Financial Statement Analysis The McDonald’s Company 112.7006 AMM

advertisement

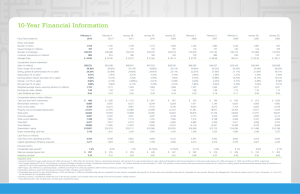

Financial Statement Analysis The McDonald’s Company AMM112.7006 Spring 2009 II Prof, Angela Wu by Xi Chen Wen Guang Li July 30, 2009 Company Summary McDonald's Corporation is the world's largest chain of fast-food restaurants, primarily selling hamburgers, chicken, french fries, breakfasts and soft drinks. More recently, it also offers salads, fruit, snack wraps, and carrot sticks. The business began in 1940, with a restaurant opened by siblings Dick and Mac McDonald in San Bernardino, California. Their introduction of the "Speedee Service System" in 1948 established the principles of the modern fast-food restaurant. The present corporation dates its founding to the opening of a franchised restaurant by Ray Kroc, in Des Plaines, Illinois on April 15, 1955, the ninth McDonald's restaurant overall. Kroc later purchased the McDonald brothers' equity in the company and led its worldwide expansion. With the successful expansion of McDonald's into many international markets, the company has become a symbol of globalization and the spread of the American way of life. Its prominence has also made it a frequent subject of public debates about obesity, corporate ethics and consumer responsibility. History & Overview 1950’s McDonalds Corporation was created. Followed by the opening of their 100th restaurant in Chicago. By 1970’s there are a McDonalds in every state 1980’s Followed its founder’s death, the McDonald Children’s Charity was created in memory of the founder. As of that point, McDonalds have restaurants in more then 40 countries serving 20 million people a day. Today McDonalds are practically in every major cities and countries around the world Stock Performance - Chart - McDonald’s - Nasdaq - Dow Jones - S&P 500 Income Statement 2008 2007 2006 Revenue 23,522 22,787 21,586 Cost of Goods sold 14,883 9,819 14,602 Gross Profit 8,639 12,968 6,984 Administrative expenses 2,356 7,429 2,405 1,775 134 6,332 3,763 4,445 238 103 123 6,681 3,982 4,568 523 410 402 Income Before Tax 6,158 3,572 4,166 Income Tax Expense 1,845 1,237 1,293 Net Income from Continuing Ops 4,313 2,335 2,873 - 60 671 4,313 2,395 3,544 Year Ended December 31, Non Recurring expenses Operating Income Other Income/Expenses Net Income before Interest and Taxes Interest Expense Discontinued Operations Net Income All amounts in millions (48) Income Statement All amounts in Millions Growth analysis (Horizontal analysis) Increase or (Decrease) Increase or (Decrease) among 2008 among 2007 2008 2007 2006 Amount Percent Amount Gross Profit 8,639 12,968 6,984 (4,328) (33.4%) 5,983 85.7% Operating Income 6,332 3,763 4,445 2,568 68.3% (682) (15.3%) Net Income 4,313 2,395 3,544 1,918 80.1% (1,149) (32.4%) Year Ended December 31 Percent • Among 2008 : Gross Profit decreased 33.4% , Operating Income Increased 68.3%, Net Income increased 80.1%. • Among 2007: Gross Profit increased 85.7%, Operating Income decreased 15.3%, Net Income decreased 32.4%. • Overall, in 2008, even though gross profit decreases, operating income and net income were up substantially, and quality’s profit trend appears favorable; in 2007, even though gross profit increases, operating income and net income were down substantially, and quality’s profit appears unfavorable. Margin Analysis (Vertical analysis) Year Ended December 31 2008 2007 Amount Percent Amount Percent All amounts in millions 2006 Amount Percent Gross Margin 8,639 36.7% 12,968 56.9% 6,984 32.4% Operating Margin 6,332 26.9% 3,763 16.5% 4,445 20.6% Net Margin 4,313 18.3% 2,395 10.5% 3,544 16.4% • Gross Margin increased 24.5% (56.9%-32.4%) from 2006 to 2007, but declined 20.2% (36.7%- 56.9%) from 2007 to 2008. • Operating Margin declined 4.1% (16.5%-20.6%) from 2006 to 2007, but increased 10.4% (26.9%16.5%) from 2007 to 2008. • Net Margin declined 5.9% (10.5%-16.4%) from 2006 to 2007, but increased 7.8% (18.3%-10.5%) from 2007 to 2008. •Overall, even though gross margin increased from 2006 to 2007 and decreased from 2007 to 2008, operating margin and net margin decreased from 2006 to 2007 and increased from 2007 to 2008. Quality appeared to have improved from 2007 to 2008. Balance Sheet Year Ended December 31 2008 2007 2006 2,063 1,981 2,136 Net Receivables 931 1,054 904 Inventory 112 125 149 Other Current Assets 412 422 436 Total Current Assets 3,518 3,582 3,625 Long Term Investments 1,222 1,156 1,036 20,255 20,985 20,846 Goodwill 2,237 2,301 2,209 Other Assets 1,230 1,367 1,307 Total Assets 28,462 29,392 29,024 All amounts in millions Assets Current Assets Cash And Cash Equivalents Property Plant and Equipment Balance Sheet Year Ended December 31 2008 2007 2006 2,506 3,634 2,739 32 865 18 - - 251 2,538 4,499 3,008 Long Term Debt 10,186 7,310 8,417 Other Liabilities 1,410 1,343 1,075 945 961 1,067 15,079 14,112 13,566 17 17 17 28,954 26,462 25,846 Treasury Stock (20,289) (16,762) (13,552) Capital Surplus 4,600 4,227 3,445 101 1,337 13,383 15,280 All amounts in millions Liabilities Current Liabilities Accounts Payable Short/Current Long Term Debt Other Current Liabilities Total Current Liabilities Deferred Long Term Liability Charges Total Liabilities Stockholders' Equity Common Stock Retained Earnings Other Stockholder Equity Total Stockholder Equity (297) 15,458 Balance Sheet All amounts in millions Ratio Analysis – Liquidity Ratios 2008 2007 2006 Current Ratio 1.39:1 0.80:1 1.21:1 Acid-Test Ratio (Quick) 1.18:1 0.67:1 1.01:1 Receivables Turnover1 23.70 times 23.28 times - Inventory Turnover 125.70 times 71.59 times - Year Ended December 31 • From year 2006 to 2007, current ratio decreased, but from year 2007 to 2008 current ratio increased. Therefore, quality appeared to be fairly liquid. • From year 2006 to 2007, Quick ratio decreased. Quick ratio seemed inadequate. From year 2007 to 2008, quick ratio increased and become more favorable. • From year 2007 to 2008, receivable turnover increased a little, overall, it maintained high receivables turnover rate. • From year 2007 to 2008, inventory turnover increased. It kept a very high inventory turnover rate . Generally, the faster the inventory turnover rate is, the less cash a company has tied up in inventory and the less the chance of inventory obsolescence. Ratio Analysis – Profitability and Solvency Ratios 2008 2007 2006 Profit Margin 18.34% 10.51% 16.42% Return on Common Stockholder’ equity 30.10% 15.58% Debt to Total Asset Ratio 52.98% 48.01% Year Ended December 31, 46.74% • From year 2006 to 2007, profit margin decreased, from year 2007 to 2008, profit margin increased. • From year 2007 to 2008, Return on common stockholder’ equity increased. Therefore, more dollars of net income the company earned for each dollar invested by the owners. • From year 2006 to 2007, debt to total asset ratio increased, from year 2007 to 2008, debt to total asset ratio increased. Too higher debt to total ratio, the greater the risk that the company may be unable to meet its maturing obligations. Therefore, if the debt to total ratio keep increasing, it’s not good. Statement of Cash Flows Year Ended December 31, All amounts in millions Net Income 2008 2007 2006 4,313 2,395 3,544 1,208 1,214 1,250 150 1,303 (289) 16 (100) (91) 94 (71) Operating Activities, Cash Flows Provided By or Used In Depreciation Adjustments To Net Income Changes In Accounts Receivables Changes In Liabilities Changes In Inventories Total Cash Flow From Operating Activities 241 (11) (30) (2) 5,917 4,876 4,342 (2,136) (1,947) (1,742) Investing Activities, Cash Flows Provided By or Used In Capital Expenditures Investments 229 - - Other Cash flows from Investing Activities 282 797 467 (1,625) (1,150) (1,273) Dividends Paid (1,823) (1,766) (1,217) Sale Purchase of Stock (3,371) (2,805) (1,984) 573 (2,265) 34 2 Total Cash Flows From Investing Activities Financing Activities, Cash Flows Provided By or Used In Net Borrowings 1,046 Other Cash Flows from Financing Activities Total Cash Flows From Financing Activities (4,115) Effect Of Exchange Rate Changes (96) Change In Cash and Cash Equivalents $82 (3,996) 123 ($147) 273 (5,192) ($2,124) Statement of Cash Flows – Operating Activities Year Ended December 31, All amounts in millions 2008 2007 2006 Net Income 4,313 2,395 3,544 Depreciation 1,208 1,214 1,250 150 1,303 (289) 16 (100) (91) Changes In Liabilities 241 94 (71) Changes In Inventories (11) (30) (2) 5,917 4,876 4,341 Adjustments To Net Income Changes In Accounts Receivables Net cash Provided by Operating Activities • Cash inflow for operating activities increased 10.97% from year 2006 to 2007, and increased 21.35% from year 2007 to 2008. • The increase from year 2007 to 2008 was mainly due to: • Adjustments to net income increase $1,892 millions greater than the net income, which decreased $1,149 millions. • The increase from year 2007 to 2008 was mainly due to: •Net income increased $1,918 millions greater than the adjustments to net income which reduced $1,153 millions. •Liabilities increased $147 millions Statement of Cash Flows – Investing Activities Year Ended December 31, All amounts in millions Capital Expenditures 2008 2007 2006 (2,136) (1,947) (1,742) Investments 229 - - Other Cash flows from Investing Activities 282 797 469 (1,625) (1,150) (1,273) Net Cash Used by Investing Activities • Cash outflow for investing activities decreased 9.94% from year 2006 to 2007, and increased 41.30% from year 2007 to 2008. • The decrease from year 2006 to 2007 was mainly related to: • Other cash flows from investing activities, cash inflow increased $328 millions greater than capital expenditures outflow which increased $205 millions. • The increase from year 2007 to 2008 was mainly related to: •Capital expenditures outflow increased $189 millions. •Other cash flows from investing activities outflow increase $515 millions. Statement of Cash Flows – Financing Activities Year Ended December 31, All amounts in millions 2008 2007 2006 Dividends Paid (1,823) (1,766) (1,217) Sale Purchase of Stock (3,371) (2,805) (1,984) Net Borrowings 1,046 573 (2,265) 34 2 273 Other Cash Flows from Financing Activities Net Cash Used by Financing Activities (4,115) (3,996) (5,192) • Cash outflow for financing activities decreased 23.04% from year 2006 to 2007 and increased 2.98% from year 2007 to 2008. • The decrease from year 2006 to 2007 was mainly related to: •Net Borrowings inflow increased $2,838 millions, greater than dividends paid and sale purchase of stock outflow that increased $1,370 millions. • The increase from year 2007 to 2008 was mainly related to: •Sale purchase of stock outflow increased $566 millions, greater than net borrowings inflow which increased $473 millions. •Dividends paid outflow increased $57 millions. Top Competitors Burger king YUM (KFC, Taco Bell, Pizza Hut) Wendy’s The most successful companies in the fast food industry are McDonald's, Burger King and Yum (Pizza Hut, Taco Bell, KFC). Together these huge conglomerates dominate the industry, employing 3.7 million people worldwide; operating a combined total of 60,000 stores. MCD Stock Vs. Major Competitors - McDonald’s - Burger king -YUM Brands - Wendy’s Back to Back Comparison MCD BKC YUM Wen Industry Market Cap: 61.91B 2.29B 15.78B 2.05B 164.34M Qtrly Rev Growth -7.00% 1.00% -6.90% 185.30% 8.00% Revenue : 22.56B 2.55B 10.90B 2.38B 410.61M Gross Margin : 37.55% 33.13% 24.90% 22.06% 9.23% EBITDA : 7.39B 454.00M 2.02B 310.35M 36.35M 27.65% 13.94% 13.48% 3.76% 6.46% Net Income : 4.25B 192.00M 1.01B (425.41M) N/A EPS : 3.772 1.402 2.094 (1.512) 0.17 P/E : 14.88 12.13 16.15 N/A 14.46 PEG: 1.6 0.86 1.35 N/A 1.17 P/S : 2.69 0.89 1.46 0.08 0.42 Oper Margins : - McDonald’s - Burger king -YUM Brands - Wendy’s - Industry Summary After this financial statement analysis, we learn McDonald’s financial situation deeply. McDonalds is the biggest fast-food franchise in the industry. Its also the most profitable. Though the company’s profits declined in 2007, but raised in 2008. most probably due to the down fall of economy that lead more consumer to buy cheaper food. It’s a good company to invest in.