Understanding Total Cost of Ownership

advertisement

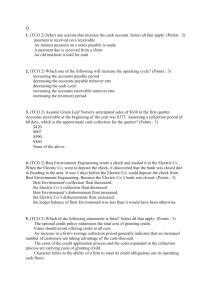

CAPITAL EQUIPMENT PLANNING Understanding Total Cost of Ownership in Capital Equipment Planning TriMedx (www.trimedx.com), an Indianapolis-based healthcare equipment services provider. Ensure accurate performance trending and cross-facility benchmarking throughout the many phases of equipment lifecycle management. By Dale Hockel & Terry Hamilton T Terry Hamilton is a senior vice president, clinical support he TCO — total cost of ownership — approach for your health organization’s capital equipment planning enables you to effectively boost your bottom line by planning for all lifecycle costs and options related to capital equipment. TCO is a five-step methodology used for comprehensive lifecycle planning to ensure that all associated costs over a given time period are considered when acquiring an asset. services for St. John Providence Health System in Warren, MI. 44 ADVANCE for Executive Insight These costs may include: QPurchase price QInstallation costs QFinancing costs (including the option to lease or rent) QEnergy costs (or savings) QRepair costs QUpgrades QMaintenance QDowntime QProductivity QTraining QDisposal TOM WHALEN Dale Hockel is the senior vice president of operations at CAPITAL EQUIPMENT PLANNING FIG. 1 - CT SCANNER TOTAL COST OF OWNERSHIP Year of Purchase 2nd Year of Ownership 3rd Year of Ownership 4th Year of Ownership 5th Year of Ownership 6th Year of Ownership 7th Year of Ownership 8th Year of Ownership 9th Year of Ownership 10th Year of Ownership $1,500,000 - - - - - - - - - Renovation Costs $250,000 - - - - - - - - - Installation Costs $200,000 - - - - - - - - - Productivity Costs (may be + or -) Purchase Price $6,000 $12,000 $12,000 $12,000 $12,000 $12,000 $12,000 $12,000 $12,000 $12,000 Financing Costs - - - - - - - - - - Energy Costs - $10,000 $10,300 $10,609 $10,927 $11,255 $11,593 $11,941 $12,299 $12,668 Upgrade Costs - - - $150,000 - - - $200,000 - - Maintenance Costs - $50,000 $51,500 $53,045 $54,636 $56,275 $57,964 $59,703 $61,494 $63,339 Repair Costs Downtime Costs Disposal Costs Total Annual Costs - $50,000 $50,000 $50,000 $50,000 $50,000 $50,000 $50,000 $50,000 $50,000 $25,000 $5,000 $10,000 $25,000 $5,000 $10,000 $25,000 $5,000 $5,000 $10,000 - - - - - - - - - $50,000 $1,981,000 $103,000 $109,800 $276,654 $108,564 $115,531 $132,556 $314,643 $116,792 $174,006 Total Cost of Ownership $3,432,546 Let’s examine how the TCO model may work for your organization, and in turn may save you thousands – even millions – of dollars in equipment purchases. 1. Capital equipment planning 2. Selection and procurement 3. Implementation 4. Management and monitoring 5. End of life management USING THE TCO METHOD When developing your organization’s 360-degree TCO grid, think of it as a fivestep process: Remember that TCO looks at total cost of ownership — not just acquisition costs, but also installation, financing, energy, re- pair, maintenance, downtime, productivity, training and disposal costs — so across the top of the grid you’ll see first year costs, second year costs and so on. You may wish to coordinate your TCO timeline with your organization’s fiscal year. It’s easier for the finance department to coordinate costs if you put things in terms of fiscal year. Along the side of Figures 1, 2 and 3 FIG. 2 - BREAST MRI TOTAL COST OF OWNERSHIP Year of Purchase 2nd Year of Ownership 3rd Year of Ownership 4th Year of Ownership 5th Year of Ownership 6th Year of Ownership 7th Year of Ownership 8th Year of Ownership 9th Year of Ownership 10th Year of Ownership Purchase Price $3,200,000 - - - - - - - - - Renovation Costs $1,000,000 - - - - - - - - - Installation Costs $150,000 - - - - - - - - - Productivity Costs (may be + or -) - - - - - - - - - - Financing Costs - - - - - - - - - - Energy Costs - $10,000 $10,300 $10,609 $10,927 $11,255 $11,593 $11,941 $12,299 $12,668 Upgrade Costs - - - - $400,000 - - - $400,000 - Maintenance Costs - $320,000 $329,600 $339,488 $349,673 $360,163 $370,968 $382,097 $393,560 $405,366 Repair Costs - - - - - - - - - - Downtime Costs - - - - - - - - - - Disposal Costs - - - - - - - - - - $4,350,000 $330,000 $339,900 $350,097 $760,600 $371,418 $382,560 $394,037 $805,858 $418,034 Total Annual Costs Total Cost of Ownership $8,502,505 ADVANCE for Executive Insight 45 CAPITAL EQUIPMENT PLANNING FIG. 3 - CYBERKNIFE TOTAL COST OF OWNERSHIP Year of Purchase 2nd Year of Ownership 3rd Year of Ownership 4th Year of Ownership 5th Year of Ownership 6th Year of Ownership 7th Year of Ownership 8th Year of Ownership 9th Year of Ownership 10th Year of Ownership Purchase Price $3,200,000 - - - - - - - - - Renovation Costs $1,000,000 - - - - - - - - - Installation Costs $150,000 - - - - - - - - - Productivity Costs (may be + or -) - - - - - - - - - - Financing Costs - - - - - - - - - - Energy Costs - $10,000 $10,300 $10,609 $10,927 $11,255 $11,593 $11,941 $12,299 $12,668 Upgrade Costs - - - - $400,000 - - - $400,000 - Maintenance Costs - $320,000 $329,600 $339,488 $349,673 $360,163 $370,968 $382,097 $393,560 $405,366 Repair Costs - - - - - - - - - - Downtime Costs - - - - - - - - - - Disposal Costs - - - - - - - - - - $4,350,000 $330,000 $339,900 $350,097 $760,600 $371,418 $382,560 $394,037 $805,858 $418,034 Total Annual Costs Total Cost of Ownership $3,432,546 you see rows, each representing a department or input entity in TCO. Within Excel you’ll be able to expand detail in certain categories by adding tabs. For example, if you’re planning for an upcoming renovation, you can add detail on the bids you received, who provided them, etc. One often-overlooked area is disposables. Typically we think of TCO in terms of big, expensive pieces of equipment. Consider IV pumps, for example. When you order IV pumps you’re typically getting hundreds at a time, and your TCO decisions around them can make a huge difference in what becomes most cost effective. MAKING TCO WORK FOR YOU While it may seem complicated, the key to effective TCO planning is to adjust it to fit your organization’s personality and needs. Consider the following to ensure effective TCO planning: QStandardize the items you include in your TCO planning, so when you evaluate equipment, you’re doing it the same way each and every time. QDetermine how your organization will measure results. When you look back at your purchase in 3 years, how will you 46 ADVANCE for Executive Insight decide whether it was successful? QMeasure your results. You’ll only know if your purchases were successful if you’ve set benchmarks. QAnalyze what worked and why. What happened during your TCO planning that contributed to the success or failure of a purchase? Remember that it’s not just operations and finance that need to be included in TCO planning. From the beginning of your planning process, involve information technology, telecommunications, physics, construction/real estate, clinical engineering (CE), supply chain, materials, legal and the end-users — doctors, nurses and other clinicians. Ensuring that the typically “last to know” people are part of the planning process means you’ll make smarter decisions that will benefit the entire hospital. It will also save you valuable time and money, making the right decision up front. BREAST MRI MACHINE A busy breast surgeon decided to purchase a new breast MRI machine due to an increasing number of patients requiring operations. The surgeon and his hos- pital entered into a joint agreement, and more partners were added. They purchased the breast MRI machine and then realized that the space in which it was to be installed was inadequate. To accommodate the new machine, lead-lined walls and additional points of egress, they needed an extra $700,000. Because the capital approval was $2 million, and the project was now over $2 million, they needed new approvals. The project was delayed several months. TCO planning would have been very useful here. CYBERKNIFE It’s important to note that newer technologies have special considerations when it comes to TCO planning because there is no experience curve. That’s what a group of doctors learned when they decided to purchase a CyberKnife when it was new to the market. It was to be installed at a clinic location approximately 40 miles from the main hospital in the doctors’ network. They purchased the equipment, and then found that the location required new a new phone and Internet network, one that would cost approximately $150,000 to install because of the clinic’s distance CAPITAL EQUIPMENT PLANNING from the main telecom hub. In addition to those unexpected costs, the OEM gave the doctors a certain number of “points” to be used for future technology upgrades. By the time the equipment was up and running, the OEM had issued an upgrade, and the doctors used all of their points to install it. They now had their working CyberKnife, but were out $150,000 and would be required to pay full price for any future upgrades. TCO planning won’t eliminate these costs, but it helps an organization to know they are coming and to be ready. LIMITATIONS OF TCO It’s important to note that TCO is not a perfect model. While it’s the best method we have for evaluating equipment lifecycle costs, keep in mind: It requires extra effort. Completing a TCO analysis does take time to complete, and therefore will drive costs up just a little. In spite of this, it’s still very important and worth those few extra dollars. There is no agreed-upon formula. Do a web It requires extra effort. Completing a TCO analysis does take time to complete, and therefore will drive costs up just a little. In spite of this, it’s still very important and worth those few extra dollars. search for “TCO model” and you’ll find a dozen or more different formulas. That’s why it’s important to find the one formula that works for your organization and stick to it. It’s not useful for assessing risks. Will your physicians use the model for planning? What about accounting for all those “what if” scenarios? There’s really no way to tell for sure. It’s not helpful when aligning investments with strategic goals. TCO planning does not take into account a healthcare organization’s desire to have the leading-edge equipment, or to be the number one bariatric medicine provider, for example. AVOIDING TCO PITFALLS TCO planning isn’t a perfect science. Avoid some common mistakes by considering the following: Q Know when warranties are worth it. For example, a warranty on a 64-slice CT scanner is typically worth it because each time a tube fails, you’re looking at $250,000 to replace it (in the first year). Q Involve clinical engineering, always. Your CE department can help you evaluate whether the OEM service agreements are necessary. Maybe you have someone in-house that’s suited to repair equipment. Or maybe you don’t, and you need to evaluate whether it’s worth it to spend money on a very expensive service contract. You just need to be able to account for that money in your TCO planning. Q Ignore the Joneses. Avoid comparing your hospital to others in the area when possible. Maybe the hospital across town is getting new MRI machines, and patients are asking about yours, too. In these tough economic times, it may make sense for your hospital to make do with its older-yet-functional equipment. Buying new isn’t always the best option – a refurbished unit may be exactly what you need for a fraction of the cost of a new one. Q Remember the cost of OPM (other people’s money). If you take out a loan to purchase capital equipment, you’ll need to account for financing costs in your TCO planning. These days, there’s a lot of talk and scrutiny when it comes to the cost of healthcare services. We owe it to our patients and community to keep costs under control, and TCO capital planning helps us do just that. ADVANCE for Executive Insight 47