Engineering Economics Fundamentals: EIT/FE Review Hugh Miller Colorado School of Mines

advertisement

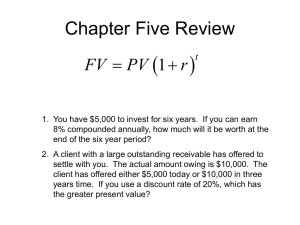

Engineering Economics Fundamentals: EIT/FE Review Hugh Miller Colorado School of Mines Mining Engineering Department Fall 2013 Basics Notation Never use scientific notation Significant Digits Maximum of 4 significant figures unless the first digit is a “1”, in which case a maximum of 5 sig figs can be used In general, omit cents (fractions of a dollar) Year-End Convention Unless otherwise indicated, it is assumed that all receipts and disbursements take place at the end of the year in which they occur. Numerous Methodologies for Solving Problems Use the method most easy for you (visualize problem setup) Concept of Interest If you won the lotto, would you rather get $1 Million now or $50,000 for 25 years? What about automobile and home financing? What type of financing makes more economic sense for your particular situation? Interest: Money paid for the use of borrowed money. Put simply, interest is the rental charge for using an asset over some period of time and then, returning the asset in the same conditions as we received it. → In project financing, the asset is usually money Why Interest exist? Taking the lender’s view of point: Risk: Possibility that the borrower will be unable to pay Inflation: Money repaid in the future will “value” less Transaction Cost: Expenses incurred in preparing the loan agreement Opportunity Cost: Committing limited funds, a lender will be unable to take advantage of other opportunities. Postponement of Use: Lending money, postpones the ability of the lender to use or purchase goods. From the borrower’s perspective …. Interest represents a cost ! Simple Interest Simple Interest is also known as the Nominal Rate of Interest Annualized percentage of the amount borrowed (principal) which is paid for the use of the money for some period of time. Suppose you invested $1,000 for one year at 6% simple rate; at the end of one year the investment would yield: $1,000 + $1,000(0.06) = $1,060 This means that each year interest gives $60 How much will you earn (including principal) after 3 years? $1,000 + $1,000(0.06) + $1,000(0.06) + $1,000(0.06) = $1,180 Note that for each year, the interest earned is only calculated over $1,000. Does this mean that you could draw the $60 earned at the end of each year? Terms In most situations, the percentage is not paid at the end of the period, where the interest earned is instead added to the original amount (principal). In this case, interest earned from previous periods is part of the basis for calculating the new interest payment. This “adding up” defines the concept of Compounded Interest Now assume you invested $1,000 for two years at 6% compounded annually; At the end of one year the investment would yield: $1,000 + $1,000 ( 0.06 ) = $1,060 or $1,000 ( 1 + 0.06 ) Since interest is compounded annually, at the end of the second year the investment would be worth: [ $1,000 ( 1 + 0.06 ) ] + [ $1,000 ( 1 + 0.06 ) ( 0.06 ) ] = $1,124 Principal and Interest for First Year Interest for Second Year Factorizing: $1,000 ( 1 + 0.06 ) ( 1 + 0.06 ) = $1,000 ( 1 + 0.06 )2 = $1,124 How much this investment would yield at the end of year 3? Solving Interest Problems Step #1: Abstracting the Problem Interest problems based upon 5 variables: P, F, A, i, and n Determine which are given (normally three) and what needs to be solved Solving Interest Problems Step #2: Draw a Cash Flow Diagram F Receipts A2 A3 A4 A5 A6 Cash Flow + A1 - Time P Disbursements Interest Formulas The compound interest relationship may generally be expressed as: F = P (1+r)n Where (1) F = Future sum of money P = Present sum of money r = Nominal rate of interest n = Number of interest periods Other variables to be introduced later: A = Series of n equal payments made at the end of each period i = Effective interest rate per period Notation: (F/P,i,n) means “Find F, given P, at a rate i for n periods” This notation is often shortened to F/P Interest Formulas r = Nominal rate of interest i = Effective interest rate per period Nominal Interest is the annualized percentage of amount borrowed. Nominal annual interest rate of 12% based upon monthly compounding means 1% interest rate per month compounded When the compounding frequency is annually: r = i When compounding is performed more than once per year, the effective rate (true annual rate) always exceeds the nominal annual rate: i > r Future Value Example: Find the amount which will accrue at the end of Year 6 if $1,500 is invested now at 6% compounded annually. Method #1: Direct Calculation (F/P,i,n) F = P (1+r)n Given n= P= i= Find F Future Value Example: Find the amount which will accrue at the end of Year 6 if $1,500 is invested now at 6% compounded annually. Method #1: Direct Calculation (F/P,i,n) F = P (1+r)n Given n = P = r = Find F 6 years $ 1,500 6.0 % F = (1,500)(1+0.06)6 F = $ 2,128 Future Value Example: Find the amount which will accrue at the end of Year 6 if $1,500 is invested now at 6% compounded annually. Method #2: Tables The value of (1+i)n = (F/P,i,n) has been tabulated for various i and n. From the handout, use the table with interest rate of 6% to find the appropriate factor. The first step is to layout the problem as follows: F = P (F/P,i,n) F = 1500 (F/P, 6%, 6) F = 1500 ( )= Future Value Example: Find the amount which will accrue at the end of Year 6 if $1,500 is invested now at 6% compounded annually. Method #2: Tables The value of (1+i)n = (F/P,i,n) has been tabulated for various i and n. Obtain the F/P Factor, then calculate F: F = P (F/P,i,n) F = 1500 (F/P, 6%, 6) F = 1500 (1.4185) = $2,128 Present Value If you want to find the amount needed at present in order to accrue a certain amount in the future, we just solve Equation 1 for P and get: P = F / (1+r)n (2) Example: If you will need $25,000 to buy a new truck in 3 years, how much should you invest now at an interest rate of 10% compounded annually? (P/F,i,n) Given F = n = i = Find P Present Value If you want to find the amount needed at present in order to accrue a certain amount in the future, we just solve Equation 1 for P and get: P = F / (1+r)n (2) Example: If you will need $25,000 to buy a new truck in 3 years, how much should you invest now at an interest rate of 10% compounded annually? Given F = n = i = Find P $25,000 3 years 10.0% P = F / (1+r)n P = (25,000) /(1 + 0.10)3 = $18,783 Present Value If you want to find the amount needed at present in order to accrue a certain amount in the future, we just solve Equation 1 for P and get: P = F / (1+r)n (2) Example: If you will need $25,000 to buy a new truck in 3 years, how much should you invest now at an interest rate of 10% compounded annually? What is the factor to be used? ____________ Solve: Present Value If you want to find the amount needed at present in order to accrue a certain amount in the future, we just solve Equation 1 for P and get: P = F / (1+r)n (2) Example: If you will need $25,000 to buy a new truck in 3 years, how much should you invest now at an interest rate of 10% compounded annually? What is the factor to be used? 0.7513 P = F(P/F,i,n) = (25,000)(0.7513) = $ 18,782 Present Value Example: If you will need $25,000 to buy a new truck in 3 years, how much should you invest now at an interest rate of 9.5% compounded annually? Method #1: Direct Calculation: Straight forward - Plug and Crank Method #2: Tables: Interpolation Which table in the appendix will be used? Tables i = 9% & 10% What is the factor to be used? A13 (9%): 0.7722 A14 (10%): 0.7513 Assume 9.5%: 0.7618 P = F(P/F,i,n) = (25,000)(0.7618) = $ 19,044 Engineering Economics EIT Review Uniform Series & Effective Interest Annuities Uniform series are known as equal annual payments made to an interest bearing account for a specified number of periods to obtain a future amount. F A2 A3 A4 A5 A6 Cash Flow + A1 - Time P Annuities Formula The future value (F) of a series of payments (A) made during (n) periods to an account that yields (i) interest: F = A [ (1+i)n – 1 ] i (5) Where F = Future sum of money n = number of interest periods A = Series of n equal payments made at the end of each period i = Effective interest rate per period Derivation of this formula can be found in most engineering economics texts & study guides Applications? Notation: (F/A,i,n) or if using tables F = A (F/A,i,n) Example: What is the future value of a series payments of $10,000 each, for 5 years, if deposited into a savings account yielding 6% nominal interest compounded yearly? Visualize the Cash Flow Diagram – then Select the Equation F = A [ (1+i)n – 1 ] = i Check with Factor Values: F = A (F/A,i,n) Example: What is the future value of a series payments of $10,000 each, for 5 years, if deposited in a savings account yielding 6% nominal interest compounded yearly? Draw the cash flow diagram. F = A [ (1+i)n – 1 ] = 10,000 [ (1+0.06)5 – 1 ] = 10,000 [ 1.3382 – 1 ] i 0.06 0.06 = $ 56,370 Checking with Factor Values: F = A (F/A,i,n) = 10,000 (F/A, 6%, 5) = 10,000 ( 5.6371 ) = $ 56,370 Sinking Fund We can also get the corresponding value of an annuity (A) during (n) periods to an account that yields (i) interest to be able to get the future value (F) : Solving for A: A = i F / [ (1+i)n – 1 ] (6) Notation: A = F (A/F,i,n) Applications? Example: How much money would you have to save annually in order to buy a car in 4 years which has a projected value of $18,000? The savings account offers 4.0% yearly interest. A= Sinking Fund Example: How much money do we have to save annually to buy a car 4 years from now that has an estimated cost of $18,000? The savings account offers 4.0 % yearly interest. A = i F / [ (1+i)n – 1 ] A = (0.04 x 18,000) / [ (1.04)4 -1 ] = 720 / 0.170 = $4,239 A = F (A/F,i,n) A = (18,000)(A/F,4.0,4) = (18,000)(0.2355) = $4,239 Present Worth of an Uniform Series Sometimes it is required to estimate the present value (P) of a series of equal payments (A) during (n) periods considering an interest rate (i) From Eq. 1 and 5 P = A [ (1+i)n – 1 ] i (1+i)n (7) Notation: P = A (P/A,i,n) Applications? Example: What is the present value of a series of royalty payments of $50,000 each for 8 years if nominal interest is 8%? P= Present Worth of an Uniform Series Example: What is the present value of a series of royalty payments of $50,000 each for 8 years if nominal interest is 8%? P = A [ (1+i)n – 1 ] = 50,000 [ (1+0.08)8 – 1 ] = 50,000 [ 1.8509 – 1 ] i (1+i)n 0.08 (1.08)8 0.1481 = $ 287,300 P = A (P/A,i,n) = (50,000)(P/A,8,8) = (50,000)(5.7466) = $ 287,300 Uniform Series Capital Recovery This is the corresponding scenario where it is required to estimate the value of a series of equal payments (A) that will be received in the future during (n) periods considering an interest rate (i) and are equivalent to the present value of an investment (P) Solving Eq. 7 for A A = i P (1+i)n (1+i)n -1 (8) Notation: A = P (A/P,i,n) Example: If an investment opportunity is offered today for $5 Million, how much must it yield at the end of every year for 10 years to justify the investment if we want to get a 12% interest? A= Uniform Series Capital Recovery Example: If an investment opportunity is offered today for $5 Million, how much must it yield at the end of every year for 10 years to justify the investment if we want to get a 12% interest? A = i P (1+i)n (1+i)n -1 = 0.12 x 5 (1+0.12)10 = (1.12)10 - 1 = 0.8849 Million 0.6 [ 3.1058 ] 2.1058 $ 884,900 per year Engineering Economics EIT Review Varying Compounding Periods Effective Interest Solving Interest Problems Example: An investment opportunity is available which will yield $1000 per year for the next three years and $600 per year for the following two years. If the interest is 12% and the investment has no terminal salvage value, what is the present value of the investment? What is Step #1? Solving Interest Problems Example: An investment opportunity is available which will yield $1000 per year for the next three years and $600 per year for the following two years. If the interest is 12% and the investment has no terminal salvage value, what is the present value of the investment? Step #1 What are we trying to solve? P What are the known variables? A, i, n Solving Interest Problems Step #2: Draw a Cash Flow Diagram PV (?) Receipts A1 A2 A3 A4 A1 + A2 + A3 = $1000 A4 + A5 = $600 A5 Time Solving Interest Problems Step #2: Draw a Cash Flow Diagram – Method #1 P = A1 (P/A1, i, n1) + A2 (P/A2, i, n2) = ($600)(P/A1, 12, 5) + ($400)(P/A2, 12, 3) = $3,124 A1 A2 A3 A4 A 5 A1 A2 A3 Time A1 = A2 = A3 = A4 = A5 = $600 + Time A1 = A2 = A3 = $400 Solving Interest Problems Step #2: Draw a Cash Flow Diagram – Method #2 P = A1 (P/A1, i, n1) + A2 (P/A2, i, n2)(P/F, i, n3) = ($1000)(P/A1, 12, 3) + ($600)(P/A2, 12, 2)(P/F, 12, 3) = $3,124 A1 A2 A3 P A4 A5 Time A1 = A2 = A3 = $1000 + Time A4 = A5 = $600 Solving Interest Problems Step #2: Method #3 – Individual Cash Flow Contributions PV (?) Receipts A1 A2 A3 A4 A5 Time Treat A1 , A2 , A3 , A4 , A5 separately (P/F) and then add. Varying Payment and Compounding Intervals Thus far, problems involving time value of money have assumed annual payments and interest compounding periods In most financial transactions and investments, interest compounding and/or revenue/costs occur at frequencies other than once a year (annually) An infinite spectrum of possibilities Sometimes called discrete, periodic compounding In reality, the economics of project feasibility are simply complex annuity problems with multiple receipts & disbursements Compounding Frequency Compounding can be performed at any interval (common: quarterly, monthly, daily) When this occurs, there is a difference between nominal and effective annual interest rates This is determined by: i = (1 + r/x)x – 1 where: i = effective annual interest rate r = nominal annual interest rate x = number of compounding periods per year Compounding Frequency Example: If a student borrows $1,000 from a finance company which charges interest at a compound rate of 2% per month: What is the nominal interest rate: r = (2%/month) x (12 months) = 24% annually What is the effective annual interest rate: i = (1 + r/x)x – 1 i = (1 + .24/12)12 – 1 = 0.268 (26.8%) Nominal and Effective Annual Rates of Interest The effective interest rate is the rate compounded once a year which is equivalent to the nominal interest rate compounded x times a year The effective interest rate is always greater than or equal to the nominal interest rate The greater the frequency of compounding the greater the difference between effective and nominal rates. But it has a limit Continuous Compounding. Frequency Annual Semiannual Quarterly Monthly Weekly Daily Continuously Periods/year 1 2 4 12 52 365 ∞ Nominal Rate Effective Rate 12% 12% 12% 12% 12% 12% 12% 12.00% 12.36% 12.55% 12.68% 12.73% 12.75% 12.75% Compounding Frequency It is also important to be able to calculate the effective interest rate (i) for the actual interest periods to be used. The effective interest rate can be obtained by dividing the nominal interest rate by the number of interest payments per year (m) i = (r/m) where: i = effective interest rate for the period r = nominal annual interest rate When Interest Periods Coincide with Payment Periods When this occurs, it is possible to directly use the equations and tables from previous discussions (annual compounding) Provided that: (1) the interest rate (i) is the effective rate for the period (2) the number of years (n) must be replaced by the total number of interest periods (mn), where m equals the number of interest periods per year When Interest Periods Coincide with Payment Periods Example: An engineer plans to borrow $3,000 from his company credit union, to be repaid in 24 equal monthly installments. The credit union charges interest at the rate of 1% per month on the unpaid balance. How much money must the engineer repay each month? A = P (A/P, i, mn) = i P (1+i)n (1+i)n -1 A = ($3000) (A/P, 1%, 24) = $141.20 When Interest Periods Coincide with Payment Periods Example: An engineer wishes to purchase an $80,000 lakeside lot (real estate) by making a down payment of $20,000 and borrowing the remaining $60,000, which he will repay on a monthly basis over the next 30 years. If the bank charges interest at the rate of 9½% per year, compounded monthly, how much money must the engineer repay each month? i = (r/m) = (0.095/12) = 0.00792 (0.79%) A = P (A/P, i, mn) = i P (1+i)n (1+i)n -1 A = ($60000) (A/P, 0.79%, 360) = $504.50 Total amount repaid to the bank? When Interest Periods are Smaller than Payment Periods When this occurs, the interest may be compounded several times between payments. One widely used approach to this type of problem is to determine the effective interest rate for the given interest period, and then treat each payment separately. When Interest Periods are Smaller than Payment Periods Example: Approach #1 An engineer deposits $1,000 in a savings account at the end of each year. If the bank pays interest at the rate of 6% per year, compounded quarterly, how much money will have accumulated in the account after 5 years? Effective Interest Rate: i = (6%/4) = 1.5% per quarter F = P (F/P,i,mn) F = $1000(F/P,1.5%,16) + $1000(F/P,1.5%,12) + $1000(F/P,1.5%,8) + $1000(F/P,1.5%,4) + $1000(F/P,1.5%,0) Using formulas or tables: F = $5,652 When Interest Periods are Smaller than Payment Periods Another approach, often more convenient, is to calculate an effective interest rate for the given payment period, and then proceed as though the interest periods and the payment periods coincide. i = (1 + r/x)x – 1 When Interest Periods are Smaller than Payment Periods Example: Approach #2 An engineer deposits $1,000 in a savings account at the end of each year. If the bank pays interest at the rate of 6% per year, compounded quarterly, how much money will have accumulated in the account after 5 years? i = (1 + r/x)x – 1 = (1 + 0.06/4)4 – 1 = 0.06136 (6.136%) F = $1,000 (F/A,6.136%,5) Using formula: F = $5,652 When Interest Periods are Larger than Payment Periods When this occurs, some payments may not have been deposited for an entire interest period. Such payments do not earn any interest during that period. Interest is only earned by those payments that have been deposited or invested for the entire interest period. Situations of this type can be treated in the following manner: Consider all deposits that were made during the interest period to have been made at the end of the interest period (i.e., no interest earned during the period) Consider all withdrawals that were made during the interest period to have been made at the beginning of the interest period (i.e., earning no interest) Then proceed as though the interest periods and the payment periods coincide. When Interest Periods are Larger than Payment Periods Example: A person has $4,000 in a savings account at the beginning of a calendar year; the bank pays interest at 6% per year, compounded quarterly. Given the transactions presented in the following table (next slide), find the account balance at the end of the calendar year. Effective Interest Rate (i) = 6%/4 = 1.5% per quarter Quarter #1: Quarter #2: Quarter #3: Quarter #4: Jan. 1 – March 31 April 1 – June 30 July 1 – Sept. 30 Oct. 1 – Dec. 31 When Interest Periods are Larger than Payment Periods Example: Date Jan. 10 Feb. 20 Apr. 12 May 5 May 13 May 24 June 21 Aug. 10 Sept. 12 Nov. 27 Dec. 17 Dec. 29 Deposit Withdrawal $175 $1,200 $1,800 $65 $115 $50 $250 $1,600 $800 $350 $2,300 $750 Effective Date Jan. 1st (beginning 1st Q) Mar. 31th (end of 1st Q) April 1st (beginning 2nd Q) June 30 (end of 2nd Q) June 30 (end of 2nd Q) April 1st (beginning 2nd Q) April 1st (beginning 2nd Q) Sept. 30 (end of 3rd Q) July 1st (beginning 3rd Q) Oct. 1 (beginning 4th Q) Dec. 31 (end of 4th Q) Oct. 1 (beginning 4th Q) When Interest Periods are Larger than Payment Periods Example: A person has $4,000 in a savings account at the beginning of a calendar year; the bank pays interest at 6% per year, compounded quarterly. Given the transactions presented in the following table (next slide), find the account balance at the end of the calendar year. F = ($4000-$175)(F/P,1.5%,4) + ($1200-$2100)(F/P,1.5%,3) + ($180-$800)(F/P,1.5%,2) + ($1600-$1100)(F/P,1.5%,1) + $2300 Using formula: F = $5,287 Continuous Compounding Continuous Compounding can be thought of as a limiting case example, where the nominal annual interest rate is held constant at r, the number of interest periods becomes infinite, and the length of each interest period becomes infinitesimally small. The effective annual interest rate in continuous compounding is expressed by the following equation: i = limm→∞[(1 + r/m)m – 1] = er - 1 Continuous Compounding Example: An investment institution is selling long-term savings certificates that pay interest at the rate of 7 ½% per year, compounded continuously. What is the actual annual yield of these certificates? i = er – 1 = e0.075 – 1 = 0.0779 (7.79%) Continuous Compounding Discrete payments: If interest is compounded continuously but payments are made annually, the following equations can be used: F/P = ern A/P = (er – 1) / (1 – e-rn) P/F = e-rn P/A = (1 – e-rn) / (er – 1) F/A =(ern – 1) / (er – 1) A/F =(er – 1) / (ern – 1) Where: n = the number of years r = nominal annual interest rate Continuous Compounding (Discrete payments) Example: A savings bank offers long-term savings certificates at 7 ½% per year, compounded continuously. If a 10-year certificate costs $1,000, what will be its value upon maturity? F = P x (F/P,r,n) = P x ern F = ($1,000) x e(0.075)(10) = $2,117 Continuous Compounding (Discrete payments) If interest is compounded continuously but payments are made (x) times per year, the previous formulas remain valid as long as r is replaced by r/x and with n being replaced by nx. Example: A person borrows $5,000 for 3 years, to be repaid in 36 equal monthly installments. The interest rate is 10% per year, compounded continuously. How much must be repaid at the end of each month? (A/P,r/x,nx) (A/P,10/12,36) A = (P) [(er – 1) / (1 – e-rn)] = ($5,000) [(e0.10/12 – 1) / (1 – e-(0.10/12)(12x3))] = $161.40 Gradient Series Thus far, most of the course discussion has focused on uniformseries problems A great many investment problems in the real world involve the analysis of unequal cash flow series and can not be solved with the annuity formulas previously introduced As such, independent and variable cash flows can only be analyzed through the repetitive application of single payment equations Mathematical solutions have been developed, however, for two special types of unequal cash flows: Uniform Gradient Series Geometric Gradient Series Uniform Gradient Series A Uniform Gradient Series (G) exists when cash flows either increase or decrease by a fixed amount in successive periods. In such cases, the annual cash flow consists of two components: (1) a constant amount (A1) equal to the cash flow in the first period (2) a variable amount (A2) equal to (n-1)G As such: AT = (A1) + (A2) A2 = G [(1/i) – (n/i)(A/F,i,n)] where: [(1/i) – (n/i)(A/F,i,n)] is called the uniform gradient factor and is written as (A/G,i,n) Therefore: AT = (A1) + G(A/G,i,n)) Uniform Gradient Series Example: An engineer is planning on buying a boat with anticipated life of15 years. In order to offset the anticipated effects of inflation on maintenance and increases in moorage fees and taxes, he intends to withdraw $5,000 at the end of the first year, and to increase the withdrawal by $1,000 at the end of each successive year. How much money must the engineer have in this account before he buys the boat, if the money earns 6% per year, compounded annually? $19000 Want to Find: P Given: A1, G, i, and n $18000 $8000 $7000 $6000 $5000 T=0 1 P 2 3 4 14 15 Uniform Gradient Series Example: AT = (A1) + G(A/G,i,n) A2 = G(A/G,i,n) = $1000 (A/G,6%,15) = $1000 (5.926) = $5926 AT = $5000 + $5926 = $10,926 P = AT (P/A,i,n) = $10,926 (P/A,6%,15) = $10,926 (9.7123) = $106,120 Geometric Gradient Series Since receipts and expenditures rarely increase or decrease every period by a fixed amount, Uniform Gradient Series (G) problems have limited applicability With Geometric Gradients, the increase or decrease in cash flows between periods is not a constant amount but a constant percentage of the cash flow in the preceding period. Like Uniform Gradients, Geometric Gradients limited applicability but are sometimes used to account for inflationary cost increases AK = A (1 + j)K-1 Where: j equals the percent change in the cash flow between periods A is the cash flow in the initial period AK is the cash flow in any subsequent period Geometric Gradient Series Present Value of the series equals: n P = A (1 + j)-1 ∑ [(1 + j)/(1 + i)]-K K=1 For i = j: P = (n x A ) / (1 + i) For i ≠ j: P = A [1–(1-j)n (1+i)-n] / (i - j) Nomenclature: P = A (P/A,i,j,n)