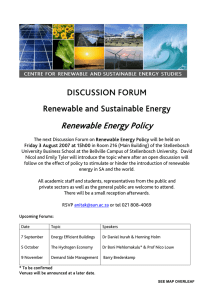

RPS C S

advertisement