When Optimists Need Credit: Asymmetric Disciplining of Alp Simsek

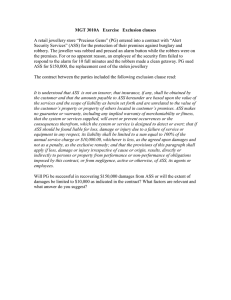

advertisement