On the Outside, Looking In Meyer Shields, FCAS, MAAA J.P. Morgan Securities, Inc.

advertisement

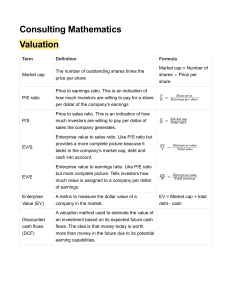

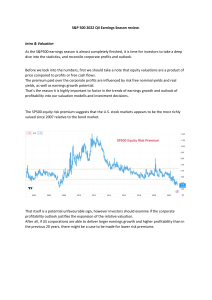

On the Outside, Looking In Meyer Shields, FCAS, MAAA J.P. Morgan Securities, Inc. November 28, 2001 Equity Research - Making Profitable Recommendations for Investors Markets are not perfectly efficient Sooner or later, investors recognize value Mosaics, few magic bullets The Value of an Insurance Company PV of Future Earnings – a good starting point, not an end Value to Investors – Undervalued, Appreciation Potential – Provide Diversification Opportunities The “Takeout Play” – Value to other companies Valuation Methods Discounted Cash Flows Price/Earnings Price/Book No Eyeballs Earnings Forecasting Need to estimate: – Revenues – Expenses – Taxes In insurance-speak: NWP & NEP, Loss Ratios, Expense Ratios, etc. Operating vs. Net Earnings Prediction Origins General Economic Trends Insurance-Industry Trends – North America – Europe – Asia Company and Line of Business Developments Upcoming Challenges – September 11 Leads The List Cost of the event itself – Unexpected cash outflows – Line of business convergence ‘Too Much Capital’ – Some insurers withdrawing from markets and LOBs – Significant capital raises in unprecedented (?) hard market Rates, Rates, Rates More September 11 Fallout Creation of Government-Sponsored Terrorism Pool Restricted Underwriting – War & Terrorism Exclusions – New Limits and Deductibles ‘One Event or Two’ – Public Relations May Matter Other Challenges “First thing, let’s kill all the lawyers…” Unanticipated Exposures Asbestos Mold D&O Fallout – The Internet Bubble Economic Downturn Sins of the Past As An Actuary Provides a thorough understanding of insurance-related financial concepts Less data to use than before Background provides both analytical tools and an understanding of how tools are used