Policy Dialogue on Corporate Governance in China Co-organizer: ERI /DRC

Strictly Confidential

Policy Dialogue on

Corporate Governance in China

Hosted by the Shanghai Stock Exchange and the OECD

Co-organizer: ERI /DRC

Shanghai, China

25 - 26 February 2004 in partnership with

The Government of Japan

The Global Corporate Governance Forum

Page 1

American Experience and Perspectives

COUDERT BROTHERS

LLP

Global Legal Advisers

1114 AVENUE OF THE AMERICAS

NEW YORK, NY 10036-7703

TEL : +1 212 626 4400

FAX : +1 212 626 4100

Page 2 February 25-26, 2004

Strictly Confidential

The Role of Board Committees:

American Experience and Perspectives

Presentation by

Barry Metzger

Senior Partner, Coudert Brothers LLP

New York and Tokyo

Page 3

Introduction

Strictly Confidential

Corporate Governance Scandal and Reform in the

United States

Despite its failure to prevent the recent crisis in

American corporate governance, there is increasing reliance on, and strengthening of, the independent director system and the role of Board committees

Page 4

Historic trend moving from the role of managing the corporation to the role of supervising management and serving as the focal point for managing relations between shareholders, management and other corporate constituencies

Page 5

The role of Board of Directors as set out in the January 2004 draft

(revised) text of the OECD Principles of the Corporate Governance

Reviewing and guiding: corporate strategy, major plans of action, risk policy, annual budgets and business plans, setting performance objectives; monitoring implementation and corporate performance; and overseeing major capital expenditures, acquisitions and divestitures;

Monitoring the effectiveness of the company’s governance practices and changing them as required;

Selecting, compensating, monitoring and replacing key executives and overseeing succession planning;

Page 6

Aligning key executive and Board remuneration with the longer term interests of the company;

Ensuring a formal and transparent Board nomination and election process;

Monitoring and managing potential conflicts of interest of management, Board members and shareholders, including misuse of corporate assets and abuse in related party transactions;

Ensuring the integrity of the corporation’s accounting and financial reporting systems; and

Overseeing the process of disclosure and communications.

Page 7

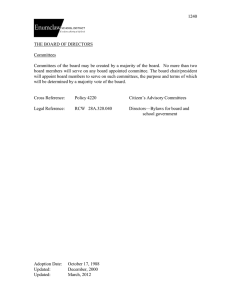

Ability to create committees long recognized and, viewed as an inherent power of the Board of Directors, it is not the subject of detailed statutory provisions

The traditional view that the Board’s activities were not subject to delegation to committees long ago gave way to the view that most decisions are subject to delegation to Board committees

Page 8

The rationale for the creating of Board committees, particularly in the context of the large modern corporation

Efficiency of Board’s operations

Need to develop subject specific expertise in the Board’s operations and the desire to access particular expertise of Board members

Particularly enhancing the objectivity and independence of the

Board’s judgment, insulating it from the potential undue influence of managers and controlling shareholders

Page 9

Establishment of committees, the appointment of members and standards of independence.

The use of committees has developed largely as a matter of market practice, with laws tending to make a general market practice universal and mandatory.

Legal requirements regarding the establish of committees:

State law

Listing rules of the stock exchanges

Federal securities laws

Page 10

No general legal requirement as to the number of independent directors on the Board

Most formal requirements arise under the listing rules of the stock exchanges

Sarbanes-Oxley Act of 2002, Section 301, requires the SEC to adopt regulations to cause national securities exchanges and associations to prohibit the listing of a company which does not have an audit committee meeting certain standards, and establishing standards of independence for such committee members

Page 11

Role of Board committees in making recommendations to the Board of Directors and in making decisions on behalf of the Board of Directors

Liabilities of directors

In respect of decisions made by Board committees

In respect of directors’ participation on Board committees

Page 12

Board Committees

Strictly Confidential

Standing committees

Executive Committee

Audit Committee

Compensation Committee

Nominating Committee

Public Policy Committee/Governance and Ethics

Committee

Page 13

Board Committees

Strictly Confidential

Ad hoc or special committees

Special Litigation Committee

Ad hoc committees formed to (i) to consider takeover or buyout offer, (ii) to investigate and advise on the appropriate response to allegations of serious misconduct against the corporation or its senior officers, and (iii) to evaluate and negotiate corporate restructurings or refinancing or other matters where conflicts of interest might otherwise arise

Page 14

Audit Committee

Strictly Confidential

Particular focus of attention and reform following corporate governance scandals, viewed primarily as the product of financial fraud involving senior management.

A particular focus of the reforms embodied in the Sarbanes-

Oxley Act of 2002

Listed companies first required to have audit committees composed solely of independent directors by New York Stock

Exchange Rules in 1978

Page 15

Audit Committee

Strictly Confidential

Purpose:

To represent the board in overseeing the accounting and financial reporting processes of the company and audits of the financial statements of the company, with the corporation’s registered public accounting firm reporting directly to the audit committee, and to establish procedures for:

Page 16

Audit Committee

Strictly Confidential

the receipt, retention, and treatment of complaints relieved by the company regarding accounting, internal accounting controls, or auditing matters; and

the confidential, anonymous submission by employees of the company of concerns regarding questionable accounting or auditing matters

Page 17

Audit Committee

Strictly Confidential

Composition: all members must be independent directors.

“… to be considered independent… a member of an audit committee of an issuer [of registered securities] may not, other than in his or her capacity as a member of the audit committee, the board of directors, or any other board committee- (i) accept any consulting, advisory or other compensatory fee from the issuer; or (ii) be an affiliated person of the issuer or any subsidiary…”

Page 18

Audit Committee

Strictly Confidential

Duties:

The Audit Committee is responsible for:

the appointment, compensation, and oversight of the work of any registered public accounting firm employed by the company;

pre-approval of all auditing services and nonaudit services provided to the company by its auditor;

Page 19

Audit Committee

Strictly Confidential

An accounting firm that performs any audit for the company shall timely report to the Audit Committee regarding:

(1) critical accounting policies and practices to be used;

(2) alternative treatments of financial information

(3) other material written communications with management

Right to retain independent advisors

Page 20

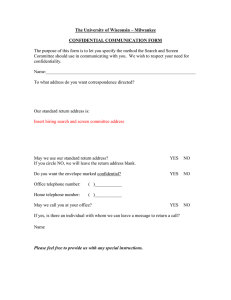

Nominating Committee

Strictly Confidential

Purpose:

To identify persons qualified to sit on the board and recommend such persons for election at the Annual

General Meeting of shareholders and to formulate and review corporate governance principles for the company.

Page 21

Nominating Committee

Strictly Confidential

Duties:

The Nomination Committee is responsible for:

Identifying and reviewing the qualifications of board candidates from a wide range of backgrounds, to fill board vacancies;

To consider succession planning keeping in mind the skills which will be needed on the board to address challenges in the future;

To regularly review the structure, size and composition of the board;

To regularly review the time required from a non-executive director; and

To make recommendations to the board on the above.

Page 22

Nominating Committee

Strictly Confidential

Current debate over right of shareholders independently to nominate candidates and to obtain access to the corporation’s proxy solicitation system

Page 23

Compensation Committee

Strictly Confidential

Particular concern that recent corporate governance crisis in the United States and the accounting frauds involved were the product of inappropriate and excessive compensation incentives and rewards

Page 24

Compensation Committee

Strictly Confidential

Purpose:

To create and monitor the implementation of programs designed to attract, retain and adequately compensate the officers of the company and to comply with applicable tax and securities law requirements.

Page 25

Compensation Committee

Strictly Confidential

Duties:

The scope of the duties of the Compensation

Committee is delineated by the board.

As a general matter, the Compensation Committee will usually be assigned the following duties:

Page 26

Compensation Committee

Strictly Confidential

determining/recommending compensation of the officers of the company (salaries, bonuses and amounts payable in connection with termination of the officer)

implementing annual bonus plans for senior officers

(determining the amount of bonuses and performance objectives of bonus plans, and monitoring achievement of objectives); and

administering equity based plans/other long term incentive plans

Page 27

Types of individuals to be recruited as directors

(need for special expertise or experience)

Where is staff work done for committee

Amount of director commitment/time required

Potential liability

Compensation

The emerging professional independent director

Page 28

Global Legal Advisers

North America: Los Angeles, New York, Palo Alto, San Francisco, Washington

Europe: Antwerp, Berlin, Brussels, Frankfurt, Ghent, London, Moscow, Paris, Rome, St. Petersburg, Stockholm

Asia/Pacific: Almaty, Bangkok, Beijing, Hong Kong, Jakarta, Shanghai, Singapore, Sydney, Tokyo

Associated Offices: Budapest, Mexico City, Milan, Prague

Page 29 www.coudert.com