example question 4C4 – Higher Rate Tax payer An individual makes a chargeable gain on an insurance bond of £5,000. Her taxable income is £50,000 per annum. Calculate, showing all your workings, any tax she must pay as a result of encashing her bond. Here the investor is already a higher rate tax payer before encashment of the bond, so she must pay 20% tax on the gain. Formula to use: Chargeable gain x 20% The actual calculation is £5,000 x (20 / 100) but the worked example step by step (using a basic calculator without using the % button) is shown below. Step 1 Step 2 Always perform the calculations in brackets first, and show your workings, so 20 £5,000 100 0.2 0.2 £1,000 Answer: The income tax liability is £1,000. © The Chartered Insurance Institute 2011 11 Calculations : a basic help guide 4D. Age allowances (Topic covered in unit R03 Ch 1, R02 Ch 6, R06 Appendix) Golden rules • An age allowance for relevant incomes under £100,000 can never be reduced below the basic personal allowance of £7,475 • Age allowance applies for the entire tax year of attaining age 65 or 75 • Any married couples allowance is a tax reducer, so only reduces a tax liability at the end of a calculation • Always check the tax tables provided to ensure you are using the correct allowance Example question 4D1: Basic OOA calculation – all allowance lost Bob is 68. His income is £30,000 per annum. Calculate, showing all your workings, his personal allowance for 2011/12. The age related personal allowance for 2011/12 is £9,940 The minimum personal allowance for 2011/12 is £7,475 The age allowance income limit for 2011/12 is £24,000 For every £2 earned over the age allowance income limit (£24,000) the personal allowance is reduced by £1 Step 1 Step 2 Step 3 First, we need subtract the age allowance income limit from Bob’s annual income, so: £30,000 £24,000 £6,000 We then divide this figure by 2, to show that this part of the personal allowance is reduced by £1 for every £2 earned, so £6,000 2 £3,000 Therefore the age related personal allowance of £9,940 is reduced by £3,000. So £9,940 £3,000 = £6,940 This is below the minimum personal allowance so Bob’s personal allowance will be £7,475 in 2011/12. Example question 4D2: Some allowance lost Barbara is 67 and earns £25,000 per annum from her pension. Calculate, showing all your workings, her age related personal allowance in 2011/12. The age related personal allowance for 2011/12 is £9,940 The minimum personal allowance for 2011/12 is £7,475 The age allowance income limit is £24,000 for 2011/12 For every £2 earned over the age allowance income limit (£24,000) the personal allowance is reduced by £1 Step 1 First, we need subtract the age allowance income limit from Barbara’s annual income, so £25,000 £24,000 © The Chartered Insurance Institute 2011 £1,000 12 Calculations Step 2 Step 3 : a basic help guide We then divide this figure by 2, to show that this part of the personal allowance is reduced by £1 for every £2 earned, so £1,000 2 £500 Therefore the age related personal allowance of £9,940 is reduced by £500. So £9,940 £500 = £9,440 This is above the minimum personal allowance, so Barbara’s personal allowance will be £9,440 in 2011/12. 5. Capital gains tax calculations (Topic covered in unit R03 Ch 3, R06 Ch 2) There are three steps that establish how much CGT is due. Always apply these in a strict order: 1. Calculate the gain 2. Deduct the annual exemption 3. Apply the current CGT rate The 2011/12 annual exemption is £10,600. The CGT rates on chargeable gains are: • • 18% for individuals who are non-taxpayers and basic rate taxpayers; and 28% for higher and additional rate taxpayers. These figures are available in the tax tables provided in the exam. Always check you are using information for the correct tax year relevant to your exam, unless otherwise instructed. Example question 5A1: CGT at basic rate A private investor, who is a non-taxpayer for income tax purposes, makes an individual gain of £120,000. Calculate, showing all your workings, the amount of tax due on this gain. Formula to use: (Gain – annual exemption) x (18 / 100) Step 1 Always perform the calculations in brackets first and show your workings, so: 18 100 0.18 Step 2 Next, do the first part of the calculation, so £120,000 Step 3 Finally, £109,900 0.18 £10,600 £109,400 £19,692 Answer: The CGT liability is £19,692 Please note: A common error is to calculate 18% of the gain and then deduct the annual exemption, giving the wrong answer. Therefore the order in which you apply these steps is critical to establishing the correct answer. © The Chartered Insurance Institute 2011 13 Calculations : a basic help guide Example question 5A2: CGT at higher rate A private investor on higher rate tax makes an individual gain of £110,600. Calculate, showing all your workings, the amount of tax due on this gain. Formula to use: (Gain – annual exemption) x (28 / 100) Step 1 Always perform the calculations in brackets first, and show your workings, so 28 100 0.28 Step 2 Next, do the first part of the calculation, so £110,600 Step 3 Finally, £100,000 0.28 £10,600 £100,000 £28,000 Answer: The CGT liability is £28,000 Finally on CGT, a split situation. If the tax payer is a marginal higher rate tax payer, then some of the chargeable gain may be in the basic rate income tax band (so chargeable at 18% CGT) and some of it in higher rate income tax band (so chargeable at 28% CGT). For example, in 2011/12, Fred has a taxable income of £30,000 (after deductions and allowances, the amount now subject to income tax). He also has a chargeable gain to CGT of £10,000. All you need to do is calculate: £5,000 of the gain at 18% plus £5,000 of the gain at 28%. Have a quick practice using the method explained above, and you should get to a total CGT bill of £2,300. 6. Inheritance tax calculations (Topic covered in unit R03 Ch 4, R06 Ch 4) The difficulty with these type of calculations is when and how to apply the nil rate band (NRB). Often the NRB is incorrectly selected. So the golden rule here is to check your tax tables to ensure the correct NRB is used. In 2011/12 the NRB is £325,000 and any part of a deceased’s estate above that threshold is taxed at 40%. Example question 6A1: IHT after NRB deduction A widower dies leaving an estate worth £600,000. His former spouse fully utilised her NRB when she died. Calculate, showing all your workings, the inheritance tax due. Important: There is no NRB to transfer to the widower as it was utilised. Step 1 It is important to deduct the NRB first as this is exempt from tax. So: £600,000 £325,000 £275,000 © The Chartered Insurance Institute 2011 14 Calculations Step 2 £275,000 is therefore chargeable at 40%. To calculate, use the percentage equation discussed earlier: 40 Step 3 : a basic help guide 100 = 0.4 £275,000 0.4 = £110,000 Answer: The IHT liability is £110,000 The calculation becomes a little more complicated when some or all of a former spouse’s NRB is unused. Example question 6A2: Inherited NRB from deceased spouse A widower dies on 1st February 2012 leaving an estate worth £1,000,000. His former spouse, who died on 30 June 2008, used £156,000 of her NRB – Calculate, showing all your workings, the inheritance tax due. The NRB in 2008/09 was £312,000 £156,000 of that NRB was utilised at that time To calculate the percentage/proportion of NRB un-used on first death: (£312,000 - £156,000) x 100 £312,000 £156,000 x 100 = 50% £312,000 Therefore 50% is the uplift to the surviving spouse’s NRB at the date of his death. The NRB in 2010 – 2012 is £325,000 50% is £325,000 x (50 / 100) = £162,500 So the widower’s NRB at death is now £325,000 + £162,500 = £487,500 Formula to use to calculate inheritance tax due: (Total estate – total NRB) x 40% Step 1 So, £1,000,000 40% £487,500 £512,500. This is the amount chargeable at Step 2 To calculate, use the percentage equation discussed earlier: 40 Step 3 £512,500 100 = 0.4 0.4 = £205,000 Answer: The IHT liability is £205,000 © The Chartered Insurance Institute 2011 15 Calculations : a basic help guide 7. Other A. Future & present values (Topic covered in unit R02 Ch 4, R06 Ch 3) You may be called up to calculate the future value of a sum of money given an investment term and compound rate of interest or return. This requirement is represented by that scary formula: FV = PV(1 + r)n The good news is, you don’t need to have a complex scientific calculator to carry out calculations like this. First of all we need to break down each component in the formula. FV = Future value PV = Present value r = rate of return n = number of compounding periods (years) Example question 7A1: Calculating the future value of an investment Calculate, showing all your workings the future value of an initial investment of £5,000, assuming a return of 4% per annum compound over 5 years. Formula to use to calculate the future value: FV = PV(1 + r)n After replacing the letters with the right numbers, it will look like this: FV = £5,000 x (1 + 4%)5 Step 1 Work out the part of the formula in brackets first. The 4% is achieved by the sum 4 100 0.04. Therefore 1 0.04 1.04. We next have £5,000 x (1.04)5 To work out (1.04)5 we simply multiply 1.04 by itself five times i.e. Step 2 1.04 1.04 1.04 (to five decimal places) Step 3 The sum will now read £5,000 1.04 1.04 = 1.21665 1.21665. This equals £6,083.25. Answer: The future value (FV) = £6,083.25 The calculation becomes a little more difficult if you are asked to calculate the investment annual rate of return, given the term and the start and end figures. Example question 7A2: Calculating an annual rate of return Calculate, showing all your workings, the annual rate of return of an investment of £8,000 which returns £9,500 two years later. Formula to use to calculate the future value: FV = PV(1 + r)n After replacing the letters with the numbers you already know, it will look like this: £9,500 = £8,000 x (1 + r)2 © The Chartered Insurance Institute 2011 16 Calculations : a basic help guide In this case you cannot do the calculation in brackets, because you don’t know the value of ‘r’. To work it out, if you remember from Chapter 2 – the golden rules for calculations – you need to find out what r equals by neutralising some of the formula items as follows: Step 1 Step 2 Step 3 Step 4 Divide both sides by £8,000. This leaves on the left hand side £9,500 £8,000 1.1875 So, the equation now reads 1.1875 (1 r)2 Next, neutralise the ‘square’ from the end of the formula (the 2 after the bracket), by finding the square Root of each side. So, the equation now looks like: √1.1875 (1 r), changing to 1.09 (1 r) once the square Root has been calculated (use the square Root function (√ on your calculator for this). Next, we subtract 1 from each side; 1.09 1.09 1 1 r 0.09. We need to show this as a percentage – to do this, simply multiply it by 100. So 0.09 100 = 9% Answer: The annual rate of return (r) = 9% NOTE: It is a good idea to check your answer by putting 0.09 in as ‘r’ in the formula. © The Chartered Insurance Institute 2011 17 Calculations : a basic help guide Need more help? Links to some useful free web resources* http://www.bbc.co.uk/skillswise/maths – A series of entry level factsheets, worksheets and quizzes for adults. http://www.mathcentre.ac.uk/ – Varied help resources, including mobile phone downloads and iPod segments. http://library.thinkquest.org/20991/prealg/eq.html – Help on basic algebraic equations. You Tube is a valuable resource – there are lots of help videos which explain calculations step by step. Two examples are below: http://www.youtube.com/watch?v=9jhgbSOEa8k&feature=related http://www.youtube.com/watch?v=QgDMJuwpZZM&feature=channel *The links for these sites are not under the control of CII. The CII shall not be responsible in any way for the content of such websites. The CII provides such links only as a convenience and the inclusion of any link does not imply endorsement by CII of the content of such sites. © The Chartered Insurance Institute 2011 18