Using Credit Registry Data to Assess Risks in the Financial System Outline

advertisement

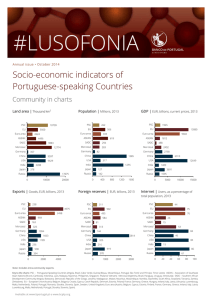

Using Credit Registry Data to Assess Risks in the Financial System Banco de Cabo Verde’s Experience June / 2013 Outline Introduction NPL task force Objectives and Research Strategy Credit Information Registry Micro-Survey Main Results Final considerations 1 Introduction Financial sector can stimulate or be a drag on economic growth the current global crisis is an unavoidable example of how financial system problems can harm growth It started as a result of increasing sophistication of the financial sector, which was not matched by improvements in regulatory and supervisory mechanisms and was amplified by governments and excess on leverage Despite its low degree of international integration, the Cape Verdean financial system is being severely affected by the global crisis through its ties to European Economy economic indicators and the financial soundness indicators are deteriorating 2 12 Real GDP growth rate (%) 10 8 Cape Verde 6 Euro Zone 4 2 0 -2 2004 2005 2006 2007* 2008 2009 2010 2011 2012 -4 -6 Main Sources of External Financing by Country of Origin Tourism Exports (goods) South Africa 0% Switzerland 1% Others 14% Austria 0% Germany 16% Belgium & Netherlands 8% Portugal 10% Italy 7% France 9% United Kingdom 33% Angola Guinea 0% Bissau 0% Portugal 16% Belgium & Netherlands 0% France 0% Spain 2% USA 0% Spain 77% FDI Emigrant Remittances Spain Italy England 2% 1% 6% Ireland 2% Others 55% El Salvador Others USA 1% 5% 1% Portugal 34% Switzerland Luxembourg 3% 3% Angola 0% United Kingdom 2% Spain 2% Others 3% USA 14% Belgium & Netherlands 10% Portugal 33% France 23% Italy 6% Germany 1% 3 Soundness Indicators 2010 2011 2012 15.6 14.0 12.3 8.4 11.8 14.0 143.9 57.0 71.2 ROA 0.7 0.5 0.3 ROE 9.9 6.3 3.9 Liquid assets/total assets 12.5 8.2 13.2 Liquid assets/short term liabilities 37.7 28.2 43.1 Credit/deposits 79.2 86.0 79.1 Capital Adequacy Capital Adequacy ratio Asset Quality NPL/Total Loans Provisions/Defaulting loans Earnings & Profitability Liquidity NPL Task Force Objectives & Research Strategy 4 Objectives Uncover the reasons behind the NPL performance Anticipate future NPL trends based on risk assessment Reasons behind banks credit to the economy performance? Macroeconomic (domestic and/or international) environment? Economic performance of some regions? Sectors specific issues? Social causes (divorces)? Risk analysis failures? Moral hazard (creditor)? adverse selection (debtor)? Impact of monetary or fiscal policy? Empirical Strategy Data Collection and analysis of the Credit Information Registry Identify sectors, institutional sectors and regions of major NPL concentration or faster NPL growth Assess if NPL increase is more related with some temporary economic problems or with structural ones (purpose of financing, modality and maturity of debt contracts and duration of impairments) Assess individuals specific issues (marital status, employer, selfemployer, monthly income,…) Survey for Banks Questionnaire design Set a representative sample (200 largest defaulting borrowers) Submitted and received by e-mail Processed in Excel 5 http://www.bcv.cv/vEN/publicationsandspeeches/Cadernos%20de%20Ed ucacao%20Financeira/Paginas/CadernosdeEducacaoFinanceira.aspx Main Results 6 In the past decade the bank loans increased at a very fast pace to finance mostly construction related activities …. Credit by Sector Credit to nominal GDP 65% 60% agriculture & fisheries 0% 55% 50% 45% manufacturing 4% other services 31% 40% construction & related activities 47% transports & Communicat. 7% 35% 30% 25% restaurants & hotels trade 4% 7% 20% 2002 2003 2004 2005 2006 2007 2008 2009 2010 ….pushed by excess liquidity and lack of other investment opportunities Total Deposits and Emigrant Deposits 12,0 Interest rates 60.000,0 10,0 in percentage 40.000,0 30.000,0 8,0 6,0 4,0 20.000,0 2,0 10.000,0 Emigrants Deposits Euribor (3 month) Jan-07 Jan-06 Jan-05 Jan-04 Jan-03 Jan-02 2007 2006 2005 2004 2003 2002 Total Deposits Jan-01 0,0 0,0 2001 million CVE 50.000,0 TB (91 days) BCV's deposits facility 7 Main results for companies Defaulting Credit by funding purposes Defauting credit contracted before 2009 90% 100% 84,1% 90% 77,4% 80% 80% 70,9% 70,3% 69,4% 70% 70% 60% 60% 50% 50% 40% 38,7% 40% 30% 20% 30% 10% 20% 0% 1 10% 2 0% 3 4 Investiments 1 2 3 4 5 6 71,9% others 9% trade 10% restaurants & hotels 15% 60% real state tourism related 24% 50% 36,4% construction 8% 26,5% 30% agriculture & fisheries 1% manufacturing 4% 20,6% 20% 10,9% other services 5% 10% 0,9% transports 24% 0% 1 2 3 4 Total NPL by economic sector 70% 40% 7 Total Defaulting Credit with last payment made in 2010 80% 5 Cash Flow needs 5 Total Main results for Individuals 80% Defaulting credit contracted before 2010 90% 71% 80% 80% 70% Defaulting credit with last payment made in 2010 70% 60% 65% 59% 60% 50% 54% 41% 40% 50% 40% 30% 30% 20% 20% 10% 28% 11% 10% 0% 0% 1 1 2 4 2 4 3 3 Defaulting credits by funding purposes Defaulters running own business education 100% 100% 90% 87% 90% automobiles 80% 70% 76% 80% 70% investment 60% 50% 60% 50% 40% consumption 30% 40% 42% 30% 30% 30% 20% commercial housing 10% 16% 20% 6% 10% 0% 1 2 4 3 5 6 7 mortgage loan 0% 1 2 4 3 5 6 7 8 Summing up NPL increase is pushed by temporary factors: weak economic performance deterioration of external economic environment contraction of the construction activity but it is greatly related to structural features of Cape Verde’s Economy: excess liquidity undeveloped financial system asymmetric information, monetary policy and risk analysis failures have also played a role in the NPL increase Forecasting …. NPL trends should remain high and increasing in short run IMF forecasts recession for Eurozone, which can affect companies’ earnings and households’ disposable income (further deterioration of income of sectors that depend on Euro Area markets as well as decreasing emigrants’ remittances) BCV’s more conservative forecasts point to: a recession of Cape Verde’s economy; some FDI recovery and weak performance of construction Defaulting loan contracts mature in the long run, the problem could last for many years There are other risks to be aware off Banks are the ones that most invest in corporate bonds, issued thru the stock market and defaulting bank debtors are the same that are defaulting debt securities Further depreciation of loan collaterals 9 Final Considerations It is critical to match the Credit Information Registry (CRC) with supervisory needs in a more complex and demanding environment Recommendations: assessment of CRC data collection, validation and analysis, to be performed by a team of bank supervision, statistics and research experts; design and implementation of an Action Plan to maximize the usefulness of the CRC in terms of bank risk assessment and statistical needs; improved dissemination of the upgraded CRC data to the banks so they may improve their risk appraisal framework, in line with a risk-based supervisory approach. 10 Thank you 11