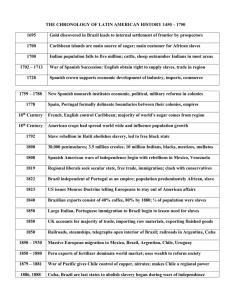

China’s Impact on Latin America A B C D E

advertisement

China’s Impact on Latin America An Angel or a Devil for Latin Emerging Economies? Javier Santiso Chief Development Economist & Deputy Director OECD Development Centre A B C D E To k y o W o r l d 29-30 B a n k May 2006 1 1 The cognitive effect: new emerging capitalisms. 2 The trade effect: the dark side of the boom. 3 China and India as a wake up call. 2 China: extraordinary or back to normal? 2005 - GDP in US$ (% of w orld) China GDP (% of w orld total) 35% Canada Spain Italy China France United Kingdom Germany Japan United States 2.5 2.6 3.9 4.3 4.8 5.0 6.4 30% 25% 20% ? 15% 10% 10.6 28.4 5% 0% 0 Source: IMF 5 10 15 20 25 30 1500 1600 1700 1820 1870 1900 1950 2001 2045 Source:Angus Maddison According to IMF estimates Chinese gross domestic product based on purchasing-powerparity (PPP) amounts to 13.6% of 2005 world GDP (20.7% in the case of USA). 3 The cognitive impact: The emergence of new capitalisms. Center and Periphery rebalanced… GDP share of world output (WEO, 2004) Emerging China Asia 4.2% 8.0% Korea&Japan 12.7% Asia represents more than one fifth of world output. US 29.6% EU 30.7% LatAm 4.8% 4 China has doubled its GDP in 8 years…without the help of Money Doctors! PPP per capita GDP in constant prices (thousand of US$, 2004-5 estimate) Japan 28 24 20 Korea 16 Mexico 12 China 8 Brazil 4 2004e 2001 1998 1995 1992 1989 1986 1983 1980 1977 1974 1971 2003 1968 2000 1965 1997 1962 1994 1959 1991 1956 1988 1953 1985 1950 0 Source: based on WEO and PWT Chinese growth rates has been higher than those observed in Brazil and Mexico during their glorious years. 5 Asia´s growth on an outward looking strategy: a development strategy to follow. Trade openness (X+M/GDP, 2004) 250% 200% China’s trade openness surpasses that of all Latin American countries … 150% 100% Region's Average 2004 50% Source: WTO, National Statistics Brazil Peru Colombia Argentina Uruguay Venezuela Mexico Chile India Indonesia South Korea China Thailand China's share in world merchandise trade (%, 1980-2004) 7% 6% 5% 3% 2% 1% Source: IMF DOTS 6 2004 2002 2000 1998 1996 1994 1992 1990 1988 1986 1984 0% 1982 … and its share in world merchandise trade has doubled in less than a decade. 4% 1980 Malaysia 0% 1 The cognitive effect: new emerging capitalisms. 2 The trade effect: the dark side of the boom. 3 China and India as a wake up call. 7 Are raw material prices facing a Chinese shock? Com m odities Prices in real term s 140 120 China? 100 80 60 40 1900 1915 1930 1945 1960 1975 1990 Many economists are putting the blame on China and -to a lesser extent- on other emerging economies (India) for the current increase in raw material (70% in real terms). 2005 Source: University of Oxford 8 The stars have been lined up for Latin America: Commodity boom has been a bonanza Worldwide GDP growth and oil price 7 70 Worldwide GDP growth (in %) 6 60 5 50 4 40 3 30 2 20 1 10 Price of Brent barrel in USD (right-hand side scale) 0 2005 2003 2001 1999 1997 1995 1993 1991 1989 1987 1985 1983 1981 1979 1977 1975 1973 1971 0 Source: BBVA from original FMI and Bloomberg data; * Projection 9 The stars have been lined up for Latin America: Commodity boom has been a bonanza Exports of commodities BBVA-MAP Index of Latin America commodity prices 170 (100 =jan03) over total exports (2004) 160 150 140 Without oil 130 120 110 TOTAL 100 90 80 Source: BBVA 2005 2004 2003 2002 2001 2000 1999 1998 1997 60 1996 70 Venezuela 83.1% Peru 70.7% Chile 59.1% Colombia 46.3% Argentina 38.0% Brazil 29.6% Mexico 14.6% Latam 31.2% Source: BBVA 10 The stars have been lined up for Latin America: Asia is becoming a major growth pilar Exports of agricultural, energy and minery products (in % over the total) (2003) 100 90 Latin America 80 70 60 50 40 30 20 Hong Kong Japan Taiwan China Germany South Korea Italy US Singapore UK France Belgium Malaysia Mexico Spain India Thailand Indonesia Brazil Colombia Peru Argentina Uruguay Bolivia Venezuela Chile Ecuador Paraguay 0 Canada Netherlands 10 Source: WTO 11 The stars have been lined up for Latin America: China became a major trading partner Growth of GDB in China (Annual Percentage variation) 7 6 6 5 5 4 4 3 3 2 2 1 1 0 0 1997 1999 Source: Based on domestic sources. Figures for 2004 and 2005 are forecasts 2001 2003 2005 12 México 7 Colombia 8 Venezuela 8 Uruguay 9 Brasil 9 Perú 10 Argentina 10 Chile Exports to China in 2003 (Percentage of total) China´s strong demand for energy and commodities: a bonanza or a threat? Share of total oil exports by destination region/country, 2003 (%) Share of total copper exports by destination region/country, 2004 3% 26% 31% 9% 17% Asia 5% 14% 0% Canada M exico Others 12% A frica 2% China A ustralasia 0% Taiwan China 2% 19% Others A sian 18% 28% Source: BBVA, Cochilco Source: BP Consumption of nickel, 2004(estimate) S. & C. A merica Euro pe Euro pe Japan 6% USA 6% A merica So uth Ko rea 50% 1% Japan Other A sia P acific Rest o f Wo rld 1% Consumption of aluminum, 2004(estimate) 20% 11% 22% 13% No rth A merica 38% No rth A merica Western Euro pe Western Euro pe China 23% Japan Other A sia Other A sia 20% China Rest o f wo rld Rest o f wo rld 24% 11% Source: JP Morgan estimates 7% 11% 13 China’s demand for commodities: a bonanza or a threat? * Asian countries competition vs. Chinese exports to US , % 60% 50% 40% 30% 20% 10% åa *Value of exports to US from China in same product categories as country´s exports, as % of country´s total exports to US Source: C.HJ.Kwan, Nomura Institute of Capital Markets Research *Arithmetic average of the following indexes: CC= n it a njt n å ( a itn ) 2 å ( a njt ) 2 n n C hi le Ve ne zu el a U ru gu ay Pe rú a Ar ge nt in a ol om bi C Br as il M éx ic o Ja pa n In do ne si a M al ay s ia Ph i li p pi ne s So ut h Ko re a Si ng ap or e an 0% Ta iw Th ai la nd 70 60 50 40 30 20 10 0 Latin American countries competition* vs. Chinese main export products and CS= 1 - 1 å aitn - a njt 2 n where ajt and ait equals the share of item “n” over total exports of countries j (China) and i in time t. Source: Blázquez, Rodríguez and Santiso (2006) 14 Does China compete with Latin American countries ? Competencia comercial china con Chile Competencia comercial china con Argentina 20% 17% 18% 16% 12% 17% 15% 15% 13% 11% 11% 11% 11% 10% 10% 9% 8% 10% 6% 5% 4% 2% 0% 0% 1998 1999 2000 2001 2002 2003 1998 Chinese commercial competition with Paraguay 10% 8% 7% 20% 6% 2001 2002 2003 19% 17% 7% 6% 2000 Chinese commercial competition with Uruguay 8% 7% 1999 16% 16% 15% 13% 13% 2002 2003 5% 10% 4% 2% 5% 0% 0% 1998 1999 2000 2001 2002 2003 Source: Blázquez, Rodríguez and Santiso, OECD Development Centre (2006) 1998 1999 2000 2001 15 Does China compete with Latin American countries ? 40% Chinese commercial competition with Costa Rica 33% 31% 30% 26% Chinese commercial competition with El Salvador 30% 36% 31% 27% 23% 23% 1999 2000 26% 24% 21% 28% 20% 20% 10% 10% 0% 0% 1998 1999 2000 2001 2002 2003 1998 2002 2003 Chinese commercial competition with Panama Chinese commercial competition with Guatemala 14% 19% 18% 18% 17% 12% 12% 11% 11% 11% 10% 10% 17% 16% 2001 16% 16% 15% 8% 8% 16% 6% 15% 4% 14% 2% 13% 0% 1998 1999 2000 2001 2002 2003 Source: Blázquez, Rodríguez and Santiso, OECD Development Centre (2006) 1998 1999 2000 2001 2002 16 2003 Does China compete with Latin American countries ? Chinese commercial competition with Bolivia Chinese commercial competition with Colombia 14% 12% 25% 11% 12% 11% 11% 10% 20% 8% 8% 8% 15% 6% 10% 4% 21% 19% 19% 19% 18% 2002 2003 16% 5% 2% 0% 0% 1998 1999 2000 2001 2002 1998 2003 Chinese commercial competition with Peru 20% 17% 16% 17% 12% 15% 2000 2001 Chinese commercial competition with Venezuela 17% 15% 1999 13% 11% 9% 10% 8% 10% 8% 8% 7% 6% 6% 4% 5% 2% 0% 0% 1998 1999 2000 2001 2002 2003 Source: Blázquez, Rodríguez and Santiso, OECD Development Centre (2006) 1998 1999 2000 2001 2002 17 2003 China has become a major destination of Brazilian exports: The bonanza. Trade Balance with China 3000 US$ millions 2.385 2500 2000 1.729 1.694 1500 966 1000 574 500 0 2001 2002 2003 2004 2005p Major countries of destination of Brazilian exports 1999 2004 United States 22,6% 1º United States 21,1% Argentina 11,2% 2º Argentina 7,6% Netherlands 5,4% 3º Netherlands 6,1% 4º China 5,6% Germany 5,3% Japan 4,6% 5º Germany 4,2% Italy 3,8% 6º Mexico 4,1% Belgium 3,8% 7º Italy 3,0% United Kingdom 3,0% 8º Japan 2,9% France 2,5% 9º Chile 2,6% Spain 2,4% 10º France 2,3% Mexico 2,2% 11º United Kingdom 2,2% Chile 1,9% 12º Spain 2,1% Russia 1,6% 13º Belgium 2,0% Paraguay 1,6% 14º Russia 1,7% China 1,4% 15º Venezuela 1,5% Source: SECEX Source: BBVA 18 Brazilian exports of primary products: more is not better (Dutch disease and monopsony). Herfindahl-Hirschmann Concentration Index of Brazilian exports by industry, 1990-2003 0,20 + concentration 0.12 0.11 0.10 0.09 0,18 0,16 0,14 0,12 0,10 Source: BBVA and Bradesco 0,04 Source: WTO. 19 2003 2002 2001 2000 1999 1998 1997 1996 1995 1994 0,00 1993 0,02 1992 Jan-04 Jan-03 Jan-02 Jan-01 Jan-00 Jan-99 Jan-98 Jan-97 Jan-96 Jan-95 Jan-94 Jan-93 Jan-92 Jan-91 Jan-90 0.05 0,06 1991 0.06 0,08 1990 0.07 + diversification 0.08 Jan-89 less concentration more concentration Herfindahl-Hirschmann Concentration Index of Brazilian exports by country of destination 1 The cognitive effect: new emerging capitalisms. 2 The trade effect: the dark side of the boom. 3 China and India as a wake up call. 20 China competes intensively with Mexico on a global level Chinese global trade competition Chinese trade competition with Latin America 0.7 0.6 T hailand Hungary Mexico 0.5 0.6 0.4 Costa Rica Mexico 0.5 USA 0.3 Brazil 0.1 Argentina Peru Japan 0.4 0.2 Colombia Poland 0.3 Venezuela Spain Chile 0.0 0.0 0.1 0.2 Czech R. 0.3 0.4 0.5 0.6 0.2 0.30 0.35 0.40 0.45 0.50 0.55 Source: Blázquez, Rodríguez and Santiso (2006) 21 0.60 Mexico’s competitive advantage: proximity to export markets Mexico benefits from its geographic proximity to its major export markets: • Lower transport and communication costs • Access to FTA • Just-in-time delivery 24 Days 4 Days 160 Km 11,700 Km Shipping time Mexico is more competitive in manufacturing more sophisticated products which require frequent communication with the client or supplier and short reaction times. 22 Pending reforms : the upgrade of port facilities Cargo Container Handling Charges Handing Mandatory Price Fixed Cooperative Median Port LSU CMPCH Restriction Services Agreements Agreements Clearance Efficiency Crime Index World Index Bank Index Country Index Index Index Index time (Days) Index (1-7) (1-7) US$/TEU 1 0.38 0 0.33 2 6.76 6.72 117 NA NA Singapore 0 0.25 0 0 NA 6.38 5.46 NA NA NA Hong Kong 0.5 0 0 0 NA 5.18 4.49 140 163 NA Taiwan 0.75 0.13 0.89 1 NA 5.16 5.16 250 202 NA Japan 0 0.25 0 0.38 7 4.95 5.76 75 NA NA Malaysia 0 0.06 1 0 4 4.88 6.08 200 105 NA Spain 0 0.38 0 0 NA 4.12 5.22 NA NA NA Korea 0.5 0.63 0 0.38 4 3.98 5.12 93 NA NA Thailand Argentina 0 0.13 0 1 7 3.81 4.52 NA 139 NA 0 0 0 0.5 NA 3.81 5.02 NA NA NA Vietnam Chile 0 0.25 0.43 1 3 3.76 6.05 202 100 NA China 0.5 0 0 0 7 3.49 4.44 110 NA NA 1 0.06 0 0.38 5 3.41 4.06 NA NA NA Indonesia 0.5 0.38 0 1 4 3.34 2.61 NA NA NA Mexico 0 0 1 1 11 3.28 3.63 NA NA NA Venezuela El Salvador 0 0 0 1 4 2.95 2.3 NA NA 61 Brazil 0.5 0.75 0 1 10 2.92 4.45 328 292 NA 0.5 0 0.5 1 7 2.88 3.32 NA 142 NA Peru 0 0 0 1 NA 2.79 4.28 NA NA NA India 0.5 0 0 0.38 7 2.79 3.51 118 NA NA Philippines Ecuador 0 0 0.43 1 15 2.63 3.65 NA 139 NA Costa Rica 0 0 0 1 4 2.46 3.28 NA NA 68 Colombia 0.5 0.13 0.5 1 7 2.26 1.88 NA NA NA Bolivia NA NA NA NA 9.5 1.61 4.38 NA NA NA 0 0 0 1 5 NA NA NA NA NA Uruguay NA: Not Available Source: Data for the first 4 columns was kindly provided by Carsten Fink, Aaditya Mattoo, and Ileana Cristina Neagu* (2002). 23 Conclusions: A Watch List Africa and Latin America: Out of the Value-Chain Game? The share of China’s total exports produced by foreigners has risen sharply, from 32% to 60% between 2000 and 2005. Foreign outsourcing is becoming a major driver of India’s and China’s high tech exports, both countries moving up quickly in the value added ladder. In 2005 for example, of China’s top 100 exporters, 53 were foreign companies and all were electronics/information technology companies. 24 Thank you Based on Jorge Blázquez, Javier Rodríguez and Javier Santiso, “Angel or Devil? Chinese Trade Impact on Latin American Emerging Markets”, OECD Development Centre, Working Paper, May 2006. 25