Green Power Partnership | US EPA

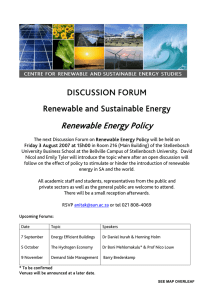

advertisement