Europe`s stock markets are relatively cheap

advertisement

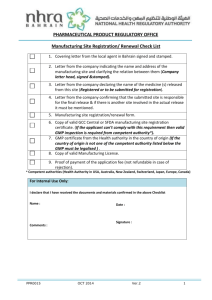

Europe’s stock markets are relatively cheap Hilliard MacBeth Hilliard’s Weekend Notebook – Friday, July 3, 2015 Richardson GMP 10180 101 Street, Suite 3360 Edmonton, AB T5J 3S4 The drama with Greece continues and won’t be resolved this weekend although we don’t expect the European Union or the € to collapse. At the same time the US stock market’s excellent performance in recent years obscures one important fact: most stock markets in Europe are cheap compared to US markets. Is it time to buy? Chart courtesy of BCA Research Inc. Last week — see “Earnings matter” — I talked about how earnings are key to driving stock market performance. But earnings, while very important, are not the whole story. Investor expectations for short-term market gains and changes in direction in economic growth are very important too. For example, imagine an economic region that had suffered worse economic growth in the last six years than during the period of 1929 to 1935. Hard to imagine? That’s the case in Europe today. In the 1930s, the European economy, led by frantic German investment in armaments and the military, was 5% larger in 1935 compared to 1929 measured in The opinions expressed in this report are the opinions of the author and readers should not assume they reflect the opinions or recommendations of Richardson GMP Limited or its affiliates. Assumptions, opinions and estimates constitute the author’s judgment as of the date of this material and are subject to change without notice. We do not warrant the completeness or accuracy of this material, and it should not be relied upon as such. Before acting on any recommendation, you should consider whether it is suitable for your particular circumstances and, if necessary, seek professional advice. Past performance is not indicative of future results. Richardson GMP Limited is a member of Canadian Investor Protection Fund. Richardson is a trade-mark of James Richardson & Sons, Limited. GMP is a registered trade-mark of GMP Securities L.P. Both used under license by Richardson GMP Limited. Tel. 1.780.409.7735 Fax 780.409.7777 www.TheMacBethGroup.com Hilliard MacBeth Director, Wealth Management Portfolio Manager Tel. 780.409.7740 real (adjusted for inflation) GDP. Today the Eurozone economy is 2% SMALLER than in 2008. As a result, based on expected reversion to the mean, the prospects for economic growth are better for the next ten years in Europe than most other areas in the world. And investors’ expectations are very modest. In our investment strategy we like to find markets that are currently neglected or overlooked by the all-important institutional investor crowd (pensions, mutual funds, hedge funds etc.) that make up at least 80% of market activity. These hired professional managers are forced by their supervisors and their investors to concentrate on the three-month-to-one-year time horizon. They have no choice. And these investors follow herd-like behavior, out of a strong desire to keep their jobs. So often there will an investment that is unpopular today with that crowd but in one or two years that lack of attention will reverse and the attitude will shift 180 degrees. This happens all the time in the stock market. If Europe is neglected by the professional investor crowd, is in the middle of a crisis due to the possible disintegration of the currency block, and has suffered negative economic growth for the last six years and is cheaper than US markets by about 32% as measured by stock prices and earnings, it could be a good time to look for bargains there. Our strategy involves the basic idea that if a sector or a geographic region is neglected by institutional investors, who control most of the money in the stock market, then there must be more companies that can be purchased for a reasonable price than shares of companies in a “hot” sector or region. This doesn’t apply to every single company in the sector but it does apply on average. The sectors in the stock market that are “cold” or overlooked or out-of-favour must contain more bargains, assuming that the companies survive and the “cold” sector or region eventually becomes attractive to investors again. Even if it takes a year or two or three. How much cheaper is the European stock market compared to the US stock market? As measured by Robert Shiller’s CAPE (cyclically-adjusted price to earnings ratio) the US market is more expensive, with the CAPE higher than 24, one of the highest levels ever except for the dot-com bubble in 2000 (over 40) and 1929 (27.3). Chart courtesy of BCA Research Inc. Europe’s CAPE is less expensive at about 17 times. This looks like a 32% difference although the argument can be made that the spread is about 15%, when adjusted for the differences between the two markets. Even among the big three Germany, France and Italy there is a wide range. Germany, the largest weighting, is about 18 times and Italy is 10.3 times. So the conclusion is that it is time to buy Europe, especially if things get messy in the next week because of Greece. With the caveat that individual sectors like IT (more important in the US) and financials (heavier weight in Europe) vary in importance between US and Eurozone markets, bargains are more prevalent in Europe.