TAX B2N2FITS BOOST ARG2NTIN2 BIOFU2LS INDUSTRY

advertisement

TAX B2N2FITS BOOST ARG2NTIN2 BIOFU2LS INDUSTRY

has already announced a US$30m investment in a biofuel

refinery located in the province of Buenos Aires.

Vicentin, one of Argentina's leading oilseed processors

and exporters, is planning to invest US$40m to set up a biofuel

refinery in the province of Santa Fe.

It is clear that companies are investing to develop this

industry not only because they need to supply the Argentine

market, but also because production costs are much lower in

Argentina than in other countries. This is mainly due to the

exchange rate advantage. In some European countries one

litre of biodiesel costs around €1, whereas in Argentina the

production cost is around US$0.50.

An attractive legal framework with tax advantages plus

low production costs due to an exchange rate advantage

places the country in an unbeatable position to attract foreign

investments and develop a sophisticated biofuels industry.

aeonetto@onettoabogados.com.ar,

Buenos Aires.

Onetto,

Abogados,

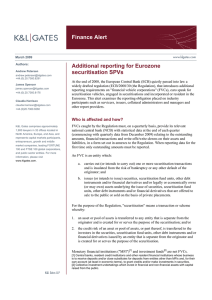

VAT AND SEGURITISATION

MBNA EUROPE BANK LTD V HM REVENUE & CUSTOMS [2006] EWHC 2326 (CH) (BRIGGS J)

An assignment of receivables by the Bank to its receivables trustee as part of a securitisation structure did not

constitute the making of a 'supply' for VAT purposes by

the Bank.

capital under the securitisation arrangements involved

the Bank making supplies.

CONCLUSIONS

-

The assignment of Receivables by the Bank to the Jersey

SPV corporate trustee of a receivables trust under the

securitisation process (the 'Receivables Trustee') did

not constitute or involve the making of a supply by

the Bank (excluding the consequential securitisation

servicer role undertaken by the Bank separately).

-

The assignment was no more than the necessary

pre-condition to the supply of a securitisation service

to the Bank by the Receivables Trustee set up to operate that service. The Receivables Trustee had no reason

to want the Receivables for any purpose other than

as security for, and the means for the servicing of, its

borrowing under the securitisation scheme.

-

The transfer of receivables for the purpose of their

being used in the provision of a securitisation service

for the transferor is an addition to the exceptional class

of transactions which prima facie look like a supply,

but which lose that character when viewed in their

context. Other examples of such exceptions which are

not supplies are:

BACKGROUND

The Bank operates a credit card business which requires a

large and constantly fluctuating amount of working capital.

The Bank had entered into a securitisation process which

meant that it could obtain that working capital at a highly

competitive cost. The stream of debts owed by the Bank's

customers (the 'Receivables') were bundled into a form

which, offered as indirect security for commercial paper

issued on the capital markets, gave that paper a higher

credit rating than that of the Bank itself.

For VAT purposes, the Bank's main business is the

making of exempt supplies of credit. Since the Bank makes

other supplies, some of which are taxable rather than

exempt, the Bank is a partially exempt trader.

As a trader, the Bank is entitled to recover, and set

off against tax which it is liable to collect and pay on

its outputs, tax incurred by it in the acquisition of goods

and services in connection with the Bank's business

('input tax').

The attribution of input tax to taxable (including

specified) and exempt supplies may critically depend

upon a correct appreciation of what supplies the Bank

makes in the course of its business. Hence whether the

securitisation process led to supplies being made was

important to the Bank and the tax authorities in their

tax calculations.

The Bank can only recover that part of its input tax

which is attributable to taxable supplies (or to certain

supplies made outside the EU ('specified supplies')).

Where the input tax can be shown to be directly attributable

to taxable or specified supplies, the Bank can recover it in

full. Where the input tax is directly attributable to exempt

supplies, the Bank cannot recover it at all.

The Bank claimed its method of deploying its

customers' debts for the purposes of raising working

-

assignment of debts to a factor to obtain a factoring

service;

-

assignment of property to a lender as security for a

loan; and

-

sale of currency to a foreign exchange dealer to

obtain an exchange service.

Jonathan Lawrence

Kirkpatrick & Lockhart Nicholson Graham LLP

jlawrence@klng.com /

•mvw.klng.com

Butterworths Journal of International Banking and Financial Law - October 2006