The securitisation process in the OECD countries. Summary of

advertisement

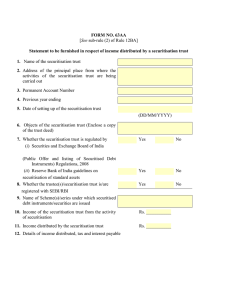

The securitisation process in the OECD countries. Summary of responses to the OECD-WPFS questionnaire and discussion on the follow-up Miguel Ángel Menéndez Beatriz Sanz WORKING PARTY ON FINANCIAL STATISTICS OECD Paris, 2 - 3 October 2007 STATISTICS DEPARTMENT The securitisation process in the OECD countries Contents 1. The launch of the questionnaire 2. Structure of the questionnaire 3. Results of the survey 4. Discussion on the follow-up STATISTICS DEPARTMENT 2 1. The launch of the questionnaire • The complexity of the process of asset securitisation has been increasing in recent years • The emergence of financial intermediaries specialising in securitisation (SPEs) • Impact on financial, credit and monetary analysis • Lack of systematic information At its 2006 meeting the WPFS approved the launch of a questionnaire on securitisation to identify the processes carried out in OECD countries STATISTICS DEPARTMENT 3 2. Structure of the questionnaire • Questions regarding the existence of securitisation processes • Questions related to the type of securitisation carried out through SPEs • Questions on the sources of information available on the securitisation carried out through SPEs • Questions on the quantitative aspects of securitisation STATISTICS DEPARTMENT 4 3. Results of the survey a. Results regarding the existence, organisation and extent of securitisation processes b. Availability of data on securitisation for the purpose of financial accounts c. Treatement in national accounts of securitisation STATISTICS DEPARTMENT 5 3.a Results regarding the existence, organisation and extent of securitisation processes Responses to the questionnaire Countries that responded Returning the questionnaire Answering that they have no securitisation processes Australia, Austria, Belgium, Hungary, Czech Republic Canada, Denmark, Germany, Finland, France, Greece, Ireland, Italy, Korea, Netherlands, New Zealand, Norway, Poland, Portugal, Slovak Republic, Spain, Switzerland, Turkey, United Kingdom, United States STATISTICS DEPARTMENT Not currently having securitisation through SPEs Czech Republic, Denmark, Hungary, Norway, Slovak Republic, Turkey 6 3.a Results regarding the existence, organization and extent of securitisation processes Securitisation processes in the OECD countries Securitisation through SPEs Resident SPEs Australia, Austria, Belgium, Canada, France, Germany, Ireland, Italy, Korea, Netherlands, New Zealand, Poland, Portugal, Spain, Switzerland, United Kingdom, United States STATISTICS DEPARTMENT Only nonresident SPEs Large and growing amount of securitisation Limited securitisation Finland, Greece Australia, Canada, Netherlands, Portugal, Spain, United States Austria No experience of securitisation procesess Czech Republic, Hungary 7 3.a Results regarding the existence, organization and extent of securitisation processes Assets of SPEs / assets of financial corporations Percentage STATISTICS DEPARTMENT United States Switzerland Spain Portugal Netherlands Korea Italy France Canada Belgium Australia 14 12 10 8 6 4 2 0 8 3.a Results regarding the existence, organization and extent of securitisation processes Outstanding securities issued by SPEs / outstanding securities issued by financial corporations Percentage 70 60 50 40 30 20 10 STATISTICS DEPARTMENT United States Switzerland Spain Portugal Netherlands Korea Italy Germany France Canada Australia 0 9 3.a Results regarding the existence, organization and extent of securitisation processes Three main questions: • What procedures are followed to carry out the securitisation through SPEs? • Does the government act as originator? • What kind of assets can be securitised? STATISTICS DEPARTMENT 10 3.a Results regarding the existence, organization and extent of securitisation processes What procedures are followed to carry out securitisation through SPEs? Traditional (conventional) securitisation Derecognising the assets: “true sales” (risks and rewards are completely transferred: the majority of countries use “true sales”) Without derecognising the assets (risks and rewards not completely transferred, in accordance with IAS rules: some countries follow these rules for individual balance sheets) Synthetic securitisation (transferring the risks through a financial derivative) STATISTICS DEPARTMENT Without derecognising the assets (this practice is currently marginal) 11 3.a Results regarding the existence, organization and extent of securitisation processes Does the government act as originator? - Eight countries responded that the government acts as originator (Austria, Belgium, Finland, France, Germany, Italy, Portugal and United States) - Government securitisations have led to detailed EU guidelines in the framework of the Excessive Deficit Procedure STATISTICS DEPARTMENT 12 3.a Results regarding the existence, organization and extent of securitisation processes What type of assets can be securitised? - All countries reported that any type of assets can be securitised - The majority of assets are mortgages and consumer loans. Future income or contingent assets could be also securitised STATISTICS DEPARTMENT 13 3.b Availability of data on securitisation for the purpose of financial accounts There are three different sources to obtain information on securitisation process: 1. Directly from the SPEs, depending on: – The possibilities of identifying them – Whether their activity is regulated – Whether their activity is supervised 2. Directly from the originators, depending on: – The possibilities of identifying them – Their role as servicer of the securitised assets 3. Other indirect sources STATISTICS DEPARTMENT 14 3.b Availability of data on securitisation for the purpose of financial accounts Data sources on securitisation processes Identification of SPEs Registers of supervisors Through the originators Belgium Italy Korea Poland Portugal Spain United Kingdom STATISTICS DEPARTMENT Credit surveys or rating agencies Australia Canada New Zealand Quantitative data Directly from SPEs SPE surveys Canada Systematic but not standarised Some SPEs’ data standarised France Spain United Kingdom United States Directly from originators Belgium Finland France Greece Ireland New Zealand Poland Spain United States 15 3.b Availability of data on securitisation for the purpose of financial accounts Other indirect sources Issue prospectuses and presale reports Rating agencies Commercial data providers Management companies Investor reports Monetary data and analysis of movements in assets of Monetary Financial Institutions Balance of payments Centralised Securities Database of the European System of Central Banks (for some European Union countries) STATISTICS DEPARTMENT 16 3.b Availability of data on securitisation for the purpose of financial accounts The difficulties of using the sources for the production of the financial accounts There are not always systematic and standarised sources Not many countries are able to construct complete (or even partial) financial accounts of securitisation processes The main problem is including the details of assets and liabilities by broad category and whom-to-whom information (i.e. counterpart sectors) STATISTICS DEPARTMENT 17 3.c Treatment in national accounts of securitisation processes Two main items regarding the treatment in national accounts of securitisation processes: 1. The classification of SPEs in the financial accounts 2. The possibilities of “double counting” when the assets are not derecognised in the balance sheet of the originator STATISTICS DEPARTMENT 18 3.c Treatment in national accounts of securitisation processes The classification of SPEs in the financial accounts The majority of countries report that SPEs are classified in S.123 Other financial intermediaries United Kingdom advises that this is only the case when they are autonomous United States notes that some SPEs are automatically consolidated with the sponsor in the business accounts of the sponsor when the latter “retains interest in the SPE” European Union guidelines for securitisation originated by government establish that SPEs should be consolidated with the originator if they do not have autonomy of decision regarding the management and disposal of the transferred assets STATISTICS DEPARTMENT 19 3.c Treatment in national accounts of securitisation processes The possibilities of “double counting” Countries consider that this is essentially not a problem – In some countries no derecognition is marginal – In other countries (Netherlands and Spain) when no derecognition occurs the counterpart of the securitisation is a deposit or a special covered bond, which is not included either in total security issues or, on the assets side, in the loans of SPEs STATISTICS DEPARTMENT 20 4. Discussion on the follow-up The follow-up will depend on the results of the discussion of the questions relating to the main aspects addressed in the questionnaire: Is securitisation in which, in accordance with IASs, the assets are not derecognized common in the OECD countries? If so, in which item of the liabilities of the originator is the liability generated by the raising of funds classified? Does the WPFS recommend that, because of the increasing importance of securitisation, member countries should estimate a complete aggregate balance sheet, including counterpart information, for securitisation SPEs, thus making this sector an additional informal sub-sector of S.123? Does the WPFS recommend that more detailed guidelines should be drafted for the recording of securitisation transactions, as part of a draft implementation document of SNA? If yes, are there volunteer countries to propose a first draft? STATISTICS DEPARTMENT 21 THANK YOU FOR YOUR ATTENTION STATISTICS DEPARTMENT