Merger Efficiency and Managerial Incentives

advertisement

Merger Efficiency and Managerial Incentives∗

M ATTHIAS K RÄKEL†

AND

DANIEL M ÜLLER‡

May 14, 2015

We consider a two-stage principal-agent model with limited liability in which a CEO is

employed as agent to gather information about suitable merger targets and to manage the

merged corporation in case of an acquisition. Our results show that the CEO systematically recommends targets with low synergies—even when targets with high synergies are

available—to obtain high-powered incentives and, hence, a high personal income at the

merger-management stage.

JEL classification: D82; D86; G34

Keywords: acquisition; merger; moral hazard

∗

We benefited from comments of two anonymous referees and the Editor Justin P. Johnson, and from discussions with Martin

Peitz, Andreas Roider, Patrick Schmitz, Monika Schnitzer, Jan Schymik, the seminar audience at the University of Regensburg, and the participants of the SFB/TR 15 meeting in Berlin (2012). All errors are of course our own. Financial support

by the Deutsche Forschungsgemeinschaft (DFG), grant SFB/TR 15, is gratefully acknowledged.

†

University of Bonn, Department of Economics, Institute for Applied Microeconomics, Adenauerallee 24-42, D-53113 Bonn,

Germany, E-mail address: m.kraekel@uni-bonn.de, Tel: +49-228-739211; Fax: +49-228-739210

‡

University of Bonn, Department of Economics, Institute for Applied Microeconomics, Adenauerallee 24-42, D-53113 Bonn,

Germany, E-mail address: daniel.mueller@uni-bonn.de, Tel: +49-228-739212, Fax: +49-228-739210.

1

1. I NTRODUCTION

On May 07, 1998, the Daimler-Benz AG and the Chrysler Corporation merged into the DaimlerChrysler

AG, one of the world’s biggest car manufacturers with 442,000 employees and a market value of about

$100 billion. The former Daimler Chief Executive Officer (CEO), Jürgen Schrempp, promised huge

synergy savings in distribution, product design, and research & development. Leading newspapers were

less optimistic. On the day following the merger, the New York Times stated that "at a news conference

held here to proclaim the biggest industrial marriage in history, neither company could explain in detail

where billions of dollars in savings from reduced expenses would come from" (Andrews 1998). In 2001,

these fears were confirmed by the actual course of events—the market value of DaimlerChrysler shrank

to $44 billion, which was nearly the pre-merger market value of the Daimler-Benz AG alone. Thus,

synergies either remained unexploited or did not exist.1

Nevertheless, the merger had one clear winner—the 1998 Daimler CEO and later DaimlerChrysler

CEO Jürgen Schrempp. Before merging, his estimated yearly income amounted to $2.9 million. After merging, the pay system for top executives at Daimler-Benz changed dramatically: at least 70 percent of top executive compensation became performance bonuses and other incentive payments (Bryant

1999). As a consequence, the new estimated income of Jürgen Schrempp (at least) doubled. There does

not only exist anecdotal evidence for the observation that the income of an acquiring firm’s CEO rises

considerably—even after a merger that leads to low or no synergies. The empirical results of Bliss and

Rosen (2001), Grinstein and Hribar (2004), Bebchuk and Grinstein (2005), Girma et al. (2006), Harford

and Li (2007), and Guest (2009) show that this observation can be considered as a stylized fact.2

With acquisitions leading to higher CEO compensation, an immediately related question is how the

anticipation of this positive income effect affects the quality of acquisition decisions. In the following,

we offer a rationale for why CEOs do not prefer the best merger targets, and how they benefit from poor

merger quality. We consider a two-stage principal-agent relationship between a CEO, on the one hand,

and the board of directors or the shareholders—henceforth summarized as the "principal"—on the other.

The CEO is protected by limited liability. Anderson et al. (2004) observe that changes in CEO compensation following a merger are likely to reflect a restructuring of incentives, which suggests that long-term

commitment to contractual terms is rather unrealistic in the context of CEO compensation. In line with

this observation, we assume this principal-agent relationship to be governed by a series of short-term

contracts. In the first stage, the CEO gathers information on possible merger targets and recommends a

target to the principal. At the end of the first stage, the principal decides on whether to acquire the target

firm or not. In case of acquisition, in the second stage the principal has to choose between merging the

old firm and the newly acquired one, or running both independently.3 If the principal prefers merging, the

CEO is employed to manage the merged firm. At this stage, the principal can optimally fine-tune CEO

incentives by using bonuses that depend on the CEO’s performance. Our analysis shows that if a CEO

1

"Chrysler proved to be a massive rescue job that sucked up billions and absorbed German management for years [...]. Synergies have been few and far between" (Bloomberg BusinessWeek 2005). General Electric is another prominent example for

a large corporation that has grown via non-synergetic acquisitions; see, e.g., The Economist (2014).

2

See Williams et al. (2008) for a literature survey.

3

As outlined by Bloomberg BusinessWeek (2005), these two basic choices also existed with regard to the Daimler-Chrysler

case—either "ramping up the technical and manufacturing collaboration between Mercedes and Chrysler" or "run[ning] the

two companies as separate entities".

2

identifies both low- and high-synergy targets, he will tend to recommend a low-synergy one to make the

principal choose high-powered incentives at the merger-management stage, yielding a large rent to the

CEO. This result, providing one possible explanation for the low synergies from the Daimler-Chrysler

merger, sheds light on how CEOs can manipulate their post-merger remuneration by making suboptimal

merger recommendations. Besides the case of Daimler-Chrysler, there exists broad empirical evidence

that merging often leads to poor outcomes (e.g., Jensen and Ruback 1983, Jarrell et al. 1988, Bradley

et al. 1988, Morck et al. 1990, Bruner 2005). This empirical literature is in line with our theoretical

findings.

Our model focuses on CEOs gaining from mediocre mergers via an increase in compensation. Alternative theories, like the empire-building approach and the hubris hypothesis, are in line with post-merger

firm performance that can be rated as relatively poor against the background of the respective purchasing

price. According to these theories, CEOs may make mediocre merger deals so that the acquiring firm’s

shareholders do not earn a positive merger premium (i.e., the purchasing price is too high). The theories,

however, cannot explain why CEOs might be interested in choosing mediocre merger targets. According to our model, CEOs prefer mediocre merger targets because they lead to a demanding situation that

justifies high-powered CEO incentives.

Regarding the observation of increased CEO compensation following a merger, one might argue that

this increase is due to larger firm size—given the stylized fact that firm size is positively correlated with

CEO pay.4 However, this fact does not yield a straightforward explanation for how CEOs gain from

merging via increased compensation and, therefore, prefer merging. On the one hand, mergers may lead

to personal costs for a CEO who is now responsible for a larger entity and has to invest more time and

effort to manage the merged corporation. In that case, there are two possibilities. If the CEO earns a

sufficiently large rent without merging, the additional personal costs only reduce this rent. Otherwise, the

CEO has to be paid for the additional burden according to the theory of compensating wage differentials.

Neither possibility, however, leads to a gain for the CEO. On the other hand, merging can lead to an

extra utility for the CEO if he is an empire builder and benefits from additional prestige and power by

managing a larger corporation. It is not clear, however, why shareholders should additionally increase

CEO pay in this situation. Hence, again we cannot argue that the CEO gains via increased compensation.

In our analysis of the CEO’s recommendation of a merger target, we focus on decision-based incentives throughout the paper: while the synergies of the recommended target firm are observable for

the principal, CEO pay in the first stage can only condition on whether an acquisition takes place or

not.5 We find that the principal may benefit from offering the CEO a sufficiently high wage premium

in case of an acquisition, although the quality of the CEO’s recommendation of a merger target is not

contractible. Offering a large acquisition premium acts as a commitment device for the principal not to

approve low-synergy recommendations because low-synergy targets will not justify the high CEO pay.

Consequently, the CEO is kept from opportunistically recommending a low-synergy merger target while

identifying high-synergy targets at the same time. The empirical findings of Grinstein and Hribar (2004)

can be interpreted in this direction. They report that, in their sample, 39% of the acquiring firms pay an

4

5

See, e.g., Anderson et al. (2004), Section 2, and the literature cited therein.

The incomplete contracting assumption of decision-based rewards was introduced by Dewatripont and Tirole (1999). According to this approach, incentive schemes condition on actual decisions but not on the content or quality of the information

underlying these decisions.

3

acquisition premium to their CEOs for the completion of the deal.

We discuss several extensions of the basic model as a robustness check for our main findings. The

first extension considers the possibility of writing long-term contracts. If the principal has sufficient

commitment power to stick to a long-term contract, the problem of opportunistic target recommendation

can be eliminated. This advantage, however, comes at a cost since the optimal long-term contract always

induces suboptimal effort compared to the flexible effort implementation of short-term contracts. We

derive conditions under which short-term contracting outperforms long-term contracting.

In a second extension, we analyze the interaction between synergies and the performance measure

for successful merger management. We show that the main result—opportunistic recommendation of

merger targets by the agent—may qualitatively still prevail. In addition, we discuss the implication of

equity based compensation of CEOs in the context of merger management. Our results imply that if the

CEO’s compensation is equity based and short-term firm success is affected by actual merger synergies,

then such compensation plans work against opportunistic recommendation.

Furthermore, we show that the assumption of management effort and synergies being substitutes is

crucial for the conflict of interest between principal and agent to arise. In addition, we discuss the

implications of endogenizing information gathering by the agent at the first stage of the game. Finally,

we consider the possibility that the agent is an empire builder or bears personal costs from merging.

The rest of the paper is organized as follows. We start with a review of the related literature in Section

2. In Section 3, we introduce our basic model, which is analyzed in Section 4. Section 5 discusses the

robustness of our main finding. We conclude in Section 6. All proofs are deferred to the Appendix.

2. R ELATED L ITERATURE

Our paper contributes to the literature on real authority and project recommendation.6,7 Closely related

to our paper, Dow and Raposo (2005) explore the determinants of a CEO’s choice of corporate strategy.

The principal-agent relationship in Dow and Raposo (2005) is governed by a long-term contract which

can be renegotiated once before the CEO decides which corporate strategy to implement. Specifically,

three types of long-term contracts are considered. First, shareholders can wait until the CEO formulates

a corporate strategy and then offer an incentive contract (ex-post contracting). Second, shareholders can

fix an initial incentive contract without knowing the CEO’s formulated strategy and possibly renegotiate

the contract ex post (ex-ante contracting). Third, if the shareholders have sufficient commitment power—

e.g., via social norms or individual ethics—they can apply ex-ante contracting without renegotiation.

While the basic information structure is similar, the paper by Dow and Raposo (2005) differs in several respects from ours. Whereas they consider long-term contracts, we focus on a series of short-term

6

The seminal papers by Aghion and Tirole (1997) and Baker et al. (1999) do not discuss the interplay of project recommendation and subsequent optimal incentive provision. Moreover, in our paper, the second-stage moral hazard problem

endogenously implies the conflict of interests between principal and agent, which is exogenously given in Aghion and

Tirole (1997) and Baker et al. (1999).

7

Landier et al. (2009) analyze organizational design given that division of labor requires project choice and project implementation to be delegated to two different agents whose opinions regarding project choice may diverge. They find that

organizational dissent fosters the efficient use of information because the implementer’s unwillingness to work hard on

the chooser’s preferred projects constrains the chooser in selecting self-serving projects. Relatedly, in a model of repeated

project choice, Marino et al. (2009) analyze the implications of separation costs for the allocation of authority when the

scope for centralization is limited by the agent’s ability to disobey the principal’s orders.

4

contracts. Most importantly, they assume that no aspect of corporate strategy is verifiable such that contracts can only be based on a measure of managerial performance. While nonverifiability may be an

appropriate assumption for the choice of corporate strategy in general, with regard to an expansionary

strategy by means of merger activity it seems reasonable that a third party can at least verify whether an

acquisition takes place or not. In consequence, with our focus on merger activity, in our model contracts

can be based not only on a measure of managerial performance but also on whether an acquisition occurs.

In fact, this additional contractual element allows for a novel suggestion on how to manage the arising

conflict of interests between the shareholders and the CEO: by contractually specifying a sufficiently

high premium payment for the event of an acquisition, the shareholders can commit themselves only

to engage in merger activity when the resulting synergies are sufficiently high. This prevents the CEO

from recommending low-synergy mergers, which ceteris paribus would induce the shareholders to specify higher incentive pay than high-synergy mergers. This commitment-based resolution via a sufficiently

high acquisition premium is not feasible in Dow and Raposo (2005) where only managerial success is

verifiable. Furthermore, this commitment rationale does not rely on assumptions on norms or ethics, but

emerges endogenously as feature of the optimal contract. Technically, in our setting with two sequential

short-term contracts, the first contract is used as a pure commitment device, whereas the second contract optimally governs the merger management of the CEO. In Subsection 5.1, we show under which

conditions sequential short-term contracting yields higher expected profits than the optimal long-term

contract.

Our result that the principal may find it optimal to pay a high acquisition premium in order to commit

herself not to approve low-synergy mergers is reminiscent of the finding by Berkovitch et al. (2010)

regarding organizational design: if project recommendation is subject to managerial moral hazard, then

implementation of the less efficient unitary functional structure (U-form) may favorably affect the manager’s recommendation behavior by making projects preferred by the manager too costly to implement,

thereby outperforming the more efficient multidivisional structure (M-form). In Berkovitch et al. (2010),

however, the choice of organizational structure is the only way to influence the manager’s recommendation behavior—monetary incentive schemes are assumed to be ineffective. Complementary to this

approach, our paper, which endogenizes the manager’s preferences over merger projects, explores information management in incentive problems via traditional monetary reward schedules. Furthermore, we

go beyond the analyses in Dow and Raposo (2005) and Berkovitch et al. (2010) by addressing the incentivization of information acquisition in the shadow of the conflict of interests and how non-monetary

means such as working conditions can help to overcome this conflict.

Besides the empirical work on post-merger CEO pay cited above, our paper is related to part of the

merger literature that is in line with the observation that CEOs sometimes choose merger targets with

low synergies.8 First, CEOs may receive a utility from empire building (e.g., higher prestige) and ignore

synergies (Baumol 1959, Marris 1963, Williamson 1963, Jensen 1986). Second, overconfident CEOs

may imagine to measure the true value of a target firm more precisely than the whole capital market,

leading to the well-known hubris effect (Roll 1986). Third, CEOs may prefer to invest in those industries

in which they are experts in order to entrench themselves (Shleifer and Vishny 1989). Fourth, a raider

may decide to acquire a target firm to benefit from a breach of implicit contracts with the workforce and

8

For an overview see DeBondt and Thompson (1992).

5

other stakeholders (Shleifer and Summers 1988, Schnitzer 1995, Brusco 1996). Finally, a risk averse

CEO of an acquiring firm may benefit from the diversification of personal risk (Amihud and Lev 1981,

Morck et al. 1990). These theories do not exclude the possibility that CEOs occasionally acquire merger

targets with low synergies. However, our approach points out that CEOs may systematically prefer

inefficient mergers to efficient ones and deliberately choose a poor merger target even when they have

the opportunity to aquire a more profitable firm. This finding fits quite well to the conclusion of Williams

et al. (2008) that managers seem to benefit from mergers that are not in their shareholders’ best interest.

Moreover, contrary to our paper, the aforementioned theories cannot explain why the incomes of the

acquiring firms’ CEOs increase.

Finally, our paper is also related to literature on self-handicapping. Katok and Siemsen (2011) show in

a laboratory experiment that individuals tend to choose overly difficult tasks to enhance their reputation.

In a general theoretical framework in which both skill and chance determine success, Harbaugh (2011)

argues that decision makers might prefer alternatives with low success probabilities for reputational

reasons. Kräkel and Müller (2012) show that sabotaging one’s own team can be rational for a team

member to increase monetary incentive pay and overall motivation. Gill and Sgroi (2012) show that

firms may prefer a tough test when launching a new product to invest in product reputation. MiklósThal and Zhang (2013) analyze a similar reputation effect in the context of consumer marketing. Here,

disinvestment in marketing can lead to reputational advantages ex post.

3. T HE M ODEL

Consider a relationship between a principal (she) and an agent (he)—both risk neutral—that lasts for two

periods, t = 1, 2. The agent is protected by limited liability, i.e., wage payments to the agent have to

be nonnegative in each period. The principal wants to engage in merger-and-acquisition activities, but

lacks the expertise and/or the time to run these activities herself. The agent’s task in the first period,

the information-gathering stage, therefore is to identify a potential merger target, i.e., a firm that the

principal might acquire. If acquisition takes place and the principal wants to proceed with the merger,

the agent’s task in the second period, the merger-management stage, then is to manage the merged firm.

The probability of the merged firm succeeding in the market depends on both the agent’s effort and the

synergies created by the merger. The agent is offered a new contract in each period.9 For simplicity,

the agent’s outside opportunity in each period is zero and, under the absence of any merger activity, the

principal’s business in each period generates a profit of zero. The sequence of events, which we describe

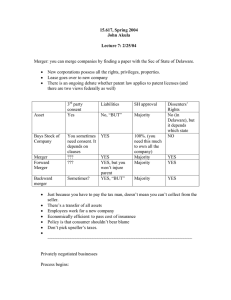

in detail in the following, is depicted in Figure 1.

Figure 1: Timing of events (P – principal; A – agent; N – nature)

Information gathering.—At the beginning of their relationship, both principal and agent know that

there are two potential merger targets, but they are uninformed about the targets’ specific synergies.

At this point, both parties share the same prior probability distribution regarding the synergies of the

potential target firms. Ex ante, both target firms are identical with the synergies δ j of target firm j = 1, 2

9

We discuss the consequences of signing long-term contracts in Section 5.1.

6

being randomly drawn from the set {−∞, δL , δH }, with 0 < δL < δH and the probabilities P (δ j =

δ) > 0 for all δ ∈ {−∞, δL , δH }.10 In the first period, with probability 1 − i, the agent remains

completely uninformed. With probability i ∈ (0, 1), on the other hand, he learns about the synergies of

both merger targets, where the set of actual synergies is denoted by ∆.11 Whether information gathering

was successful as well as the set ∆ of synergies in case of successful information gathering is private

information of the agent. However, the agent can make a recommendation to the principal that points to

a specific merger target. In case of a recommendation, if the agent succeeded in gathering information,

he offers information on the respective target’s synergies δ to justify his recommendation. While this

information makes δ observable for the principal, the communication between the principal and the

agent is unverifiable by a third party, which prevents the principal from forcing the agent to reveal the

complete profile of merger synergies. In particular, the assumption of the information on δ offered by the

agent being unverifiable seems realistic, because the magnitude of synergies from merging also depends

on specific characteristics of the acquiring firm, which are typically not known by a third party. In

addition, merger-specific human capital of the acquiring firm’s CEO as well as his individual strengths

and weaknesses may also be important for generating synergies. Knowledge about these individual

characteristics are more likely to be available for the shareholders than for a third party. In general,

unverifiability of δ can arise from asymmetric information between the parties belonging to the acquiring

firm and external parties. If the agent is indifferent between several targets, we assume that he will

recommend the target with the highest synergies. Moreover, if the agent is indifferent between making a

merger recommendation or not, he will make a recommendation.12 After the agent has made his report,

the principal decides whether to proceed with the acquisition and (if so) which target firm to acquire.

Merger synergies.—If the principal acquires a target firm with negative synergies δ = −∞, she will go

bankrupt after the first period and suffer an extreme loss of −∞ in the second period—e.g., from losing

everything she owns due to insolvency. In this sense, the mere acquisition of a target firm with negative

synergies severely harms the principal’s core business and forces her out of business.13 For this reason,

we refer to a merger with negative synergies as a destructive merger. In case of a productive merger, on

the other hand, the principal acquires a target firm with strictly positive synergies δ ∈ {δL , δH }. Then,

at the beginning of the second period, she can choose between running two independent businesses or

merging her two businesses. For simplicity, the per-period profit of a target firm with δ > 0 under

the absence of any merger activity is set to zero. In consequence, the principal can acquire any such

firm at the end of the first period at no cost, reflecting its market value. If the principal decides to

conduct a merger of her two businesses in order to capitalize on the synergies, then she has to employ the

agent to manage the merged firm—tasks such as identification and realization of potential cost savings,

restructuring of assets, and reconfiguration of the organization all require managerial effort. The principal

10

Similar to Aghion and Tirole (1997), we include the possibility δ = −∞ to exclude situations in which the principal chooses

merger targets randomly.

11

Thus, if both merger targets have identical merger synergies, δ 1 = δ 2 = δ, then the set of actual merger synergies is a

singleton, ∆ = {δ}. If, on the other hand, δ 1 6= δ 2 , then ∆ = {δ 1 , δ 2 }.

12

Note that the agent, in case he learned merger synergies, has the freedom to choose whether to provide the principal with information regarding a merger target. Given the assumed tie-breaking rule, in equilibrium he will always provide information

whenever it is available. This tie-breaking rule, however, is of no qualitative importance for the analysis.

13

For example, imagine the case where the acquired firm realizes a huge loss ex post and the principal, as new owner, is liable

for the loss. Alternatively, it is conceivable that the principal is harmed considerably when it turns out that the acquired firm

is involved in criminal activities.

7

cannot replace the current agent by another one, because the current agent has acquired valuable targetspecific knowledge that is not transferable to a new agent. The merged firm’s success, π, depends on

both the synergies created by the merger and the second-period managing effort exerted by the agent.

The agent’s effort choice, e ≥ 0, is unobservable for the principal and comes at cost c(e) for the agent,

where c0 (e) > 0 for e > 0, c00 (e) > 0, and c (0) = c0 (0) = 0. If the agent exerts effort e and the acquired

firm exhibits synergies δ > 0, the merged firm’s profit is high, π = πH , with probability p(e+δ) ∈ (0, 1),

and low, π = πL < πH , otherwise. Thus, effort and synergies are substitutes. For example, if higher

synergies allow for savings of working time, the agent may compensate lower synergies by working

overtime. The success probability increases monotonically in the agent’s effort with a declining rate,

i.e., p0 > 0 and p00 < 0. If the principal is indifferent between acquiring and not acquiring the target

firm, she will not pursue the acquisition. If the principal is indifferent between a merger or running two

independent businesses, she will pursue the merger.

Contracting.—With the information gathered and communicated by the agent in the first period being

unverifiable, the first-period contract specifies a wage payment contingent on whether an acquisition has

occurred or not.14 The agent receives w1H in case of an acquisition and w1L otherwise.15 Regarding

the second-period contract, we assume that the merged firm’s success π is not verifiable because it is

realized in the distant future and thus cannot be used for current contracting purposes. Instead, there is

a contractible binary performance measure on the agent’s managerial effort, σ ∈ {σL , σH }. The higher

the agent’s managerial effort, the larger the probability of realization σH of the performance measure:

q(e) = P (σ = σH |e) ∈ [0, 1), with q 0 (e) > 0, q 00 (e) ≤ 0, and q (0) = 0.16 The second-period contract

offered by the principal thus specifies wage payments contingent on the agent’s performance: w2H in

case of good performance σH , and w2L in case of bad performance σL . Due to the agent’s limited

liability, we have wtL ≥ 0 and wtH ≥ 0 for t = 1, 2.

Sequence of events.—At the beginning of the first period, the principal offers the agent a contract

w1 = (w1H , w1L ). If the agent rejects this contract, the game ends and both parties receive their

zero reservation payoff for each period. If the agent accepts the contract, nature determines whether he

obtains information about potential merger targets or not. Subsequently, the agent decides whether to

recommend a target firm to the principal. The principal then decides whether to acquire a target firm and,

if so, which one, and first-period wage payments are made according to contract w1 . If the principal

does not acquire a target firm or goes bankrupt, the interaction of principal and agent concerning the

merger activity is terminated after the first period.17 In this case, in the second period the agent obtains

his zero reservation utility and the principal either earns zero profits from running only her core business

14

This assumption is in the spirit of decision-based incentives à la Dewatripont and Tirole (1999). We thus implicitly assume

that courts are not willing to enforce message games according to Moore and Repullo (1990).

15

Implicitly we assume that it is not contractible immediately after the acquisition of a target firm whether an actual merger

of the two businesses took place. This seems plausible if one thinks of the merger as a long-term ongoing process of

standardizing production and harmonizing work flows over the two businesses.

16

The performance measure is directly related to the agent’s activity level but is not affected by merger synergies. For example,

if the CEO’s compensation is equity based, signal σ might reflect short-term changes in the firm’s stock value. These

changes reflect how determinedly the CEO pursues the merger management, e.g., by renegotiating supply conditions or

thinning out the work force, but do not yet reflect the actual merger’s effect on long-term firm performance. It is conceivable,

however, that also short-term firm success is already affected by merger synergies. We discuss such a setting in Section 5.2

below.

17

Note that this assumption does not rule out that agent and principal still collaborate on further tasks not considered in our

paper. For example, it is conceivable that (unless in case of bankruptcy) a CEO continues to work for a corporation, although

shareholders and the board have voted against merging.

8

or suffers an extreme loss from bankruptcy. If the principal has acquired a target firm with strictly

positive synergies, the game continues in t = 2. At the beginning of the second period, the principal

decides whether to conduct a merger or run her two businesses independently. In the latter case, the agent

obtains his zero second-period reservation utility and the principal earns zero second-period profits. In

the former case, the principal has to employ the agent to manage the merged firm and offers him a

contract w2 = (w2H , w2L ). If the agent rejects this contract, each party obtains a zero payoff in the

second period. If the agent accepts, he decides how much effort e to exert in managing the merged firm.

After nature has determined the realization of the performance measure σ, second-period wage payments

are made according to contract w2 .

4. T HE A NALYSIS

The analysis proceeds by backward induction. First, we analyze the principal’s contract offer and the

agent’s subsequent effort choice in the merger-management stage. Next, we address the agent’s recommendation behavior and the principal’s subsequent acquisition decision. Finally, we identify the

principal’s optimal contract offer in the information-gathering stage.

4.1. Merger Management

Suppose the principal acquired a firm endowed with productive merger potential δ > 0 and hires the

agent in the second period to manage the merged firm. Given he accepted the second-period contract

w2 , the agent chooses effort e ≥ 0 to maximize his expected second-period utility

EU2 (e) = q(e) w2H + [1 − q(e)] w2L − c(e).

(1)

If w2H < w2L , i.e., if successful performance is punished, the agent optimally exerts no effort at all,

e∗ = 0. If, on the other hand, w2H ≥ w2L , i.e., successful performance is at least weakly rewarded, the

agent’s effort choice is implicitly characterized by the corresponding first-order condition,

w2H − w2L =

c0 (e∗ )

.

q 0 (e∗ )

(2)

Setting w2H < w2L cannot be optimal for the principal, because she could elicit the same (zero) effort

at strictly lower expected wage cost by setting w2H = w2L = 0. Therefore, without loss of generality,

we can restrict attention to second-period wage schemes with w2H ≥ w2L . The principal chooses w2 to

maximize her expected profit,

πL + (πH − πL )p(e∗ + δ) − w2L − q(e∗ ) (w2H − w2L ) ,

(3)

subject to the incentive compatibility constraint (2), the participation constraint EU2 (e∗ ) ≥ 0, and the

limited-liability constraint w2H , w2L ≥ 0.

Given the limited-liability constraint, the agent always obtains a non-negative expected wage payment.

Therefore, with shirking being costless for the agent—i.e., c(0) = 0—the participation constraint will

never impose a binding restriction and can safely be ignored. Under the optimal second-period contract

9

we then must have w2L = 0. For otherwise, if w2H ≥ w2L > 0, the principal could strictly increase her

expected profits by lowering both w2H and w2L by some identical small amount such that the limitedliability constraint still is satisfied and the agent’s choice of effort remains unchanged.

The choice of the remaining wage component w2H pins down the agent’s effort choice e∗ according

to (2). In consequence, the principal will implement effort level

e∗ (δ) = arg max[S(e, δ) − R(e)],

(4)

e≥0

where

S(e, δ) := πL + (πH − πL ) p (e + δ) − c (e)

(5)

denotes expected second-period surplus and

R(e) :=

c0 (e)

q(e) − c(e).

q 0 (e)

(6)

reflects the part of this surplus that the principal cannot extract. The function R(e) thus represents the

0

agent’s rent in the merger-management stage if he exerts effort e under contract w2 = ( qc0(e)

(e) , 0). Due to

the concavity of q and the convexity of c, the agent’s rent R(e) is strictly positive for e > 0. To guarantee

strict concavity of the principal’s objective function, in what follows the function R(e) is assumed to

be convex.18 Noting that ∂S(0, δ)/∂e > 0 = R0 (0), the effort level e∗ (δ) > 0 then is implicitly

characterized by

∂S(e∗ (δ), δ)

= R0 (e∗ (δ)).

∂e

(7)

The next proposition summarizes the above observations regarding the optimal second-period contract

and the associated effort level:

∗ =

Proposition 1. The optimal contract in the merger-management stage specifies wage payments w2H

∗ = 0, and implements effort e∗ (δ) > 0.

c0 (e∗ (δ))/q 0 (e∗ (δ)) and w2L

The findings for the optimal second-period contract reveal that an increase in merger synergies strictly

decreases effort e∗ (δ) as well as the agent’s second-period wage for good performance and his expected

second-period rent.

Corollary 1. Under the optimal contract in the merger-management stage, the implemented effort, the

bonus payment for successful performance, and the agent’s expected rent are all decreasing in merger

∗ /dδ < 0 and dR(e∗ (δ))/dδ < 0.

synergies, i.e., de∗ (δ)/dδ < 0, dw2H

The intuition for the second-period bonus payment being decreasing in the level of merger synergies is

rooted in the concavity of the probability function p, i.e., the fact that the marginal probability of success

is decreasing. A smaller δ (i.e., low synergies from the merger) makes the agent exert effort at a high

marginal productivity level p0 . In this situation, the principal benefits much more from high-powered

incentives than under high synergies, which are associated with lower values of marginal productivity

p0 . In other words, low synergies put the firm in a difficult situation. Hence, rather poor prospects for

18

Note that for the family of power functions c (e) = eα and q (e) = eβ with α > 1 and β ∈ (0, 1], R(e) is always convex.

10

success of the merged firm induce the principal to create strong incentives to encourage the agent to

save the merger project. In Section 5.3, we show that the assumption of managerial effort and merger

synergies being substitutes turns out to be crucial for this effect.

The principal’s second-period profit under merging is

Π2 (δ) = S(e∗ (δ), δ) − R(e∗ (δ)).

(8)

Note that in terms of second-period profits under merging the principal benefits from higher merger

synergies, Π2 (δL ) < Π2 (δH ), as high synergies increase the likelihood of high firm profits and reduce

the agent’s rent.19

In order to focus on the conflict of interest between the principal and the agent, we assume that

Π2 (δL ) > 0 for the rest of the paper. On the one hand, this assumption does not preclude post-merger

losses in the form of πL < 0.20 On the other hand, the assumption implies that the principal always

prefers running a merged firm over running two independent businesses if synergies are strictly positive.

4.2. Merger Recommendation and Acquisition Decision

At the end of the first period, at date 1.5, for a given first-period contract w1 = (w1H , w1L ) the principal

has to decide whether to make an acquisition or not. If the agent does not make a recommendation or

recommends a destructive merger with negative synergies (δ = −∞), the principal will refrain from

making an acquisition in order to avoid the risk of bankruptcy. If, on the other hand, the principal faces

a recommendation pointing to a productive merger target with strictly positive synergies δ > 0, she will

acquire the merger target in question if

Π2 (δ) > w1H − w1L .

(9)

At date 1.4, if the agent succeeded in gathering information and identified at least one productive

merger target—i.e., ∆ 6= {−∞}—he has to decide whether to make a recommendation and, if so, what

merger target to recommend.21 Restricting attention to contracts with a nonnegative first-period wage

spread, we obtain the following result regarding the agent’s reporting decision:22

Proposition 2. Let w1L ≤ w1H and suppose that the agent has identified at least one productive merger

target with positive synergies, ∆ 6= {−∞}.

(i) If the first-period acquisition premium is low, 0 ≤ w1H − w1L < Π2 (δL ), then the agent recom-

Technically, the envelope theorem applies, leading to dΠ2 (δ)/dδ = ∂S/∂δ = (πH − πL ) · p0 (e∗ (δ) + δ) > 0.

To see this, note that p(δL )πH + [1 − p(δL )]πL > 0 or, equivalently, πL > −πH p(δL )/(1 − p(δL )), is a sufficient condition

for Π2 (δL ) > 0 (where we made use of R(0) = c(0) = 0).

21

If the agent does not make a recommendation, the principal will not make an acquisition to avoid the risk of bankruptcy. If

the agent did not succeed in gathering information about synergies, he cannot back up his recommendation with evidence.

In this case, the principal will not make an acquisition to avoid the risk of bankruptcy even if the agent makes a recommendation. If the agent learned about synergies and ∆ = {−∞}, he makes a useless recommendation with δ = −∞ and the

principal refrains from acquiring the target.

22

By (9), for w1L > w1H the principal will always acquire the target firm because even running two independent businesses

is more profitable than paying the high first-period wage w1L if no acquisition takes place. As we show in the proof of

Proposition 3, it is never optimal for the principal to offer a first-period contract with w1L > w1H .

19

20

11

mends the productive merger target with the lowest synergies

δ=

δL

if δL ∈ ∆

δ

H

if δL ∈

/∆

.

(10)

(ii) If the first-period acquisition premium is high, w1H − w1L ≥ Π2 (δL ), then the agent recommends

the productive merger target with the highest synergies

δ=

δH

if δH ∈ ∆

δ

L

if δH ∈

/∆

.

(11)

According to Proposition 2(i), if the first-period acquisition premium w1H − w1L is not too high, the

agent will propose the least productive merger and, by (9), the principal will be willing to follow this

recommendation. In particular, this means that the agent will go against the principal’s interest whenever

he identifies both low-synergy and high-synergy target firms and recommend a low-synergy merger with

δ = δL . The agent’s incentive to propose the least productive merger follows from Corollary 1: since

limited liability prevents the principal from extracting rents to the full, recommendation of the least

productive merger yields a maximum second-period bonus payment for the agent and thus a maximum

rent.

If the first-period acquisition premium is sufficiently high, cf. Proposition 2(ii), the agent is willing to

act in the principal’s best interest and recommends the most productive merger target he has identified.

On the one hand, this willingness may arise because the agent is indifferent between any recommendation

he could make: if w1H − w1L > Π2 (δH ), then, by (9), the principal rejects the agent’s recommendation

irrespective of the recommended target’s synergies. On the other hand, and more interestingly, this

willingness may also be rooted in the principal’s unwillingness to acquire anything but a high-synergy

target: if Π2 (δL ) ≤ w1H − w1L < Π2 (δH ), then, by (9), the only way for the agent to obtain the high

first-period wage w1H > w1L and a positive second-period rent in addition is to present the principal

a high-synergy target. In this situation, the agent strictly prefers to recommend a target firm with high

synergies if he observes both low- and high-synergy targets.

Proposition 2 sheds new light on the case of the DaimlerChrysler merger mentioned in the introduction.

In the light of Proposition 2, the former Daimler CEO may not have opted for the acquisition of Chrysler

to realize benefits from empire building, entrenchment, or personal diversification. Instead, he may

have aimed at manipulating his post-merger remuneration. In that case, the recommendation of a lowsynergy target led to a challenging situation for the CEO. As a consequence, the board of directors chose

high-powered incentives to intensify the CEO’s efforts to rescue the joint entity, thereby maximizing the

CEO’s personal rent.

4.3. First-Period Contracting

At date 1.1, anticipating the agent’s recommendation decision and her own acquisition decision, the

principal offers the first-period contract w1 = (w1H , w1L ) in order to maximize her expected overall

12

profits

Π1 = Pacquisition {E[Π2 (δ)|acquisition] − w1H } + (1 − Pacquisition )(−w1L ),

(12)

where Pacquisition denotes the probability of an acquisition occurring and E the expectation operator with

respect to δ.23

With our focus on first-period contracts with a non-negative wage spread, w1H ≥ w1L , it follows

immediately that the agent (weakly) prefers an acquisition to occur because he then obtains a (weakly)

higher wage and, in case of a productive merger, a second-period rent. In consequence, the agent will,

whenever feasible, recommend a productive merger target with δ > 0 instead of making no recommendation or recommending a destructive merger target with δ = −∞. The agent’s decision whether to

recommend a target firm with synergies δ = δL or δ = δH is governed by the principal’s acquisition decision as well as prospective second-period rents. According to (9), when faced with a recommendation

δ ∈ {δL , δH }, the principal’s acquisition decision is determined by the difference in first-period wages,

w1H − w1L . Thus, with absolute levels of first-period wages playing no role regarding the agent’s rec∗ = 0. Denote by P (δ ∈ ∆) the probability that

ommendation decision, the principal optimally sets w1L

k

at least one identified merger target has synergies δk (k = L, H), by P (δH ∈ ∆, δL ∈ ∆) the probability

that one target has synergies δH and the other target δL , and by P (δk ∈ ∆, δj ∈

/ ∆) the probability that

one target has synergies δk and the other target does not have synergies δj (k, j = L, H; k 6= j). We

obtain the following result for the principal’s optimal first-period contract offer:

Proposition 3.

(i) If

P (δL ∈ ∆, δH ∈

/ ∆) + P (δH ∈ ∆, δL ∈

/ ∆)

Π2 (δH )

>2+

,

Π2 (δL )

P (δH ∈ ∆, δL ∈ ∆)

∗ = 0

∗

= Π2 (δL ) and w1L

the optimal contract in the information-gathering stage specifies w1H

and the principal acquires only a high-synergy target firm.

∗ = w ∗ = 0 and

(ii) Otherwise, the optimal contract in the information-gathering stage specifies w1H

1L

the principal acquires both a high-synergy or low-synergy target firm.

According to Proposition 3(i), the principal may actually benefit from offering the agent a sufficiently

∗

high wage premium in case of an acquisition, w1H

= Π2 (δL ), even though the content (or quality) of

the agent’s recommendation itself is not contractible. The reason is that the high acquisition premium

acts as a commitment device for the principal only to acquire productive target firms with high synergies.

This, in turn, deters the agent from withholding a high-synergy recommendation because he cannot reap

∗ = 0 and

the higher second-period rent associated with low synergies. In this sense, we can refer to w1L

∗ = Π (δ ) as commitment-based contract. The decision whether the principal offers an acquisition

w1H

2 L

premium is driven by two effects. First, offering such a premium will be profitable if the higher secondperiod profits from a high-synergy merger, Π2 (δH ), are large relative to second-period profits from a lowsynergy merger, Π2 (δL ). Second, the principal will prefer offering such a premium if it is likely that the

agent is tempted not to recommend the most productive acquisition, i.e., the higher P (δH ∈ ∆, δL ∈ ∆).

23

Note that participation of the agent again is not an issue because of non-negativity of wages due to limited liability.

13

The principal’s expected profits under such a commitment-based contract are

Πcommitment

= iP (δH ∈ ∆)[Π2 (δH ) − Π2 (δL )].

1

(13)

Proposition 3(ii), on the other hand, shows that the agent recommending a low-synergy target even

when a high-synergy target is available is not an out-of-equilibrium event. Suppose that profits from a

high-synergy merger are low relative to profits from a low-synergy merger, i.e., Π2 (δH )/Π2 (δL ) falls

∗ =

below the threshold in Proposition 3(i). Then the agent is offered a zero first-period fixed wage, w1H

∗ = 0, and—according to Proposition 2—recommends the least productive merger target (that avoids

w1L

bankruptcy) in order to maximize his second-period rent. The contract with a zero first-period fixed wage

can be called laissez-faire contract, resulting in expected profits

faire

Πlaissez

= i[P (δL ∈ ∆)Π2 (δL ) + P (δH ∈ ∆, δL ∈

/ ∆)Π2 (δH )].

1

(14)

5. D ISCUSSION

In the following, we address the robustness of our results by considering five natural extensions of our

basic model.

5.1. Long-Term Contracting

Under short-term contracting, the agent’s incentive to recommend a low-synergy merger even though he

also identified a target firm with high synergies arises, because, when making her second-period contract

offer, the principal is willing to implement higher incentive pay when she is convinced that she is going

to merge with a low-synergy firm. Commitment to a single non-renegotiable long-term contract that

governs wage payments for both periods should do away with the problem of the agent not reporting in

the principal’s best interest. Nevertheless, it is not a priori clear that the principal indeed prefers such

a commitment, because she forgoes the flexibility guaranteed by a series of short-term contracts: when

merging with a low-synergy firm the principal in fact wants incentive pay to be higher than when merging

with a high-synergy firm. In the following, we derive the optimal long-term contract and briefly discuss

under what circumstances the principal is actually worse off than under short-term contracting.

Retaining our assumptions regarding contractibility, a long-term contract (w1H , w1L , w2H , w2L ) specifies four wage payments: at the end of the first period the agent obtains w1H if an acquisition occurred

and w1L otherwise; at the end of the second period the agent obtains w2H if managerial performance

was high and w2L if managerial performance was poor. Furthermore, we assume the long-term contract

to be non-renegotiable. Finally, for the sake of exposition, we restrict attention to the case of long-term

firm profits being non-negative, i.e., πL ≥ 0.

As before, given second-period wage payments w2L and w2H , the agent’s effort choice e∗ in the

merger-management stage is determined by (2). Define Π̂2 (e, δ) := S(e, δ) − R(e). When the agent

recommended a firm with synergies δ > 0, at the end of the first period the principal acquires this firm

and merges her two businesses if

Π̂2 (e∗ , δ) − w2L > w1H − w1L .

14

(15)

Note that for a given long-term contract, it is more attractive for the principal to acquire a high-synergy

firm than a low-synergy firm because the merged firm is more likely to generate high profits when synergies are high. From (15) it thus follows that there are three basic possibilities for the principal to design

her long-term contract offer: first, she can offer a wage schedule such that she is willing to acquire and

merge with both high-synergy and low-synergy firms; second, she can offer a wage schedule such that

she is willing to acquire and merge with a high-synergy firm but not with a low-synergy firm; third,

wages can be chosen such that she is never willing to acquire a target firm irrespective of its synergies.

Regarding the agent’s recommendation decision, under long-term contracting his prospective secondperiod rent in case of a productive merger does not depend on the level of synergies. While the agent

is indifferent between recommending a high-synergy merger or a low-synergy merger as long as the

respective firm is acquired, the principal is more willing to acquire a target firm the higher that firm’s

synergies. Therefore, given our assumed tie-breaking rule, the agent will recommend the productive

merger target with the highest synergies.

As we show in the appendix, with the agent always making his recommendation in the principal’s

best interest, she cannot benefit from not merging with a target firm that has positive synergies. In

consequence, factoring out P (∆ 6= {−∞}), the principal’s expected profits can be written as

(

P (δH ∈ ∆)

[Π̂2 (e∗ , δH ) − w2L ]

P (∆ 6= {−∞})

)

P (δL ∈ ∆, δH ∈

/ ∆)

∗

+

[Π̂2 (e , δL ) − w2L ] + [1 − iP (∆ 6= {−∞})] (−w1L ). (16)

P (∆ 6= {−∞})

iP (∆ 6= {−∞})

− w1H +

The principal chooses the nonnegative wage payments w1L , w1H , w2L and implements effort e∗ (by

appropriate choice of w2H − w2L ) to maximize (16) subject to the specification of (15) which ensures

that she is willing to acquire both high-synergy and low-synergy firms,

Π̂2 (e∗ , δL ) − w2L > w1H − w1L ,

(17)

and the agent’s long-term participation constraint

iP (∆ 6= {−∞}) [w1H + w2L + R(e∗ )] + [1 − iP (∆ 6= {−∞})] (w1L ) ≥ 0.

(18)

As limited liability dictates wages to be nonnegative and the agent can always opt for exerting no effort at

all, the agent’s participation constraint (18) never imposes a binding constraint and can safely be ignored.

If also (17) was absent, then the principal would optimally set w1L = w1H = w2L = 0 and induce effort

level

eLH = arg max

∗

e ≥0

P (δH ∈ ∆)

P (δL ∈ ∆, δH ∈

/ ∆)

Π̂2 (e∗ , δH ) +

Π̂2 (e∗ , δL ).

P (∆ 6= {−∞})

P (∆ 6= {−∞})

(19)

As eLH maximizes a convex combination of Π̂2 (e∗ , δH ) and Π̂2 (e∗ , δL ), we obtain that e∗ (δH ) < eLH <

e∗ (δL ), where e∗ (δ) = arg maxe≥0 Π̂2 (e, δ) as defined in (7). With Π̂2 (0, δL ) > 0 being guaranteed by

πL ≥ 0 and Π̂2 (e∗ , δL ) being increasing over the interval (0, e∗ (δL )), the neglected constraint (17) then

15

is satisfied for eLH ∈ (e∗ (δH ), e∗ (δL )).

Proposition 4. The optimal long-term contract induces effort level eLH ∈ (e∗ (δH ), e∗ (δL )) and specifies

∗∗ , w ∗∗ , w ∗∗ , w ∗∗ ) = (0, 0, c0 (e

0

wages (w1H

LH )/q (eLH ), 0).

1L

2H

2L

The principal’s profits under the optimal long-term contract can be written as

long term

Π1

= i{P (δH ∈ ∆)Π̂2 (eLH , δH ) + P (δL ∈ ∆, δH ∈

/ ∆)Π̂2 (eLH , δL )}.

(20)

To see that commitment to a long-term contract is not necessarily to the principal’s benefit, let us compare expected profits under the optimal long-term contract and the optimal short-term contract—either

the commitment-based contract or the laissez-faire contract. According to (13) and (20), Πcommitment

>

1

long term

Π1

if and only if

P (δH ∈ ∆) · [Π2 (δH ) − Π̂2 (eLH , δH ) − Π2 (δL )] > P (δL ∈ ∆, δH ∈

/ ∆) · Π̂2 (eLH , δL ).

(21)

Condition (21) will be satisfied if second-period profits under a low-synergy merger—i.e., Π2 (δL ) and

Π̂2 (eLH , δL )—are sufficiently small, because Π2 (δH ) > Π̂2 (eLH , δH ) always holds. Intuitively, in this

situation implementing optimal effort under high synergies is decisive, which is only achieved by the

commitment-based contract but not by the long-term contract. In addition, (21) tends to be satisfied if

the probability P (δH ∈ ∆) of finding a high-synergy target is very high, because then the expected opportunity costs of using the commitment-based contract—possibly foregone profits under a low-synergy

merger—become negligible.

Comparing expected profits under the optimal long-term contract and the laissez-faire contract shows

long term

faire > Π

that, according to (14) and (20), Πlaissez

1

1

if and only if24

P (δL ∈ ∆, δH ∈

/ ∆){Π2 (δL ) − Π̂2 (eLH , δL )} + P (δH ∈ ∆, δL ∈

/ ∆){Π2 (δH ) − Π̂2 (eLH , δH )}

> P (δL ∈ ∆, δH ∈ ∆){Π̂2 (eLH , δH ) − Π2 (δL )}. (22)

Condition (22) is quite intuitive: The left-hand side reflects the benefit of flexibility afforded by the

laissez-faire contract. Whenever only one kind of productive merger is available for the agent to report

and thus there is no conflict of interest, the principal is strictly better off under short-term contracting

where she can better attune the agent’s managerial effort to the level of synergies of the merged firm.

The right-hand side, on the other hand, reflects the benefit of long-term commitment. Whenever the

agent can actually choose between recommending a low-synergy and a high-synergy merger, then he

reports in the principal’s best interest under the long-term contract but not under short-term contracting.

Therefore, under a long-term contract the principal in this case benefits from higher synergies. Overall,

we would expect the long-term contract to perform worse than the laissez-faire contract if the probability

P (δL ∈ ∆, δH ∈ ∆) of observing both levels of productive synergies simultaneously is rather low.

Finally, note that the optimal long-term contract identified in Proposition 4 is not renegotiation-proof.

More specifically, suppose the agent recommended a merger target with low synergies δL . Under the optimal long-term contract the principal will acquire and merge with this target firm, her expected second24

Recall that P (δk ∈ ∆) = P (δk ∈ ∆, δj ∈ ∆) + P (δk ∈ ∆, δj ∈

/ ∆), where k, j = L, H and k 6= j.

16

period profits are Π̂2 (eLH , δL ), and the agent’s expected second-period utility is R(eLH ). Now suppose

that after the agent’s recommendation the principal offers the agent an alternative second-period conR , w R ) = (c0 (e∗ (δ ))/q 0 (e∗ (δ )), 0) to govern the merger-management stage. This contract,

tract (w2H

L

L

2L

which implements effort e∗ (δL ), results in expected profits Π2 (δL ) = S(e∗ (δL ), δL ) − R(e∗ (δL )) for the

principal and expected utility R(e∗ (δL )) for the agent. Since e∗ (δL ) > eLH and R0 (e∗ ) > 0, both the

principal and the agent are strictly better off under this alternative contract and thus willing to abandon

the original long-term contract. In consequence, if renegotiation cannot be ruled out, it becomes even

more likely that the principal prefers a series of short-term contracts over a long-term contract.

5.2. Interaction between Synergies and Performance Measure

In the basic model we assumed that the agent’s performance measure and, hence, the probability of a

favorable realization of the measure, q, is purely effort based. It is also conceivable, however, that the

performance measure (e.g., short-term firm success) may already have been influenced by the merger

synergies. In that case, the probability of a favorable outcome of the performance measure should increase in the synergies created by the merger. This clearly creates an incentive for the agent to recommend a merger target with high synergies in the first period, thereby increasing his likelihood of good

performance in the second period. Our main result, however, may also prevail under these circumstances,

i.e., even with successful merger management being more likely for a more productive merger, the agent

may nevertheless recommend a merger target with low synergies.

Let q(e+δ) denote the probability of high second-period performance of the agent, which now depends

on the sum of effort and merger synergies. Otherwise, the model is the same as before. Proceeding in

analogy to our previous analysis of merger management (see Section 4.1), the agent chooses secondperiod effort according to the incentive constraint

w2H − w2L =

c0 (e∗ )

.

q 0 (e∗ + δ)

(23)

With the agent’s participation not being an issue, the principal sets w2L = 0 and w2H = c0 (e∗ )/q 0 (e∗ +δ).

Considering the effort level as the principal’s choice variable, she implements e∗ (δ), which is implicitly

characterized by the first-order condition

(πH − πL )p0 (e∗ (δ) + δ) − c0 (e∗ (δ)) − Re (e∗ (δ), δ) = 0

(24)

where as before the agent’s rent R(e, δ) := q(e + δ)c0 (e)/q 0 (e + δ) − c(e) is assumed to be convex in

effort e, i.e., Ree (e, δ) ≥ 0.

In our baseline model, the agent’s incentive to recommend the least productive merger arose from the

desire to boost his own second-period incentive pay (cf. Corollary 1). Suppressing the dependency of q

and c on effort and/or merger synergies, we have

∗

dw2H

c00 q 0 − c0 q 00 de∗ (δ) c0 q 00

=

·

− 02

dδ

[q 0 ]2

dδ

[q ]

17

(25)

where

de∗ (δ)

Reδ (e∗ (δ), δ) − p00 · (πH − πL )

= 00

dδ

p · (πH − πL ) − Ree (e∗ (δ), δ) − c00

(26)

and

Reδ (e∗ (δ), δ) =

[c00 q 0 − c0 q 00 ][(q 0 )2 − 2qq 00 ] + qq 0 [c00 q 00 − c0 q 000 ]

.

[q 0 ]3

(27)

Inspection of (25) to (27) reveals that q 00 ≈ 0 and q 000 ≈ 0 (i.e., if q is sufficiently flat in the relevant

range) is a sufficient condition for Reδ (e∗ (δ), δ) > 0, which, in turn, implies de∗ (δ)/dδ < 0 such that

∗ /dδ < 0. In words, if synergies have a positive effect on the probability that the agent receives

dw2H

a high wage for successful merger management, this wage can decrease in synergies. This finding is

quite intuitive. The agent’s incentives arise from his expected wage payment for successful merger

management. If the probability of receiving the payment is already large due to high synergies, the

principal might prefer a rather low payment to reduce labor costs and, hence, the agent’s rent.

Altogether, the agent’s second-period expected utility (or rent) can be written as follows:

∗

EU2 (e∗ (δ)) = q(e∗ (δ) + δ) · w2H

(δ) − c(e∗ (δ)).

(28)

Applying the envelope theorem shows that the main effects of synergies on the agent’s rent refer to the

expected payment for successful merger management:

∗

dw2H

dEU2

∗

= q 0 (e∗ (δ) + δ) · w2H

(δ) + q(e∗ (δ) + δ) ·

.

dδ

dδ

(29)

Hence, there are two effects that work into opposite directions. The first expression in (29) is positive and

measures the increase in the agent’s success probability if he recommends a merger target with higher

synergies. The second expression in (29) measures the impact of synergies on the optimal wage for

successful merger management. As discussed in the paragraph before, this expression can be negative

so that the agent benefits from lower synergies due to an increase in his wage payment. The first effect

is absent in the model of Section 3. If the second effect dominates the first effect, we will still have the

result that an agent who has identified positive merger synergies prefers to recommend the least profitable

one in order to increase his second-period rent.

To illustrate that the second effect may indeed dominate the first effect, consider the following example. Let q(e + δ) = α · (e + δ) and p(e + δ) = β · ln(e + δ) with α, β > 0 being sufficiently small to

guarantee q, p ∈ (0, 1) in the optimum. Second-period effort costs are described by c (e) =

γ 2

2e

with

γ > 0. For this specification the agent will focus on the wage-increasing effect of low merger synergies

if γ is sufficiently large so that the optimal effort is very small anyway. In consequence, dEU2 /dδ < 0.25

According to the above discussion, if merger synergies do not only affect the success of the merged

firm but also the agent’s performance measure, there are forces at work that dampen the agent’s incentive

to report a low-synergy target if he has also identified a high-synergy one. If a CEO’s compensation is

equity based and short-term firm success is affected by actual merger synergies, then this observation

25

See Kräkel and Müller (2014) for detailed calculations regarding the specification used in the example.

18

is in line with the idea stated in Bliss and Rosen (2001) that CEOs with a greater percentage of stockbased compensation make fewer wealth-reducing mergers than CEOs with a greater percentage of cash

compensation. However, even if the CEO is compensated via stock options and the stock price reflects

merger synergies, the CEO may still have an incentive not to recommend the merger target with the

highest synergies. The crucial aspect is the timing of the stock-options program. If the program is

initiated after the decision to acquire a target, the CEO may still be interested to manipulate the conditions

of the stock-options program. The CEO might prefer to recommend a merger target with only moderate

synergies in order to obtain higher-powered incentives in terms of more stock options. Given that this

effect of a possible higher income dominates the effect of a lower success probability from only moderate

synergies, the general trade-off discussed above still exists.

5.3. Synergies and Efforts as Complements

So far, we have assumed effort and synergies to be technological substitutes with regard to the probability

of high firm profits, i.e., ∂ 2 p(e+δ)/∂e∂δ < 0. This technological substitutability turns out to be essential

for the conflict of interests between the principal and the agent to arise. To see this, suppose instead that

∂ 2 p (e, δ) /∂e∂δ > 0, i.e., effort and synergies are technological complements. From Proposition 1

we know that the agent’s second-period incentive constraint is given by w2H = c0 (e∗ ) /q 0 (e∗ ). If we

consider the agent’s effort as the principal’s choice variable, she implements e∗ (δ), which is implicitly

described by the first-order condition

(πH − πL )

∂p (e∗ (δ), δ)

− c0 (e∗ (δ)) − R0 (e∗ (δ)) = 0

∂e

(30)

∗ denote the corresponding wage. Thus,

with R(e) being defined in (6). Let w2H

∗

dw2H

c00 (e∗ (δ)) q 0 (e∗ (δ)) − c0 (e∗ (δ)) q 00 (e∗ (δ)) de∗ (δ)

=

dδ

dδ

[q 0 (e∗ (δ))]2

where

2

(31)

∗

(δ),δ)

(πH − πL ) ∂ p(e

de∗ (δ)

∂e∂δ

=−

> 0.

2

∗

dδ

(πH − πL ) ∂ p(e∂e(δ),δ)

− c00 (e∗ (δ)) − R00 (e∗ (δ))

2

(32)

Recall that in the case of effort and synergies being substitutes, the optimally implemented effort level is

decreasing in the level of merger synergies—cf. Corollary 1. In the case of complements, in contrast, the

∗ /dδ) = sign (de∗ /dδ),

optimally implemented effort level is increasing in synergies. Since sign (dw2H

the result of Corollary 1 does not hold any longer.26

5.4. Endogenous Information Gathering

Throughout the paper, we assumed that the outcome of information gathering was determined exogenously. It is conceivable, however, that the more effort the agent devotes to information gathering, the

more likely he might identify a target firm that generates positive synergies. The prospect of obtaining a

second-period rent from successfully managing a productive merger then not only determines the agent’s

26

If p (e, δ) = p(e · δ) so that effort and synergies are complements within the probability function, Corollary 1 may still hold.

An example can be requested from the authors.

19

choice of managerial effort, but also generates an incentive spillover on information gathering, which

increases the agent’s incentive to identify productive merger targets beyond the prospect of being paid

an acquisition premium. Thus, the implicit incentives created by prospective second-period rents make

first-period incentive provision comparatively easy.27 Now, remember that we assumed the agent to be

irreplaceable because of his specific knowledge regarding the target firm. If we enriched our model by

making information gathering dependent on the agent’s effort, even if the principal could replace the

original agent after the first period, it’s not clear that she actually would want to do so as she faces the

following trade-off: while doing away with the conflict of interests regarding the recommendation of

a merger target, replacing the original agent destroys implicit first-period incentives, thereby making

incentive provision in the information gathering stage more expensive.

Nevertheless, in our model one might also imagine situations where the principal prefers to disincentivize information gathering in order to reduce the scope for opportunistic recommendation behavior of

the agent. For example, suppose that the agent can spend costly effort on information gathering and that

the number of target firms he identifies in case of successful information gathering is higher when he

exerted high effort than when he spent only little effort.28 Under a laissez-faire contract observing more

potential merger targets in tendency increases the scope for the agent to opportunistically recommend

a low-synergy merger even though high-synergy targets are available. Here, deterring the agent from

exerting high effort on information acquisition may actually be to the principal’s benefit.

5.5. Empire Building and Costs of Merging

It is conceivable that the agent not only cares about his expected compensation and his effort costs but

also has a personal preference regarding the principal’s merger decision. On the one hand, the agent

might be an empire builder who derives a direct benefit from the increase in power and prestige that

accompanies the management of a larger corporation (e.g., Jensen 1986). On the other hand, the agent

might bear personal costs from merging (e.g., due to traveling between the headquarter and the newly

acquired firm).29 If the agent is an empire builder or if the personal costs from merging are sufficiently

small, the agent as before earns a positive second-period rent irrespective of the level of synergies. In

consequence, the agent’s participation constraint remains slack, he prefers merging to not merging, and

has an incentive to manipulate his second-period compensation by recommending a low-synergy target

if possible. Thus, in this case, our results remain qualitatively unchanged. If, on the other hand, personal

costs from merging are large, the principal may have to offer the agent additional compensation to make

him sign the second-period contract; i.e., the participation constraint may become binding. With the

agent’s rent being decreasing in the level of synergies, for moderately high personal costs the agent’s

participation constraint is binding only for a high-synergy target. Hence, only recommendation of a lowsynergy target yields a positive rent for the agent, which makes going against the principal’s interests all

27

The insight that second-period rents can be utilized by the principal to optimally design first-period incentives was first

emphasized by Schmitz (2005) and further elaborated by Ohlendorf and Schmitz (2012).

28

For a detailed analysis see Kräkel and Müller (2014), where at date 1.3 the agent exerts effort I ∈ {0, 1} at personal cost

C(I) = C · I where C > 0. If information gathering is successful, which is the case with probability i ∈ (0, 1), the agent

identifies only n(0) ≥ 1 target firms if he exerts little effort, I = 0, whereas he identifies n(1) > n(0) target firms if he

exerts high effort, I = 1.

29

The following discussion is based on Kräkel and Müller (2014), where the second-period utility of the agent in case of a

merger is assumed to take the form q(e)w2H + [1 − q(e)]w2L − c(e) − θ. Here, we have θ < 0 for the case of an empire

builder and θ > 0 in case of a merger leading to additional personal cost for the agent.

20

the more attractive. For very high personal costs, however, the agent’s participation constraint is binding

for both levels of synergies. Since the agent does not earn a positive rent in either situation, by the

assumed tie-breaking rule, he will always recommend a high-synergy target if possible.

If contractual provisions allow the principal to influence the agent’s personal costs from merging—

e.g., by contractually stipulating a certain frequency of traveling—she has another channel to influence

the agent’s recommendation of merger targets. As outlined above, if the imposed personal costs are so

high that the agent does not earn a positive rent under either level of synergies, he recommends the target

with the highest synergies. This rent-reduction strategy, however, leads to lower expected profits for the

principal in case of a high-synergy merger because of the binding participation constraint of the agent.

This trade-off has to be kept in mind by the principal when deciding whether to offer such a rent-reduction

contract or one of the two other contracts—the commitment-based contract and the laissez-faire contract.

6. C ONCLUSION

In this paper, we offer a rationale for why CEOs may prefer to recommend low-synergy merger targets

instead of high-synergy ones when identifying both kinds of targets at the same time. The CEO is protected by limited liability and earns a positive rent from merger management under the optimal contract.

By recommending a low-synergy target, the CEO increases the magnitude of his rent since the shareholders are forced to install a high-powered incentive plan. Frequent CEO replacement would be a solution

to this problem, because then different CEOs would be responsible for finding a merger target on the one

hand and implementing the merger on the other. This solution, however, might be prohibitively costly for

the shareholders. First, replacement of the initial CEO may lead to a loss of target-specific knowledge.

Second, future rents from merger management can be used for incentivizing a CEO, which reduces the

shareholders costs (e.g., for creating CEO incentives to find profitable merger targets). Finally, frequent

CEO replacement in general fosters myopic behavior of CEOs, which might lead to severe problems in

the long run (e.g., the CEO may only be interested to invest in projects that lead to immediate returns,

which might not be identical with the projects that maximize shareholder value).

As an alternative to such a drastic policy, we identify two possible solutions for shareholders to influence the CEO’s recommendation behavior. First, offering a large acquisition premium to the CEO

can serve as a commitment device for shareholders to accept only sufficiently productive targets. Second, if the CEO has personal merger costs that can be endogenously influenced via the CEO contract,

shareholders can benefit from sufficiently large costs so that the CEO no longer receives a positive rent.

As a consequence, the CEO is not interested in recommending poor merger targets to manipulate his

post-merger remuneration and, hence, his rent.

In our setting, low post-merger profits were allowed to become negative. Together with the finding

that CEOs prefer mergers which ex ante are less likely to succeed, this fits well to empirical cases (e.g.,

DaimlerChrysler) where merging is indeed value reducing. If we reinterpret the synergy parameter δ as

the CEO’s target-specific ability of running the merged corporation, a CEO will prefer a merger target

for which he is poorly suited at the merger-management stage, i.e., merging with a business in which he

is not an expert, to maximize his post-merger remuneration. This prediction differs from the traditional

entrenchment hypothesis mentioned in Section 2, according to which CEOs have an incentive to expand

in those industries in which they are experts in order to protect their jobs.

21

A. P ROOFS

∗ = c0 (e∗ (δ))/q 0 (e∗ (δ)), we have

Proof of Corollary 1. With w2H

∗

dw2H

c00 (e∗ (δ))q 0 (e∗ (δ)) − c0 (e∗ (δ))q 00 (e∗ (δ)) de∗ (δ)

=

·

dδ

[q 0 (e∗ (δ))]2

dδ

(A.1)

∗

∗ 0 ∗

de∗ (δ)

dw2H

∂R(e∗ (δ))

=

· q(e∗ (δ)) + w2H

q (e (δ)) − c0 (e∗ (δ)) ·

.

∂δ

dδ

|

{z

} dδ

(A.2)

and

=0

Differentiation of (7) with respect to δ reveals that

de∗ (δ)

(πH − πL )p00 (e∗ (δ) + δ)

=−

< 0,

dδ

(πH − πL )p00 (e∗ (δ) + δ) − c00 (e∗ (δ)) − R00 (e∗ (δ))

(A.3)

which completes the proof.

Proof of Proposition 2. From Proposition 1, we know that if the agent makes a recommendation with

δ > 0, then under the optimal second-period contract the principal implements effort e∗ (δ), the agent’s

participation constraint is slack and he obtains a strictly positive rent, i.e., EU2 (e∗ (δ)) = R(e∗ (δ)).

Note that for w1H ≥ w1L the agent always prefers an acquisition to occur because he obtains a

(weakly) higher wage and a second-period rent. Therefore, whenever feasible, the agent prefers making

a recommendation with δ ∈ {δL , δH } over not making a recommendation or making a useless recommendation with δ = −∞.

Anticipating the principal’s acquisition decision, the agent recommends the target that maximizes his

expected utility. Given ∆ 6= {−∞} and 0 ≤ w1L ≤ w1H , we have to distinguish three cases:

Case 1: Π2 (δH ) ≤ w1H − w1L