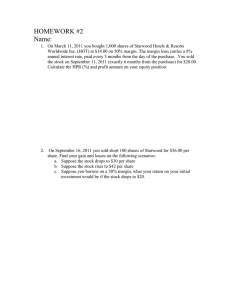

NAME ______________________________ HONORS FINANCE AND INVESTMENTS Chapter 3 Problems

advertisement

NAME ______________________________ HONORS FINANCE AND INVESTMENTS Chapter 3 Problems Pgs. 49 – 50 1. You purchase 100 shares for $50 a share ($5,000), and after a year the price rises to $60. What will be the percentage return on your investment if you bought the stock on margin and the margin requirement was (a) 25 percent, (b) 50 percent, and (c) 75 percent? (Ignore commissions, dividends, and interest expense.) 2. Repeat Problem 1 to determine the percentage return on your investment but in this case suppose the price of the stock falls to $40 per share. What generalization can be inferred from your answers to Problems 1 and 2? 3. A stock is currently selling for $45 a share. What is the gain or loss on the following transactions? a. You take a long position and the stock’s price declines to $41.50. b. You sell the stock short and the price declines to $41.50. c. You take a long position and the price rises to $54. d. You sell the stock short and the price rises to $54. 4. A sophisticated investor, B. Graham, sold 500 shares short of Amwell, Inc. at $42 a share. The price of the stock subsequently fell to $38 before rising to $49 at which time graham covered the position (that is, closed the short position). What was the percentage gain or loss on this investment? 5. A year ago, Kim Altman purchased 200 shares of BLK, Inc. for $25.50 on margin. At that time the margin requirement was 40 percent. IF the interest rate on borrowed funds was 9 percent and she sold the stock for $34, what is the percentage return on the funds she invested in the stock? 6. Barbara buys 100 shares of DEM at $35 a share and 200 shares of GOP at $40 a share. She buys on margin and the broker charges interest of 10 percent on the loan. a. If the margin requirement is 55 percent, what is the maximum amount she can borrow? b. If she buys the stocks using the borrowed money and holds the securities for a year, how much interest must she pay? c. If after a year she sells DEM for $29 a share and GOP for $32 a share, how much did she lose on her investment? d. What is the percentage loss on the funds she invested if the interest payment is included in the calculation? 7. After an analysis of Lion/Bear, Inc., Karl O’Grady has concluded that the firm will face financial difficulty within a year. The stock is currently selling for $5 and O’Grady wants to sell it short. His broker is willing to execute the transaction but only if O’Grady puts up cash as collateral equal to the amount of the short sale. If O’Grady does sell the stock short, what is the percentage return he loses if the price of the stock rises to $7? What would be the percentage return if the firm went bankrupt and folded? 8. Lisa Lasher buys 400 shares of stock on margin at $18 per share. If the margin requirement is 50 percent, how much must the stock rise for her to realize a 25 percent return on her invested funds? (Ignore dividends, commissions, and interest on borrowed funds.)