THE SECURITISATION PROCESS IN THE OECD COUNTRIES: UNDERSTAND THIS PHENOMENON

advertisement

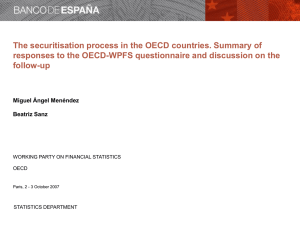

THE SECURITISATION PROCESS IN THE OECD COUNTRIES: PROPOSAL FOR A NEW QUESTIONNAIRE TO BETTER UNDERSTAND THIS PHENOMENON Miguel Ángel Menéndez Beatriz Sanz WORKING PARTY ON FINANCIAL STATISTICS OECD París, 13-14 October 2008 STATISTICS DEPARTMENT Securitisation in the OECD countries Contents 1. The first questionnaire. Updated version 2. The need for further details 3. The structure of a new questionnaire 4. Table requested with statistical data 5. Proposed follow-up schedule STATISTICS DEPARTMENT 2 1. The first questionnaire. Updated version The WPFS in its October 2006 meeting agreed to launch a questionnaire to identify the securitisation being carried out in OECD countries [COM/STD/DAF(2006)2]. Its aim was to investigate: the existence, organisation and extent of securitisation the availability of data and the sources the treatment of securitisation in national accounts The results were presented to the WPFS in its October 2007 meeting [COM/STD/DAF(2007)9] and the main conclusions were: the need for more information on SPEs the need to collect more quantitative and qualitative information Updated version of the results. Summary of responses: [COM/STD/DAF(2008)8] only Iceland and Japan missing the aim is to have a live updating process STATISTICS DEPARTMENT 3 2. The need for further details • The agreed follow-up in 2007 has been affected by the financial turmoil: securitisation and transfer of credit risk are complex processes an in-depth understanding of the phenomenon of securitisation is an essential and complex task close international co-operation seems to be necessary • As a consequence: The proposal of a new questionnaire to obtain further information to supplement that provided by the first one, seems the best way forward, and The request to complete a standardised table with very full information on the SPEs engaged in the securitisation processes [COM/STD/DAF(2008)10] STATISTICS DEPARTMENT 4 3. The structure of a new questionnaire I. Questions related to “traditional securitisation”, when the originator is not allowed to derecognise the loan: a) The precise heading on the asset side of the SPEs’ balance sheet b) The mechanisms to avoid a single loan being recorded twice c) The name of the heading on the liability side of the originators’ balance sheet d) If the heading on the liability side of the originators’ balance sheet is “deposits”: the consolidation criterion followed when the originator buys the securities issued by the SPE STATISTICS DEPARTMENT 5 3. The structure of a new questionnaire II. Question related to “synthetic” securitisation: e) How “synthetic” securitisation is performed III. Questions related to the structure of the SPE’s liabilities: f) Issues of short-term securities that are continually re-issued by the SPEs g) Commitment by the originator to provide financial support to the SPE if necessary and the provision of lines of liquidity to the SPE STATISTICS DEPARTMENT 6 3. The structure of a new questionnaire IV. Questions related to securitisation involving the participation of two SPEs (one issues the securities to provide the funds to the SPE that acquires the assets from the originator): h) The existence of this type of securitisation i) Residency of the SPE issuing the securities j) Identification and description of similar types of securitisation k) Cases in which the period between the acquisition by an SPE of the assets and the issuance of securities is lengthy l) If there are such cases: examples of the length of the period STATISTICS DEPARTMENT 7 3. The structure of a new questionnaire V. Question related to the securitisation scope and definitions: m) Role of international organisations in establishing homogeneous terminology, concepts and definitions for institutions, transactions and instruments involved in securitisation VI. Questions related to the valuation of assets and liabilities linked to securitisation: n) Valuation rules and the need for homogeneous valuation criteria o) Treatment of write-offs and write-downs by the SPEs STATISTICS DEPARTMENT 8 3. The structure of a new questionnaire VII. Question related to the revised version of the SNA p) Guidance notes complementing the SNA, setting out in detail all the known securitisation alternatives and the recommended way of recording them in the SNA, with some examples of valuation criteria STATISTICS DEPARTMENT 9 4. Table requested with statistical data SPE’s Balance Sheet (year-end 2005-2007) Assets (Units in national currency) Total Rest of the world Households General government Other financial institutions Banks Non-financial corporations ASSETS Currency and Deposits Seurities other than shares: short term Securities other than shares: long-term Loans Shares and other equity Financial derivatives Other assets STATISTICS DEPARTMENT 10 4. Table requested with statistical data SPE’s Balance Sheet (year-end 2005 to 2007) Liabilities (Units in national currency) Total Rest of the world Households General government Other financial institutions Banks Non-financial corporations LIABILITIES Deposits Seurities other than shares: short term Securities other than shares: long-term Loans Shares and other equity Financial derivatives Other liabilities STATISTICS DEPARTMENT 11 5. Proposed follow-up schedule • End-October 2008: delegates send further proposals to enlarge or amend the questionnaire and the table requested • Mid-November 2008: OECD launches the final versions of the questionnaire and of the table • Mid-February 2009: delegates send their replies to the questionnaire and the data requested (by fully or partially completing the table) • October 2009: a summary of the results will be presented at the next WPFS meeting STATISTICS DEPARTMENT 12 THANK YOU FOR YOUR ATTENTION STATISTICS DEPARTMENT