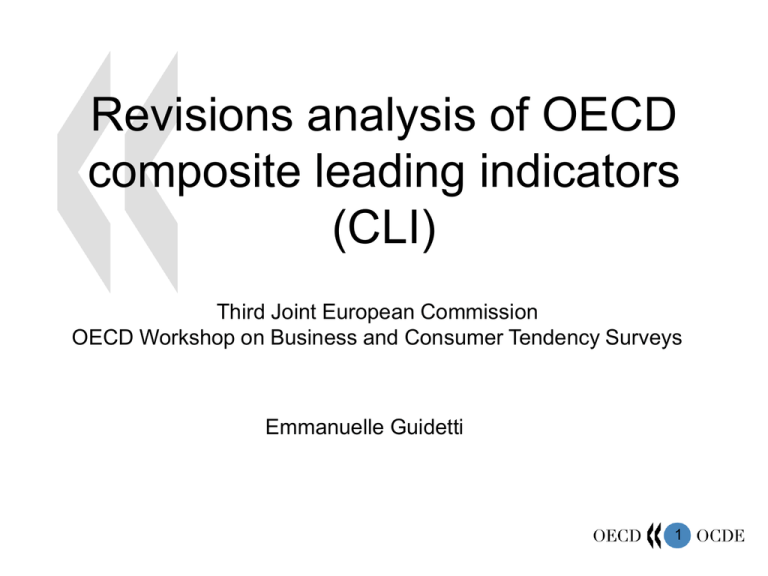

Revisions analysis of OECD composite leading indicators (CLI)

advertisement

Revisions analysis of OECD composite leading indicators (CLI) Third Joint European Commission OECD Workshop on Business and Consumer Tendency Surveys Emmanuelle Guidetti 1 Introduction A leading indicator is a statistic that signals the movements, up and down, of future economic activity before they occur, and it may also give some indication of the magnitude of those movements. What is the purpose of the OECD CLI? How is the OECD CLI constructed? What is the current period performance of the CLI? 2 What is the purpose of the OECD CLI? OECD area Composite Leading Indicator (CLI) and economic activity (long-term average = 1) 1.08 1.06 1.04 1.02 1 0.98 0.96 0.94 Apr-07 Jan-07 Oct-06 Jul-06 Apr-06 Jan-06 Oct-05 Jul-05 Apr-05 Jan-05 Oct-04 Jul-04 Apr-04 Jan-04 Oct-03 Jul-03 Apr-03 Jan-03 Oct-02 Jul-02 Apr-02 Jan-02 Oct-01 Jul-01 Apr-01 Jan-01 Oct-00 Jul-00 Apr-00 Jan-00 Jul-99 Oct-99 Apr-99 Jan-99 0.92 OECD economic activity above the long-term average OECD economic activity below the long-term average OECD CLI 3 How is the OECD CLI constructed? Selection of Reference series Selection of components series Weighting PAT box (de-trending the series) Normalisation (cyclical amplitude homogenised) Periodicity Transformation (monthly basis) Smoothing (reduce irregularity) Presentation of CLI Aggregation into a single indicator (the minimum % of component series required is 60%) - Amplitude adjustment (refers to the deviation from the long-term trend of the series and focuses on the cyclical behaviour of the indicator) - Trend restoration (gives information about the likely rate and amplitude of changes) - Six months rate of change (is less volatile and provides earlier and clearer signals for future turning points than the CLI itself.) 4 What is the current performance of the CLI? The aim of the current analysis on CLIs is to evaluate the quality of the indicator when they are first released in order to: • identify areas where their reliability could be improved • provide further information to users on their use for economic analyses. 5 Why do we have revisions? • Timeliness/availability • Frequency • Smoothness • Other factors 6 1st and 2nd Euro area G7 OECD area United Kingdom Switzerland Sweden Spain Portugal Norway Netherlands Italy Ireland Greece Germany France Finland Denmark Belgium Austria Japan Australia United States Mexico Canada Size of revisions Revision: Rt=Lt-Pt Mean Absolute Revision to first estimates of Year-on-Year growth rates from Dec98 (Aug00) to Aug06 2.0 1.5 1.0 0.5 0.0 2nd and 3rd 7 Size of revisions over time Mean Absolute Revision between 1st estimate and those published one month later for the entire period and two sub-period Dec98/Aug00 to Sep02 Oct02 to Aug06 Euro area G7 OECD area United Kingdom Switzerland Sweden Spain Portugal Norway Netherlands Italy Ireland Greece Germany France 0.0 Finland 0.0 Denmark 0.5 Belgium 0.5 Austria 1.0 Japan 1.0 Australia 1.5 United States 1.5 Mexico 2.0 Canada 2.0 Dec98/Aug00 to Aug06 8 Assessment of bias Mean revision between 1st estimate and those published one month and between 2nd and 3rd releases for year-on-year growth rate over the entire period 0.2 0.0 -0.2 -0.4 -0.6 -0.8 -1.0 1st and 2nd estimates Euro area G7 OECD area United Kingdom Switzerland Sweden Spain Portugal Norway Netherlands Italy Ireland Greece Germany France Finland Denmark Belgium Austria Japan Australia United States Mexico Canada -1.2 2nd and 3rd estimates 9 Reliability of 1st estimate as a signal of shortterm expansion or slowdown in economic activity First measure is the sign of the movements around 90% of the time, for almost of the countries, the sign of the initial estimates of year-on-year growth rates are the same as those published one month later. This ratio becomes 95% while talking about zone aggregates. Second measure is the acceleration/deceleration test Around 80% of the time, for around 40% of the countries, the first estimate of year-on-year growth rates signals no difference in direction with the 2nd estimates. This ratio becomes almost 90% while talking about zone aggregates. 10 Reliability of 1st estimate to provide early signals of turning points in economic activity Chart to compare earlier (P) and later (M1) estimates OECD area Chart to compare earlier (P) and later (M1) estimates Euro area First published estimate (P) Estimate published 1 month later (L) Aug/06 Feb/06 Aug/05 Feb/05 Aug/04 Feb/04 Aug/03 Feb/03 Aug/02 Feb/02 Aug/01 Feb/01 Aug/06 Feb/06 Aug/05 Feb/05 Aug/04 Feb/04 -8 Aug/03 -8 Feb/03 -4 Aug/02 -4 Feb/02 0 Aug/01 0 Feb/01 4 Aug/00 4 Aug/00 8 8 First published estimate (P) Estimate published 1 month later (L) 11 Reliability of 1st estimate to provide early signals of turning points in economic activity Chart to compare earlier (P) and later (M1) estimates Mexico Chart to compare earlier (P) and later (M1) estimates United States 16 15 12 10 8 5 4 0 0 -5 -4 Aug/00 Dec/00 Apr/01 Aug/01 Dec/01 Apr/02 Aug/02 Dec/02 Apr/03 Aug/03 Dec/03 Apr/04 Aug/04 Dec/04 Apr/05 Aug/05 Dec/05 Apr/06 Jun/06 Chart to compare earlier (P) and later (M1) estimates Japan First published estimate (P) Estimate published 1 month later (L) First published estimate (P) Estimate published 1 month later (L) Jun/05 First published estimate (P) Estimate published 1 month later (L) Dec/05 Dec/04 Jun/04 Dec/03 Jun/03 Jun/02 Dec/02 Dec/01 Jun/01 Dec/00 Jun/00 Dec/99 Dec/98 10 8 6 4 2 0 -2 -4 -6 Jun/99 Jun/05 Dec/05 Jun/04 Dec/04 Dec/03 Jun/03 Dec/02 Jun/02 Dec/01 Jun/01 Dec/00 Jun/00 Jun/99 Dec/99 Dec/98 -10 12 Conclusion 1st releases of CLI are revised frequently but the size is rather small for most countries and negligible for aggregates. No evidence of bias Improvement in the reliability of the 2nd estimates 1st and 2nd estimates of year-on-year growth rates give reliable signals of approaching cyclical turning points It is not enough to have timely components they also need to be smooth to guarantee small revisions. This further reinforces the argument that smoothness is probably the most important factor explaining revisions to the OECD CLI. 13 Investigation on the importance of smoothness of the component series in the size of revisions of CLI Survey components Financial components Other components Smoothness MCD Smoothness MCD Smoothness MCD Response Rate of Surveys data Total components 1 Canada Mexico United States 8 7 7 Australia Japan 7 7 Austria Belgium Denmark Finland France Germany Ireland Italy Netherlands Norway Portugal Spain Sweden Turkey United Kingdom 6 6 8 9 10 6 8 6 6 7 6 5 9 7 7 2 Total 142 3 2 3 3 4 1 1 5 1 2 1 2 1 1 3 1 1 2 3 2 1 13 4 5 1 1 1 1 2 1 2 1 1 1 1 1 2 2 36 3 1 4 2 65% 62% 1 2 60% 98% 1 1 2 2 1 1 1 1 3 1 1 1 1 2 1 1 1 2 1 1 1 1 1 1 1 1 1 1 6 1 1 2 10 3 17 11 0 0 2 6 11 2 56% 96% 90% 85% 77% 89% 45% 97% 80% 80% 78% 55% 77% 1 47% 1 1 1 1 1 2 1 1 Consumer 5 1 2 2 3 2 2 4 3 3 2 1 1 3 2 3 1 1 2 1 3 3 1 1 2 Manufacturing 10 71% 100% 63% 70% 70% 100% 57% 100% 70% 85% 33% 100% 14 14 Investigation on the importance of smoothness of the component series in the size of revisions of CLI Business or consumer tendency component with MCD of 4 or 5 or 6 Mexico Finished goods stocks: tendency Production: tendency Belgium Production: tendency Export order inflow: tendency Denmark Consumer confidence Finland Production: tendency Germany Order inflow: tendency Ireland Finished goods stocks : level Employment: tendency Order books: level Consumer confidence Netherlands Production: future tendency Order inflow: tendency Spain Order books/demand: tendency Turkey Prospects for exports United Kingdom Consumer confidence 15 Investigation on the importance of smoothness of the component series in the size of revisions of CLI The correlation coefficient between smoothness and mean absolute revision of first estimates of the CLIs is rather good and equals to 0.54. The link is even stronger for second estimates of the CLIs with an extremely high correlation coefficient of 0.82. The general pattern seems to be: the higher the MCD value the higher the mean absolute revision. 16 Investigation on the importance of smoothness of the component series in the size of revisions of CLI The revision analysis on Irish CLI components shows the following: 0.70 M2-M1 R2=0.89 Mean Absolute Revision Share prices 0.60 Spread of Interest M1-P Consumer indicator Employment Finished goods stocks 0.80 0.70 0.60 0.50 0.40 0.30 0.20 0.10 0.00 Order books Mean Absolute Revision 0.50 0.40 0.30 0.20 0.10 0.00 0 1 2 3 4 5 6 MCD 17 Investigation on the importance of smoothness of the component series in the size of revisions of CLI The revision analysis on German CLI components is: 0.40 R2=0. 94 Mean Absolute Revision Mean Absolute Revision 0.35 0.30 0.25 0.20 0.15 0.10 0.05 0.30 0.20 0.10 M2-M1 Spread of Interest Export Order Books Finished goods stocks M1-P Orders inflow Business climate indicator 0.00 0.00 0 1 2 3 4 5 6 MCD 18 Investigation on the importance of smoothness of the component series in the size of revisions of CLI If we plot together Irish and German results we can get the following graph: 0.70 Mean Absolute Revision 0.60 R2=0. 85 0.50 0.40 0.30 0.20 0.10 0.00 0 1 2 3 MCD 4 5 6 19 END 20