Australian Electoral Commission Agency Resources and Planned

advertisement

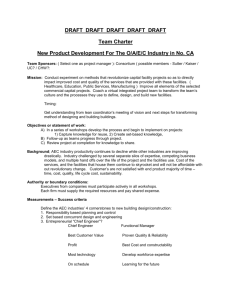

Australian Electoral Commission Agency Resources and Planned Performance AUSTRALIAN ELECTORAL COMMISSION Section 1: Agency Overview and Resources ........................................................... 79 1.1 Strategic Direction Statement ......................................................................... 79 1.2 Agency Resource Statement .......................................................................... 80 1.3 Budget Measures ............................................................................................ 82 Section 2: Outcomes and Planned Performance ..................................................... 83 2.1 Outcomes and Performance Information........................................................ 83 Section 3: Explanatory Tables and Budgeted Financial Statements..................... 92 3.1 Explanatory Tables ......................................................................................... 92 3.2 Budgeted Financial Statements ...................................................................... 94 77 AUSTRALIAN ELECTORAL COMMISSION Section 1: Agency Overview and Resources 1.1 STRATEGIC DIRECTION STATEMENT The Australian Electoral Commission (AEC) administers the Commonwealth Electoral Act 1918, making it responsible for conducting federal elections and referendums and maintaining the Commonwealth electoral roll. The AEC must also provide a range of electoral information and education programs and activities. The AEC’s actions impact on the Australian community as stated in its outcome: Maintain an impartial and independent electoral system for eligible voters through active electoral roll management, efficient delivery of polling services and targeted education and public awareness programs. The main focus of the AEC in 2012-13 will be to continue activities to ensure that the electoral roll is as complete and accurate as possible, whilst at the same time ensuring it is election ready. This includes implementation of recommendations from the Report of the Joint Standing Committee on Electoral Matters ‘Report on the conduct of the 2007 federal election and matters related thereto’ that are supported by government and, where required, have the legislative authority of the Parliament. In addition, the AEC will continue to seek the most effective ways of informing and educating the Australian public about electoral matters. Achievement of the AEC’s outcome has been enhanced by the increase in the funding base following a review undertaken in 2011-12 of AEC’s funding requirements going forward. 79 AEC Budget Statements 1.2 AGENCY RESOURCE STATEMENT Table 1.1 shows the total resources from all sources. The table summarises how resources will be applied by outcome and by administered and departmental classification. Table 1.1: Australian Electoral Commission Resource Statement — Budget Estimates for 2012-13 as at Budget May 2012 Estimate of prior year amounts available in 2012-13 $'000 Ordinary annual services 1 Departm ental appropriation Departmental appropriation 2 s31 Relevant agency receipts Total Total estimate Actual available appropriation 2012-13 $'000 2012-13 $'000 2011-12 $'000 7,048 112,567 14,104 126,671 119,615 14,104 133,719 104,417 14,571 118,988 7,048 126,671 133,719 118,988 3,421 3,421 270 270 3,691 3,691 370 370 3,421 270 3,691 370 10,469 126,941 137,410 119,358 - 9,000 9,000 9,000 9,000 9,000 9,000 10,469 135,941 146,410 128,358 7,048 4 Total ordinary annual services A + 3 Proposed at Budget = 5 Other services Departm ental non-operating Equity injections Total Total other services B Total available annual appropriations Special appropriations Special appropriations lim ited by criteria/entitlem ent Commonwealth Electoral Act 1918 Total special appropriations C Total appropriations excluding Special Accounts 80 AEC Budget Statements Table 1.1: Australian Electoral Commission Resource Statement — Budget Estimates for 2012-13 as at Budget May 2012 (continued) Estimate of prior year amounts available in 2012-13 $'000 Special Accounts Opening balance6 Non-appropriation receipts to Special Accounts Total Special Account D Total estimate Actual available appropriation 2012-13 $'000 2012-13 $'000 2011-12 $'000 - - - - - - - - + Proposed at Budget = Total resourcing A+B+C+D 10,469 135,941 146,410 128,358 Less appropriations draw n from annual or special appropriations above and credited to special accounts Total net resourcing for AEC 10,469 135,941 146,410 128,358 1 Appropriation Bill (No.1) 2012-13. 2 Includes an amount of $10.629m in 2012-13 for the Departmental Capital Budget (refer to table 3.2.5 for further details). For accounting purposes this amount has been designated as 'contributions by owners'. 3 Estimated adjusted balance carried forward from previous year. 4 s31 Relevant Agency receipts — estimate. 5 Appropriation Bill (No.2) 2012-13. 6 Estimated opening balance for special accounts (less ‘Special Public Money’ held in accounts like Other Trust Monies accounts (OTM), Services for other Government and Non-agency Bodies accounts (SOG), or Services for Other Entities and Trust Moneys Special accounts (SOETM)). For further information on special accounts see Table 3.1.2. 81 AEC Budget Statements 1.3 BUDGET MEASURES Budget measures relating to the Australian Electoral Commission are detailed in Budget Paper No. 2 and are summarised below. Table 1.2: Australian Electoral Commission 2012-13 Budget Measures Program 2011-12 $'000 Expense m easures Australian Electoral Commission additional funding Departmental expenses Total expense m easures Departmental Total Prepared on a Government Finance Statistics (fiscal) basis. 82 2012-13 2013-14 2014-15 2015-16 $'000 $'000 $'000 $'000 - (10,000) (16,000) (16,000) (16,000) - (10,000) (16,000) (16,000) (16,000) (10,000) (16,000) (16,000) (16,000) AEC Budget Statements Section 2: Outcomes and Planned Performance 2.1 OUTCOMES AND PERFORMANCE INFORMATION Government outcomes are the intended results, impacts or consequences of actions by the Australian Government on the Australian community. Commonwealth programs are the primary vehicle by which Australian Government agencies achieve the intended results of their outcome statements. Agencies are required to identify the programs which contribute to Government outcomes over the Budget and forward years. Each outcome is described below together with its related programs, specifying the performance indicators and targets used to assess and monitor the performance of the Australian Electoral Commission in achieving Government outcomes. Outcome 1: Maintain an impartial and independent electoral system for eligible voters through active electoral roll management, efficient delivery of polling services and targeted education and public awareness programs. Outcome 1 Strategy During 2012-13 the AEC will focus on: • continuing to ensure that the electoral roll is accurate and up-to-date; • maintaining election readiness; and • delivering communication, public awareness and electoral education activities. The AEC will also continue implementing recommendations from the Report of the Joint Standing Committee on Electoral Matters (JSCEM) ‘Report on the conduct of the 2007 federal election and matters related thereto’ that are supported by government and, where required, have the legislative authority of the Parliament. These recommendations will assist the AEC in harnessing technology to modernise processes and engage more effectively with electors. Implementation will be fully offset by savings that will be obtained from work practices that will become more efficient as a result of the changes. In addition, the AEC will maintain capacity to: • deliver ongoing funding and disclosure services; 83 AEC Budget Statements • conduct non-parliamentary elections as required, including protected action ballots, industrial elections and fee for service elections; • provide electoral assistance to other countries as authorised, particularly in the Asia-Pacific region; and • investigate innovative ways to increase informed participants in the electoral process. Outcome Expense Statement Table 2.1 provides an overview of the total expenses for the Outcome by program. Table 2.1: Budgeted Expenses for Outcome 1 Outcom e 1: Maintain an im partial and independent electoral system for eligible voters through active electoral roll m anagem ent, efficient delivery of polling services and targeted education and public aw areness program s. Program 1.1: Electoral Roll Managem ent Departmental expenses Departmental appropriation 1 Special appropriations Expenses not requiring appropriation in the Budget year 2 Total for Program 1.1 Program 1.2: Election Managem ent and Support Services Departmental expenses Departmental appropriation 1 Expenses not requiring appropriation in the Budget year 2 Total for Program 1.2 Program 1.3: Education and Com m unication Departmental expenses Departmental appropriation 1 Expenses not requiring appropriation in the Budget year 2 Total for Program 1.3 Outcom e 1 Totals by appropriation type Departmental expenses Departmental appropriation 1 Special appropriations Expenses not requiring appropriation in the Budget year Total expenses for Outcom e 1 2 2011-12 Estimated actual expenses $'000 2012-13 Estimated expenses 41,210 9,000 3,794 40,155 9,000 3,215 54,004 52,370 56,149 4,244 58,606 3,834 60,393 62,440 16,048 1,213 17,281 1,131 17,261 18,412 113,407 9,000 9,251 116,042 9,000 8,180 131,658 133,222 $'000 2011-12 2012-13 Average Staffing Level (num ber) 808 822 1 Departmental appropriation combines ‘ordinary annual services (Appropriation Bill No. 1)’ and ‘revenue from independent sources (s31)’. 2 Expenses not requiring appropriation in the Budget year is made up of Depreciation Expense, Amortisation Expense, Makegood Expense and Resources Received Free of Charge. Note: Departmental appropriation splits and totals are indicative estimates and may change in the course of the budget year as Australian Government priorities change. 84 AEC Budget Statements Contributions to Outcome 1 Program 1.1: Electoral Roll Management Program Objective Voter entitlement for Australians and support for electoral events and redistributions through maintaining an accurate and up-to-date electoral roll. Program 1.1: Electoral Roll Management 2011-12 Revised budget $'000 2012-13 Budget 2013-14 Forw ard year 1 $'000 $'000 2014-15 2015-16 Forw ard Forw ard year 2 year 3 $'000 $'000 Special Appropriations: Commonwealth Electoral Act 1918 (D) 9,000 9,000 9,000 9,000 9,000 Annual departmental expenses: Electoral Roll Management 40,850 40,132 71,071 44,536 44,196 Support Services for Electoral Redistributions 360 23 1,313 392 25 Expenses not requiring appropriation in the Budget year 1 3,794 3,215 2,619 2,965 2,901 Total program expenses 54,004 52,370 84,003 56,893 56,122 1 Expenses not requiring appropriation in the Budget year is made up of Depreciation Expense, Amortisation Expense, Makegood Expense and Resources Received Free of Charge. Program 1.1 Deliverables Electoral Roll Management • Maintain multiple streams of contact with electors to encourage them to enrol and keep their enrolment up-to-date. Support Services for electoral redistributions • Deliver support for the redistributions culminating in the AEC providing updated electoral boundary redistribution maps and advice to impacted electors. 85 AEC Budget Statements Program 1.1 Key Performance Indicators Electoral Roll management • 95% of eligible people are on the electoral roll. • 99.5% of enrolment transactions are correctly processed and 99% are processed within 3 business days. • At least 98% of roll products are accurate and at least 98% of roll products are delivered by agreed deadline. • Those eligible to enrol have enhanced capacity to access certain enrolment services electronically where legislative authority exists. • Continue to implement the Indigenous Electoral Participation Program. Support services for electoral redistributions • Support services provided by the AEC are appropriate and allow for the effective and timely conduct of redistribution activities, complying with legislative requirements and to the satisfaction of redistribution committees. 86 AEC Budget Statements Program 1.2: Election Management and Support Services Program Objective Access to an impartial and independent electoral system through the provision of election services, assistance and advice. Program 1.2: Election Management and Support Services 2011-12 Revised budget $'000 2012-13 Budget 2013-14 Forw ard year 1 $'000 2014-15 Forw ard year 2 $'000 2015-16 Forw ard year 3 $'000 $'000 Annual departmental expenses: Federal Elections, By-Elections and Referendums 34,522 37,892 82,961 37,074 41,026 Party Registrations 1,368 1,185 7,861 1,469 1,283 Funding and Disclosure Services 8,263 8,657 11,004 8,875 9,373 Fee-for-Service 2,310 2,053 4,784 2,481 2,223 Industrial and Torres Strait Regional Authority (TRSA) Elections 3,998 4,125 6,993 4,294 4,466 Advice and Assistance in Overseas Elections 5,688 4,694 4,690 6,110 5,083 Expenses not requiring appropriation in the Budget year 1 4,244 3,834 3,804 3,315 3,459 Total program expenses 60,393 62,440 122,097 63,618 66,913 1 Expenses not requiring appropriation in the Budget year is made up of Depreciation Expense, Amortisation Expense, Makegood Expense and Resources Received Free of Charge. Program 1.2 Deliverables Federal elections, by-elections and referendums • Deliver a range of products and services to support the successful conduct of a federal election or referendum. Party registrations • Maintain the Register of Political Parties in a way that meets the requirements of the Commonwealth Electoral Act 1918 (the Act) and assists persons in making applications for party registration. Funding and disclosure services • Deliver transparency and accountability in the sources of political funding in Australia and the expenditure of those participants involved in the political process at the federal level. A range of products has been produced, and will continue to be maintained, that are designed to assist persons with reporting obligations to lodge accurate and timely returns in accordance with the 87 AEC Budget Statements requirements of the Act. Industrial Elections and Protected Action Ballots • Conduct industrial elections in a timely and transparent manner that meets the requirements of the Fair Work (Registered Organisations) Act 2009 and each organisation’s rules. • Conduct Protected Action Ballots (PABs) in accordance with the provisions of the Fair Work Act 2009 and the orders issued by Fair Work Australia (FWA). Torres Strait Regional Authority (TSRA) elections • Deliver a range of products and services to support the successful conduct of TSRA elections that are conducted in line with the Aboriginal and Torres Strait Islander Act 2005. Fee-for-service • Successfully deliver elections and ballots for authorities and organisations on a full cost recovery basis in accordance with the AEC’s minimum standards. • Deliver effective assistance with the conduct of state, territory and local government elections where requested by the relevant electoral body. Advice and assistance in overseas elections • Provide, in cases approved by the Minister for Foreign Affairs, advice and assistance in matters relating to elections and referendums to authorities of foreign countries or to foreign organisations. As part of this process, capacity building materials will be developed. Program 1.2 Key Performance Indicators Federal elections, by-elections and referendums • Federal electoral events (including by-elections and referendums) are successfully delivered as required within the reporting period. AEC election practices and management are in accordance with relevant legislation. All election tasks are carried out in accordance with legislated timeframes. • High level of election preparedness maintained and key milestones met. Party registrations • Party registration processed in accordance with legislation and the Party Register 88 AEC Budget Statements is updated in a timely manner. Funding and disclosure services • Election Funding calculated and paid in accordance with the legislation. • Financial disclosures obtained and placed on the public record in accordance with legislated timeframes. Industrial Elections and Protected Action Ballots • Industrial elections are delivered in accordance with relevant legislation and each individual organisation’s rules. • PAB’s are delivered in accordance with relevant legislation and FWA orders. • All election tasks are carried out in accordance with legislated timeframes. Torres Strait Regional Authority (TSRA) elections • TSRA elections are delivered in accordance with relevant legislation, on a full cost recovery basis. Fee-for-service elections • Fee for service elections are successfully delivered, as required, on a full cost recovery basis. • Effective assistance is provided with the conduct of state, territory and local government elections where requested by the relevant electoral body. • State, local government stakeholders and fee-for-service clients are fully satisfied with the services provided. Advice and assistance in overseas elections • International assistance by the AEC meets the goals specified for individual projects undertaken, with stakeholders fully satisfied with the services provided. 89 AEC Budget Statements Program 1.3 Education and Communication Program Objective • Informed Australians through the provision of information services on electoral matters. Program 1.3: Education and Communication 2011-12 Revised budget $'000 2012-13 Budget 2013-14 2014-15 2015-16 Forw ard Forw ard Forw ard year 1 year 2 year 3 $'000 $'000 $'000 $'000 Annual departmental expenses: Electoral Education and Communication 3,546 3,622 7,039 3,808 3,922 Communication Strategies and Services 9,003 9,877 15,787 9,669 10,693 Community Strategies 3,499 3,782 17,004 3,758 4,095 Expenses not requiring appropriation in the Budget year 1 1,213 1,131 1,281 948 1,020 Total program expenses 17,261 18,412 41,111 18,183 19,730 1 Expenses not requiring appropriation in the Budget year is made up of Depreciation Expense, Amortisation Expense, Makegood Expense and Resources Received Free of Charge. Program 1.3 Deliverables Electoral education • Continue to deliver a variety of electoral education services. • Greater use of on-line technology to deliver supporting resource material. • Collaborate and partner with other government and instrumentalities in the delivery of quality civics education. non-government Communication strategies and services • Development and implementation of the AEC’s communication strategy to support its conduct of the next federal election and any referendums. • Effective use of contemporary technology to deliver modern products and services in line with community preferences for more on-line services. Community Strategies • Deliver the Indigenous Elector Participation Program. 90 AEC Budget Statements Program 1.3 Key Performance Indicators Electoral education • 78,000 visitors to National Electoral Education Centre (NEEC) per annum. • 2,000 NEEC sessions delivered per annum. • 100,000 participants in AEC education outreach services. • 1,200 participants in teacher professional development sessions. • Contemporary service delivery options, including partnerships that promote public awareness of electoral matters. • Contemporary online education resource material that responds to curriculum needs. • Participant feedback indicates 90% satisfaction with AEC education services. Communication strategies and services • AEC communication strategies and services developed, implemented and reviewed as appropriate. • Audience feedback is positive for effectiveness of specific advertising campaigns and public awareness activities through surveys, market research, and stakeholder consultation. • Published information is timely and accurate, makes appropriate use of available technology, and meets on-line accessibility standards. Community Strategies • Evaluation shows the Indigenous Elector Participation Program, is meeting its objectives. • Feedback from target audience on the Indigenous Electoral Participation Program shows the program is well received. 91 AEC Budget Statements Section 3: Explanatory Tables and Budgeted Financial Statements Section 3 presents explanatory tables and budgeted financial statements which provide a comprehensive snapshot of agency finances for the 2012-13 budget year. It explains how budget plans are incorporated into the financial statements and provides further details of the reconciliation between appropriations and program expenses, movements in administered funds, special accounts and government indigenous expenditure. 3.1 EXPLANATORY TABLES 3.1.1 Movement of Administered Funds Between Years Table 3.1.1 is not included as there is no movement of administered funds between years. 3.1.2 Special Accounts Special Accounts provide a means to set aside and record amounts used for specified purposes. Special Accounts can be created by a Finance Minister’s Determination under the FMA Act or under separate enabling legislation. Table 3.1.2 shows the expected additions (receipts) and reductions (payments) for each account used by AEC. Table 3.1.2: Estimates of Special Account Flows and Balances Other Trust Monies - S20 FMA Act (A) Outcome 1 Opening balance 2012-13 2011-12 $'000 - Total Special Accounts 2012-13 Budget estim ate Total Special Accounts 2011-12 estimate actual (A) = Administered (D) = Departmental 92 Receipts Payments Adjustments 2012-13 2012-13 2012-13 2011-12 2011-12 2011-12 $'000 $'000 $'000 - Closing balance 2012-13 2011-12 $'000 - - - - - - - - - - - AEC Budget Statements Table 3.1.3: Australian Government Indigenous Expenditure Bill No. 1 $'000 Appropriations Bill Special Total No. 2 approp approp $'000 $'000 $'000 Total Program $'000 $'000 3,626 3,221 3,626 3,221 - 3,626 3,221 3,626 3,221 1 1 1 1 - 3,626 3,221 - 3,626 3,221 1 1 - 3,626 3,221 - 3,626 3,221 1 1 Australian Electoral Com m ission Outcom e 1 Departmental 2012-13 Departmental 2011-12 Total outcome 1 2012-13 Total outcome 1 2011-12 3,626 3,221 3,626 3,221 - - Total departmental 2012-13 Total departmental 2011-12 3,626 3,221 - Total AGIE 2012-13 Total AGIE 2011-12 3,626 3,221 - 93 Other AEC Budget Statements 3.2 BUDGETED FINANCIAL STATEMENTS 3.2.1 Differences in Agency Resourcing and Financial Statements No material differences exist between agency resourcing and the financial statements. 3.2.2 Analysis of Budgeted Financial Statements Budgeted Departmental Income Statement The AEC’s funding varies with each year according to the electoral cycle. As 2012-13 is a pre-election year, funding is slightly higher than 2011-12 for departmental items. In the lead up to the election departmental revenue rises from $125.0 million in 2012-13 to $239.5 million in 2013-14, including the s.31 receipts. The increase in appropriation from 2012-13 and into the forward years results from the AEC Funding Review which increased the base funding to maintain the AEC’s operating capacity and revised the indexation for election funding. The increase in the appropriations are $10.0 million in 2012-13 and $48.8 million in 2013-14, $32.0 million of which is specifically for election costs. The budgeted loss for 2011-12 of $10.802 million comprises $9.166 million for depreciation/amortisation expenses and $1.636 million due to the effect on long service leave provisions from the decrease in the bond rate. Budgeted Departmental Balance Sheet The increase in AEC base funding has steadied AEC’s financial position with financial assets averaging $9.937 million in the Budget and Forward Estimates period. The AEC’s most significant liability is employee entitlements, ranging from $23.1 million to $25.2 million over the forward estimates period. Budgeted Statement of Cashflows The cashflow remains steady between 2011-12 and 2012-13, but then increases significantly in 2013-14 due to it being an election year in the cycle. The increase reflects the increase in casual staff required as well as increased supplier payments for holding the election. There is increased investing activity conducted due to the focus on harnessing technology to modernise processes and engage more effectively with electors, hence the cash outflows for property, plant and equipment and intangibles. 94 AEC Budget Statements Schedule of Administered Activity Schedule of Budgeted Income and Expenses Administered on Behalf of Government The administered revenue and expenses for 2012-13 represent election related nonvoter fines and penalties, which being a pre-election year the revenue levels will be low. As 2013-14 is an election year, the AEC will receive appropriation for payments it administers on behalf of government including public funding of election campaigns for candidates that obtain at least four percent of the formal first preference votes in the division of the state or territory they contest, which is estimated to be $68.0 million. Schedule of Budgeted Assets and Liabilities Administered on Behalf of Government No administered assets or liabilities are held by the AEC. Schedule of Budgeted Administered Cashflows Administered monies are transferred to the Official Public Account on a regular basis. 95 AEC Budget Statements 3.2.3 Budgeted Financial Statements Tables Table 3.2.1 Departmental Comprehensive Income Statement (Showing Net Cost of Services) (for the period ended 30 June) Estimated actual 2011-12 $'000 Budget estimate 2012-13 $'000 Forw ard estimate 2013-14 $'000 Forw ard estimate 2014-15 $'000 Forw ard estimate 2015-16 $'000 79,682 42,725 9,166 85 131,658 77,127 47,915 8,095 85 133,222 115,030 124,477 7,619 85 247,211 75,448 56,018 7,143 85 138,694 76,762 58,623 7,295 85 142,765 14,571 85 14,656 14,656 14,104 85 14,189 14,189 13,994 85 14,079 14,079 15,413 85 15,498 15,498 15,509 85 15,594 15,594 Net cost of (contribution by) services 117,002 119,033 233,132 123,196 127,171 Revenue from Government 106,200 110,938* 225,513* 116,053* 119,876* Surplus (Deficit) attributable to the Australian Governm ent (10,802) (8,095) (7,619) (7,143) (7,295) Total com prehensive incom e (loss) attributable to the Australian Governm ent (10,802) (8,095) (7,619) (7,143) (7,295) EXPENSES Employee benefits Suppliers Depreciation and amortisation Other expenses Total expenses LESS: OWN-SOURCE INCOME Ow n-source revenue Sale of goods and rendering of services Other Total ow n-source revenue Total ow n-source incom e Note: Im pact of Net Cash Apppropriation Arrangem ents Total Com prehensive Incom e (loss) less depreciation/am ortisation expenses previously funded through revenue appropriations 2 (1,636) plus depreciation/amortisation expenses previously funded through revenue appropriations 1 Total Com prehensive Incom e (loss) - as per the Statem ent of Com prehensive Incom e Prepared on Australian Accounting Standards basis. 1 2 - - - (9,166) (8,095) (7,619) (7,143) (7,295) (10,802) (8,095) (7,619) (7,143) (7,295) From 2010-11, the Australian Government introduced net cash appropriation arrangements where Bill 1 revenue appropriations for the depreciation/amortisation expenses of FMA Act agencies were replaced with a separate capital budget (the Departmental Capital Budget, or DCB) provided through Bill 1 equity appropriations. For information regarding DCBs, please refer to Table 3.2.5 Departmental Capital Budget Statement. Loss attributable to the change in long service leave provisions from the decrease in the bond rate. 96 - AEC Budget Statements Table 3.2.2: Budgeted Departmental Balance Sheet (as at 30 June) Estimated actual 2011-12 $'000 Budget estimate 2012-13 $'000 Forw ard estimate 2013-14 $'000 Forw ard estimate 2014-15 $'000 Forw ard estimate 2015-16 $'000 ASSETS Financial assets Cash and cash equivalents Trade and other receivables Other financial assets Total financial assets 1,016 9,219 500 10,735 1,016 10,627 500 12,143 1,016 7,122 500 8,638 1,016 8,337 500 9,853 1,016 7,597 500 9,113 Non-financial assets Land and buildings Property, plant and equipment Intangibles Inventories Other non-financial assets Total non-financial assets Total assets 5,624 7,511 12,627 3,381 2,123 31,266 42,001 6,063 10,465 13,038 3,381 2,123 35,070 47,213 4,629 8,654 13,841 3,381 2,123 32,628 41,266 4,172 8,153 14,342 3,381 2,123 32,171 42,024 5,542 11,297 14,456 3,381 2,123 36,799 45,912 2,342 3,316 5,658 2,811 3,316 6,127 2,411 3,316 5,727 3,961 3,316 7,277 3,662 3,316 6,978 23,363 1,895 25,258 30,916 25,216 1,981 27,197 33,324 23,116 1,981 25,097 30,824 23,816 1,981 25,797 33,074 23,816 1,981 25,797 32,775 11,085 13,889 10,442 8,950 13,137 17,218 11,416 28,117 11,416 32,289 11,416 37,940 11,416 49,422 11,416 (17,549) 11,085 (25,644) 13,889 (33,263) 10,442 (40,406) 8,950 (47,701) 13,137 11,085 13,889 10,442 LIABILITIES Payables Suppliers Other payables Total payables Provisions Employee provisions Other provisions Total provisions Total liabilities Net assets EQUITY 1 Parent entity interest Contributed equity Reserves Retained surplus (accumulated deficit) Total parent entity interest Total Equity Prepared on Australian Accounting Standards basis. 1 'Equity' is the residual interest in assets after deduction of liabilities. 97 8,950 13,137 AEC Budget Statements Table 3.2.3: Budgeted Departmental Statement of Changes in Equity — Summary of Movement (Budget Year 2012-13) Retained Asset earnings revaluation reserve $'000 $'000 Opening balance as at 1 July 2012 Balance carried forw ard from previous period Adjusted opening balance Contributed equity/ capital $'000 Total equity 11,085 11,085 (17,549) (17,549) 11,416 11,416 17,218 17,218 Surplus (deficit) for the period (8,095) - - Total com prehensive incom e (8,095) $'000 Com prehensive incom e Transactions w ith ow ners Contributions by ow ners Equity Injection - Appropriation Departmental Capital Budget (DCBs) Sub-total transactions w ith ow ners Closing balance attributable to the Australian Governm ent (25,644) Prepared on Australian Accounting Standards basis. 98 (8,095) (8,095) - 270 10,629 10,899 270 10,629 10,899 11,416 28,117 13,889 AEC Budget Statements Table 3.2.4: Budgeted Departmental Statement of Cash Flows (for the period ended 30 June) OPERATING ACTIVITIES Cash received Appropriations Sale of goods and rendering of services Total cash received Cash used Employees Suppliers Other Total cash used Net cash from (used by) operating activities Estimated actual 2011-12 $'000 Budget estimate 2012-13 $'000 Forw ard estimate 2013-14 $'000 Forw ard estimate 2014-15 $'000 Forw ard estimate 2015-16 $'000 103,213 14,571 117,784 100,479 14,167 114,646 220,490 13,909 234,399 108,752 15,413 124,165 120,617 15,509 136,126 67,384 46,672 85 114,141 67,362 46,199 85 113,646 115,030 118,284 85 233,399 75,448 47,632 85 123,165 76,761 58,839 85 135,685 3,643 1,000 1,000 1,000 441 11,494 11,494 11,899 11,899 5,172 5,172 6,651 6,651 11,923 11,923 (11,494) (11,899) (5,172) (6,651) (11,923) 7,217 370 7,587 10,629 270 10,899 4,202 (30) 4,172 5,651 5,651 11,482 11,482 7,587 10,899 4,172 5,651 11,482 - - - - 1,280 1,016 1,016 1,016 1,016 1,016 1,016 1,016 1,016 1,016 INVESTING ACTIVITIES Cash used Purchase of property, plant and equipment Total cash used Net cash from (used by) investing activities FINANCING ACTIVITIES Cash received Departmental Capital Budget Contributed equity Total cash received Net cash from (used by) financing activities Net increase (decrease) in cash held Cash and cash equivalents at the beginning of the reporting period Cash and cash equivalents at the end of the reporting period Prepared on Australian Accounting Standards basis. (264) 99 AEC Budget Statements Table 3.2.5: Departmental Capital Budget Statement Estimated actual 2011-12 $'000 Budget estimate 2012-13 $'000 NEW CAPITAL APPROPRIATIONS Capital budget - Bill 1 (DCB) Equity injections - Bill 2 Total new capital appropriations 7,217 370 7,587 10,629 270 10,899 Provided for: Purchase of non-financial assets Total Item s 7,587 7,587 PURCHASE OF NON-FINANCIAL ASSETS Funded by capital appropriations 1 Funded by capital appropriation - DCB Funded internally from departmental resources 3 TOTAL 2 Forw ard estimate 2013-14 $'000 Forw ard estimate 2014-15 $'000 Forw ard estimate 2015-16 $'000 4,202 (30) 4,172 5,651 5,651 11,482 11,482 10,899 10,899 4,172 4,172 5,651 5,651 11,482 11,482 370 7,217 270 10,629 (30) 4,202 5,651 11,482 3,907 11,494 1,000 11,899 1,000 5,172 1,000 6,651 441 11,923 RECONCILIATION OF CASH USED TO ACQUIRE ASSETS TO ASSET MOVEMENT TABLE Total purchases 11,494 11,899 5,172 6,651 Total cash used to acquire assets 11,494 11,899 5,172 6,651 1 Includes both current and prior Bill 2/4/6 appropriations and special capital appropriations. 2 Does not include annual finance lease costs. Includes purchase from current and previous years’ Departmental Capital Budgets (DCBs). 3 Includes the following sources of funding: - current and prior year Bill 1/3/5 appropriations (excluding amounts from the DCB); - donations and contributions; - gifts; - internally developed assets; - s 31 relevant agency receipts; and - proceeds from the sale of assets. 100 11,923 11,923 AEC Budget Statements Table 3.2.6: Statement of Departmental Asset Movements (2012-13) Buildings $'000 As at 1 July 2012 Gross book value Accumulated depreciation/amortisation and impairment Opening net book balance CAPITAL ASSET ADDITIONS Estim ated expenditure on new or replacem ent assets By purchase - appropriation equity 1 By purchase - appropriation ordinary annual services 2 Total additions Other m ovem ents Depreciation/amortisation expense Total other m ovem ents 2 Total $'000 9,575 10,968 42,514 63,057 (3,951) 5,624 (3,457) 7,511 (29,887) 12,627 (37,295) 25,762 - - 270 270 2,500 2,500 6,399 6,399 2,730 3,000 11,629 11,899 (2,061) (2,061) (3,445) (3,445) (2,589) (2,589) (8,095) (8,095) 17,367 45,514 74,956 (6,902) 10,465 (32,476) 13,038 (45,390) 29,566 As at 30 June 2013 Gross book value 12,075 Accumulated depreciation/amortisation and impairment (6,012) Closing net book balance 6,063 Prepared on Australian Accounting Standards basis. 1 Asset Category Other property, Computer plant and softw are and equipment intangibles $'000 $'000 “Appropriation equity” refers to equity injections or Administered Assets and Liabilities appropriations provided through Appropriation Bill (No.2) 2012-13. “Appropriation ordinary annual services” refers to funding provided through Appropriation Bill (No.1) 2012-13 for depreciation/amortisation expenses, DCBs or other operational expenses. 101 AEC Budget Statements Table 3.2.7: Schedule of Budgeted Income and Expenses Administered on Behalf of Government (for the period ended 30 June) Estimated actual 2011-12 $'000 Budget estimate 2012-13 $'000 Forw ard estimate 2013-14 $'000 Forw ard estimate 2014-15 $'000 Forw ard estimate 2015-16 $'000 - - 68,000 - - - - 68,000 - - LESS: OWN-SOURCE INCOME Ow n-source revenue Taxation revenue Other taxes, fees and fines Total taxation revenue 65 65 32 32 1,200 1,200 66 66 33 33 Total ow n-source revenues adm inistered on behalf of Governm ent 65 32 1,200 66 33 (65) 65 (32) 32 (66) 66 (33) 33 EXPENSES ADMINISTERED ON BEHALF OF GOVERNMENT Election Public Funding Total expenses adm inistered on behalf of Governm ent Net Cost of (contribution by) services Surplus (Deficit) Prepared on Australian Accounting Standards basis. 102 66,800 (66,800) AEC Budget Statements Table 3.2.8: Schedule of Budgeted Assets and Liabilities Administered on Behalf of Government (as at 30 June) The AEC has no budgeted assets and liabilities administered on behalf of the Australian Government. Table 3.2.9: Schedule of Budgeted Administered Cash Flows (for the period ended 30 June) Estimated actual 2011-12 $'000 Budget estimate 2012-13 $'000 Forw ard estimate 2013-14 $'000 Forw ard estimate 2014-15 $'000 Forw ard estimate 2015-16 $'000 65 65 32 32 1,200 1,200 66 66 33 33 - - 68,000 68,000 - - 65 32 (66,800) 66 33 65 32 (66,800) 66 33 - - - - - - - 68,000 - - OPERATING ACTIVITIES Cash received Taxes Total cash received Cash used Election Public Funding Total cash used Net cash from (used by) operating activities Net increase (decrease) in cash held Cash and cash equivalents at beginning of reporting period Cash from Official Public Account for: - Appropriations Cash to Official Public Account for: - Appropriations Cash and cash equivalents at end of reporting period Prepared on Australian Accounting Standards basis. 103 (65) - (32) - (1,200) - (66) - (33) - AEC Budget Statements Table 3.2.10: Schedule of Administered Capital Budget The AEC has no budgeted administered capital administered on behalf of the Australian Government. Table 3.2.11: Schedule of Asset Movements — Administered The AEC has no budgeted assets administered on behalf of the Australian Government. 104