FIN 335 Test 2 Name: _______________________________________ Summer 2014 Chapters 5-10

advertisement

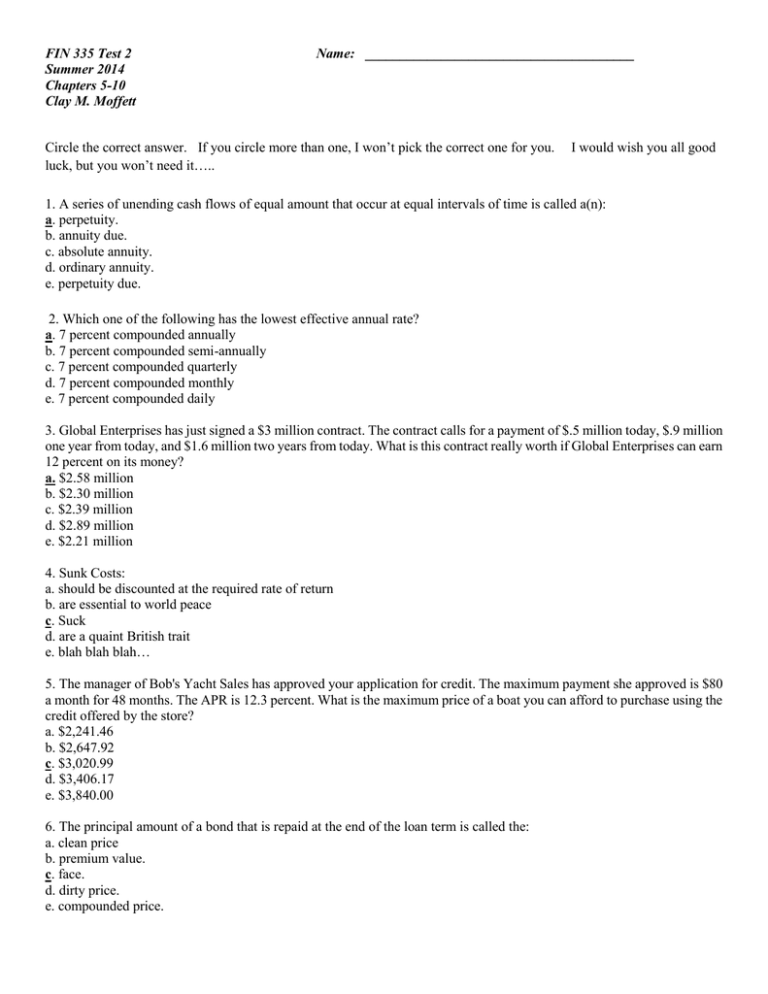

FIN 335 Test 2 Summer 2014 Chapters 5-10 Clay M. Moffett Name: _______________________________________ Circle the correct answer. If you circle more than one, I won’t pick the correct one for you. luck, but you won’t need it….. I would wish you all good 1. A series of unending cash flows of equal amount that occur at equal intervals of time is called a(n): a. perpetuity. b. annuity due. c. absolute annuity. d. ordinary annuity. e. perpetuity due. 2. Which one of the following has the lowest effective annual rate? a. 7 percent compounded annually b. 7 percent compounded semi-annually c. 7 percent compounded quarterly d. 7 percent compounded monthly e. 7 percent compounded daily 3. Global Enterprises has just signed a $3 million contract. The contract calls for a payment of $.5 million today, $.9 million one year from today, and $1.6 million two years from today. What is this contract really worth if Global Enterprises can earn 12 percent on its money? a. $2.58 million b. $2.30 million c. $2.39 million d. $2.89 million e. $2.21 million 4. Sunk Costs: a. should be discounted at the required rate of return b. are essential to world peace c. Suck d. are a quaint British trait e. blah blah blah… 5. The manager of Bob's Yacht Sales has approved your application for credit. The maximum payment she approved is $80 a month for 48 months. The APR is 12.3 percent. What is the maximum price of a boat you can afford to purchase using the credit offered by the store? a. $2,241.46 b. $2,647.92 c. $3,020.99 d. $3,406.17 e. $3,840.00 6. The principal amount of a bond that is repaid at the end of the loan term is called the: a. clean price b. premium value. c. face. d. dirty price. e. compounded price. 7. The yield to maturity on a bond is: a. equal to the coupon rate divided by the current market price. b. another name for the current yield. c. the current required market rate. d. equal to the annual interest divided by the face value. e. another name for the coupon rate. 8. A bond that pays no interest payments and sells at a deep discount is called a(n) _____ bond. a. callable b. income c. zero coupon d. convertible e. tax-free 9. The price at which an investor can purchase a bond from a dealer is called the _____ price. a. asked b. coupon c. call d. put e. bid 10. The Fisher effect expresses the relationship between: a. the yield to call and the yield to maturity. b. real and nominal rates c. coupon and real rates. d. the current yield and the yield to call. e. nominal and coupon rates. 11. When a bond's yield to maturity is greater than the bond's coupon rate, the bond: a. will be called. b. is selling at a premium. c. is selling at a discount d. is priced at par. e. has reached its maturity date. 12. The primary market is defined as the market: a. where the largest number of shares are traded on a daily basis. b. in which the largest number of issues are listed. c. with the largest number of participants. d. where new securities are offered. e. where shareholders trade most frequently with each other. 13. An agent who buys and sells securities from inventory is called a: a. floor trader. b. floor broker. c. commission broker. d. broker. e. dealer 14. The price of a stock at year 5 can be expressed as: a. P0 g5. b. D0 (1 + R)5. c. P1 (1 + R)5. d. D6 / (R g). e. D5 / (R g). 15. If shareholders are granted a preemptive right they will be: a. given the choice of receiving dividends in cash or in additional shares of stock. b. paid dividends prior to the preferred shareholders during the preemptive period. c. given the first right to purchase any new shares of stock that are issued. d. able to determine who the candidates should be for any open seats on the board. e. granted shares that receive additional voting privileges. 16. Northwest, Inc. stock is selling for $40.59 a share based on a 10 percent rate of return. What is the amount of the next annual dividend if the dividends are increasing by 2 percent annually? a. $3.18 b. $3.25 c. $3.31 d. $3.38 e. $3.45 17. The Johnston Company will pay an annual dividend of $2.05 next year. The company has increased its dividend by 3.5 percent a year for the past twenty years and expects to continue doing so. What will a share of this stock be worth three years from now if the required return is 14 percent? a. $21.65 b. $20.91 c. $20.21 d. $22.41 e. $22.79 18. A project has an average accounting return that is less than the requirement. Which one of the following indicates that the project should be accepted anyways? a. payback period in excess of the requirement b. positive NPV c. negative IRR d. PI less than 1.0 e. negative MIRR 19. Which one of the following is the primary advantage of payback analysis? a. incorporation of the time value of money concept b. arbitrary cutoff date c. any idiot can use it. d. unbiased analysis e. factors in appropriate risk 20. What is the net present value of a project with the following cash flows if the discount rate is 15 percent? a. -$2,989.48 b. -$2,599.55 c. $1,153.37 d. $2,880.08 e. $3,312.09 21. Top Shelf Industries is considering remodeling a building that it leases to a retail store. The remodeling costs are estimated at $2.15 million. If it proceeds with the remodeling, the tenant has agreed to pay an additional $750,000 a year in rent for the next 4 years. The discount rate is 13 percent. What is the benefit of the remodeling project to Top Shelf Industries? a. $279,146.51 b. $71,551.76 c. $80,853.49 d. $187,457.39 e. $370,864.45 22. The excess return required on a risky investment over that of a risk-free investment is called the: a. inflation premium. b. required return. c. real return. d. average actual return. e. risk premium. 23. A bell-shaped frequency distribution that is defined by its average and standard deviation is called a: a. beta distribution. b. variance. c. standard deviation. d. probability curve. e. normal distribution. 24. The average compound return earned per year over a multiyear period is called the _____ return. a. standardized mean b. real c. annual percentage d. arithmetic average e. geometric average 25. Standard deviation measures the _____ of a security's returns over time. a. average value b. frequency c. arithmetic average d. mean e. volatility 26. The geometric average return of 7, 11, -2, and 4 percent is computed as: a. (1.07 + 1.11 + 1.02 + 1.04)1/4 - 1. b. (1.07 + 1.11 + 1.02 + 1.04)1/4. c. (1.07+1.11 +.98 +1.04) (4) + 1. d. [(1.07 + 1.11 + .98 + 1.04) ¼] +1. e. (1.07 +1.11+.98 +1.04)1/4 - 1. 27. Weak form market efficiency states that the value of a security is based on: a. all public and private information. b. all publicly available information plus any data that can be gathered from insider trading. c. all publicly available information. d. historical information only e. random information with no clear distinction as to the source of that information. 28. A bond has an average return of 5.9 percent and a standard deviation of 2.1 percent. What range of returns would you expect to see 68 percent of the time on this security? a. 3.8 percent to 8.0 percent b. 1.7 percent to 10.1 percent c. 1.7 percent to 10.1 percent d. 3.8 percent to 8.0 percent e. 5.9 percent to 10.1 percent 29. Your portfolio has provided you with returns of 7.9 percent, 11.2 percent, 3.8 percent, and 14.7 percent over the past four years, respectively. What is the geometric average return for this period? a. 8.98 percent b. 9.16 percent c. 9.33 percent d. 9.40 percent e. 9.44 percent Formula Sheet. Cash Flow From Assets = Operating Cash Flow – Net Capital Spending – Changes in NWC ROE = PM * AT * EM Internal Growth Rate t = ln(FV / PV) / ln(1 + r) ROA b 1 - ROA b Sustainabl e Growth Rate r = (FV / PV)1/t – 1 ROE b 1 - ROE b (1 + R) = (1 + r)(1 + h) 1 1(1 r)t B C r P0 F (1 r)t D0 (1 g) D1 R-g R-g FIN 335 Test 1 Name: _______________________________________ Summer 2014 Answer Sheet 1. 2. 3. 4. 5. 6. 7. 8. 9. 10. 11. 12. 13. 14. 15. 16. 17. 18. 19. 20. 21. 22. 23. 24. 25. 26. 27. 28. 29. A A A A A A A A A A A A A A A A A A A A A A A A A A A A A B B B B B B B B B B B B B B B B B B B B B B B B B B B B B C C C C C C C C C C C C C C C C C C C C C C C C C C C C C D D D D D D D D D D D D D D D D D D D D D D D D D D D D D E E E E E E E E E E E E E E E E E E E E E E E E E E E E E 335 London 14 T2 Key 1. A series of unending cash flows of equal amount that occur at equal intervals of time is called a(n): a. perpetuity. b. annuity due. c. absolute annuity. d. ordinary annuity. e. perpetuity due. 2. Which one of the following has the lowest effective annual rate? a. 7 percent compounded annually b. 7 percent compounded semi-annually c. 7 percent compounded quarterly d. 7 percent compounded monthly e. 7 percent compounded daily 3. Global Enterprises has just signed a $3 million contract. The contract calls for a payment of $.5 million today, $.9 million one year from today, and $1.6 million two years from today. What is this contract really worth if Global Enterprises can earn 12 percent on its money? a. $2.58 million b. $2.30 million c. $2.39 million d. $2.89 million e. $2.21 million 4. Sunk Costs: a. should be discounted at the required rate of return b. are essential to world peace c. Suck d. are a quaint British trait e. blah blah blah… 5. The manager of Bob's Yacht Sales has approved your application for credit. The maximum payment she approved is $80 a month for 48 months. The APR is 12.3 percent. What is the maximum price of a boat you can afford to purchase using the credit offered by the store? a. $2,241.46 b. $2,647.92 c. $3,020.99 d. $3,406.17 e. $3,840.00 6. The principal amount of a bond that is repaid at the end of the loan term is called the: a. clean price b. premium value. c. face. d. dirty price. e. compounded price. 7. The yield to maturity on a bond is: a. equal to the coupon rate divided by the current market price. b. another name for the current yield. c. the current required market rate. d. equal to the annual interest divided by the face value. e. another name for the coupon rate. 8. A bond that pays no interest payments and sells at a deep discount is called a(n) _____ bond. a. callable b. income c. zero coupon d. convertible e. tax-free 9. The price at which an investor can purchase a bond from a dealer is called the _____ price. a. asked b. coupon c. call d. put e. bid 10. The Fisher effect expresses the relationship between: a. the yield to call and the yield to maturity. b. real and nominal rates c. coupon and real rates. d. the current yield and the yield to call. e. nominal and coupon rates. 11. When a bond's yield to maturity is greater than the bond's coupon rate, the bond: a. will be called. b. is selling at a premium. c. is selling at a discount d. is priced at par. e. has reached its maturity date. 12. The primary market is defined as the market: a. where the largest number of shares are traded on a daily basis. b. in which the largest number of issues are listed. c. with the largest number of participants. d. where new securities are offered. e. where shareholders trade most frequently with each other. 13. An agent who buys and sells securities from inventory is called a: a. floor trader. b. floor broker. c. commission broker. d. broker. e. dealer 14. The price of a stock at year 5 can be expressed as: a. P0 g5. b. D0 (1 + R)5. c. P1 (1 + R)5. d. D6 / (R g). e. D5 / (R g). 15. If shareholders are granted a preemptive right they will be: a. given the choice of receiving dividends in cash or in additional shares of stock. b. paid dividends prior to the preferred shareholders during the preemptive period. c. given the first right to purchase any new shares of stock that are issued. d. able to determine who the candidates should be for any open seats on the board. e. granted shares that receive additional voting privileges. 16. Northwest, Inc. stock is selling for $40.59 a share based on a 10 percent rate of return. What is the amount of the next annual dividend if the dividends are increasing by 2 percent annually? a. $3.18 b. $3.25 c. $3.31 d. $3.38 e. $3.45 17. The Johnston Company will pay an annual dividend of $2.05 next year. The company has increased its dividend by 3.5 percent a year for the past twenty years and expects to continue doing so. What will a share of this stock be worth three years from now if the required return is 14 percent? a. $21.65 b. $20.91 c. $20.21 d. $22.41 e. $22.79 18. A project has an average accounting return that is less than the requirement. Which one of the following indicates that the project should be accepted anyways? a. payback period in excess of the requirement b. positive NPV c. negative IRR d. PI less than 1.0 e. negative MIRR 19. Which one of the following is the primary advantage of payback analysis? a. incorporation of the time value of money concept b. arbitrary cutoff date c. any idiot can use it. d. unbiased analysis e. factors in appropriate risk 20. What is the net present value of a project with the following cash flows if the discount rate is 15 percent? a. -$2,989.48 b. -$2,599.55 c. $1,153.37 d. $2,880.08 e. $3,312.09 21. Top Shelf Industries is considering remodeling a building that it leases to a retail store. The remodeling costs are estimated at $2.15 million. If it proceeds with the remodeling, the tenant has agreed to pay an additional $750,000 a year in rent for the next 4 years. The discount rate is 13 percent. What is the benefit of the remodeling project to Top Shelf Industries? a. $279,146.51 b. $71,551.76 c. $80,853.49 d. $187,457.39 e. $370,864.45 22. The excess return required on a risky investment over that of a risk-free investment is called the: a. inflation premium. b. required return. c. real return. d. average actual return. e. risk premium. 23. A bell-shaped frequency distribution that is defined by its average and standard deviation is called a: a. beta distribution. b. variance. c. standard deviation. d. probability curve. e. normal distribution. 24. The average compound return earned per year over a multiyear period is called the _____ return. a. standardized mean b. real c. annual percentage d. arithmetic average e. geometric average 25. Standard deviation measures the _____ of a security's returns over time. a. average value b. frequency c. arithmetic average d. mean e. volatility 26. The geometric average return of 7, 11, -2, and 4 percent is computed as: a. (1.07 + 1.11 + 1.02 + 1.04)1/4 - 1. b. (1.07 + 1.11 + 1.02 + 1.04)1/4. c. (1.07+1.11 +.98 +1.04) (4) + 1. d. [(1.07 + 1.11 + .98 + 1.04) ¼] +1. e. (1.07 +1.11+.98 +1.04)1/4 - 1. 27. Weak form market efficiency states that the value of a security is based on: a. all public and private information. b. all publicly available information plus any data that can be gathered from insider trading. c. all publicly available information. d. historical information only e. random information with no clear distinction as to the source of that information. 28. A bond has an average return of 5.9 percent and a standard deviation of 2.1 percent. What range of returns would you expect to see 68 percent of the time on this security? a. 3.8 percent to 8.0 percent b. 1.7 percent to 10.1 percent c. 1.7 percent to 10.1 percent d. 3.8 percent to 8.0 percent e. 5.9 percent to 10.1 percent 29. Your portfolio has provided you with returns of 7.9 percent, 11.2 percent, 3.8 percent, and 14.7 percent over the past four years, respectively. What is the geometric average return for this period? a. 8.98 percent b. 9.16 percent c. 9.33 percent d. 9.40 percent e. 9.44 percent