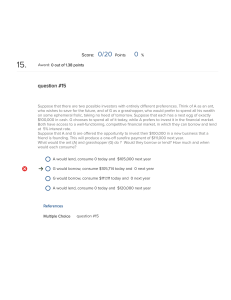

Module 24 May 2015

advertisement

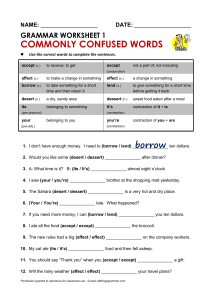

Module 24 May 2015 A dollar today is worth more than a dollar a year from now…if you know you are going to receive $1000 a year from now, you can borrow money today to be paid back when you receive your $1000…however, you must borrow less than $1000 because you must factor in the amount borrowed plus interest Scenario 2: Get $1000 now and put in the bank…one year from now it will be more than $1000 because it will have earned interest Present value – of $1 realized one year from now is equal to $1/(1+r): the amount of money you must lend out today in order to have $1 in one year. It is the value to you today of $1 realized one year from now. If the interest rate is 10%, then r=0.10. If you lend out $X at the end of the year you will receive $X plus interest which is $X x r or $X(1+ r) If $X(1 +r) = $1 then $X=$1/(1+r) $X=$1/(1+0.10)=$1/$1.10=$0.91 In order to have $1 a year from now at an interest rate of 10%, you must invest $0.91 $V is the amount of money you’ll lend today in order to have $1 in two years $Vx(1+r) in one year and if you re-lend you will receive $Vx(1+r) x (1+r) = $𝑉 × (1 + 𝑟)2 Solve if we want $1 in two years $0.83 A project is the present value of current and future benefits minus the present value of current and future costs.