Data Security Standard

advertisement

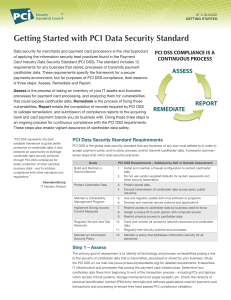

Data Security Standard • What Is PCI ? • Who Does It Apply To ? • Who Is Involved With the Compliance Process ? • How We Can Stay Compliant ? PCI (Payment Card Industry)Standards Council Responsible for the development, management, education, and awareness of the PCI Security Standards, including the Data Security Standard (PCI DSS) requirements. • • • • Manage risk associated with credit card activity Protect card data Avoid Punitive measures/damages Minimize cost for non-compliance Standard applies to: - Merchants (Departments) - Service Providers (3rd Party, Gateways) Applies if you: - Store Cardholder Data - Transmit Cardholder Data - Process Cardholder Data Applies to: - Electronic Transactions - Paper Transactions Complete the PCI Self- Assessment Questionnaire (SAQ) Ensures Cardholder Data Is protected - Encrypt Transmission of data Implements Strong Access Controls - Restrict physical access to data Maintain Security Policy - Policy that addresses information security for all personnel UT Merchants and Usage - UT has over 125 merchants University Wide - Over 960,000 transactions - $165 Million in revenue Potential Fee Assessments $500,000 per data security incident $50,000 per day for non-compliance with PCI Liability for all fraud losses incurred from compromised account numbers Liability for the cost of re-issuing cards associated with a compromise of data Suspension of Merchant Account • UT System Administration (UTSA) – Information Security Office • I.T. (System & Campus) • Chief Business Office (CBO) • Treasurer’s Office • Merchant (Departments) UTSA (University of TN System Administration) Information Security Office - Consulting, guidance, and oversight related to PCI compliance and IT Security controls - Review technical implementations related to PCI - Incident response coordination - Quarterly security scan coordination - Validate SAQs annually IT Position of Authority - Provide compliance support & consulting - Identify & review systems in PCI scope - Provide technical guidance - Ensure a segmented cardholder data environment exists Chief Business Officer - Approve the business need for Merchant ID’s - Attest to SAQ (signature of CBO) - Monitor PCI compliance Treasurer’s Office - Oversee credit card accounting for approved merchant - Manage the Merchant ID approval process - Maintain the relationship with the University’s credit card processor Merchant (Departments) - Complete SAQ annually - Have internal procedures in place - Update terminal software every 18 months - Notify UTSA in the event of a data breach - Financially responsible for cost associated with compliance (Fees, fines, remediation) All completed forms due in Bursar’s by the close of th business, April, 15 , 2014 • Byron Porter 448-4847 bporter3@uthsc.edu • Nadia Hussey 448-2914 njoneshu@uthsc.edu Bursar’s Office Hyman Building 62 S. Dunlap Rm. 103