ACCTG 326: Intermediate Financial Accounting Fall 2013

advertisement

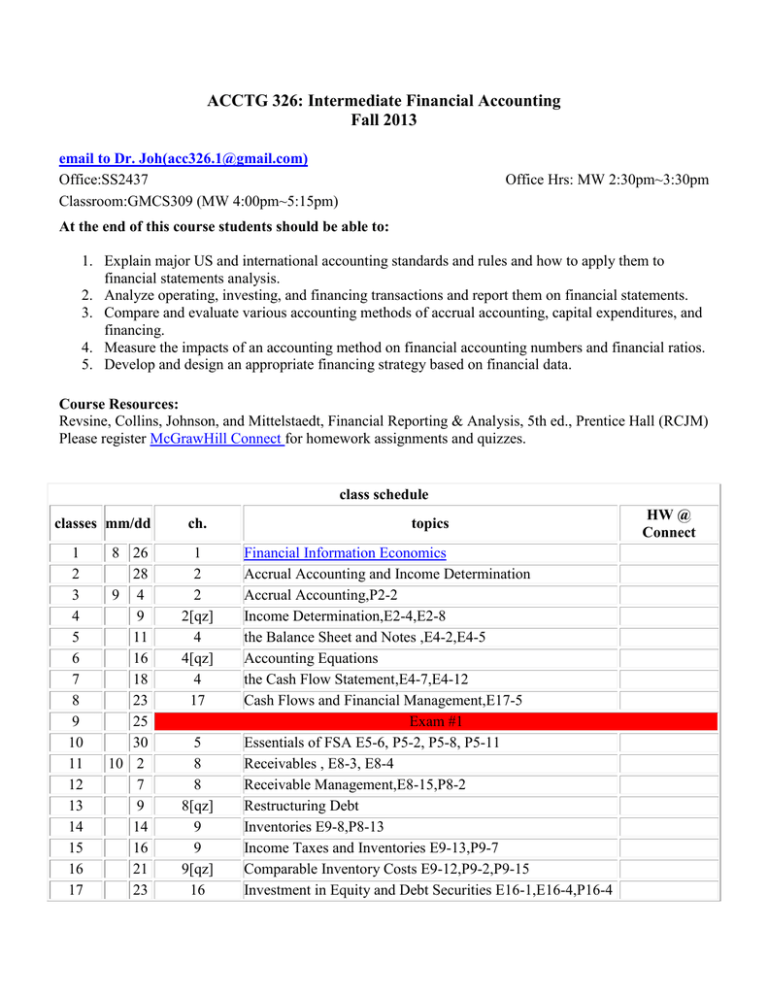

ACCTG 326: Intermediate Financial Accounting Fall 2013 email to Dr. Joh(acc326.1@gmail.com) Office:SS2437 Classroom:GMCS309 (MW 4:00pm~5:15pm) Office Hrs: MW 2:30pm~3:30pm At the end of this course students should be able to: 1. Explain major US and international accounting standards and rules and how to apply them to financial statements analysis. 2. Analyze operating, investing, and financing transactions and report them on financial statements. 3. Compare and evaluate various accounting methods of accrual accounting, capital expenditures, and financing. 4. Measure the impacts of an accounting method on financial accounting numbers and financial ratios. 5. Develop and design an appropriate financing strategy based on financial data. Course Resources: Revsine, Collins, Johnson, and Mittelstaedt, Financial Reporting & Analysis, 5th ed., Prentice Hall (RCJM) Please register McGrawHill Connect for homework assignments and quizzes. class schedule classes mm/dd 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 8 26 28 9 4 9 11 16 18 23 25 30 10 2 7 9 14 16 21 23 ch. topics 1 2 2 2[qz] 4 4[qz] 4 17 Financial Information Economics Accrual Accounting and Income Determination Accrual Accounting,P2-2 Income Determination,E2-4,E2-8 the Balance Sheet and Notes ,E4-2,E4-5 Accounting Equations the Cash Flow Statement,E4-7,E4-12 Cash Flows and Financial Management,E17-5 Exam #1 Essentials of FSA E5-6, P5-2, P5-8, P5-11 Receivables , E8-3, E8-4 Receivable Management,E8-15,P8-2 Restructuring Debt Inventories E9-8,P8-13 Income Taxes and Inventories E9-13,P9-7 Comparable Inventory Costs E9-12,P9-2,P9-15 Investment in Equity and Debt Securities E16-1,E16-4,P16-4 5 8 8 8[qz] 9 9 9[qz] 16 HW @ Connect (pp.949~961) 18 19 20 21 27 28 28 30 11 4 6 11/11 13 18 20 25 27 11/28~30 12 4 9 29 30 11 16 22 23 24 25 26 Fair Valuation 10 10 10[qz] 10 11 11 12 13 13 13 Exam #2 Long-lived Assets,E10-1,E10-11 Asset Exchanges and Repairs,E10-3,E10-6 Veteran's Day Depreciation,E10-4 Intangibles Debt Financing Bond Amortization Table,E11-5,E11-6 Lease Accounting,E12-4 Thanksgiving Income Tax Reporting Managing Taxes,E13-1,E13-15 Tax & Fin Acctg Final Exam (3:30pm~5:30pm) TBA : To be announced. [qz]: chapter review quiz. Course Policies: The pre-requisite for the course is Accounting 201 or its equivalent, with a minimum grade of C. No make-up examination will be permitted except for reasons of illness where the instructor is notified in advance of the scheduled exam and the student supplies a letter from a physician explaining the nature of the illness. I retain the right to retain any class related materials prepared by students. Each significant contribution during class discussion is rewarded by a bonus point card. A few examples of "significant contribution" are "to ask appropriate questions helping the class understand the content," "to show a better and creative approach to cases or problems." Each bonus card is worth one multiple choice question in the next exam. You may not sell or buy the card or use the bonus card to raise your score above 100%. Assignments will be collected on a random basis. Each submitted assignment must show their work. No two assignment should not look similar. Each quiz will be given on finishing each chapter. The date might be different from the dates on the schedule. On finishing each chapter, there may be a review quiz. Out of the seven scheduled quizzes, the worst two scores will be dropped. The class average for this course has typically been in the 2.3 - 2.9 range. Each letter grade is determined based on his/her rank of all Acctg326 sections. The top 15% will receive an A or A-; 20% either a B+/B/B-; 60% a C+/C/C-; and 5% a D+ or below D+. Incompletes will be given only in the RAREST of circumstances and according to university policy. There will be no opportunity to raise your course grade by doing "extra credit" work during or after the end of the semester-that would violate University policy. Course Assessment: Assignments Exam 1* Maximum Possible Points 100 Weights 20% 100 30% 100 30% Quizzes( either @Connect or In-class) 100 10% Homework Assignments 100 10% 500 100% Exam 2* Final Exam * Total * Each test is non-cumulative. Office Hours I encourage each of you to take advantage of my regularly scheduled office hours to discuss problems and to seek assistance when needed throughout the semester. I would like to talk to each of you at least once. If you cannot make it to my regularly-scheduled office hours, feel free to schedule an individual appointment with me. It is my job to help you learn and succeed in this class, and I will help whenever possible. In an effort to make the class successful for all students, please provide me feedback on how the course is going and how you feel you are doing in the course. I can make this class more successful if I hear from you about what you do and do not understand. I welcome your feedback during office hours and via e-mail. Grading questions or appeals DO NOT WAIT UNTIL THE END OF THE SEMESTER TO TAKE ACTION ON GRADING ISSUES. BY THAT TIME IT WILL BE TOO LATE! If you feel there exists a grading error on any of the above grade components, or if you feel you need to bring to my attention other facts or circumstances that might affect the grade for that item, you will have one week from the date the grade is posted on Blackboard or the graded item is redistributed back to the class (whichever is earlier) to take such action and have the matter resolved. If for whatever reason you are not in class on the day the graded item is available for pickup, the one-week period will still begin on that day. Dishonesty Policy: Cheating on any exam or class assignments will result in a zero for that activity. A definition of "cheating" is found in the SDSU Student Policies Manual, Section 01:10:01 on cheating, plagiarism and facilitating academic dishonesty. Executive Order 969 mandates that faculty report all incidents of academic dishonesty to the Center for Student Rights and Responsibilities. http://csrr.sdsu.edu. Fulfillment of assigned projects must represent the original work of each student. Plagiarism is not appropriate.