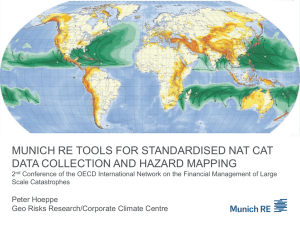

CLIMATE CHANGE AND TRENDS OF NATURAL DISASTERS Peter Hoeppe

advertisement

CLIMATE CHANGE AND TRENDS OF NATURAL DISASTERS – WHAT IS TO BE DONE 2nd Conference of the OECD International Network on the Financial Management of Large Scale Catastrophes Peter Hoeppe Geo Risks Research/Corporate Climate Centre Munich Re Insurer for Insurances Founded 1880 One of the leading reinsurance companies Covering risks of natural hazards is part of the core business 2 Munich Re the First Alerter to Global Warming MR-Publication Flood / Inundation (August 1973) © January 2007, Münchener Rückversicherungs-Gesellschaft, Geo Risks Research 3 Origins and Types of Natural Catastrophes Extraterrestrial: Meteorites No human influence Geophysical (terrestrial): Earthquakes, volcano eruptions, tsunamis No human influence Atmospheric (weather): Windstorms, floods, storms, hail, lightning, avalanches, mud slides Pieces of evidence for human influence, risk of change! Trends of Natural Disasters The last years have brought records in natural disasters in respect to: Intensities Frequencies Damages and losses 5 Heat wave of 2003, with more than 70,000 fatalities the largest humanitarian natural catastrophe in Europe for centuries Perceived Temperature on 8 August 2003 and excess mortality Heat stress extreme 300 high 2.300 moderate 9.400 light comfortable light moderate 19.500 high extreme 1.000 20.100 800 Cold stress 2.700 15.000 Sources: Robine et al., 2007; German Weather Service, 2004 August 2005 – Hurricane Katrina 6th strongest hurricane, largest losses of a single event source: AP 25.-30.8 Hurricane Katrina, USA (1.322 fatalities) Economic losses (US$ m): Insured losses (US$ m): 125.000 61.000 (NFIP included) 7 July 2005 – Mumbai Flood On 26th July 2005 the meteorological station at Santacruz in North Mumbai (India) recorded 944 mm of rainfall within 24 hours, the highest ever in the history of precipitation recordings in India. Economic losses (US$ m): Insured losses (US$ m): 5.000 Fatalities: 1150 750 Flood series in the UK, June- July 2007 Largest flood loss ever! Overall losses: > US$ 8 bn Insured losses: US$ 6 bn Source: www.metoffice.gov.uk/weather/seasonal/summer2007/index.html 9 Tropical Cyclone Nargis, May 3, 2008 Wind velocities up to 215 km/h (Cat 4) Floods in the Irrawaddy delta, also Yangoon affected Human catastrophe Estimated number of fatalities about 100,000 Source: http://www.reliefweb.int © 2008 Münchener Rückversicherungs-Gesellschaft, GeoRisikoForschung, NatCatSERVICE Victoria Wildfires, Australia (Black Saturday Fires) February 2009 Wildfires, February 2009 Overall losses: US$ 1,300m* Insured losses: US$ 650m* Fatalities: 173 *Losses in original values © 2009 Münchener Rückversicherungs-Gesellschaft, Geo Risks Research, NatCatSERVICE. As at June 2009 Source: Reuters, Berlin 11 Munich Re NatCatSERVICE – One of the world‘s most comprehensive databases on natural catastrophes From 1980 until today all loss events For USA and selected countries in Europe all loss events since 1970 Retrospectively all Great Natural Catastrophes since 1950 In addition all major historical events starting from 79 AD – eruption of Mt.Vesuvio (3,000 historical data sets) Currently more than 26,000 events documented Natural catastrophes 2008 Earthquake, tsunami, volcanic eruption Storm Flood Extreme temperature (heat wave, forest fires) Great natural catastrophes: Earthquake China Hurricane Ike Cyclone Nargis Winter damage China © 2009 Münchener Rückversicherungs-Gesellschaft, Geo Risks Research, NatCatSERVICE. As at June 2009 12 Natural catastrophes in Asia Great natural catastrophes in Asia 1950 – 2008 Geophysical events (earthquake, tsunami, volcanic activity) Hydrological events (flood, mass movement) Meteorological events (storm) Climatological events (extreme temperature, drought, wildfire) © 2009 Münchener Rückversicherungs-Gesellschaft, Geo Risks Research, NatCatSERVICE – As at September 2009 Natural catastrophes 2008 Weather catastrophes in Asia 1980 – 2008 Number of events 400 350 300 250 200 150 100 50 1980 1982 1984 1986 1988 Meteorological events (Storm) 1990 1992 1994 1996 1998 2000 Hydrological events (Flood, mass movement) © 2009 Münchener Rückversicherungs-Gesellschaft, Geo Risks Research, NatCatSERVICE – As at September 2009 2002 2004 Climatological events (Extreme temperature, drought, forest fire) 2006 2008 Global natural disasters 1980 – 2008 Geophysical, meteorological, hydrological events 500 450 400 350 Number 300 250 200 150 100 50 1980 1982 1984 Geophysical events (Earthquake, tsunami, volcanic eruption) 1986 1988 1990 1992 Meteorological events (Storm) 1994 1996 1998 2000 Hydrological events (Flood, mass movement) © 2009 Münchener Rückversicherungs-Gesellschaft, Geo Risks Research, NatCatSERVICE 2002 2004 2006 2008 ----- Trend line 15 Climate change probably has a significant impact on increases of nat cat losses, especially in North America and Asia/Australia. Annual growth rates of nat cat losses and climate component 1980 – 2007 Nat cat loss trend (% p.a.) Climate component (% p.a.) Global North America Europe Asia/ Australia 11 11 8 15 4 5 1 6 Comments These data are indicative only – a more precise determination of the regional loss drivers related to climate change is needed (e.g. via LSE cooperation) Nat cat loss trend: growth rates of original/nominal values and not adjusted for inflation Climate component: actually “Climate plus X” because influencing factors include anthropogenic climate change, natural climate variability, changes in vulnerability and changes in population distribution 16 Global Warming is Real! Continental Temperature Changes Quelle: IPCC FoAR, 2007 Black lines: decadal averages of observations Blue band: 5-95% range 19 simulations from 5 climate models using only natural forcings Red band: 5-95% range for 58 simulations from 14 climate models using natural and anthropogenic forcings 17 Climate Change and Extreme Weather Events (IPCC, 2007) very likely > 90% likely >66% more likely than not > 50% 18 Trends of heavy precipitation events during summer monsoon in India Source: Goswami, B. N. et al. (2006), Science 314 Increase of Sea Level for different CO2-Scenarios Quelle: Rahmstorf (2007), Science, 315, 368 140 cm A1FI B1 50 cm *Basis: Range of ΔT = 1.5º-5.8ºC (IPCC TAR) Observed changes in sea surface temperatures NATL = WPAC = SPAC = EPAC = NIO = SIO = North Atlantic West Pacific South Pacific East Pacific Northern Indic Southern Indic Source: Webster et al. (2005), Science, 309 21 Residence Time of Greenhouse Gases in the Atmosphere Greenhouse gas Value 1750 Value Human Residence Relative Share [ppm] 2007 [ppm] share time green- human [%] [years] house GHE potential [%] CO2 (Carbon dioxide) 280 384 30 120- 150 1 62 CH4 (Methane) 0.7 1.78 30 10-12 23 20 0.27 0.32 20 80-150 270- 6 N2O (Nitrous oxide) 310 CFCs (Chlorofluoro- 0 carbons) SF6 (Sulphur- 0.00001 - 100 1-260 0.0000005 0 0.0000042 1-3 1-3 500- 10 12000 100 3200 22200 <1 hexafluoride) H2O Water vapor Source: IPCC, diverse few days 2 Munich Re as a risk carrier © 2009 Münchener Rückversicherungs-Gesellschaft, Geo Risks Research, NatCatSERVICE. As at June 2009 24 DESERTEC Concept for Energy, Water and Climate Protection © 2009 Münchener Rückversicherungs-Gesellschaft, Geo Risks Research, NatCatSERVICE. As at June 2009 25 DII Founding Meeting at Munich Re 13 July 2009 Desertec Industrial Initiative (DII) 12 companies signed a Memorandum of Understanding to establish a Desertec Industrial Initiative (DII). The objective of this initiative is to analyse and develop the technical, economic, political, social and ecological framework for carbon-free power generation in the deserts of North Africa. Insurance Linked Adaptation to Increasing Weather Extremes in Developing Countries Munich Climate Insurance Initiative (MCII) MCII MCII was founded in 2005 on initiative by Munich Re Today MCII is a registered non profit organisation with members from: Insurance, NGOs, Relief Organisations, Research Institutes, World Bank and independent experts. Objectives: Develop insurance-related solutions to help manage the impacts of climate change in developing countries. Recent activities: MCII-Submission to UNFCCC with concrete suggestions of insurance tools to be implemented in a Post-Kyoto-Protocol. Suggestions are being discussed by delegates of the climate negotiations on their way to Copenhagen. RISK MANAGEMENT MODULE The MCII Proposal TIER 1 Climate Insurance Pool High Layer RISK Premiums paid by AF ($5 bn) Middle Layer RISK Support financed by AF ($2 bn) Low Layer RISK Support financed by AF ($3 bn) Insurance Pillar TIER 2 Support for micro and macro insurance systems Prevention Pillar The two-tiered insurance pillar • Meets the principles set out by the UNFCCC • Provides assistance to the most vulnerable, and • Includes private market participation. mainly Rough estimated annual costs: $ 10 bn Evaluating the economics of climate risks & opportunities in the insurance sector Collaboration between Munich Re and the London School of Economics Main areas of research activities quantifying the costs of a climate-related increase in natural catastrophes dealing with the uncertainties of climate models evaluating the potential and consequences of emissions trading systems and the appropriate design of such schemes estimating the economic impacts of climate change on the BRIC states (Brazil, Russia, India, China) Institute: Chair: Management: Project duration: Sponsoring: Centre for Climate Change Economics and Policy at LSE Lord Nicholas Stern Prof. Rees (LSE), Prof. Gouldson (Leeds) 2008-2012 £3m (~ €4m) 30 Conclusions Natural catastrophes, especially weather related events, are increasing in number and magnitude especially in Asia. Global warming is real. There is more and more scientific evidence for causal links between climate change and increasing frequencies and intensities of natural catastrophes. We have to mitigate global warming and adapt to the changing risks in respect to the regionally specific risk patterns. In Copenhagen ambitious CO2-reduction targets should be fixed to avoid dangerous, unmanageable climate change. The Copenhagen outcome should provide adaptation funds for developing and emerging countries, including new insurance solutions. The insurance industry supports climate change mitigation and adaptation measures by sharing its knowledge with the public and providing custom made covers for innovative technologies. 31 THANK YOU!