Governmental Accounting: Special Funds & Financial Statements

advertisement

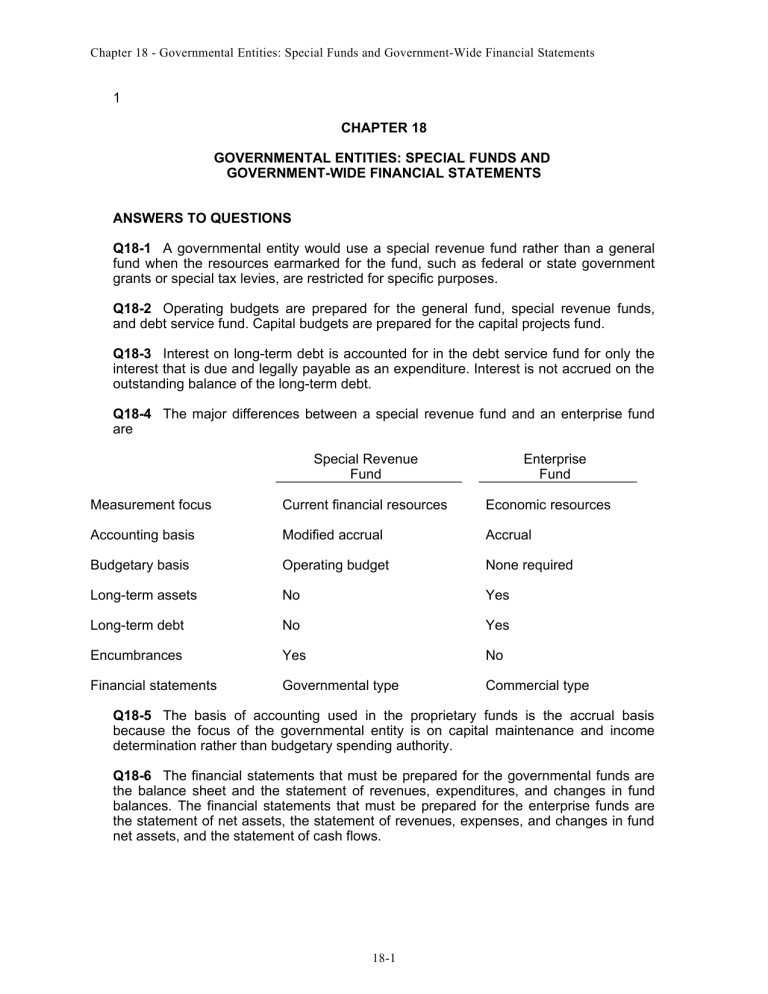

Chapter 18 - Governmental Entities: Special Funds and Government-Wide Financial Statements 1 CHAPTER 18 GOVERNMENTAL ENTITIES: SPECIAL FUNDS AND GOVERNMENT-WIDE FINANCIAL STATEMENTS ANSWERS TO QUESTIONS Q18-1 A governmental entity would use a special revenue fund rather than a general fund when the resources earmarked for the fund, such as federal or state government grants or special tax levies, are restricted for specific purposes. Q18-2 Operating budgets are prepared for the general fund, special revenue funds, and debt service fund. Capital budgets are prepared for the capital projects fund. Q18-3 Interest on long-term debt is accounted for in the debt service fund for only the interest that is due and legally payable as an expenditure. Interest is not accrued on the outstanding balance of the long-term debt. Q18-4 The major differences between a special revenue fund and an enterprise fund are Special Revenue Fund Enterprise Fund Measurement focus Current financial resources Economic resources Accounting basis Modified accrual Accrual Budgetary basis Operating budget None required Long-term assets No Yes Long-term debt No Yes Encumbrances Yes No Financial statements Governmental type Commercial type Q18-5 The basis of accounting used in the proprietary funds is the accrual basis because the focus of the governmental entity is on capital maintenance and income determination rather than budgetary spending authority. Q18-6 The financial statements that must be prepared for the governmental funds are the balance sheet and the statement of revenues, expenditures, and changes in fund balances. The financial statements that must be prepared for the enterprise funds are the statement of net assets, the statement of revenues, expenses, and changes in fund net assets, and the statement of cash flows. 18-1 Chapter 18 - Governmental Entities: Special Funds and Government-Wide Financial Statements Q18-7 Proceeds from a bond issue are accounted for as an other financing source in the fund that issued the bonds. However, some governments have a policy that the capital projects fund may not keep any bond premium, in which case the bond premium is typically transferred to a debt service fund. Other financing sources and uses are reported separately below operations, but above special items, on the governmental funds’ statement of revenues, expenditures, and changes in fund balance. Q18-8 A permanent fund is a governmental fund for which the principal is maintained, but the income in the fund can be used by the government for its programs that benefit all of its citizens. The basis of accounting in permanent funds is the modified accrual method. Private-purpose trust funds are established to benefit specific individuals or organizations, as specified by the donor. These private-purpose trust funds may have an expendable principal, or the principal may be non-expendable. The accrual basis of accounting is used for private-purpose funds. Thus, a major difference between these funds is the specificity of who the beneficiaries of the fund are. Q18-9 GASB 34 specifies that only governmental and enterprise funds determined to be “major” funds need to be separately disclosed in their own columns in the fund financial statements. There are two tests to determine which individual governmental and enterprise funds are considered major if they meet both tests. The general fund is always considered a major fund. The first test is total assets, liabilities, revenues, or expenditures/expenses of that individual fund are at least 10 percent or more of the governmental or enterprise category. The second test is that total assets, liabilities, revenues, or expenditures/expenses of the individual governmental or enterprise fund are at least 5 percent of the total for all governmental and enterprise funds combined. Any individual funds that are not considered major are aggregated and presented in a single column. Management may, at any time, separately disclose even those non-major funds for which they feel the additional disclosure will provide information valuable to the readers of the financial statements. Q18-10 Because the measurement focus of the governmental funds is on current financial resources, revenue would be recognized in the governmental funds only if the donated items are available to finance expenditures of the current period, For example, donated land would be included in contribution revenue of a governmental fund if the land was sold, or the government has entered into a contract to sell the land, and that the proceeds from the sale will be available to finance expenditures of the current period. However, a donation to a governmental fund, in the form of financial resources or capital assets, that has a restriction imposed by the donor which makes the donation unavailable to finance current expenditures, is not included in the governmental fund’s financial statements. Of course, on the government-wide statement of activities, all donations would be shown, at fair value on a separate line below general revenues. Specifically, endowment and permanent fund principal donations are reported below general revenues and above special and extraordinary items. On the governmental funds financial statements, special and extraordinary items are reported below operations, but above the net change in fund balance line, in the statement of revenues, expenditures, and changes in fund balance. Special items are those significant transactions within the control of management that are either unusual in nature or infrequent in occurrence. Extraordinary items are transactions or events that are both unusual and infrequent in occurrence. Q18-11 Agency funds must be self-balancing with assets equaling liabilities. Therefore, agency funds do not have a net fund balance. 18-2 Chapter 18 - Governmental Entities: Special Funds and Government-Wide Financial Statements Q18-12 Component units are separate government entities for which the primary government is financially accountable. The financial presentation of these component units is dependent on the separability from the primary government. If the component unit is virtually inseparable, then the component unit’s financial information is blended into the primary government’s financial statements. However, if the component unit is distinguishable, and has its own taxing authority, then the component unit’s financial information is presented in a separate column in the government-wide financial statements. Q18-13 Two reconciliation schedules are required by GASB 34. The first reconciles the fund balances reported in the governmental funds to the net assets of governmental activities reported on the government-wide financial statements. For example, internal service funds are not a governmental fund, but the accounts for internal service funds are blended into the governmental activities that are reported on the government-wide financial statements. The second reconciliation schedule reconciles the net change in fund balances reported in the governmental funds statements to the change in net assets reported in the government-wide financial statements. These two reconciliation schedules are required by GASB 34 to be presented either on the face of the fund financial statements or in a separate schedule immediately following the fund financial statements. Q18-14 The budgetary comparison schedule reports, for the general fund and any other governmental fund that has a legally adopted budget, the initially approved budget, the final budget of the year, and the actual amounts, for each line item in the statement of revenues, expenditures, and changes in fund balance. A variance column may also be used to compare the actual against the final budget. This budgetary comparison schedule is part of the required supplementary information (RSI) required by GASB 34. GASB 41 amended GASB 34 for those governments that do not use the general fund and special revenue fund structure specified in GASB 34 for their budgetary purposes. GASB 41 specified that those governments with significant perspective differences should provide a budgetary comparison schedule in the RSI based on the structure the government used for its legally adopted budget. Q18-15 The government-wide financial statements present the infrastructure assets, such as roads, bridges, tunnels, sewer and water systems, etc., and other long-term assets of the government entity, such as buildings, equipment, vehicles, etc. The capital assets should be reported at historical cost or fair value at the time of donation, if donated. Because the basis of accounting for the government-wide financial statements is the accrual method, depreciation is recorded on the other long-term assets and these are reported net of depreciation. For infrastructure assets, the governmental entity may elect to use a modified approach in which depreciation is not recorded. The modified approach requires an assessment of the current condition of the infrastructure assets and an estimate of the annual amount required to maintain and preserve the infrastructure assets. In addition, the government-wide financial statements present the general long-term debt obligations of the governmental entity at the present value of the debt principal and future interest, just as computed under the accrual basis of accounting that is used for commercial entities. 18-3 Chapter 18 - Governmental Entities: Special Funds and Government-Wide Financial Statements SOLUTIONS TO CASES C18-1 Basis of Accounting and Reporting Issues a. In the accrual basis of accounting, revenue should be recognized in the accounting period in which it is earned and becomes measurable. In the modified accrual basis of accounting, revenue should be recognized in the accounting period in which it becomes both measurable and available to finance expenditures of the fiscal period. "Available" means collectible within the current period or soon enough thereafter to be used to pay current period liabilities. b. For the general fund, the modified accrual basis of accounting should be used because it is a governmental fund, which is, in essence, an accounting segregation of financial resources. For the special revenue fund, the modified accrual basis of accounting should be used because it is a governmental fund, which is, in essence, an accounting segregation of financial resources. For the enterprise fund, the accrual basis of accounting should be used because it is a proprietary fund, with activities similar to those in the commercial, profit-seeking sector. 18-4 Chapter 18 - Governmental Entities: Special Funds and Government-Wide Financial Statements C18-2 Capital Projects, Debt Service, and Internal Service Funds a. Capital projects funds account for the acquisition or construction of major capital facilities or improvements. A separate capital projects fund is created at the time the project is approved and ceases at the completion of the project. Accounting for capital projects funds is similar to accounting for the general fund. The modified accrual basis of accounting is used; no fixed assets, depreciation, or long-term debt is recorded in these funds. The bond proceeds are not revenue to the capital projects fund; they are reported as Other Financing Sources. A premium on the sale of bonds is transferred to the debt service fund. When the expenditure is recorded, Contract Payable is credited for the current portion due and Contract Payable-Retained Percentage is credited for the amount held back to ensure that the contractor fully completes the project to the satisfaction of the governmental entity. The financial statements for capital projects funds are a balance sheet and a statement of revenues, expenditures, and changes in fund balance. No budget versus actual is required because capital projects funds use a capital budget rather than an operating budget. b. Debt service funds account for the accumulation and use of resources for the payment of general long-term debt principal and interest. Accounting for the debt service fund is similar to accounting for the general fund. The modified accrual basis of accounting is used; no fixed assets or long-term debt is recorded; only current maturities are recorded in the fund. The bond premium received from the capital projects fund is recorded as an other financing source – transfer in. The matured portion of a serial bond is recognized as an expenditure and Matured Bonds Payable is credited. Interest legally due and payable is recorded as an expenditure and Matured Interest Payable is credited. The financial statements of the debt service fund are a balance sheet and a statement of revenue, expenditures, and changes in fund balance. c. Internal service funds account for the financing of goods or services provided by one department to other departments on a cost-reimbursement basis. Separate internal service funds are established for each type of service. Accounting for internal service funds is the same as for enterprise funds or commercial entities. The accrual basis is used; these funds record fixed assets, depreciation, and long-term debt. The internal service fund may be started with a transfer in from the general fund. The billings are recorded in "Due from" accounts and the revenue account, Charges for Services. The closing entries involve a Profit and Loss Summary or Excess of Net Revenues over Costs account. The financial statements of an internal service fund are a statement of net assets; a statement of revenues, expenses, and changes in fund net assets; and, a statement of cash flows. 18-5 Chapter 18 - Governmental Entities: Special Funds and Government-Wide Financial Statements C18-3 Discovery Case Summary of major information items in the Financial Report of the United States Government, 1. The report is prepared by the Secretary of the Treasury. 2. The Management’s Discussion and Analysis presents comparative historical information for operations and financial position along with budget information, both historical and projected. 3. The Comptroller General of the United States heads the General Accountability Office (GAO) who is the auditor for the U.S. government. For several years, the Comptroller General has disclaimed an opinion on the consolidated financial statements because of the material deficiencies in the government’s systems, recordkeeping, documentation, and financial reporting. The material deficiencies are listed in the auditor’s report. 4. The following five statements are presented: (1) Statements of Net Cost, (2) Statements of Operations and Changes in Net Position, (3) Reconciliations of Net Operating Revenue (Cost) to the Budget Surplus (unaudited), (4) Dispositions of the Budget Surplus (unaudited), and (5) Balance Sheets. 5. The Statements of Net Cost present the costs and revenue for the major departments, agencies, commissions, and other units of the federal government. 6. The Statement of Operations and Changes in Net Position presents the revenues by type, the total costs, and the net operating revenue (cost) for each year. 7. The Reconciliation of Net Operating Revenue (Cost) to the Budget Surplus presents the increases or decreases in major cost programs, along with the amount of capitalized fixed assets by major agencies of the federal government. 8. The Dispositions of the Budget Surplus presents the changes in assets and liabilities during the years reported. 9. The Balance Sheets present the assets, by major type, the liabilities, by major type, and reconciles to the net position of the U.S. government. 10. Major footnotes include a stewardship report on the resources held by the U.S. government, and a large number of notes to the financial statements that report on specific items related to agencies, commissions, and other entities within the federal government. 18-6 Chapter 18 - Governmental Entities: Special Funds and Government-Wide Financial Statements C18-4 Becoming Familiar With a Local Government’s Comprehensive Annual Financial Report (CAFR) (Note to the instructor: Most local governments now produce a comprehensive annual financial report. You might select the local city or county in which the university is located or a large city close to the university town. Printed copies of the CAFR may be obtained directly from that governmental entity and you could place these copies on reserve in your university library for use by your students. Alternatively, many governments now provide their CAFRs online. A web search using “CAFR” and the name of your city, county or state will show if your selection provides an online copy of its CAFR. Or, you may do a web search using “CAFR” and then select one of the government units that provide an online copy of its CAFR and then provide that link to your students or insert that link into your online syllabus.) a. Students should read the MD&A to get familiar with the governmental entity. One of the items contained in the MD&A is information on the nature of the services performed by the government. At the local government level, the services usually consist of police and fire protection, street maintenance, recreation, and other services typically the responsibility of the local government. b. Because there is so much information contained in a CAFR, it is important to see what information is covered by the auditor’s opinion. The auditor’s opinion is usually unqualified. The auditor does not audit the MD&A and other RSI and does not express an opinion on this information. The auditor reads the MD&A and other RSI to determine if the information contained therein is reasonable. c. A general purpose government will have most fund types. It is beneficial for the student to see which fund types are used and which ones are not used by a government. d. Students should become familiar with the types of information found in the notes. One item of information disclosed in the notes is a description of the measurement focus and basis of accounting used by the governmental funds. The footnotes’ discussions regarding the governmental funds and their use of the financial resources measurement focus and modified accrual basis of accounting reinforce what the students learned from the text. e. Listing the financial statements that use the economic resources measurement focus and accrual basis of accounting reinforces the coverage in the text. In their evaluation, students should remember that the governmental fund financial statements are the only ones prepared using the current financial resources measurement focus and the modified accrual basis of accounting. f. Students should be aware of the reporting of major funds in the financial statements of governmental and proprietary funds. g. This question emphasizes that the reporting entity for the government may be larger than the local governmental if the local government has fiscal accountability over other governmental entities. Because many component units are reported discretely, students should have little problem identifying the existence of component units. 18-7 Chapter 18 - Governmental Entities: Special Funds and Government-Wide Financial Statements C18-4 (continued) h. The purpose of this question is for students to become acquainted with the balance sheet equation for the governmental funds: Assets = Liabilities + Fund Balance. Another goal for this question is for students to see that fund balance is separated into two components: (1) assigned and (2) unassigned. i. The purpose behind questions i - l is to help students understand the format of the statement of revenues, expenditures, and changes in fund balance. The first section deals with revenues, which are reported according to source. Students will discover that taxes are generally not the only source of revenue. j. The objective of this question is to get students to understand how governments report expenditures. Students may expect governments to report expenditures by object; however, expenditures are not reported this way on the statement of revenues, expenditures, and changes in fund balance. k. The purpose of this question is to have students examine the items reported in other financing sources and uses. This should reinforce what they learn in the text when they read the section dealing with interfund transfers. l. This question covers the last items reported on the statement of revenues, expenditures, and changes in fund balance: special items, the change in fund balance for the year, and the ending fund balance at the end of the most recent year. Students should not expect to see any special items since their occurrence is rare. However, students should see the change in fund balance for the year being added to the beginning fund balance to produce ending fund balance. 18-8 Chapter 18 - Governmental Entities: Special Funds and Government-Wide Financial Statements C18-5 The GASB’s Decision-Making Process Until recently, the GASB’s presentation of its decision-making process was found on their web site at www.gasb.org/ under GASB FACTS on the link entitled Facts About the GASB: The Mission and Structure of the Board, and An Open Decision-Making Process. In order to find this information on the revised website, it is necessary to go to the link entitled “How Standards Are Set” in the “Education” tab. (http://www.gasb.org/jsp/GASB/Page/GASBSectionPage&cid=1176156714545 ) 1. The Governmental Accounting Standards Advisory Council (GASAC). This council is composed of about 25 persons from a diverse background in government accounting and finance. This council provides suggestions for topics to be considered by the GASB. In addition, the Board receives concerns about current governmental accounting needs from other persons and groups who work in governmental accounting or auditing. 2. Task Force. In many cases, a task force is formed shortly after the Board agrees to place the project on its agenda. A task force is comprised of persons who know the project’s subject matter and provides expertise and advice to the GASB as it focuses on the critical issues and determine if a new standard is necessary. http://www.gasb.org/cs/ContentServer?c=Page&pagename=GASB%2FPage %2FGASBSectionPage&cid=1176156714627 3. Discussion Memorandum (DM). The DM is normally prepared by the staff and defines the problem(s), the scope of the project, the accounting and reporting issues; and presents relevant research, alternative solutions to the issues, and arguments both for and against each alternative. Written comments are solicited and in many cases a public hearing is scheduled to discuss the DM. The answers to this question and the next two are covered in this website: http://www.gasb.org/cs/ContentServer?c=Page&pagename=GASB%2FPage %2FGASBSectionPage&cid=1176156714567 4. Invitation to Comment (ITC). An ITC is sometimes issued when the GASB seeks more input on one or more of the issues. 5. Preliminary Views (PV). A PV puts forth the Board’s consensus at an early stage in the process. A majority of the Board must approve the issuance of a PV. The Board solicits comments on the PV. 6. Public Hearing. A public hearing is typically scheduled to provide the Board with an opportunity to hear the viewpoints of the public as well as to allow the Board to raise questions to the staff regarding written or oral comments received on the project, including any submissions at the public hearing. http://www.gasb.org/cs/ContentServer?c=Page&pagename=GASB%2FPage %2FGASBSectionPage&cid=1176156714607 7. Analysis of Oral and Written Comments. The staff performs an analysis of the submitted comments, looking for information and good arguments on the issues, and presents this analysis to the members of the Board who often make their own review of the comments. 8. Meetings of the Board. The Board may have several, or many, meetings to discuss the issues. Board meetings on the project are open to the public, although observers are not allowed to participate in the discussions. 9. Exposure Draft (ED). An ED presents the proposed new standards, the proposed effective date and method of transition, background information, and explains the basis for the Board’s conclusions regarding the issues covered by the ED. 18-9 Chapter 18 - Governmental Entities: Special Funds and Government-Wide Financial Statements http://www.gasb.org/cs/ContentServer?c=Page&pagename=GASB%2FPage %2FGASBSectionPage&cid=1176156714567 10. Further Deliberations by the Board. The Board receives comments on the ED and discusses the comments to determine if any modifications are needed in the proposed standard. 11. Statements of Governmental Accounting Standards or Statements of Governmental Accounting Concepts. A majority of the Board must vote in favor of adopting a pronouncement. Statements of Standards establish new accounting or reporting requirements. Statements of Concepts do not create new standards, but rather give guidance for dealing with problems that arise on an issue. And then, the Board continues to work on the next project! 18-10 Chapter 18 - Governmental Entities: Special Funds and Government-Wide Financial Statements C18-6 Summarizing a Recent GASB Exposure Draft Note to the Instructor: This case provides your students with the opportunity to be on the leading edge of a proposed governmental accounting or reporting standard. Students can learn about some of the specifics of an expected, new GASB Statement. The most recent ED on the web page will be dependent on future actions of the GASB. Click on the “Current Projects” link in the Projects tab of the GASB’s home page to see information on the status of current GASB projects. These projects are in various stages of progress, but as of late 2010, GASB projects include a conceptual framework, derivatives, economic condition reporting, and postemployment benefit accounting and reporting. Of course, given the dynamic nature of governmental accounting and reporting, it is expected that new projects will be added, and some of the current projects may be discontinued or included within a larger project the board is studying. And, some may become new GASB Statements! 18-11 Chapter 18 - Governmental Entities: Special Funds and Government-Wide Financial Statements SOLUTIONS TO EXERCISES E18-1 Multiple-Choice Questions on Government Financial Reporting 1. a 2. d 3. b 4. a 5. a 6. b 7. a $8,839,000 = assets of $14,839,000 minus liabilities of $6,000,000 8. c $7,150,000 = capital assets (net) of $12,500,000 minus long-term debt of $5,350,000 9. c $1,035,000 = net assets of $8,839,000 minus $7,150,000 minus $654,000 10. a (answers b, c, and d each include a fiduciary fund which is not a major fund) 11. d 12. c 18-12 Chapter 18 - Governmental Entities: Special Funds and Government-Wide Financial Statements E18-2 Multiple-Choice Questions on Governmental Funds [AICPA Adapted] 1. d 2. b 3. a 4. c 5. c 6. b E18-3 Multiple-Choice Questions on Proprietary Funds [AICPA Adapted] 1. b 2. d 3. d 4. b 5. c 6. c Prepaid insurance would be reported as an asset. 7. b 8. c 9. c 18-13 Chapter 18 - Governmental Entities: Special Funds and Government-Wide Financial Statements E18-4 Multiple-Choice Questions on Various Funds 1. c The additions - investment earnings include the $50,000 of dividends and the $35,000 of interest earned. The contribution is reported as an addition -contributions. 2. a The entries in the trust fund to record the resources spent would appear as follows: 3. d 4. d Deductions - Benefits Vouchers Payable 75,000 Vouchers Payable Cash 75,000 c 75,000 Income is determined as follows: Revenue – Charges for Services Operating Expenses Depreciation Expense Interest Expense Income 5. 75,000 $100,000 (45,000) (40,000) (5,000) $ 10,000 The assets at June 30, 20X7 appear as follows: Cash Due from Other Funds Computer Equipment (net) Total Assets $ 96,000 7,000 610,000 $713,000 6. b This is an example of an interfund services provided or used transaction. The general fund would debit expenditures. 7. a This is an example of an interfund services provided or used transaction. The enterprise fund would debit operating expenses. 8. b The net assets would be for the $600,000 transfer in plus the $10,000 of income for the period. 18-14 Chapter 18 - Governmental Entities: Special Funds and Government-Wide Financial Statements E18-5 Multiple-Choice Questions on Financial Reporting Issues for Government-wide and Fund-Based Financial Statements 1. c 2. c the net assets of internal service funds are included in governmental activities 3. d 4. d 5. a $150,000 = $500,000 – $350,000 6. d $37,000 = $25,000 + $20,000 – $8,000 7. c $660,000 = $1,000,000 + $300,000 - $40,000 - $600,000 8. d $1,035,000 = $1,000,000 + $60,000 interest - $20,000 benefits paid - $5,000 deduction for investment revaluation 18-15 Chapter 18 - Governmental Entities: Special Funds and Government-Wide Financial Statements E18-6 Capital Projects Fund Entries a. Entries for capital projects fund during 20X2: 1..1. Receipt of grant, sale of bonds and transfer of premium. January 1, 20X2 . Cash Revenue – County Grant Receipt of grant from county. January 1, 20X2 Cash Other Financing Sources – Bond Issue Other Financing Sources – Bond Premium Sale of $150,000 par bonds at 104. November 3, 20X2 Other Financing Uses – Transfer Out to Debt Service Fund Cash Transfer premium to debt service fund. 2. Entries to record and pay for construction: April 5, 20X2 ENCUMBRANCES BUDGETARY FUND BALANCE – ASSIGNED FOR ENCUMBRANCES August 8, 20X2 BUDGETARY FUND BALANCE – ASSIGNED FOR ENCUMBRANCES ENCUMBRANCES Expenditures—Capital Outlay Contract Payable Establish contract payable for walkway. Expenditures—Capital Outlay Vouchers Payable Establish vouchers payable for added carpeting. November 3, 20X2 Contract Payable Vouchers Payable Cash Pay contract payable and vouchers payable. 3. Close nominal accounts: Revenue – County Grant Other Financing Sources – Bond Issue Other Financing Sources – Bond Premium Fund Balance – Unassigned 18-16 50,000 156,000 6,000 50,000 150,000 6,000 6,000 182,000 182,000 182,000 189,000 5,500 189,000 5.500 50,000 150,000 6,000 182,000 189,000 5,500 194,500 206,000 Chapter 18 - Governmental Entities: Special Funds and Government-Wide Financial Statements E18-6 (continued) Fund Balance – Unassigned Expenditures Other Financing Uses – Transfer Out to Debt Service Fund 4. Transfer of ending balance and close transfer account: Other Financing Uses – Transfer Out to Debt Service Fund Cash Record transfer of remainder to Debt Service. Fund Balance – Unassigned Other Financing Uses – Transfer Out to Debt Service Fund Close transfer out against unassigned fund balance. b. 200,500 194,500 6,000 5,500 5,500 5,500 5,500 City of Waterman Capital Projects Fund Statement of Revenues, Expenditures, and Changes in Fund Balance For Fiscal Year Ended December 31, 20X2 Revenue: County Grant Expenditures: Capital Outlay Deficiency due to excess of Expenditures over Revenue Other Financing Sources (Uses): Proceeds of Bond Issue Transfer Out to Debt Service Fund--Premium Transfer Out to Debt Service Fund--Remainder Total Other Financing Sources (Uses) Net Change in Fund Balance Fund Balance, January 1, 20X2 Fund Balance, December 31, 20X2 18-17 $ 50,000 194,500 $(144,500) ) $156,000 (6,000) (5,500) 144,500 -0-0$ -0$ Chapter 18 - Governmental Entities: Special Funds and Government-Wide Financial Statements E18-7 Debt Service Fund Entries and Statement a. Entries for debt service fund during 20X2: 1. 2. ESTIMATED REVENUES CONTROL ESTIMATED OTHER FINANCING SOURCES – TRANSFER IN APPROPRIATIONS CONTROL BUDGETARY FUND BALANCE Record budget. 35,000 Property Taxes Receivable Allowance for Uncollectibles Revenue – Property Tax Record tax levy. 40,000 Cash Property Taxes Receivable Record tax collections. 35,000 5,000 Property Taxes Receivable — Delinquent 5,000 Allowance for Uncollectibles 4,000 Property Taxes Receivable Allowance for Uncollectibles – Delinquent Revenue – Property Tax Revise estimate of uncollectibles and reclassify remaining receivables. Cash Other Financing Sources – Transfer in from Capital Projects Fund Receive bond premium. 3. 4,000 36,000 35,000 5,000 1,000 3,000 6,000 6,000 Expenditures Matured Bonds Payable ($150,000 x 1/10 due) Matured Interest Payable ($150,000 x 0.10 interest) Record matured principal and interest. 30,000 Matured Bonds Payable Matured Interest Payable Cash Pay matured principal and interest. 15,000 15,000 Expenditures Vouchers Payable Record other expenditures. 1,700 Vouchers Payable Cash Pay approved vouchers. 1,200 18-18 34,000 6,000 15,000 15,000 30,000 1,700 1,200 Chapter 18 - Governmental Entities: Special Funds and Government-Wide Financial Statements E18-7 (continued) 4. Cash 5,500 Other Financing Sources – Transfer In From Capital Projects Fund 5,500 Record transfer of unspent funds in capital projects fund to debt service fund. 5. b. APPROPRIATIONS CONTROL BUDGETARY FUND BALANCE ESTIMATED REVENUES CONTROL ESTIMATED OTHER FINANCING SOURCES – TRANSFER IN Close budgetary accounts. 34,000 6,000 Revenue – Property Tax Other Financing Sources – Transfer in from Capital Projects Fund ($6,000 + $5,500) Fund Balance – Assigned for Debt Service Expenditures Close nominal accounts. 39,000 5,000 11,500 18,800 31,700 City of Waterman Debt Service Fund Balance Sheet December 31, 20X2 Assets: Cash Property Tax Receivables (net) Total Assets Liabilities: Vouchers Payable Fund Balance: Spendable: Assigned to: Debt Service Total Liabilities and Fund Balance c. 35,000 $15,300 4,000 $19,300 $ 500 18,800 $19,300 City of Waterman Debt Service Fund Statement of Revenues, Expenditures, and Changes in Fund Balance For Fiscal Year Ended December 31, 20X2 Revenue: Property Taxes Expenditures: Principal Retirement $15,000 Interest 15,000 Miscellaneous 1,700 Total Expenditures Excess of Revenue over Expenditures Other Financing Sources (Uses): Transfers In From Capital Projects Fund Net Change in Fund Balance Fund Balance, January 1, 20X2 Fund Balance, December 31, 20X2 18-19 $39,000 31,700 $ 7,300 11,500 $18,800 -0$18,800 Chapter 18 - Governmental Entities: Special Funds and Government-Wide Financial Statements E18-8 Enterprise Fund Entries and Statements a. Entries for enterprise fund: 1. Accounts Receivable Revenue Record charges to customers. 420,000 Cash Accounts Receivable Record collections on account. 432,000 2. Cash Due to General Fund Receive loan from general fund. 30,000 3. Plant and Equipment Contracts Payable Record extension of water and gas lines. 75,000 Contracts Payable Cash Record payment for extended lines. 75,000 4. Inventory of Supplies Operating Expenses Interest Expense Due to Central Stores Fund Vouchers Payable Interest Payable Record expenses. 12,400 328,000 30,000 420,000 432,000 30,000 75,000 75,000 12,400 328,000 30,000 Due to Central Stores Fund 12,400 Vouchers Payable 325,000 Interest Payable 30,000 Cash 367,400 Record payment of approved vouchers, interest, and payment to central stores. 5. Revenue Allowance for Uncollectibles Reduce revenue for uncollectible accounts. 6,300 Depreciation Expense Accumulated Depreciation Adjust for depreciation for period. 32,000 Supplies Expense Inventory of Supplies Adjust for supplies on hand. 15,200 18-20 6,300 32,000 15,200 Chapter 18 - Governmental Entities: Special Funds and Government-Wide Financial Statements E18-8 (continued) Closing entries: Revenue Operating Expenses Interest Expense Depreciation Expense Supplies Expense Profit and Loss Summary Close nominal accounts. 413,700 Profit and Loss Summary Net Assets – Unrestricted Close profit and loss summary. 8,500 328,000 30,000 32,000 15,200 8,500 8,500 Net Assets – Unrestricted 43,000 Net Assets – Invested in Capital Assets, Net of Related Debt 43,000 Record increase in net assets-invested: $43,000 = Ending balance of $563,000 net capital assets (Land + Plant & Equipment) less $500,000 related debt minus $20,000 beginning balance in net assets-Invested in capital assets net of related debt b. Augusta MUD Enterprise Fund Statement of Net Assets December 31, 20X1 Assets: Cash Accounts Receivable Less: Allowance for Uncollectibles Inventory of Supplies Land Plant and Equipment Less: Accumulated Depreciation Total Assets $ 13,000 (6,300) $555,000 (112,000) $111,600 6,700 5,200 120,000 443,000 $686,500 Liabilities: Vouchers Payable Due to General Fund Bonds Payable, 6% Total Liabilities $ 18,000 30,000 500,000 $548,000 Net Assets: Invested in Capital Assets, net of Related Debt Unrestricted Total Net Assets $ 63,000 75,500 $138,500 18-21 Chapter 18 - Governmental Entities: Special Funds and Government-Wide Financial Statements E18-8 (continued) c. Augusta MUD Enterprise Fund Statement of Revenue, Expenses, and Changes in Fund Net Assets For Fiscal Year Ended December 31, 20X1 Revenue: Revenue from Services Expenses: Operating Depreciation Supplies Operating Income Nonoperating Expense: Less: Interest on Capital-Related Debt Change in Net Assets Net Assets, January 1 Net Assets, December 31 $413,700 $328,000 32,000 15,200 375,200 $ 38,500 30,000 $ 8,500 130,000 $138,500 [Note that interest expense on capital-related debt is a non-operating expense.] 18-22 Chapter 18 - Governmental Entities: Special Funds and Government-Wide Financial Statements E18-8 (continued) d. Augusta MUD Enterprise Fund Statement of Cash Flows For the Year Ended December 31, 20X1 Cash Flows from Operating Activities: Cash Received from Customers Cash Payments for Goods and Services Cash Paid to Internal Service Fund for Supplies Net Cash Provided by Operating Activities Cash Flows from Noncapital Financing Activities: Cash Received from General Fund for Noncapital Loan Net Cash Provided by Noncapital Financing Activities Cash Flows from Capital and Related Financing Activities: Interest on Capital-Related Debt Extension of Service Lines Net Cash Used for Capital and Related Financing Activities $ 432,000 (325,000) (12,400) $ 94,600 $ 30,000 30,000 $(30,000) (75,000) (105,000) Cash Flows from Investing Activities -0- Net Increase in Cash Cash at Beginning of Year Cash at End of Year $ 19,600 92,000 $111,600 Reconciliation of Operating Income to Net Cash Provided by Operating Activities: Operating Income Adjustments to Reconcile Operating Income to Net Cash Provided by Operating Activities: Depreciation Change in Assets and Liabilities: Decrease in Inventory and Supplies Decrease in net Accounts Receivable Increase in Vouchers Payable Total Adjustments Net Cash Provided by Operating Activities $ 38,500 $ 32,000 2,800 18,300 3,000 56,100 $ 94,600 [Note that interest paid on capital-related debt is reported in cash flows from capital and related financing activities and not in the operating activities.] 18-23 Chapter 18 - Governmental Entities: Special Funds and Government-Wide Financial Statements E18-9 Interfund Transfers and Transactions General Fund 1. a. b. 2. 3. a. June 30, 20X8, Closing entry: Fund Balance – Unassigned Other Financing Uses – Transfer Out to Building Maintenance Fund April 1, 20X8, Financing transaction: Due from Building Maintenance Fund Cash b. Shown on the general fund balance sheet on June 30, 20X8 a. April 15, 20X8, Transfer out: Other Financing Uses – Transfer Out to Debt Service Fund Cash b. 4. March 1, 20X8, Transfer out: Other Financing Uses – Transfer Out to Building Maintenance Fund Cash a. June 30, 20X8, Closing entry: Fund Balance – Unassigned Other Financing Uses – Transfer Out to Debt Service Fund May 5, 20X8, Interfund services provided or used: Expenditures Due to Transportation Service Fund June 30, 20X8, Closing entry: Fund Balance – Unassigned Expenditures 12,000 8,000 8,000 2,400 2,400 2,400 825 825 825 18-24 12,000 12,000 2,400 Due to Transportation Service Fund Cash b. 12,000 825 825 825 Chapter 18 - Governmental Entities: Special Funds and Government-Wide Financial Statements E18-9 (continued) 1. Building Maintenance Internal Service Fund a. b. 2. 12,000 June 30, 20X8, Closing entry: Transfer In from General Fund Net Assets 12,000 12,000 12,000 April 1, 20X8, Financing transaction: Cash Due to General Fund 8,000 8,000 Debt Service Fund a. b. 4. March 1, 20X8, Transfer in: Cash Transfer In from General Fund Building Maintenance Fund a. 3. Other Fund April 15, 20X8, Transfer in: Cash Other Financing Sources – Transfer In from General Fund June 30, 20X8, Closing entry: Other Financing Sources – Transfer In from General Fund Unassigned Fund Balance 2,400 2,400 2,400 2,400 Transportation Service Fund a. May 5, 20X8, Interfund services provided or used: Due from General Fund Revenue from Billings Cash Due from General Fund b. 825 825 June 30, 20X8, Closing entry: Revenue from Billings Net Assets - Unrestricted 825 18-25 825 825 825 Chapter 18 - Governmental Entities: Special Funds and Government-Wide Financial Statements E18-10 Internal Service Fund Entries and Statements a. Entries for 20X2, including closing entries: 1. 2. Inventory of Supplies 96,000 Furniture and Equipment 4,700 Vouchers Payable Record acquisitions of supplies, furniture, and office equipment. Due from Other Funds Billings to Departments Record billings for jobs completed. 292,000 Cash Due from Other Funds Record collections on billings. 287,300 Costs of Printing Jobs Operating Expenses Inventory of Supplies Vouchers Payable Record costs of printing jobs. 204,000 38,000 Depreciation Expense Accumulated Depreciation Record depreciation for period. 23,000 Vouchers Payable Cash Pay approved vouchers. 243,000 100,700 292,000 287,300 92,400 149,600 23,000 243,000 Closing entries: Billings to Departments Costs of Printing Jobs Operating Expenses Depreciation Expense Profit and Loss Summary Close nominal accounts. 292,000 Profit and Loss Summary Net Assets – Unrestricted Close profit and loss summary. 27,000 204,000 38,000 23,000 27,000 27,000 Net Assets – Invested in Capital Assets, Net of Related Debt 18,300 Net Assets - Unrestricted 18,300 Reclassify net assets as of end of period: $18,300 = (ending balance of $191,700 net capital assets less $0 related debt ) less $210,000 beginning balance in net assets invested. 18-26 Chapter 18 - Governmental Entities: Special Funds and Government-Wide Financial Statements E18-10 (continued) b. Bellevue Printing Shop Fund Statement of Net Assets December 31, 20X2 Assets: Cash Due from Other Funds Inventory of Supplies Furniture and Equipment Less: Accumulated Depreciation Total Assets $264,700 (73,000) $ 68,900 20,300 13,400 191,700 $294,300 Liabilities: Vouchers Payable Total Liabilities $ 19,300 $ 19,300 Net Assets: Invested in Capital Assets, Net of Related Debt Unrestricted Total Net Assets $191,700 83,300 $275,000 c. Bellevue Printing Shop Fund Statement of Revenue, Expenses, and Changes in Fund Net Assets For Fiscal Year Ended December 31, 20X2 Revenue: Billings to Departments Expenses: Costs of Printing Jobs Operating Depreciation Income Net Assets, January 1 Net Assets, December 31 $292,000 $204,000 38,000 23,000 18-27 265,000 $ 27,000 248,000 $275,000 Chapter 18 - Governmental Entities: Special Funds and Government-Wide Financial Statements E18-10 (continued) d. Bellevue City Internal Service Fund – Printing Shop Statement of Cash Flows For the Year Ended December 31, 20X2 Cash Flows from Operating Activities: Cash Received from Customers Cash Payments for Printing Jobs Net Cash Provided by Operating Activities $ 287,300 (238,300) Cash Flows from Noncapital Financing Activities Cash Flows from Capital and Related Financing Activities Acquisition of Capital Assets (furniture and copier) Net Cash Used for Capital and Related Financing Activities $49,000 -0- $ (4,700) (4,700) Cash Flows from Investing Activities -0- Net Increase in Cash Cash at Beginning of Year Cash at End of Year $44,300 24,600 $68,900 Reconciliation of Operating Income to Net Cash Provided by Operating Activities: Operating Income $27,000 Adjustments to Reconcile Operating Income to Net Cash Used by Operating Activities: Depreciation Change in Assets and Liabilities: Increase in Due from Other Funds from Billings Increase in Inventory of Supplies Increase in Vouchers Payable Total Adjustments $ 23,000 (4,700) (3,600) 7,300 Net Cash Provided by Operating Activities 22,000 $49,000 18-28 Chapter 18 - Governmental Entities: Special Funds and Government-Wide Financial Statements E18-11 Multiple-Choice Questions on Government-wide Financial Statements 1. c ($1,450,000 - $120,000) 2. a [($1,450,000 - $120,000) - $780,000] 3. b 4. c For the amount of the bond issue proceeds. Note that no repayments of debt were made during the year. 5. c The interest adjustment is from the modified accrual basis ($30,000) to the accrual basis of measurement ($25,000). 6. d 7. c 8. b 9. c 10. b 18-29 Chapter 18 - Governmental Entities: Special Funds and Government-Wide Financial Statements SOLUTIONS TO PROBLEMS P18-12 Adjusting Entries for General Fund [AICPA Adapted] Adjusting entries to correct the general fund: 1. No entry required. 2. Expenditures Buildings Correct for state grant expended for buildings. Expenditures Capital Outlays (equipment) Correct for expenditures for playground equipment. 3. Bonds Payable Buildings Correct for bonds used to construct buildings. Other Financing Uses – Transfer Out to Debt Service Fund Debt Service from Current Funds Correct for transfer to debt service fund. 4. 5. 300,000 22,000 1,000,000 130,000 ENCUMBRANCES BUDGETARY FUND BALANCE – ASSIGNED FOR ENCUMBRANCES Correct for unrecorded encumbrances. 2,800 Expenditures Inventory of Supplies Correct for supplies used in period. 4,950 Fund Balance – Unassigned Fund Balance – Assigned for Inventory Correct for reserve for ending inventory. 6,500 18-30 300,000 22,000 1,000,000 130,000 2,800 4,950 6,500 Chapter 18 - Governmental Entities: Special Funds and Government-Wide Financial Statements P18-13 Entries for Funds [AICPA Adapted] Fund Journal Entries 1. General Fund ESTIMATED REVENUES CONTROL 400,000 APPROPRIATIONS CONTROL BUDGETARY FUND BALANCE – UNASSIGNED 394,000 6,000 2. General Fund Taxes Receivable – Current Revenue – Taxes Allowance for Uncollectibles – Current 382,200 7,800 3. PrivatePurpose Trust Fund Investments Contributions 50,000 Cash Additions – Interest 4. 5. 6. General 390,000 5,500 Other Financing Uses – Transfer Out to Internal Service Fund Cash Internal Service Fund Cash Transfer In from General Fund Capital Projects Cash Other Financing Sources – Bond Issue 5,000 5,000 72,000 Due from General Fund Other Financing Sources – Transfer In from General Fund 3,000 Debt Service Fund Special Assessments Receivable Revenue – Special Assessments 24,000 General Other Financing Uses – Transfer Out to Capital Projects Fund Due to Capital Projects Fund 5,500 5,000 5,000 72,000 3,000 3,000 General Fund Due to Capital Projects Fund Cash 3,000 Capital Projects Fund Cash Due from General Fund 3,000 Debt Service Fund Cash Special Assessments Receivable 18-31 50,000 24,000 24,000 3,000 3,000 3,000 24,000 Chapter 18 - Governmental Entities: Special Funds and Government-Wide Financial Statements P18-13 (continued) Fund 7. Capital Projects Fund Journal Entries ENCUMBRANCES 75,000 BUDGETARY FUND BALANCE – ASSIGNED FOR ENCUMBRANCES 75,000 BUDGETARY FUND BALANCE – ASSIGNED FOR ENCUMBRANCES ENCUMBRANCES 75,000 75,000 Expenditures Contracts Payable 75,000 Contracts Payable Cash 75,000 8. Internal Service Fund Inventory of Supplies Cash (or Vouchers Payable) 9. General Fund Cash Taxes Receivable – Current Revenue – Licenses and Fees Allowance for Uncollectibles – Current Revenue – Taxes Estimate Actual Correction 1,900 393,000 3,800 75,000 75,000 1,900 386,000 7,000 3,800 $7,800 (4,000) $3,800 10. Capital Projects Fund Cash Other Financing Sources – Bond Issue 11. General Fund BUDGETARY FUND BALANCE – ASSIGNED FOR ENCUMBRANCES ENCUMBRANCES Expenditures Cash 500,000 15,000 15,000 18-32 500,000 15,000 15,000 Chapter 18 - Governmental Entities: Special Funds and Government-Wide Financial Statements P18-14 Entries to Adjust Account Balances [AICPA Adapted] a. General Fund Adjusting entries: 1. Allowance for Uncollectibles – Delinquent 2,200 Fund Balance – Unassigned 2,200 Reduce estimated losses on prior year's taxes to amount of receivables of $8,000. 2. Revenue 27,000 Donated Land 27,000 Remove accounts belonging only in the government-wide financial statements. 3. Fund Balance – Unassigned Fund Balance – Assigned for Encumbrances – 20X0 Record purchase orders outstanding on June 30, 20X0. 8,800 8,800 Expenditures – 20X0 8,800 Other Expenditures 8,800 Reclassify purchases of supplies chargeable to prior year's appropriations. Excess of $600 actual cost over estimate is approved and charged to current year expenditures. 4. ENCUMBRANCES 2,100 BUDGETARY FUND BALANCE – ASSIGNED FOR ENCUMBRANCES 2,100 Record encumbering of appropriations for purchase orders outstanding on June 30, 20X1. 5. Special Assessment Bonds Payable 100,000 Due to Capital Projects Fund 100,000 Record liability to capital projects fund for cash obtained from sale of special assessment bonds. 6. Revenue 21,000 Tax Anticipation Notes Payable 20,000 Due to Water Utility Fund 1,000 Record tax anticipation notes payable and liability to water utility fund for funds obtained from sale of scrap. 18-33 Chapter 18 - Governmental Entities: Special Funds and Government-Wide Financial Statements P18-14 (continued) Closing entries: APPROPRIATIONS CONTROL ESTIMATED REVENUES CONTROL BUDGETARY FUND BALANCE – UNASSIGNED BUDGETARY FUND BALANCE – ASSIGNED FOR ENCUMBRANCES ENCUMBRANCES 2,100 Fund Balance – Unassigned Fund Balance – Assigned for Encumbrances 2,100 Revenue Fund Balance – Unassigned Other Expenditures Expenditures – Building Addition Constructed Expenditures – Serial Bonds Paid 306,000 31,200 Fund Balance – Assigned for Encumbrances – 20X0 Expenditures – 20X0 b. 348,000 8,800 310,000 38,000 2,100 2,100 271,200 50,000 16,000 8,800 Adjusting Journal Entries: Capital Projects Fund: 5. Due from General Fund 100,000 Other Financing Sources – Bond Issue 100,000 Record receivable due from general fund for proceeds of sale of bonds. Water Utility Fund: 6. Due from General Fund 1,000 Revenue – Miscellaneous 1,000 Record receivable from general fund for cash obtained from sale of scrap. 18-34 Chapter 18 - Governmental Entities: Special Funds and Government-Wide Financial Statements P18-15 Capital Projects Fund Entries and Statements a. Journal entries: 1. CPF Cash Other Financing Sources – Bond Issue Other Financing Sources – Bond Premium Other Financing Uses – Transfer Out to Debt Service Fund Cash 2. 5,080,000 80,000 DSF Cash Other Financing Sources – Transfer In from Capital Projects Fund 80,000 CPF Expenditures Vouchers Payable 45,000 Vouchers Payable Cash 5,000,000 80,000 80,000 80,000 45,000 45,000 45,000 (Note: It is not necessary to first establish, and then immediately reverse an encumbrance account.) 3. 4. CPF ENCUMBRANCES 4,500,000 BUDGETARY FUND BALANCE – ASSIGNED FOR ENCUMBRANCES 4,500,000 CPF BUDGETARY FUND BALANCE – ASSIGNED FOR ENCUMBRANCES ENCUMBRANCES 2,000,000 Expenditures Contracts Payable Contracts Payable – Retained Percentage CPF Contracts Payable Cash 2,000,000 2,000,000 1,800,000 1,800,000 200,000 1,800,000 Closing entries for Capital Projects Fund: Other Financing Sources – Bond Issue Other Financing Sources – Bond Premium Expenditures Other Financing Uses – Transfer Out to Debt Service Fund Fund Balance – Unassigned BUDGETARY FUND BALANCE – ASSIGNED FOR ENCUMBRANCES ENCUMBRANCES 18-35 5,000,000 80,000 2,045,000 80,000 2,955,000 2,500,000 2,500,000 Chapter 18 - Governmental Entities: Special Funds and Government-Wide Financial Statements P18-15 (continued) Fund Balance – Unassigned Fund Balance – Assigned for Encumbrances b. 2,500,000 2,500,000 West City Capital Projects Fund Balance Sheet June 30, 20X3 Cash Total Assets Assets $ 3,155,000 $ 3,155,000 Liabilities and Fund Balance Contracts Payable – Retained Percentage Fund Balance: Spendable: Assigned to: General Government Services Unassigned Total Liabilities and Fund Balance c. $ $2,500,000 455,000 200,000 2,955,000 $ 3,155,000 West City Capital Projects Fund Statement of Revenues, Expenditures, and Changes in Fund Balance For Fiscal Year Ended June 30, 20X3 Expenditures: Capital Outlays: Building Removal Building Construction Total Expenditures Deficiency of Revenues over Expenditures Other Financing Sources (Uses): Proceeds of Serial Bonds Transfer Out to Debt Service Fund Total Other Financing Sources (Uses) Net Change in Fund Balance Fund Balance, July 1, 20X2 Fund Balance, June 30, 20X3 18-36 $ 45,000 2,000,000 $ 2,045,000 $(2,045,000) 5,080,000 (80,000) $ 5,000,000 $ 2,955,000 -0$ 2,955,000 Chapter 18 - Governmental Entities: Special Funds and Government-Wide Financial Statements P18-16 Recording Entries in Various Funds [AICPA Adapted] 1. Entries made in the capital projects fund for 20X8: Cash Other Financing Sources – Bond Issue Issued $800,000 of bonds at their face value. 800,000 ENCUMBRANCES BUDGETARY FUND BALANCE – ASSIGNED FOR ENCUMBRANCES Contractor’s bid is accepted. 750,000 BUDGETARY FUND BALANCE – ASSIGNED FOR ENCUMBRANCES ENCUMBRANCES One-third of the project was completed during 20X8. Expenditures Contracts Payable Actual construction cost incurred in 20X8. 2. 800,000 750,000 250,000 246,000 250,000 246,000 Entries made in the special revenue fund for 20X8: ESTIMATED REVENUES CONTROL APPROPRIATIONS CONTROL BUDGETARY FUND BALANCE – UNASSIGNED Record the budget for 20X8. 112,000 Cash Revenues Collected hotel room taxes. 109,000 108,000 4,000 109,000 Expenditures 103,000 Vouchers Payable Incurred expenditures for general promotion and motor vehicle. 103,000 Vouchers Payable Cash Paid expenditures. 103,000 103,000 18-37 Chapter 18 - Governmental Entities: Special Funds and Government-Wide Financial Statements P18-16 (continued) 3. Entry made in the general fund for 20X8: Other Financing Uses – Transfer Out to Debt Service Fund Cash Record transfer of resources to debt service fund. 313,500 313,500 Entries made in the debt service fund for 20X8: Cash Other Financing Sources – Transfer In from General Fund Record transfer of resources from general fund. 4. 313,500 313,500 Expenditures – Interest Matured Interest Payable Record interest legally due and payable. 13,500 Expenditures – Principal Matured Bonds Payable Record principal legally due and payable. 300,000 Matured Bonds Payable Matured Interest Payable Cash Record payment of matured bonds and interest. 300,000 13,500 13,500 300,000 313,500 Closing entries in the general fund for 20X8: BUDGETARY FUND BALANCE – ASSIGNED FOR ENCUMBRANCES ENCUMBRANCES Close outstanding encumbrances at year-end. 83,000 83,000 Fund Balance – Unassigned 83,000 Fund Balance – Assigned for Encumbrances 83,000 Reserve actual fund balance for encumbrances expected to be honored in 20X9. 5. Adjusting entry in the general fund for 20X8: Fund Balance – Assigned for Inventories 3,000 Inventory of Supplies Adjust inventory of supplies to balance at December 31, 20X8. 18-38 3,000 Chapter 18 - Governmental Entities: Special Funds and Government-Wide Financial Statements P18-17 Matching Questions Involving Various Funds 1. L 2. C 3. R 4. M 5. I 6. G 7. Q 8. A 9. O 10. F 18-39 Chapter 18 - Governmental Entities: Special Funds and Government-Wide Financial Statements P18-18 Questions on Fund Transactions [AICPA Adapted] 1. $104,500 (Stated in item #3.) 2. $17,000 (Stated in item #4.) 3. $125,000 (Item #5 states that $83,000 is assigned for encumbrances. To this is added the $42,000 reserve for the ending inventory.) 4. $236,000 (Item #1 states that $600,000 of bond proceeds were received in the capital project fund, less $364,000 of construction expenditures in the period.) 5. $6,000 (Item #2 states that $109,000 tax revenues were received from which $81,000 and $22,000 was expended.) 6. $104,500 (Stated in item #3.) 7. $386,000 (Item #1 states construction expenditures of $364,000 plus item #2 states a motor vehicle purchase of $22,000.) 8. $100,000 (Item #3 states a reduction in long-term debt principal of $100,000.) 9. $181,000 (Item #6 states that $181,000 was used to purchase supplies during the period.) 10. $190,000 (Item #6 states encumbrances of $190,000.) 18-40 Chapter 18 - Governmental Entities: Special Funds and Government-Wide Financial Statements P18-19 1. C 2. A 3. C 4. A 5. E 6. A 7. C 8. B 9. B 10. C 11. A 12. E 13. D 14. D 15. C Matching Questions Involving the Statement of Cash Flows for a Proprietary Fund 18-41 Chapter 18 - Governmental Entities: Special Funds and Government-Wide Financial Statements P18-20 1. C 2. D 3. C 4. C 5. B 6. A 7. C 8. D 9. A 10. C 11. B 12. B 13. D Matching Questions Involving the Statement of Revenues, Expenditures, and Changes in Fund Balance for a Capital Projects Fund and a Debt Service Fund 18-42 Chapter 18 - Governmental Entities: Special Funds and Government-Wide Financial Statements P18-21 Question on Fund Transactions [AICPA Adapted] a. 1. G 2. K 3. L 4. L 5. E 6. J 7. D 8. A 9. F 10. B 11. B and J 12. F and J 13. C and J 14. J 15. B and J 16. G and J 17. A 18. D 19. I and J 20. H and J b. 18-43 Chapter 18 - Governmental Entities: Special Funds and Government-Wide Financial Statements P18-22 Major Fund Tests Step 1: 10 percent criterion tests Denominators for 10 percent tests are the total of each of the four items for that fund type (for governmental and then for enterprise) 10 percent criterion tests: Governmental fund type: Percent of: Assets $2,112,400 Liabilities $951,300 Revenues $5,790,000 2.00% 3.99% 1.68% 0.00% 0.00% 5.65% 7.94% 0.71% 5.72% 0.19% Assets $3,996,000 Liabilities $2,900,700 Revenues $618,000 66.07%* 33.93%* 62.08%* 37.92%* 46.76%* 53.24%* General fund – is always a major fund Special Revenue 1.28%(a) Capital Project – Library 21.30%* Capital Project – Arena 1.33% Debt Service 1.94% Permanent 11.65%* Enterprise fund type: Percent of: Enterprise – Electric Enterprise – Water (a) 1.28% = $27,000 / $2,112,400 * Meets the 10 percent criterion test 18-44 Expenditures $5,659,800 5.80% 7.39% 0.99% 5.12% 0.32% Expenses $543,000 45.12%* 54.88%* Chapter 18 - Governmental Entities: Special Funds and Government-Wide Financial Statements P18-22 (continued) Step 2: 5 percent criterion tests The 5 percent criterion test is applied only to those funds that met the 10 percent criterion test. (For each of the four 5 percent tests, the denominator is the combined amount of that item from the governmental funds plus the enterprise funds.) Computation of denominators for 5 percent governmental and enterprise fund types: Revenue Expenditures/ Assets Liabilities s Expenses Governmental fund types $2,112,400 $ 951,300 $5,790,000 $5,659,800 Enterprise fund types 3,996,000 2,900,700 618,000 543,000 Combined $6,108,400 $3,852,000 $6,408,000 $6,202,800 5 percent criterion tests: Percent of combined amount of: Governmental fund type: General fund – is always a major fund Capital Project – Library Permanent Enterprise type funds: Enterprise – Electric Enterprise – Water Assets Liabilities Revenues $6,108,400 $3,852,000 $6,408,000 7.37%(a)** 4.03% 43.22%** 22.20%** Expenditures/ Expenses $6,202,800 0.99% 0.00% 7.18%** 0.17% 6.74%** 0.29% 46.75%** 28.56%** 4.51% 5.13%** 3.95% 4.80% (a) 7.37% = $450,000 / $6,108,400 ** Meets the 5 percent criterion test To be a major fund, an individual fund must meet both the 10 percent and the 5 percent major fund criteria in at least one financial statement item. Each major fund is presented in a separate column on the fund-based financial statements presented as part of the comprehensive annual financial report for the governmental entity. (1) General fund – is always a major fund (2) Capital Projects – Library fund – assets (both 10% and 5% criterion tests) (3) Enterprise – Electric – assets and liabilities (both 10% and 5% criterion tests) (4) Enterprise – Water – assets, liabilities, revenues (both 10% and 5% criterion tests) The other governmental funds must be aggregated and reported in a single column in the governmental funds balance sheet and statement of revenues, expenditures, and changes in fund balance. 18-45 Chapter 18 - Governmental Entities: Special Funds and Government-Wide Financial Statements P18-23 Reconciliation Schedules a. Reconciliation of the Balance Sheet of the Governmental Funds to the Statement of Net Assets: City of Sycamore Reconciliation of the Balance Sheet of Governmental Funds to the Statement of Net Assets Fund balances reported in the governmental funds Amounts reported for the governmental activities in the statement of net assets are different because: Capital assets used in governmental activities are not financial resources and therefore are not reported in the governmental funds. The internal service fund reported $18,000 in capital assets. Thus, the amount of the adjustment Is for the capital assets not reported in just the governmental funds, ($4,311,000 = $4,329,000 - $18,000) Internal service funds are used by management to charge costs of certain activities. The assets and liabilities of the internal service fund and are Included in governmental activities In the statement of net assets. Long-term liabilities, including bonds payable, are not due and payable in the current period and therefore are not reported as liabilities in the governmental funds. Interest in the governmental funds is recognized under the modified accrual basis, but under the accrual basis for the government-wide financial statements. Net assets are adjusted for interest ($5,000 = $6,000 - $1,000). Net assets of governmental activities 18-46 $ 888,400 4,311,000 37,000 (460,000) (5,000) $4,771,400 Chapter 18 - Governmental Entities: Special Funds and Government-Wide Financial Statements P18-23 (continued) b. Reconciliation of the Statement of Revenues, Expenditures, and Changes in Fund Balances of Governmental Funds to the Statement of Activities: City of Sycamore Reconciliation of the Statement of Revenues, Expenditures, and Changes in Fund Balances of Governmental Funds to the Statement of Activities Net change in fund balances – governmental funds Governmental funds report capital outlays as expenditures. However, in the statement of activities, the costs of those assets is capitalized and depreciated over their estimated useful lives. This is the amount by which capital outlays in the governmental funds ($287,000) exceeded depreciation of the governmental assets ($187,000) Bond proceeds provide current financial resources for the governmental funds. However, the issuance of debt increases long-term liabilities in the statement of net assets. Bond proceeds of $460,000 are not reduced because there is no repayment of principal during the year. Revenues and expenses in the statement of activities are recorded on the accrual basis. Interest in the governmental funds is recorded on the modified accrual basis. Accrual interest revenue exceeded modified accrual interest revenue recognized in the governmental funds by $1,000. Accrual interest expense exceeded modified accrual interest expense by $6,000 ($46,000 - $40,000). The net interest adjustment is $5,000. Internal service funds are used by management to charge the costs of certain services. The net revenue (expense) of the internal service funds is reported with governmental activities. Change in net assets of governmental activities 18-47 $509,400 100,000 (460,000) (5,000) 9,000 $153,400 Chapter 18 - Governmental Entities: Special Funds and Government-Wide Financial Statements P18-24 True/False Questions 1. F The budgetary comparison schedule requires both the initial budget and the final budget. 2. T 3. F A component unit is financially accountable to the primary government. 4. F The net assets in the government-wide statement of net assets would be categorized by: invested in capital assets, net of related debt; restricted by outside donors in specific funds; and, unrestricted. 5. F The tests for a major governmental, or enterprise fund, for which separate disclosure is required in the government-wide financial statements are: (a) total assets, liabilities, revenues, or expenditures/expenses of that individual governmental or enterprise fund are at least 10 percent or more of the governmental or enterprise category, and (b) total assets, liabilities, revenues, or expenditures/expenses of the individual governmental or enterprise fund are at least 5 percent of the total for all governmental and enterprise funds combined. 6. T 7. T 8. F 9. T 10. F 11. T 12. F Depreciation on fixed assets of a government entity may be computed by any method deemed appropriate, such as straight-line or an accelerated method, but depreciation of fixed assets is not equal to the expenditures for fixed assets made in the governmental funds. 13. F Management’s Discussion and Analysis is a required supplementary information disclosure in the new government reporting model. 14. F Fiduciary funds are not part of the government-wide statement of net assets, but would be separately reported in the fiduciary funds section of the fundbased financial statements. 15. T The internal service fund is blended into the governmental activities columns of the government-wide financial statement of net assets and statement of activities. In the reconciliation schedule for the statement of revenues, expenditures, and changes in fund balances, bond proceeds would be subtracted because they were included as other financing sources in the governmental funds, but are an addition to liabilities in the government-wide financial statements. 18-48 Chapter 18 - Governmental Entities: Special Funds and Government-Wide Financial Statements 11P18-25 Determining Whether a Special Revenue Fund Is a Major Fund 1. 2. 3. 4. Test 1: 10% criterion: Are the assets, liabilities, revenues, or expenditures of the special revenue fund at least 10% of their respective totals for all governmental funds? Totals for Amount Reported by Items Tested Governmental Funds Special Revenue Fund Assets $50,000,000 $4,100,000 ( 8.2%) (10% test failed) Liabilities 22,000,000 3,900,000 (17.7%) (10% test met) Revenues 70,000,000 6,700,000 ( 9.6%) (10% test failed) Expenditures 60,000,000 6,500,000 (10.8%) (10% test met) Test 2: 5% criterion: Two items met the 10% criterion test--liabilities and expenditures. The 5% criterion test is met if at least one of the items that met the 10% criterion first test is at least 5% of the respective amounts for all governmental and enterprise funds. 2. 4. Items Tested Liabilities (5% test met) Expenditures/expenses (5% test met) Totals for Governmental and Enterprise Funds $37,000,000 Amount reported by Special Revenue Fund $3,900,000 (10.5%) 82,000,000 6,500,000 ( 7.9%) Conclusion: The special revenue fund should be reported as a major fund on the financial statements of the governmental funds for 20X2 because both its expenditures and liabilities met the 10% and the 5% tests. 18-49 Chapter 18 - Governmental Entities: Special Funds and Government-Wide Financial Statements P18-26 Preparation of a Statement of Net Assets for a Governmental Entity Gibson City Statement of Net Assets December 31, 20X2 Assets Cash and cash equivalents Taxes receivable (net) Accounts receivable (net) Internal balances Inventories Investments Capital assets: Land Infrastructure Other depreciable assets (net) Total assets Liabilities Vouchers payable Accrued interest payable Revenue bonds payable General obligation bonds payable Total liabilities Net assets Invested in capital assets, net of related debt Restricted Unrestricted Total net assets Governmental Activities Business-type Activities $ 68,000 52,000 $ 28,000 12,000 5,000 7,000 15,000 (5,000) 10,000 25,000 100,000 60,000 75,000 $385,000 $ 32,000 1,500 50,000 45,000 $162,000 $ 4,000 2,000 80,000 Total $ 96,000 52,000 12,000 17,000 40,000 150,000 60,000 120,000 $547,000 60,000 $ 93,500 $ 86,000 $ 36,000 3,500 80,000 60,000 $179,500 $175,000* 55,000 61,500*** $291,500 $ 15,000** 5,000 56,000*** $ 76,000 $190,000 60,000 117,500 $367,500 Computation notes: * $235,000 of capital assets (net) minus $60,000 of general obligation bonds equals $175,000. ** $95,000 of capital assets minus $80,000 of revenue bonds equals $15,000. *** The unrestricted net assets amount is plugged in to make the total net assets equal assets minus liabilities. The internal balances amount of $5,000 is the amount that the governmental activities owe to business-type activities. 18-50