Research on the Effectiveness of a Trend Test in the Chris Nyce

advertisement

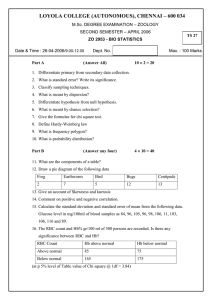

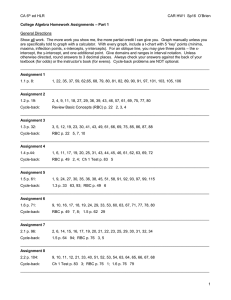

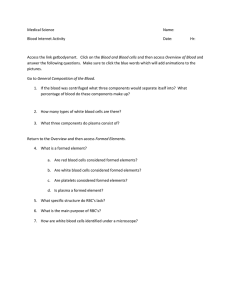

Research on the Effectiveness of a Trend Test in the Property/Casualty RBC Formula Chris Nyce KPMG Senior Manager kpmg Disclaimer These results are based on research conducted by a subgroup of the American Academy P/C RBC Committee Views expressed today are based on the research, but do not necessarily reflect the views of the Academy, KPMG, or the NAIC who of course makes all decisions about changes to the RBC formula Examples used are illustrative, and not a reference to any specific company Anyone who says otherwise is not only wrong, but is itching for a fight Our Mission Began the research with a charge - “Given the use of a trend test in the life RBC formula, is the application of a trend test in the Property/Casualty RBC formula a good idea?” Our interpretation- Not a “Yes/No” question Instead-”What is the most effective way of differentiating between companies above the Company Action Level that are likely to fall below it, and those that are likely to remain above it.” We approached this with a one year time horizon, i.e. based on observable data this year, what will happen next year Status of the Work Ideas to be discussed here have cleared the Academy RBC committee Formal report has been written, and is being modified based on comments for review by the AAA counsel - Note this is the normal procedure for AAA committee work product Will be submitted to NAIC for consideration at the June meeting Background Life test currently uses a trend test Applies to companies with RBC between 250% and the company action level (“CAL”) of 200% - RBC ratio is the ratio of capital to RBC required capital Life test looks at past changes in RBC ratio - Max of last year and the three year average RBC decline for each company - Subtract result from current RBC ratio - If below 190%, company is deemed to be at the CAL Note that even before our work, the feeling of committee members was that the life trend test did not work well for P/C companies - We quickly confirmed this to be true Our Approach Basic question-”What is the most effective predictor of decline in capital adequacy?” In general terms, used “Hypothesis Testing” Examined specific cases of past company failures Formulated hypotheses on the causes of RBC decline Tested the hypotheses using statistical tests on annual statement data Conducted additional tests by examining the effectiveness retrospectively Measured the results using a specific set of metrics Selected one approach that produced the best metrics Boundaries of our Study Did not constrain ourselves to examining the life formula Based on publicly filed data from the NAIC blank Outcome has to be intuitively correct, and simple All research also from public data sources For NAIC data, company names remained confidential Outcome had to be based on empirical data, not on our preconceived opinions Data Considerations For “micro” analysis we used public data sources such as AM BEST and press reports NAIC provided 5 year history of all requested data elements - Confidential as to company identifier - About 2400 companies - Used data through 2002 for statistical tests, updated through 2003 for retrospective test We scrubbed the data, in general separately for each test to maximize data points utilized - Screened out invalid entries and extreme values Micro Results-Initial Hypotheses Companies we examined could be characterized as experiencing trouble due to various causes, such as: - High levels of reinsurance recoverables, causing high leverage in estimating reserves, and exposure to disputed balances - High leverage of premiums and reserves to surplus - Reserve inadequacies coming to roost - Poor operating results - Fraud and misrepresentation - Ill-liquid or incorrectly valued assets - Under-funded pensions: (usually a contributor, not a cause) What is the Best Early Indicator of Future Capital Declines? Lack of Liquidity Bad Assets Poor Profitability Reserve Inadequacies Fraud Past Capital Declines Leverage Overall “Macro” Approach Performed statistical tests on the NAIC database - Explored the basic relationships behind each hypothesis Performed retrospective tests on characteristics of companies just prior to falling to the CAL Set up metrics to evaluate the outcome of the retrospective test Determined recommendations based on all of the above Statistical Tests Explored relationships between hypothesized variables Performed tests on the NAIC database of 2400 companies for 5 years ending 2002 Looked for statistical tendencies Generally used correlation and regression analysis - Examined the percentage of variation explained - Calculated the measures of significance Used to corroborate and explain retrospective result Note that a poor result in our tests does not necessarily mean that the measure is not good for IRIS or other financial evaluations - And high correlations don’t necessarily mean the hypothesis would form a good trend test Statistical Test of Life Type Trend Test Does a simple life type of trend test work? - Correlation between year to year changes in RBC ratio for all companies= -23% (wrong sign) - For only companies near the CAL = 1% - In 2001 and 2002, the direction of the change in subsequent years was only the same 41% of the time Changes in market asset valuations dominated any characteristics of companies themselves Implication: Life type of trend test is worse than random guessing for P/C Companies What About Underwriting Results and Reserve Runoff? Underwriting Results - Correlation between subsequent year combined ratios= 25% to 34% between 2000-2002 - For only companies near CAL correlation is 33% to 75% (highly significant) Reserve Runoff - Correlation between subsequent year runoff ratios=33% to 37% between 2000 and 2002 - For only companies near CAL correlation is 29% to 35% This is good and bad news - Statistical relationship is strong - But still only predicts a portion of the subsequent year outcome What is the Predictive Power of Leverage? Gross Leverage - Correlation between gross leverage and subsequent year RBC ratio change= -1% to 1% between 2000-2002 - For only companies near CAL correlation is –5% to –3% (not significant) Net Leverage - Correlation between net leverage and subsequent year RBC ratio change= 3% to 4% between 2000-2002 - For only companies near CAL correlation is 1% to 16% (wrong sign) This is not a good outcome - Statistical relationship is weak and sign is sometimes wrong Well then it must be Liquidity? Correlation between liquid assets to surplus and subsequent RBC change is –4% to 1% over 2001 to 2002 Depending on sample, relationship is not significant, or sign is wrong In 2002 and 2003, Portion of Companies Falling to CAL RBC Ratio in Prior Year Total Companies in Sample Number of Percentage Companies Falling to CAL Falling to CAL 200% to 300% 314 30 9.6% 300% to 350% 166 9 5.4% 350% to 400% 205 4 2.0% 400% to 450% 176 3 1.7% Greater than 200% 3582 55 1.5% Retrospective Tests Performed on NAIC database of 2400 companies ending 2003 Generally “Yes/No” - Measured whether the hypothesis accurately predicted the subsequent year outcome, or not - Therefore, scrubs were oriented toward invalids, but not toward extremes Measured on three metrics - Effectiveness-Percentage of overall correct predictions - False alarms-Percentage of companies flagged that did not deteriorate to CAL - Failing Companies Flagged-Percentage of companies that subsequently declined to the CAL that were correctly flagged Retrospective Approach Started by setting a threshold such as leverage above industry average, or combined ratio above 110%, etc. - Based on the threshold, companies were “flagged” or “not flagged” Allowed for mixed approaches; - Leverage, reserve runoff, and combined ratio - Reserve runoff and combined ratio - Three year tests of reserve runoff and combined ratio Adjusted the threshold to optimize the metrics - Based on trial and error Understand, this test tells us not what causes RBC decline, but what best predicts it - Although the implication for the cause is pretty clear Retrospective Metrics Life Trend Test Test Year UW Ratio Three Year Average UW Ratio Test Year Runoff Ratio Three Year Average Runoff Ratio Gross Leverage, End of Test Year Net Leverage, End of Test Year Composite UW and Runoff Composite uw/runoff/leverage Two Tiered Underwriting Test Threshold trend -20% -17% 7% 5% 650% 350% Composite Composite -20%/34% Ratio of failing False Effectiveness Total # of cos flagged alarms/total Ratio Companies 62% 47% 50% 480 67% 30% 67% 480 64% 36% 61% 480 46% 43% 53% 480 46% 37% 59% 480 56% 48% 48% 480 54% 46% 51% 480 64% 34% 63% 480 69% 42% 56% 480 67% 26% 71% 480 Why not 100% Effective Formula approach doesn’t account for capital changes (contributed, dividend) Financial statements can always be subject to restatement RBC ratio decline could involve fraud, or an other wise solid looking asset losing value - Or pension funding The statistical relationship is strong, but is not 100% predictive of direction and magnitude Need to keep the test simple An Effective Approach Based on Tests RBC Ratio Current Year Combined Ratio Company Status 200%300% Greater than 120% CAL Less than 120% No Regulatory Action Greater than 134% CAL Less than 134% No Regulatory Action All No Regulatory Action 300%350% Above 350%