Insolvency Reform - A Chinese Taipei Perspective Sherri CHUANG Ministry of Finance

advertisement

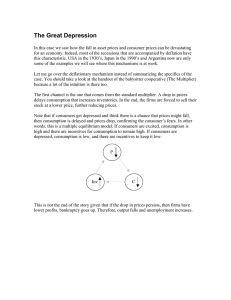

Insolvency Reform A Chinese Taipei Perspective Sherri CHUANG Ministry of Finance Chinese Taipei Current Banking NPL Problem NPL ratio Fist NPL bulk sale to AMC 15.0 AMC mechanism established 12500 The rate of deposit reserve & business tax decreased to write off NPL 10,747 10,211 10,073 10000 8,833 7,303 7.5 6.8 5,105 5.0 5.7 3,515 7500 8.2 5,865 6.2 6.4 5000 4.9 4.2 2.5 15000 13,274 12.5 10.0 NPL amount 4.2 2500 3.0 0.0 0 1995 1996 1997 1998 1999 2000 2001 2002 2003II MOF Efforts • Target: NPL Ratio < 5% • Actions – Requiring write off NPLs – Providing the incentive – Facilitating AMC mechanism • US $9 billion NPL sold to AMC till Oct 2003 • Issue:latest NPL ratio of 6.4% is still high compared to healthy counterparts Development of Informal Workouts • Current Moratoriums Between Banking Creditors & Debtors • MOF involved from 1998 till 2001 • Negotiation mechanism under the Bankers Association after Nov 2001 • Planning to include AMC into the mechanism • Drafting Rescue Law • • • • Firm’s value evaluated by appraisal committee Joint management by creditor banks Obligations by the firm in financial difficulty Termination of workouts • Developing Turnaround Fund by Joint-venturing with Executive Yuan Development Fund ( the Fund) • Broadening the investment scope of the Fund to venture capital firms which focus on turning around companies • Raising the ceiling of investment of the Fund Current Judicial Reform on Bankruptcy • Draft Amendments to the Bankruptcy Law – Connection of liquidation and bankruptcy – The procedures for liquidation of government-owned corporations – The recognition of bankruptcy judgments declared in foreign courts • MOF Suggestions on the Draft – Balancing the rights between creditors and debtors – Avoid appointing the debtor’s management as receivers or conservators – Bankruptcy cases assigned to specific divisions or judges Summary • Improving asset quality continuously in order to restore financial intermediary function • Guiding debt-rescheduling to real restructuring in order to maximize NPL value • Supporting turnaround fund in order to develop corporate restructuring expertise