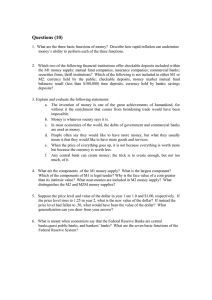

Chapter 4 Financial Intermediaries 1

advertisement

Chapter 4 Financial Intermediaries 1 The Direct Transfer A.New Securities 1.Sale facilitated by investment bankers 2.Funds are directly transferred from savers to firms Savers have claims (debt or equity) on issuer. Issuer receives the money. 2 The Indirect Transfer through a Financial Intermediary B. Financial Intermediary 1.Savers deposit funds in a bank, that individual receives a claim on the bank (the account) and not on the firm to whom the bank lends the funds 2.If the intermediary makes a bad loan, the saver does not sustain the loss unless the financial intermediary fails 3 The Indirect Transfer through a Financial Intermediary Savers have claims on the financial intermediary. Financial intermediaries have claims on ultimate user of the funds. Each financial intermediary creates claims on itself and transfers funds from savers to: – Firms – Governments – People who need funds 4 Variety of Financial Intermediaries C. Types of Intermediaries – Commercial Banks – Thrift Institutions • Savings and Loan Associations • Mutual Savings Banks • Credit Unions – Life Insurance Companies – Pension plans – Money market mutual funds 5 Financial Intermediaries Regulation D. Depository Institutions Deregulation and Monetary Control Act of 1980 1.All depository institutions are subject to regulation by the Federal Reserve 2.Gave managements of various financial institutions more flexible to vary their loan portfolios 3.Depository institutions are able to borrow funds from the Federal Reserve 6 Commercial Banks Assets and liabilities – Importance of loans – Importance of deposit liabilities – Small equity base 7 Commercial Banks A. Commercial Banks are the most important depository institution B. Primary assets are consumer loans 1. Stress that loans must be paid off quickly 2. Because of rapid bank deposit turnover C. Primary liabilities are deposits 1. Checking accounts (demand deposits) 2. Savings accounts 3. Time deposits 8 Variety of Deposits D. Demand Deposits are payable on demand 1. The owner of a checking account/savings account can demand immediate cash E. Certificates of Deposit (CD) 1. Time Deposits 2. Fixed Term a) May redeem earlier but will pay penalty 3. Bank established the terms (interest rate and time) 4. Terms offered by one bank are similar to other banks a) Call and find the best rate and time 9 Variety of Deposits F. Negotiable CD 1. Certificate of deposit issued in amounts of $100,000 or more whose terms are individually negotiated between the bank and the saver 10 Variety of Deposits F. Negotiable CD 1. Certificate of deposit issued in amounts of $100,000 or more whose terms are individually negotiated between the bank and the saver 11 Thrift Institutions A. Place for savers B. The money that is in savings accounts is loaned by the thrift to borrowers in need of funds C. Two Types 1. Mutual Savings Bank a) Owned by its depositors b) Bank is managed by board of directors 2. Savings and Loan Association a) Primarily a source of mortgage loans b) Has evolved into a thrift institution that accepts deposits from anyone and makes a variety of loans c) Slightly higher interest rates 12 Regulation of Depository Institutions A. Government Regulation 1. Protect the banks creditors a) Depositors B. Federal Deposit Insurance Corporation (FDIC) 1. $250,000 per person (social security number) 2. All commercial banks that are part of the Federal Reserve System must purchase this insurance 3.Adds stability to the banking system. 13 Regulation of Depository Institutions Reserves C. Required Reserves 1. Commercial banks and other depository institutions must keep funds in reserve against their deposit liabilities D. Determined by the Federal Reserve E. Controls money supply F. Commercial banks and holding reserves: 1. Cash in the vault 2. Deposits with another bank 14 Regulation of Depository Institutions Reserves E. Excess Reserves 1. Reserves held by a bank in excess of those it must hold to meet its reserve requirement 2. Excess may be loaned out 3. No excess-“Fully Loaned Up” F. Correspondent Bank 1. Major bank with which a smaller bank has a relationship to facilitate check clearing and to serve as a depository for reserves G. Secondary Reserves 1. Short-term securities held by banks to increase liquidity a) Treasury Bills 15 Regulation of Depository Institutions Deposit Insurance H. Federal government deposit insurance resulted from the Great Depression of the 1930’s. I. Federal Deposit Insurance Corporation (FDIC) 1. 2. 3. 4. Increased the public’s confidence in the banking system. Protect the banks creditors (Depositors) Insures deposits up to $250,000 per person (SS #). Has powers of bank examination. J. All commercial banks that are members of the Federal Reserve System must purchase insurance from FDIC K. Many state banking authorities also require that FDIC insurance be carried 16 Life Insurance Companies A. Insure an individual from death B. Long Term C. Life insurance or life assurance is a contract between the policy owner and the insurer, where the insurer agrees to pay a sum of money upon the occurrence of the insured individual's or individuals' death or other event, such as terminal illness or critical illness. In return, the policy owner agrees to pay a stipulated amount called a premium at regular intervals or in lump sums. There may be designs in some countries where bills and death expenses plus catering for after funeral expenses should be included in Policy Premium. 17 Pension Plans A. Accumulate assets for workers so they will have funds for retirement B. Funds are periodically put into the pension plan by the saver, employer, or both C. Used to purchase income-earning assets D. In general, a pension is an arrangement to provide people with an income when they are no longer earning a regular income from employment. It is a tax deferred savings vehicle that allows for the tax-free accumulation of a fund for later use as a retirement income. Pensions should not be confused with severance packages; the former is paid in regular installments, while the latter is paid in one lump sum. 18 Money Market Mutual Funds Specialized investment company Makes only short-term investments Acquires money market instruments Shares in money funds have become popular investments 19 Money Market Mutual Funds A. Invests on the behalf of individuals B. Is a mutual fund a financial intermediary? 1. Yes, if the fund transfers the invested money to a firm, government, or individual seeking to borrow funds 2. No, if the fund buys securities on the secondary market. The money is transferred to another investor who is seeking to liquidate a position in the particular security 3. Most mutual funds do not serve as a financial intermediary because they buy existing securities 20 Money Market Mutual Funds C. Money Market Mutual Fund 1. Investment Company that invests solely in newly issued short-term money market instruments 2. Held until maturity, at which time the process is repeated 3. Why are Money Market Mutual Funds Popular? a) Safety of principal (1) Short-term (2) Minimal price fluctuations (3)Minimal risk of default because of high credit ratings b) Liquidity (1) Individuals may withdrawal money at will c) High interest rates (1) Fund offers competitive short-term yields (2) Mostly higher than commercial banks 21 Money Market Instruments 4. Money Funds Invest in a Variety of Short-Term Securities a) Negotiable CD b) US Treasury Bill (T-Bill) (1) Short-term debt instrument issued by the federal government (2) Maturity of less than one year c) Commercial Paper (1) Unsecured short-term promissory notes issued by the most creditworthy corporations 22 Money Market Instruments a) Repurchase Agreement (Repo) (1) Sales of a short-term security in which the seller agrees to buy back the security at a specified price b) Banker’s Acceptance (1) Short-term promissory note guaranteed by a bank c) Tax Anticipation Notes (1) Short-term government security secured by expected tax revenues d) Eurodollar CD (1) Issued by either branches of domestic banks located abroad or by foreign banks (2) Denominated in US Dollars 23 Money Market Instruments 5. Money Funds usually invest in a wide variety of investments, some of the funds do specialize a) Government securities 24 Competition of Funds A. A commercial bank or any financial intermediary can lend only what has been lent to it B. No one can make investment without a source of funds C. A transfer of funds from one intermediary to another can have an important impact on the supply of credit available to a particular sector of the economy D. Although the total supply of credit is unaffected, there will be a redistribution of credit E. Financial intermediaries compete with each other for funds 25