Effect of Reinsurance on BCAR Case Study CARe Seminar on Reinsurance

advertisement

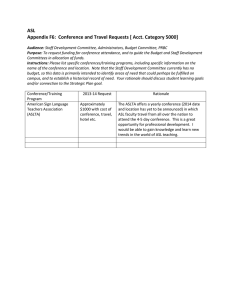

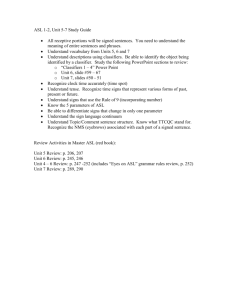

Effect of Reinsurance on BCAR Case Study CARe Seminar on Reinsurance May 20, 2008 Thomas M. Mount, ACAS, MAAA A. M. Best Company Outline Quick review of BCAR Baseline scenario Reinsurance “Solution” What can possibly go wrong??? Summary BCAR - Structural Overview BCAR Ratio = Economic Surplus / Net Required Capital Economic Surplus Reported Surplus (PHS) Equity Adjustments: Unearned Premiums Loss Reserves Assets Debt Adjustments: Surplus Notes Debt Service Requirements Stress Test Adjustments: Future Operating Losses Potential Catastrophe Exp. Other Net Required Capital Gross Required Capital (GRC): (B1) Fixed Income Securities (B2) Equity Securities (B3) Interest Rate (B4) Credit (B5) Loss and LAE Reserves (B6) Net Premiums Written (B7) Off-Balance Sheet Covariance Adjustment Net Required Capital (NRC)* Economic Surplus (APHS) *NRC= (B1)²+(B2)²+(B3)²+(0.5*B4)² +[(0.5*B4)+B5)]²+(B6)² +B7 Minimum Capital Requirements Rating Level A++ A+ A AB++ B+ B/BC++/C+ Minimum BCAR 175 160 145 130 115 100 80 60 Baseline Scenario Monoline liability insurer Writes in 3 states 20+ year history $2M per occurrence net retention Softening market conditions Current rating = AHistorical BCARs 145, 140, 135 (prior yr end) Selected minimum required BCAR = 135 Baseline Scenario Reported Surplus Net Loss Reserves NPW 2007 YE w/o ASL 300,000 600,000 300,000 (B1) Fixed Income Risk (B2) Equities Risk (B3) Interest Rate Risk (B4) Credit Risk (B5) Reserve Risk (B6) Premium Risk (B7) Business Risk Gross Required Capital 3,500 0 6,000 2,700 230,931 112,036 0 355,167 Net Required Capital 257,986 APHS 330,042 BCAR 128 What to do? Eliminate bad risks (re-underwrite)? File new (higher) rates? Diversify into more states? Diversify into more lines? Raise capital? But I need help NOW !!!!!! How About a Reinsurance Solution? Prospective Aggregate Stop Loss Coverage begins 1/1/08 Reduces NPW risk $50M of limit in risk layer = 17% of NPW Attaches 10 points over the ELR of 80% Low cost Increases BCAR now Benefit of ASL Reported Surplus Net Loss Reserves NPW 2007 YE w/o ASL 300,000 600,000 300,000 2007 YE w/ ASL 300,000 600,000 300,000 (B1) Fixed Income Risk (B2) Equities Risk (B3) Interest Rate Risk (B4) Credit Risk (B5) Reserve Risk (B6) Premium Risk (B7) Business Risk Gross Required Capital 3,500 0 6,000 2,700 230,931 112,036 0 355,167 3,500 0 6,000 2,700 230,931 61,036 0 304,167 Net Required Capital 257,986 240,271 APHS 330,042 330,042 BCAR 128 137 NPW Risk Line Other Liability Line Other Liability BEFORE ASL Adjustment Capital Required NPW Factor Capital 300,000 0.373 112,036 1.00 Diversification Factor 1.00 Growth Factor 112,036 Adjusted Required Capital AFTER ASL Adjustment Capital Required NPW Factor Capital 300,000 0.203 61,036 1.00 Diversification Factor 1.00 Growth Factor 61,036 Adjusted Required Capital Origin of NWP Risk Capital Factors Lognorm(1.9607, 0.11756) Shift=-2.0183 6 5 1% in tail 4 3 2 1 0 -0.5 -0.4 -0.3 -0.2 -0.1 0 0.1 0.2 0.3 (Profit)/Loss % (All years) industry mean break even Capital factor 99% 0.4 NPW Risk 140% 120% 10% Loss & LAE Ratio 100% Retained Risk 37% 17% 10% Ceded Risk Layer 80% Retained Expected Losses 60% 40% 80% 80% Before ASL After ASL 20% 0% as of 12/31/07 3 More Yrs Status Quo Reported Surplus Net Loss Reserves NPW 2007 YE w/ ASL 300,000 600,000 300,000 2008 YE w/ ASL 300,000 600,000 300,000 2009 YE w/ ASL 300,000 600,000 300,000 2010 YE w/ ASL 300,000 600,000 300,000 (B1) Fixed Income Risk (B2) Equities Risk (B3) Interest Rate Risk (B4) Credit Risk (B5) Reserve Risk (B6) Premium Risk (B7) Business Risk Gross Required Capital 3,500 0 6,000 2,700 230,931 61,036 0 304,167 3,500 0 6,000 2,700 230,931 61,036 0 304,167 3,500 0 6,000 2,700 230,931 61,036 0 304,167 3,500 0 6,000 2,700 230,931 61,036 0 304,167 Net Required Capital 240,271 240,271 240,271 240,271 APHS 330,042 330,042 330,042 330,042 BCAR 137 137 137 137 What could possibly go wrong??? Adverse Reserve Development Scenario Limit used up on prior AY’s in CY 2010 Recoverables increase $150M $50M each for 2008, 2009, 2010 Compounded by reinsurance dependence factor Reserve risk analyzed pre ASL Revised assessment of Expected Loss for NPW Reduces credit to capital factor Adverse Development Scenario Status Quo 2010 YE w/ ASL 300,000 600,000 300,000 Adverse 2010 YE w/ ASL 300,000 600,000 300,000 Change 0 0 0 (B1) Fixed Income Risk (B2) Equities Risk (B3) Interest Rate Risk (B4) Credit Risk (B5) Reserve Risk (B6) Premium Risk (B7) Business Risk Gross Required Capital 3,500 0 6,000 2,700 230,931 61,036 0 304,167 3,500 0 6,000 9,046 288,508 112,036 0 419,090 0 0 0 6,346 57,577 51,000 0 114,923 Net Required Capital 240,271 313,828 73,557 APHS 330,042 330,042 0 BCAR 137 105 (32) Reported Surplus Net Loss Reserves NPW Credit Risk BEFORE Ceding Adverse Development to ASL Credit Risk Adjusted Amount Asset Risk Factor (%) Adjusted Required Capital Statement Value Adjustment Agents' Balances In Course of Collection 30,000 0 30,000 5.0 1,500 Reinsurance Recoverables (A) All Other Insurers Less: Funds Held By Company Net Reinsurance Recoverables 30,000 0 30,000 0 0 0 30,000 0 30,000 4.0 4.0 4.0 1,200 0 1,200 Multiply: Reinsurance Dependence Factor (B) Adjusted Net Reinsurance Recoverables 30,000 0 30,000 4.0 1.00 1,200 Company Total 60,000 0 60,000 4.5 2,700 Notes: (A) - Includes ceded paid, case, IBNR, and unearned premium recoverables. (B) - Excessive Reinsurance Dependence: Non-Affiliated Reinsurance Recoverables / PHS Company 0.1 Industry Expected 0.4 Excess 0.0 Credit Risk AFTER Ceding Adverse Development to ASL Credit Risk Adjusted Amount Asset Risk Factor (%) Adjusted Required Capital Statement Value Adjustment Agents' Balances In Course of Collection 30,000 0 30,000 5.0 1,500 Reinsurance Recoverables (A) All Other Insurers Less: Schedule F Provision Net Reinsurance Recoverables 30,000 0 30,000 150,000 0 150,000 180,000 0 180,000 4.0 10.0 4.0 7,200 0 7,200 Multiply: Reinsurance Dependence Factor (B) Adjusted Net Reinsurance Recoverables 30,000 150,000 180,000 4.2 1.05 7,546 Company Total 60,000 150,000 210,000 4.3 9,046 Notes: (A) - Includes ceded paid, unpaid, IBNR, and unearned premium recoverables. (B) - Excessive Reinsurance Dependence: Non-Affiliated Reinsurance Recoverables / PHS Company 0.60 Industry Expected 0.40 Excess 0.20 Reserve Risk Dollars (000s) 288,508 Capital Charge 230,931 112,500 90,000 150,000 Deficiency Ceded Layer Booked Reserves 600,000 600,000 Before ASL Adjustment After ASL Adjustment as of 12/31/2010 Reserve Risk Baseline Industry Reserve Capital Factor Calc. 2.5 2 1% in tail 1.5 1 0.5 0 -60% -40% -20% 0% 30% 60% 90% (Favorable)/Adverse Reserve Development % of Original Reserves zero defic. capital factor 99% 120% Revised NPW Risk 160% 140% 37% 120% Loss & LAE Ratio 10% 100% 80% ELR=107% 17% 10% 17% ELR=80% 60% 40% Retained Risk 80% 90% 20% 0% Prior View of ASL Credit Revised View of ASL Credit Ceded Risk Layer Retained Expected Losses Prospective Stop Loss Rating/Capitalization Issues BCAR score initially improves due to the transfer of risk to the reinsurer Distorts true picture of risk when utilized Exposure bases understated (NWP & Reserves) BCAR distorted/understated Adds reinsurance recoverable credit risk Protects volatility but increases reins dependence Short term solution to a long term problem Summary Understand what the contract is trying to do Understand the accounting of the contract Understand the impact of that acctg on BCAR Make the appropriate BCAR adjustments Need to update adjustments each year Any adjustments to assuming company? Commutation of these contracts also requires adjustments to BCAR Never allow rating to be more than 1 rating level above true picture before credit for risk transfer Effect of Reinsurance on BCAR Questions/Comments?